Internal Revenue Commissioner Danny Werfel speaks during his swearing-in ceremony at the IRS in Washington, D.C., on April 4, 2023.

Bonnie Cash | Getty Images News | Getty Images

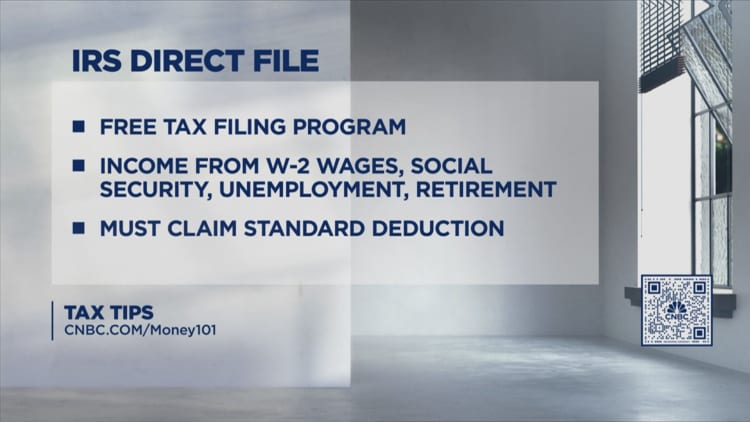

The 2025 tax season kicks off on Jan. 27, and more taxpayers will have access to Direct File, the IRS’ free tax filing program, which launched in 2024.

Starting on Jan. 27, Direct File will be open to eligible taxpayers in 25 states, including 12 states from the 2024 pilot and 13 new states, the agency announced Friday.

The U.S. Department of the Treasury estimates that more than 30 million taxpayers across those 25 states will be eligible to use Direct File in 2025.

This season, new Direct File features will make tax returns “quicker and easier,” IRS Commissioner Danny Werfel told reporters on a press call.

More from Personal Finance:

IRS announces the start of the 2025 tax season

Biden’s total student debt relief passes $183 billion

How much you can save by not drinking during ‘Dry January’

For 2025, participating states include Alaska, Arizona, California, Connecticut, Florida, Idaho, Illinois, Kansas, Maine, Maryland, Massachusetts, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Oregon, Pennsylvania, South Dakota, Tennessee, Texas, Washington state, Wisconsin and Wyoming, according to the IRS.

After completing federal returns via Direct File, the program guides users to their state’s software for state filings. For some states, Direct File can transfer filing data.

However, you cannot use Direct File if you did not live in a participating state for the entirety of 2024, according to the website. You can check eligibility here.

Direct File to ‘cover more tax situations’

However, for 2025, Direct File has expanded to “cover more tax situations than last year,” Werfel said Friday.

For 2025, Direct File will add support for interest income above $1,500, pension and annuity income — excluding individual retirement accounts — and Alaska Permanent Fund Dividends, the agency announced in October.

Direct File will also accept more tax breaks, including the child and dependent care credit, premium tax credit for Marketplace insurance and the credit for elderly or disabled and retirement saver’s credit. While filers still must claim the standard deduction, Direct File will add the tax break for health savings accounts.

Starting this season, filers can automatically import data from their IRS account, including personal data, an identity protection pin and some details from Form W-2, according to the IRS.

Other options to file your taxes for free

In addition to Direct File, most taxpayers also qualify for IRS Free File, which offers free guided tax prep through private software partners. The program opened on Jan. 10 and eligible taxpayers can start e-filing returns prepared by Free File on Jan. 27.

You are eligible for IRS Free File if your 2023 adjusted gross income was $79,000 or less.

“Many taxpayers believe that Free File is only for the simplest returns, but that is simply not true,” Tim Hugo, executive director of the Free File Alliance, said in a press release on Sunday.

For free tax preparation, many filers are also eligible for programs such as Volunteer Income Tax Assistance, Tax Counseling for the Elderly and MilTax.