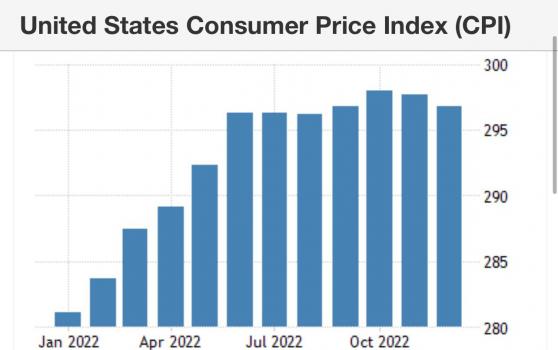

6th Consecutive Month Of Lower Inflation But Still High

Benzinga – Good Morning Everyone!

We finally have a taste of deflation. Thanks to a -0.1% month-over-month CPI reading.

Prices as of 4 pm, EST, 1/11/23; % YTD

MARKET UPDATE

U.S. CPI year-over-year in 2022

- January 7.5%

- February 7.9%

- March 8.5%

- April 8.3%

- May 8.6%

- June 9.1%

- July 8.5%

- August 8.3%

- September 8.2%

- October 7.7%

- November 7.1%

- December 6.5% street at 6.5%

6th consecutive month of lower inflation but 6.5% still well above Fed’s 2% goal

- 3 year average before the pandemic was 2.1%

Q4 earnings begin tomorrow

- JP Morgan (NYSE: JPM) Bank of America (NYSE: NYSE:) Wells Fargo (NYSE: NYSE:) Citi (NYSE: C)

- United Healthcare (NYSE: UNH)

10yr flat on the day

10 a.m. Biden speech on inflation and the economy

Fed speakers today Bullard and Barkin

China

- Ahead of the Chinese New Year holiday (the highest period for travel)

- China will stop reporting daily Covid cases and deaths

Crude 78.67 +1.2%

Disney (NYSE: DIS)

- Mark Parker (former Nike (NYSE:) CEO) elected to Board

Google (NASDAQ: NASDAQ:)

- Alphabet’s life sciences unit (which is small) cutting 15% of jobs

- 200 jobs impacted

Earnings

-

Taiwan Semiconductor

- Guides Q1 revenues $16.7-$17.5 billion vs street at $17.64

- Gross margins to be negatively impacted due to lower utilization rate

- 2023 Capex = $32 billion to $36 billion

-

KB Home (NYSE: KBH) -3%

- Orders down 50-60% year-over-year vs. street at down 35%

- Cancellations up 68%

CRYPTO UPDATE

Gensler: crypto industry is the “Wild West”

- Spoke during Twitter Spaces held by US Army yesterday

- “Most of these 10 or 15,000 tokens will fail … history tells us that there’s not much room for micro currencies”

- Says most not complying with securities laws (which remain unclear…)

Coinbase (NASDAQ: NASDAQ:) debt downgraded

- S&P Global (credit agency) downgraded Coinbase corporate debt to “BB-” from “BBB”

- From investment grade to speculative grade

- Downgrade follows large wave of layoffs

US taxpayers foot bill for $4.3 billion loan to help Silvergate (NYSE: SI) stay afloat

Crypto bank Silvergate is facing a bank run after working closely with FTX

But US taxpayers just footed the bill for a $4.3 billion loan to help the bank stay afloat

Is this really something the government should be doing?

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.