Bank: inflation likely to have peaked

The Bank of England believes inflation has probably peaked, in the UK and other advanced economies too.

In a summary of today’s decision, the Bank says:

Global consumer price inflation remains high, although it is likely to have peaked across many advanced economies, including in the United Kingdom.

Wholesale gas prices have fallen recently and global supply chain disruption appears to have eased amid a slowing in global demand. Many central banks have continued to tighten monetary policy, although market pricing indicates reductions in policy rates further ahead.

Key events

Closing post

Time for a recap:

Inflation may have peaked, the Bank of England believes, but this didn’t prevent the UK’s central bank raising interest rates today to the highest level since the aftermath of the financial crisis.

The BoE’s monetary policy committee voted, by 7 to 2, to lift Bank Rate to 4%, from 3.5% today, its 10th rate rise in a row.

Announcing the move, the Bank said:

Global consumer price inflation remains high, although it is likely to have peaked across many advanced economies, including in the United Kingdom.

Wholesale gas prices have fallen recently and global supply chain disruption appears to have eased amid a slowing in global demand.

But, Bank of England governor Andrew Bailey said it was too early to declare victory in the battle against inflation.

He told a press conference in London that:

“We’ve seen the first signs that inflation has turned the corner. But it’s too soon to declare victory just yet, inflationary pressures are still there.”

Stocks rallied in London, with the UK-focused FTSE 250 index jumping by 3.6%. The pound has weakened against the dollar, though, down 1% at $1.225.

The Bank is concerned that pay growth in the private sector, and inflation among services companies, has been higher than forecast three months ago. It wants to sqeeze these inflationary pressures out of the economy.

It also fears that UK productivity will suffer from the rise in over 50s workers who have left the labour force.

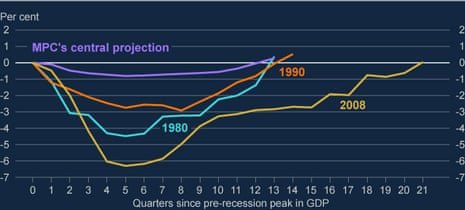

The Bank has revised its economic growth forecasts up – it now predicts the UK economy avoided recession at the end of last year, with modest growth in Q4 2022. It still expects the economy to shrink this year, but by less than before – and less than in previous recessions.

Top Bank officials told reporters in London that the hit from Brexit had arrived sooner than expected, and that interest rates could continue to rise if pay rises remained high.

The financial markets now expect just one more interest rate rise, from 4% to 4.25%, this spring.

Here’s the full story:

And analysis of the Bank’s thinking:

And an explanation of how it will affect you:

Plus here are today’s other main stories:

FTSE 250 index soars on hopes interest rates near peak

In the City, shares have ended the day higher as traders welcome signs that central banks may be slowing their interest rate increases.

The UK’s blue-chip FTSE 100 index has closed 59 points higher, or +0.76%, at 7820 points – approaching January’s four-year highs.

The smaller FTSE 250 index, which is more domestically-focused, surged by 3.6% to its highest level since last May. Cruise operator Carnival (+13.2%) and consumer publishing group Future (+13%) led the risers.

Michael Hewson, chief market analyst at CMC Markets UK, explains:

European markets have moved strongly higher after the Bank of England and European Central Bank both raised rates by 50bps which was in line with expectations, with the DAX moving to a new 11-month high, while the FTSE250 has outperformed the FTSE100.

While the tone of both press conferences would appear to suggest that both central banks have further to go in raising rates, markets appear to be taking the view that we’re near a peak as far as rates are concerned, and even if they aren’t done yet, they are close, sending bond yields falling sharply across the board.

What the Bank of England interest rate rise means for you

Today’s interest rate rise is yet more bad news for the approximately 2.2 million people on a variable rate mortgage, who are also grappling with higher fuel and energy bills, my colleague Zoe Wood explains.

Many now face paying hundreds of pounds extra a year.

About half of those 2.2 million are either on a base rate tracker or discounted-rate deal. The other half are paying their lender’s standard variable rate (SVR).

A tracker directly follows the base rate, so your payments will almost certainly soon reflect the full rise. On a tracker now at 4.5%, the interest rate would rise to 5%, adding £41 a month to a £150,000 repayment mortgage with 20 years remaining. The monthly payment on such a mortgage would rise from £949 to £990.

Of course, for those with bigger mortgages, the numbers will be bigger. On a £500,000 mortgage the monthly payment will rise by £139 to £3,301.

Those who must remortgage their home loans this year also face an increase in borrowing costs. Higher interest rates wil also affect those with credit cards and loans. Here’s the full story:

Bank of England Governor Andrew Bailey has told Bloomberg TV that the bank has a “long way to go” in its fight against inflation.

He also (again) flagged the bank’s decision to drop the word “forcefully” from its forward guidance on rate hikes, saying:

“We are going to react to the information and the evidence that we see. We haven’t pre-announced an intention.”

Following today’s interest rate decision, Andrew Bailey has been interviewed by several news outlets including CNBC.

He’s told them that he’s not saying the Bank is done raising interest rates, as the world is too uncertain.

Bailey says:

“I’m not saying ‘This is it, we’re done’, because the world is too uncertain in our case.

“There is an encouraging downward path of inflation in our central projection. But there’s a big risk. We’ve got the biggest risk in our forecast on inflation on the upside that we’ve ever had.

UK’s Royal Mail workers to strike on February 16

Postal workers at Britain’s Royal Mail will strike for 24 hours on February 16 in a long-running dispute over pay, the Communication Workers Union has announced.

The CWU said on Twitter that:

“We have served notice on Royal Mail Group for a 24-hour strike commencing for all shifts starting after 12:30pm on Thursday 16th February,”

🚨BREAKING: We have served notice on Royal Mail Group for a 24 hour strike commencing for all shifts starting after 12:30pm on Thursday 16th February.

We cannot and will not sit back as they destroy our members jobs. #WeAreStillHere

— The CWU (@CWUnews) February 2, 2023

Kalyeena Makortoff

The impending recession could leave borrowers struggling to repay their debts, the high street bank Santander UK warned today, as it put aside more cash to protect itself from potential defaults.

The UK arm of the Spanish bank said on Thursday that while the outlook for the British economy remained uncertain, a recession in 2023 was likely.

It said that despite government support for energy bills, rising prices would continue to eat away at disposable income, which “could impact lending repayments”.

The warning was issued alongside the bank’s full-year results, which showed the lender put aside £321m in 2022 to cover potential defaults, compared with the £233m it released a year earlier as Covid restrictions began to lift.

More here:

Santander also warned house prices are set to tumble back to 2021 levels, PA Media reports.

The Spanish-owned group is pencilling in a 10% fall in house prices this year as interest rate hikes knock homebuyer demand and a 1.3% contraction in the wider UK economy over 2023.

The pound has hit its lowest level against the US dollar since mid-January, as traders ponder whether the Bank of England has taken UK interest rates towards their peak today.

Sterling dropped as low as $1.223, down from as high as $1.24 early this morning, before recovering a little to $1.229.

Neil Mehta, BlueBay portfolio manager at RBC BlueBay Asset Management says the Bank is now at a ‘difficult juncture’, having raised base rate to 4%.

While dropping language around forward guidance will allow flexibility at coming meetings, more than just caution is required before declaring victory.

The improved growth and inflation seem premature – the full effect on higher mortgage payments and higher energy costs have yet to be fully digested by consumers, with real incomes set to deteriorate further.

Ongoing strike action and a depleted labour pool will keep wage pressures high, with politicians having little manoeuvrability.

Slumpflation is becoming entrenched and the balancing act between core inflation and growth will become harder to maintain over the coming months.

Moreover, policy and political uncertainty is set to remain high, with lower GBP the release valve for market participants.

Analysis: Bank of England hints at a brighter future after rate rise

The message from the Bank of England today is that things are going to be bad, but not as bad as previously feared, our economics editor Larry Elliott explains.

He writes:

Interest rates may be near their peak. Inflation will be close to zero in a couple of years. Recent shocks have damaged the economy’s supply potential.

Those were the main messages from the Bank of England as it raised interest rates for a 10th successive time.

Threadneedle Street is still expecting a recession but a mild one by UK standards, and less severe than it was predicting in the immediate aftermath of Liz Truss’s brief period as prime minister.

Here’s Larry’s analysis:

Full story: Bank of England raises UK interest rates to 4%

Phillip Inman

The Bank of England has blamed the inflationary impact of higher than expected wage rises for an increase in interest rates from 3.5% to 4%, my colleague Phillip Inman writes.

The move, announced at noon today, piles more pressure on mortgage payers and businesses struggling to pay off their loans, he points out.

Amid calls from unions for higher wages to protect against the worst falls in living standards for 100 years, a majority of the Bank’s monetary policy committee (MPC) said the 0.5 percentage point rise was needed after a jump in private sector wages above the central bank’s previous forecasts.

Marking its 10th consecutive rate increase, the Bank said the economy would enter a shorter and shallower recession than it predicted last year – with output falling by 1% from peak to trough compared with a 3% drop it said in November.

Bank staff now expected GDP to have grown by 0.1% in the final quarter of 2022, stronger than predicted in November. That would mean the UK did not enter a technical recession in 2022, as previously thought after the economy shank by 0.3% in the third quarter.

The UK economy is forecast to shrink in each quarter of 2023 and the first quarter of 2024 before staging a modest recovery.

The Bank said the hit to trade from Brexit was being felt sooner than previously expected.

“The effects of Brexit on trade are now estimated to be emerging more quickly than previously assumed, and that lowers productivity somewhat.”

More here:

PA Media have a good take on the Bank of England’s warning today that the hit to the UK economy from Brexit is coming through faster than had previously been expected.

Speaking at a press conference following the Bank’s latest interest rate hike, Ben Broadbent, the deputy governor for monetary policy, said they had not changed their overall assessment of the economic impact of Brexit (as covered here).

He acknowledged, however, that they had not expected to see the effect on growth figures to come through quite so quickly.

“Brexit … has been something that has pulled on our potential output in our country and that’s been our assessment for many years.

“We’ve not changed our estimate of the long-running effects, but we’ve brought some of them forward and we think they’re probably coming in faster than we first expected.”

He added:

“Yes it (Brexit) is having some effect on growth, although ultimately no bigger effect than we assessed some years ago.

“Based on the numbers for trade and some degree for the numbers on investment, we think these effects are coming through faster than initially envisaged.”

Although the Bank has forecast a shallower recession than feared, its growth projections are still rather weak, as Sky’s Ed Conway shows here:

This isn’t one of the main charts in the @bankofengland forecasts today but it might be one of the most important.

Come 2026 the UK economy will still be smaller than it was in 2019.

Another seven years of lost growth. (I added the red dotted line) pic.twitter.com/aLOZbO4X7I— Ed Conway (@EdConwaySky) February 2, 2023

Bank raises interest rates to 4%: the City reacts

Reaction to the Bank of England’s decision has been flooding in.

Here’s some of the best so far.

Moody’s Analytics economist Thomas Sgouralis says today’s rate rise won’t be the last in this cycle.

“The Bank of England has raised rates from 3.5% to a 14 year high of 4%, the tenth consecutive increase in the policy rate since December 2021, underscoring its fight against inflation in the UK, which is the highest among G7 economies.

Despite inflation showing signs of moderation, and with an economy that is vulnerable, today’s meeting is unlikely to be the end of the tightening cycle. We expect the BoE to take the policy interest rate to 4.5% before it pauses, since inflation is expected to start declining significantly from the middle of the year forward as the energy costs and consumption ease.”

Alexander Batten, fixed income portfolio manager at Columbia Threadneedle Investments predicts the Bank of England is close to ending its interest rate increases – perhaps after one more hike, to 4.25%, next month

The Bank’s forward guidance has been watered down even further. Language around forceful hikes, i.e 50bp or higher, has been removed, and more tightening has been tied to evidence of more persistent inflationary pressures appearing. The Bank have indicated the data they are looking at for this point – wages, services inflation and inflation expectations.

The soft data suggests a significant weakening of the labour market ahead but we suspect this may not come soon enough to prevent one final 25bp hike in March.

Paul Dales, chief UK Economist at Capital Economics, doesn’t see the Bank cutting interest rates during 2023:

While raising rates by 50 basis points (bps) today, from 3.50% to 4.00%, the Bank of England implied that rates are very close to their peak.

We still think that rates may rise to 4.50%, but perhaps via two 25bps increases rather than one 50bps rise. Either way, we think that lingering domestic inflation pressures will force the Bank to keep interest rates at their peak for all of this year.

ING’s Developed Markets Economist James Smith and Senior Rates Strategist Antoine Bouvet are sceptical that today’s rate hike will be the last.

They say:

“Below-target inflation forecasts, more muted language on future tightening, and a warning about the impact of past rate hikes, all signal that Bank Rate is close to peaking. We expect one further 25bp rate hike in March, though we think a rate cut is unlikely for at least a year.

“For several months now, the Bank has been warning that it expects to continue hiking and that it could do so forcefully. The minutes of the last meeting confirmed that “forcefully” can be understood as meaning 50bp rate hike increments. So the fact that the Bank has dropped this reference suggests any future rate rises are likely to be smaller – and that’s further reinforced by an admission that the impact of past rate hikes is still largely to feed through to the economy.

Martin Beck, chief economic advisor to the EY ITEM Club, thinks the Bank is still too pessimistic about the economic outlook, despite predicting a shallower recession.

The economy is still expected to shrink in 2024 on a calendar-year basis, despite pressure from high inflation fading. Households being expected to continue saving substantially more than pre-COVID-19 norms is one reason behind this.

But this may be a questionable assumption given the significant savings accumulated by households during the pandemic and the likelihood that the mood-music around the economy will steadily improve, boosting consumers’ appetite to save less and spend more.

Paul Diggle, deputy chief economist at abrdn, explains how the Bank of England has changed the language in its announcement today:

“As was widely expected, the Bank of England raised interest rates by 50 basis points to 4%. More interesting than the decision itself, however, was the vote split, changes to the Banks forecasts, and its guidance.

“Indeed, the Committee remains divided, with 2 of the 9 members voting for no change at this meeting. Revised forecasts see slightly stronger GDP growth and slightly lower inflation. That’s because activity data has been a little more resilient since the previous forecasts, while energy prices have fallen back. Nonetheless, the Bank is still forecasting a recession and inflation above target until well into next year.

“The Bank’s guidance on the future path of policy was watered down a touch. It now reads “if there were to be evidence of more persistent pressures, then further tightening in monetary policy would be required”. That’s a little more caveated than the previous “should the economy evolve broadly in line with the November Monetary Policy Report projections, further increases in Bank Rate may be required”.

“Taken together, this may indicate the Bank thinks it is getting close to the end of its hiking cycle.”

Q: What is the Bank’s message to financial markets today – they may be tempted to declare victory for you on inflation now, and start loosening financial conditions….

The mssage for everyone, including financial markets, is that there is a very clear path downward on inflation, Andrew Bailey replies firmly.

But, the BoE governor says there is also a lot of uncertainty around it, over the degree of risk and the timing.

Bailey explains:

The message I would give to financial markets is, we all have to watch this very carefully, and we will set policy to reflect how the economy evolves and how those risks evolve.

Q: Is the Bank concerned that the tight labour market means inflation doesn’t fall to your 2% target for a long time?

Governor Andrew Bailey agrees that there is tightness in the jobs market, so “yes, that is a big risk”.

But other factors – such as government efforts to encourage people back into the jobs market – are also factors, he adds.

The Bank’s top brass are wary of committing too much about the long term (perhaps remembering John Maynard Keynes famous quote)

Deputy governor Ben Broadbent grins, and reminds the press conference that:

Over the long term, we will set policy to ensure inflation is at the target.

Bailey: Brexit hit has arrived faster than thought

Back on Brexit…. governor Andrew Bailey says it is very hard to separate out the effects of Brexit, Covid and the energy crisis.

These shocks have held back both productivity and labour supply, he said.

But the Bank’s best judgement is that the long-run impact pf Brexit seems to have arrived more quickly than expected [as deputy governor Ben Broadbent said earlier].

The Bank of England’s forecasts for potential supply growth in the UK economy are “unbelievable grim”, says Torsten Bell of Resolution Foundation.

Unbelievable quite how grim @bankofengland are. Perma-stagnation as we keep the productivity disaster of the 2010s without the offsetting growth in the workforce. The result? “Normal” growth:

– 2.7% pre-financial crisis to

– 1.7% in 2010s

– 0.7% in 2020s pic.twitter.com/vQBdUflNfc— Torsten Bell (@TorstenBell) February 2, 2023

Q: The Bank’s agents predict a 6% increase in pay settlements – is that sustainable, with your inflation target?

Deputy governor Ben Broadbent says the simple answer is that “obviously no” – 6% pay growth is not consistent with a 2% inflation target, with productivity growth of 1%.

But pay growth is not expected to remain at that level.