BoE official says Brexit productivity penalty is £1,000 per household

Back in the UK, a Bank of England policy maker has warned that a wave of business investment was “stopped in its tracks” by the Brexit vote nearly seven years ago.

Jonathan Haskel, an external member of the Bank’s Monetary Policy Committee, said an interview with The Overshoot that business investment had “basically flattened out” after the 2016 referendum.

That drop in business investment growth, the Bank has calculated, has created a productivity penalty of about 1.3% of GDP.

This is based on what would have happened if investment carried on growing at the pre-referendum rate.

Haskel explained to the Overshoot:

That 1.3% of GDP is about £29 billion, or roughly £1000 per household.

At the end of the forecast period, the penalty goes up to something like 2.8% of GDP, which is very close to the 3.2% number we found using the totally different reduced form methodology based on goods trade volumes.

This is a timely point, after The Observer reported that a cross-party summit bringing together leading leavers and remainers has been held, to try to address and remedy the failings of Brexit.

This has prompted Lord Frost, the UK’s former chief Brexit negotiator, to urge ministers to “fully and enthusiastically embrace the advantages of Brexit”. Frost claims the meeting is part of a plot to unravel the deal he negotiated.

Haskel, though, insists that the UK’s productivity slowdown “goes back to Brexit”.

Asked why the UK has had a more severe productivity slowdown than other countries since the financial crisis, he says this is partly due to the country’s large financial sector.

But, Haskel adds:

If you look in the period up to 2016, it’s true that we had a bigger slowdown in productivity up to 2016, but we had a lot of investment.

We had a big boom between 2012-ish to 2016. But then investment just plateaued from 2016, and we dropped to the bottom of G7 countries.

Haskel also suggests that delays in the NHS are responsible for the rise in economic inactivity, as more people leave the labour force.

He says:

There are basically two competing hypotheses here in the U.K. One is that actually lots of people have just retired. They were not active before and they’ve decided to give it up and just retire. Um, that’s hypothesis one. Hypothesis two is, is related to ill health.

The National Health Service here has had very long waiting lists. It’s proved to be very, very difficult for a very overstretched health service to deal with Covid and deal with the aftermath. We are finding some weak correlations between regional increases in inactivity and regional increases in self-reported ill health within the U.K.

You can read the full interview here:

Key events

Closing summary

Time for a recap

A Bank of England policy maker has warned that UK business investment growth was “stopped in its tracks” by Brexit.

Jonathan Haskel, a member of the Monetary Policy Committee, said that this created a productivity penalty of £29bn – or £1,000 per household.

UK businesses began 2023 in a pessimistic mood, according to the latest survey of the economy from BDO. It found that optimism fell last month, as firms experienced a sharp decline in growth as customers cut back.

There’s better news from the eurozone, though – the EC has raised its growth forecasts. It now predicts the European Union will avoid a recession this year, as the fall in gas prices has helped the economy.

Staff at Amazon’s fulfilment centre in Coventry are to walk out on February 28, March 2 and from March 13 to 17, as industrial action at the company intensifies.

But a long-running London bus dispute involving drivers employed by Abellio has ended, after workers accepted a pay rise worth 18%.

Here’s the rest of today’s stories:

As expected, the US stock market has opened a little higher ahead of Tuesday’s inflation report which is expected to show a slowdown in price rises.

The Dow Jones industrial average, which tracks 30 large US companies, has gained 49 points or 0.15% to 33,919 points. The tech-focused Nasdaq Composite is 0.2% higher.

Shares in Manchester United are up 3.6%, at $24.40, following a Bloomberg report that Qatar investors could make an offer for the English football giant in the coming days.

Qatari investors are set to make an offer for Manchester United in the coming days, a move that would cement the country’s desire to become a major player in global sports https://t.co/YUTVk8thBS

— Bloomberg (@business) February 13, 2023

London bus drivers accept 18% pay rise

There’s been a breakthrough in a long-running industrial action in London.

Abellio bus workers, largely based in the south and west of London, have accepted a pay offer which will see drivers with over two years’ service being paid £18 an hour. This equates to a pay increase of 18% on the basic rate, the Unite union says.

Over 1,800 Abellio workers took more than 20 days of strike action, Unite says, including three days of strike action in late November and strike action in December.

Unite general secretary Sharon Graham says:

“This is an important pay victory. Workers have stood firm and with the support of their union, Unite, they have secured a richly deserved pay increase.

Unite’s constant focus on the jobs, pay and conditions of our members is continuing to deliver increased pay awards for workers.”

Amazon has insisted that only a “tiny proportion” of its workforce are involved in the strikes announced today.

A spokesperson for the e-commerce giant says:

“In fact, according to the verified figures, only a fraction of 1% of our UK employees voted in the ballot – and that includes those who voted against industrial action.

“We appreciate the great work our teams do throughout the year and we’re proud to offer competitive pay which starts at a minimum of between £10.50 and £11.45 per hour, depending on location.

“This represents a 29% increase in the minimum hourly wage paid to Amazon employees since 2018.

“Employees are also offered comprehensive benefits that are worth thousands more – including private medical insurance, life assurance, subsidised meals and an employee discount, to name a few.”

Wall Street is set to open slightly higher, as investors brace for Tuesday’s US inflation report.

Amazon workers announce series of strikes at warehouse in pay dispute

Amazon workers have announced a series of strikes at one of the company’s warehouses in a dispute over pay, PA Media report.

The GMB said more than 350 staff at the fulfilment centre in Coventry will walk out on February 28, March 2 and from March 13 to 17.

BREAKING 🚨: Amazon workers in Coventry step up strikes with week of action 👏

— GMB Union (@GMB_union) February 13, 2023

The union said its members made history last month by becoming the first Amazon workers in the UK to strike in their campaign for a pay rate of £15 an hour.

Amanda Gearing, GMB senior organiser, said the “unprecedented” strikes showed the anger among Amazon workers in Coventry.

She said:

“They work for one of the richest companies in the world, yet they have to work round the clock to keep themselves afloat.

“It’s sickening that Amazon workers in Coventry will earn just 8p above the national minimum wage in April 2023.

“Amazon bosses can stop this industrial action by doing the right thing and negotiating a proper pay rise with workers.”

AMAZON WORKERS announce week long strike in Coventry in March in dispute about pay. Strike dates: Feb 28, March 2, March 13-17. GMB says 350+ employees expected to take part. 1/2

— zoe conway (@zoeconway1) February 13, 2023

First ever strike by Amazon UK workers was in Coventry last month. GMB sees this action as a turning-point – for years they failed to make inroads into this sector. Amazon says involves a fraction of their 70,000 UK employees. they do not recognise the GMB 2/2

— zoe conway (@zoeconway1) February 13, 2023

The pound has made a decent start to the new week.

Sterling has gained almost half a cent against the US dollar, back to $1.21. Against the euro, it’s up a third of a eurocent at €1.133.

The currency could be benefitting from last Friday’s news that Britain has avoided falling into recession. But there are forecasts that the pound could weaken against the euro:

Rabobank 2/2: We continue to expect #EURGBP to edge to 0.90 by the middle of the year and see scope for further dips below #GBPUSD 1.20.

— Francesc Riverola – FXStreet.com 🎗 (@Francesc_Forex) February 13, 2023

Back in the City, shares in UK courier firm DX Group have fallen after it was hit by a legal claim of corporate espionage.

The Sunday Times reported yesterday that Sheffield-based logistics firm Tuffnells was alleging that several DX Group employees, who were former employees of Tuffnells, had conspired to obtain daily customer service reports.

Tuffnells has lodged its corporate espionage claim in the High Court, claiming that a traffic clerk at a London warehouse was asked to leak confidential corporate information to a rival in exchange for a £50 payment from a delivery driver.

Today, DX Group told shareholders that it had received a claim from Tuffnell Parcels Express last Friday afternoon, and that it had investigated the issue last year.

DX added:

The Group intends to defend its position robustly and will respond to the claim in due course.

Shares in DX fell by over 10% at one stage today, and are currently down around 6%.

Jonathan Haske’s comments about the impact of Brexit come less than two weeks after the Bank of England said the economic hit from leaving the EU had arrived sooner than thought.

At its February Monetary Policy Report, Threadneedle Street warned that business investment is “very subdued” and that the trade hit from Brexit had happened even sooner than it first feared.

And last week, another MPC policymaker – Catherine Mann – suggested Brexit had made the UK’s inflation problem worse, as new trade barriers had pushed up costs.

The Office for National Statistics has also reported this morning that UK renters are around three times more likely to face energy and food insecurity than property owners.

The ONS recorded that, over the four weeks to December 18, adults who rented their homes were 2.9 times more likely to experience some form of energy insecurity than those who own their own properties.

It added that renters were 3.2 times more likely to have suffered food insecurity.

The report also indicated older people are less likely to face energy security problems than younger adults, saying:

Adults aged 30 to 64 years had between 1.5 and 1.8 higher odds of experiencing some form of energy insecurity than those aged 65 years and over; while adults aged 16 to 64 years had between 2.0 and 4.6 higher odds of experiencing some form of food insecurity than those aged 65 years and over.

New figures from the Office for National Statistics have highlighted the shortage of healthcare workers that is hurting the UK economy.

In December 2022, across the UK there were more online adverts for healthcare jobs than for other professions, the ONS reports.

Healthcare vacancies were the most common option in 88.8% of local authorities, it adds, while there was higher demand for “information and communication technology” professions in the other 11.2% of the country.

The ONS says that this increase is part of a longer-term increase in demand.

Despite raised relative demand during the height of the coronavirus pandemic, since 2017 their share of online job adverts has been increasing consistently.

The increased share of healthcare profession job adverts, over the last year, was through an increase in the share of adverts for care assistants, nursing, and specialised nurses.

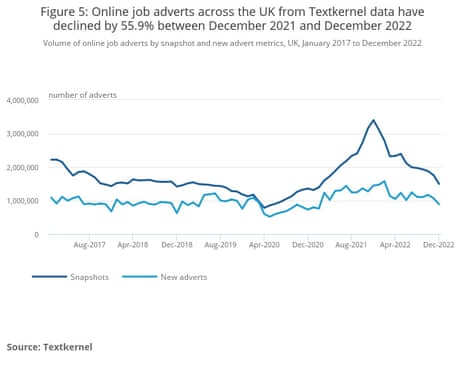

The ONS says it analyed data from jobs site Textkernel. It found that the number of online job adverts had more than halved year-on-year by the end of 2022, as companies cut back on hiring.