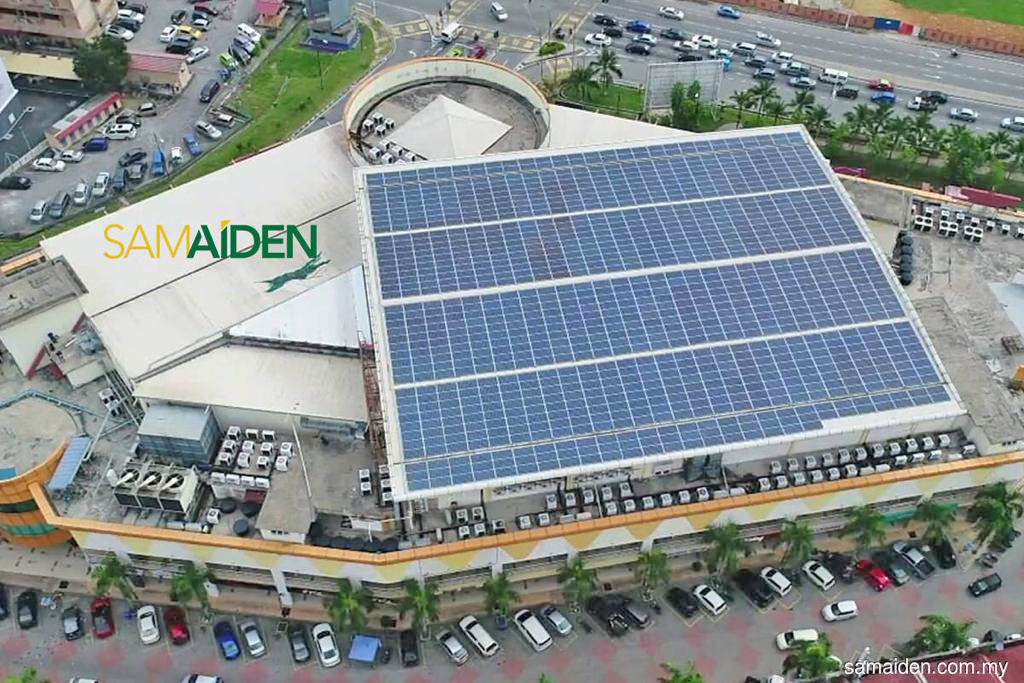

Accelerating momentum and increasing adoption of green energy will continue to drive solar players such as Samaiden and Solarvest – two of only four listed pure-play solar EPCC players. — Bernama photo

PROSPECTS are looking brighter for solar players in the country – pun intended – as initiatives are being introduced for clean energy and green mobility development.

In the revised Budget 2023, we have seen positive initiatives such as the extension of Green Investment Tax Allowance (GITA) and Green Income Tax Exemption (GITE) incentive period from 3 to 5 years until 31 December 2025.

They also include the provision of RM2 billion financing from Bank Negara Malaysia (BNM) to support green tech start-ups and SMEs to implement low-carbon practices, as well as the implementation of Green Technology Financing Scheme (GTFS) with an increased allocation of RM3 billion until 2025, and the scope of financing to be widened to cover electric vehicles (EVs) with a guaranteed limit of up to 60 per cent.

Additionally, a provision of 100 per cent statutory income tax exemption for manufacturers of EV chargers from 2023 to 2032, and a 100 per cent allowance on investment tax for five years, is yet another example of the push towards cleaner energy in the revised Budget 2023.

Indeed, accelerating momentum and increasing adoption of green energy will continue to drive solar players such as Samaiden Group Bhd (Samaiden) and Solarvest Holdings Berhad (Solarvest) – two of only four listed pure-play solar EPCC players.

Together with surging demand, researchers with RHB Investment Bank Bhd (RHB Research) see further catalysts stemming from the recent tariff hike and decreasing cost pressure from panel prices and material costs.

“Earnings should also scale to new highs, backed by robust orderbook on hand and contribution from own green energy plants,” it commented in a special report on solar sector outlook.

The introduction of the Bursa Malaysia launched its Voluntary Carbon Market (VCM) at the end of last year is said to spur solar interest.Introduced late last year, the exchange will facilitate corporations in trading voluntary carbon credits – putting a value on carbon, which penalises activity that creates carbon emissions and rewards climate-friendly projects and solutions.

“This could spur companies to engage in decarbonisation projects and green investments such as solar adoption, providing better growth for Samaiden’s and Solar’s orderbooks,” RHB Research added.

According to Bursa Malaysia’s press release, any kind of undertaking that results in avoidance, reduction or elimination of GHG emissions is accepted to be traded be it nature-based or technology-based solutions.

Meanwhile, on March 16 this year, Bursa Carbon Exchange (BCX) carried out the nation’s inaugural carbon credit auction with 15 buyers from various industries purchasing a total of 150,000 Verified Carbon Standard (Verra)-registered carbon credits.

In a statement, Bursa said that BCX enables the trading of standardised contracts with underlying carbon credits from climate-friendly projects and solutions, which corporates can use to offset emission footprint and meet climate goals.

“With this key milestone, the auction facilitated the price-discovery of carbon credits from two new products offered by the BCX – the Global Technology-Based Carbon Contract (GTC) and the Global Nature-Based Plus Carbon Contract (GNC+),” Bursa said.

The GTC was oversubscribed and cleared at RM18.50 per contract, which featured carbon credits from the Linshu Biogas Recovery and Power Generation Project in China, which aligns with the United Nations Sustainable Development Goals (UNSDG), namely generating clean energy, providing decent work and addressing climate change by reducing fugitive methane emission leakage to the atmosphere.

Meanwhile, GNC+ fetched a clearing price of RM68 per contract, featuring carbon credits from the Southern Cardamom Project, which is a REDD+ (Reducing Emissions from Deforestation and Forest Degradation) project from Cambodia that comes with climate, community and biodiversity (CCB) standard that provides additional co-benefits, contributing to the livelihoods of local communities and biodiversity conservation in the Indo-Burma Biodiversity Hotspot.

“Both projects were carefully selected and curated to spur local interest in similar carbon offsetting project development.

“There was strong interest and healthy price signal by the domestic corporate sector, notably government-linked companies and financial institutions, which demonstrated their leadership in the budding VCM space in Malaysia,” it said.

Among the successful bidders were AmBank Malaysia, AmBank Islamic, AmInvestment Bank, AU Synergy, CIMB Bank, Maybank, Masteel, MIDF Investment, Permodalan Nasional, Pet Far Eastern Malaysia, Petronas, Press Metal, Telekom Malaysia and Yinson.

Programme opens up parameters

The Energy Commission has confirmed that non-solar renewable energy resource developers may participate in the Corporate Green Power Programme (CGPP).

This follows the government’s recent announcement of an additional quota of 200MW for the CGPP to enable more companies to subscribe to green electricity supply to fulfil environmental social and governance (ESG) commitments, the industry regulator said.

In line with this, applications for the entire quota under the CGPP programme will be open until Dec 31, 2023 or until the quota is fully subscribed, the commission said in a statement on March 14.

Introduced in November last year, the CGPP is aimed at encouraging solar power producers and commercial power consumers to partner up to commission additional solar power generation capacity.

The deadline for interested parties to apply under this programme was initially set for February, and then extended to March, before being further extended to December.

Natural Resources, Environment and Climate Change Minister Nik Nazmi Nik Ahmad announced the additional quota of 200MW for CGPP on March 9. This raised the total CGPP quota to 800MW.

The Energy Commission said that for now, the use of non-solar power plants can still be implemented under the Feed-in Tariff scheme or through the New Enhanced Dispatch Arrangement mechanism.

“In accordance with the announcement and changes, the information guide for the CGPP (for solar PV plants) will be uploaded on the commission’s website by April 2023,” it added.

And looking at large scale solar (LSS) projects here, compared to the previous reverse bidding mechanism for LSS programmes, the CGPA will be an agreement between SPP and corporate consumers.

Under the New Enhanced Dispatch Arrangement (NEDA), the SPP will export the electricity generated to the power grid and the energy will be purchased by the consumer at an agreed-upon price.

If the System Marginal Price (SMP) is higher than the CGPA price, RHB Research noted that the SPP will pay the consumer the difference, and vice versa.

As seen with the previous LSS4, due to competitive tariff bids, some of the projects had to be delayed in account of rising costs.

The LSS4 power purchase agreements (PPA) were also extended by four years. Assuming a contract value of RM2.3 million per MW, the total worth of solar projects under CGPP could fetch RM1.4 billion.

“Both solar players under our coverage have expressed their intention in capitalising on the new programme either as project owner or engineering, procurement, construction and commissioning (EPCC) contractor.

“We believe Solarvest stands a better chance in the tenders given its previous LSS4 participation.”

Looking at LSS billings and potential LSS5, the research house saw that the progress in LSS projects in Malaysia has been rather weak in the past two years no thanks to elevated cost pressure and the movement control order (MCO).

Only 56 per cent or 909MW of the LSS 1-3 capacities are operational as of 4Q21. Beginning 1Q22, the Energy Commission (EC) has included the 830.06MW LSS4 capacities into the database.

Only 45 per cent or 1160.4MW of the total LSS1-4 capacities are operational as of 2Q22. We believe the situation will improve in 2023 as most LSS4 contract winners would have achieved financial closure by end-2022.

“Hence, EPCC contractors are generally still busy, with LSS projects and robust commercial and industrial (C&I) demand. The 1,200MW new quota may provide project sustainability for solar EPCC contractors – even with the absence of LSS5, for now.

“We believe the regulator will want to emphasis on the implementation of the Virtual Power Purchase Agreement (VPPA), probably by this year. That said, with the financial closure and kickstarting of LSS4 contracts, we will not be surprise to see the EC rolling out the next round of LSS bidding in 2H23 if the moderated solar panel prices sustain by then.

“As the government had previously announced an allocation of 1,200MW for solar resources to boost the country’s commitment in the energy transition, it is under the assumption that the remaining 600MW will come under LSS5, which will inject another circa RM1.4 billion worth of contracts. This will provide further upside for both solar players.”

Together with surging demand, RHB Research see further catalysts stemming from the recent tariff hike and decreasing cost pressure from panel prices and material costs. — Bernama photo

Easing cost factors

A big boost for solar players also come in the form of easing prices for key components of solar module prices including raw material prices, shipping costs, module technologies, and foreign exchange rates.

Over 2022, these costs escalated, some even to record highs, which had caused delays in projects and dampened solar demand.

“In 2022, the US dollar aggressively strengthened against the ringgit, which caused solar prices to skyrocket and, in turn, postponed installations by C&I clients as well as narrowed margins,” RHB Research noted.

“To safeguard against the diminishing margins, Solarvest and Samaiden began to trade in Chinese yuan, a relatively more stable currency.

Although the US dollar had depreciated since Nov 2022, both companies guided that they are still trading in both currencies, opting for the better quote.”

Moving forward, although it will not be eliminated entirely, the option to trade in CNY will help to mitigate the impact of FX risk for both solar players under RHB Research’s coverage.

Samaiden guided that other items – which account for circa 20 per cent of total costs – such as inverters, and transformers cables are still procured in the US dollar.

The rise in polysilicon prices had the largest impact to material costs in 2021 to 2022, which caused some contracts to be delayed and renegotiated. The hike was attributable to the growth of polysilicon demand surpassing capacity enhancements.

“On the bright side, compared to the recent peak registered in Aug 2022, the average price of the polysilicon has fallen by slightly more than 50 per cent.

“The China Nonferrous Metals Industry Association (CNMIA) attributed the decline to a slight demand reduction as well as the growing capacity of the polysilicon industry. CNMIA estimates that China’s domestic polysilicon capacity has reached 1.2 million metric tonnes by the end of 2022.”

Other factors such as the increase in the price of aluminum, which is used for frames, also contributed to the price hike of photovoltaic (PV) modules. However, Solarvest guided that aluminum prices account for less than five per cent of its module cost. Hence, the rebound in aluminum prices, after it tapered down in late 2022, is of no concern.

“In the longer run, continued technological advancements should stabilise module prices, sequentially creating greater demand for solar installations not only among C&I, but also residential clients. Samaiden and Solarvest expect solar installations to pick up, coming from the softening of solar panel prices.”

When asked on regional contracts, Chong revealed that Solarvest is fast looking to tap into overseas efforts.

Solarvest gearing up for higher demand

SOLARVEST is fast making its mark in Malaysia’s PV scene. According to its executive director and group chief executive officer, Davis Chong Chun Shiong, this comes as Malaysia’s potential for clean energy development is promising, supported by the government’s implementation of favourable initiatives aimed at fostering the growth of the clean energy sector.

The country has set a target to increase its renewable energy capacity by 31 per cent by 2025 and to achieve carbon neutrality by 2050.

Chong lauded the revised Budget 2023’s initiatives for the solar sector.

“Besides, in the recent release of International Renewable Energy Agency’s (IRENA) Malaysia energy transition outlook 2023 report, Malaysia’s final energy consumption will double by 2050 in the Planned Energy Scenario (PES), where energy demand is expected to increase two per cent annually on average, from 2.1 exajoule (EJ) in 2018 to 4.0 EJ by 2050,” Chong told BizHive in an exclusive interview.

“With that, solar PV will play a key role in the energy transition with its total capacity potentially reaching 59GW in the PES, translating into a generation capacity share of 51 per cent.

“Given Malaysia’s potential for its renewable energy generation capacity, the inclusion of Battery Energy Storage System in GITA and GITE’s scope of solar activities announced in the Budget 2023 also marks a great start in strengthening the country’s grid infrastructure.”

Davis Chong Chun Shiong

As the country progress towards grid modernisation with better voltage stability, we believe efficient integration of clean energy for green electrification can be attained.

Apart from utility-scale solar farm projects, the commercial and industrial (C&I) segment makes up most of Solarvest’s clientele.

Out of our current unbilled orderbook of RM595 million, 30 per cent or RM178.9 million is contributed by the residential and C&I segment, while 70 per cent or RM 417.0 million is taken up by large-scale solar projects.

The uptake of C&I projects can be attributed to the growing awareness of corporate sustainability initiatives, leading up to an increase in interest in clean energy adoption among C&I players.

Malaysian Government’s recent announcement of the Imbalance Cost Pass-Through mechanism for a 20 sen/kilowatt-hour (kWh) surcharge from the previous 3.7 sen/kWh on medium voltage (MV) and high voltage (HV) C&I users also incentivised businesses to transition towards solar energy for cost savings in the long-term.

Looking ahead, the clean energy adoption rate among C&I players is expected to accelerate following the anticipation of carbon pricing mechanisms. To reduce the carbon costs imposed on their operations, businesses are expected to implement green investments to reduce greenhouse gas (GHG) emissions.

This can be observed in the surge of interest in our Powervest solar financing program, in which we have a project pipeline of around 600 megawatt-peak (MWp) for the C&I segment.

East Malaysia’s solar ventures

Following the Sarawak Government’s implementation of the Post Covid-19 Development Strategy 2030 (PCDS2030), it aspires to transform the State into a regional renewable energy powerhouse.

Among the initiatives to promote renewable energy is the development of hydrogen energy, floating solar, mini hydro projects, and EVs.

“As an effort to strengthen our market presence in East Malaysia, we have signed a Memorandum of Understanding (MoU) with the Centre for Technology Excellence Sarawak (CENTEXS) and Huawei Technologies (Malaysia) Sdn Bhd (Huawei Malaysia) to launch a Green Energy Lab in Kuching, Sarawak in January 2023,” Chong said.

“The Lab will provide green energy-related learning programmes involving solar, green mobility, battery storage systems, as well as green hydrogen to spur research and development collaboration and intellectual property creation in clean energy solutions.”

As for Sabah, the introduction of the Sabah Renewable Energy Rural Electrification Roadmap (Sabah RE2 Roadmap) also shows great potential for clean energy development in the state.

With the Sabah RE2 Roadmap, the state targets to introduce micro-grid renewable energy for at least half of the unelectrified remote areas in Sabah by 20276.

“On the corporate front, we are pleased to announce that Solarvest has achieved financial close for our last LSS4 project, namely the 12 megawatts (MW) solar farm in Manjung, Perak. This completes the financial close for all three LSS4 projects, which have a cumulative capacity of 50MW.

“After two of the three LSS4 projects are commissioned by May 2023 as scheduled, we are expecting an increase in net profit of around RM7 million.

“Besides, we are certainly looking forward to the tender submission for the 800MW virtual power purchase agreements (VPPA) quota under the Corporate Green Power Programme (CGPP).

“We intend to leverage this opportunity to replenish our current unbilled order book of RM595 million.”

Eye on regional contracts

When asked on regional contracts, Chong revealed that Solarvest is fast looking to tap into overseas efforts.

This follows its maiden consortium with a solar energy solutions provider based in the Philippines to provide rural electrification in Mindanao Island there.

In a statement on March 6, Solarvest said it is partnering with Edward Marcs Philippines Inc to work with Philippine government-owned National Power Corporation (NPC) to construct electricity distribution systems in rural areas.

“The Philippines’ electricity demand has been growing steadily due to economic growth, urbanisation, and population growth,” Chong said of this update.

“By that, the country faces challenges such as limited access to electricity in remote and off-grid areas.

“Solar energy has emerged as a promising solution to this problem due to its relative cost efficient and ease of access in meeting the growing electricity demand.

“We are glad to play a part in meeting the Philippines’ rural electrification targets by means of renewable energy via our involvement in a 1 MWp ground-mounted solar development with the Philippines-government-owned National Power Corporation (NPC).”

Following the reopening of national economies, Solarvest is resuming its overseas expansion effort and as of 23 February 2023, having tendered 119MWp of projects in the Philippines; 322MWp of projects in Taiwan; 57MWp of projects in Vietnam; and 9MWp of projects in Indonesia.

Starting up with innovation

Beyond the aforementioned projects, Solarvest also has focus on building up the start-up scene via its Solarvest Innovation Lab 2023 (SIL).

SIL is a startup program that was first founded in October 2021 to promote innovation and entrepreneurship with a focus on green technology (greentech), financial technology (fintech), and renewable energy in Malaysia.

SIL 2023 is a continuation and revitalisation of the startup program and has a broader and more impactful reach among start-ups with a more comprehensive support for their technical and business needs, capital requirements, and networking opportunities.

The goal is to create an ecosystem that supports startups at every growth stage and unlocks the commercial potential of their innovative concepts.

“By unearthing revolutionary ideas in greentech, fintech, and renewable energy, we will push the innovation frontier and bridge the gap between new business concepts and marketable solutions,” Chong said of this initiative.

“Additionally, as we expand vertically across the clean energy ecosystem, we plan to integrate viable business ideas in the development of better solutions that will help increase energy yield and overall efficiencies.”

Chow remains optimistic of Samaiden’s prospects, following the government’s commitment to meeting its target of achieving net zero greenhouse gas emissions by 2050

Samaiden grows towards next stage as it transfers to Main Market

SAMAIDEN hopes to take its company growth to the next stage, coming hot off the heels of its recent transfer of its entire issued share capital and outstanding warrants from ACE Market to the Main Market of Bursa Malaysia.

“For us, this is a historic milestone following our listing on the ACE Market of Bursa Securities on October 15, 2020,” Samaiden Group Bhd group managing director Chow Pui Hee said in a statement.

“We intend to leverage on our Main Market listing status to expand our market presence supported by the track record of EPCC projects that we have completed while seeking opportunities based on our renewable energy expertise in photovoltaic systems and power plants to offer the services that businesses and organisation need, for more sustainable operations.”

In a follow-up interview with BizHive, Chow remained optimistic of Samaiden’s prospects, following the government’s commitment to meeting its target of achieving net zero greenhouse gas emissions by 2050.

“In addition, I believe that the Malaysian government will continue to assist the development of the renewable energy industry in the future. After all, net zero greenhouse gas emissions is a big vision, and we are happy to be part of it.”

Chow suggested that liberalising the power supply within the nation is critically vital to promote the growth of our energy sector.

This comes as quota restrictions are still in place for power generation.

“We firmly believe that restriction alleviation, to certain extent, could spur the growth of green energy transition,” he told BizHive.

Chow Pui Hee

China’s reopening a ‘market disruption’

When asked if China’s abandonment of Covid-zero policy have any impact to solar power panel supply and price, Chow believed China’s reopening is disrupting energy markets as the abrupt shift from Covid Zero shutters industry and upends the usual flow of commodities.

“The China Silicon Industry Association has issued a statement saying that many wafer manufacturers used in solar panels have scaled back operations, with some operating at only 60 to 70 per cent of capacity.

“The supply shock comes at the tail end of a record-breaking year for solar installations in China. To keep up production, some Chinese renewables firms are operating closed loops in their factories to keep the virus at bay.

“The group will continue to maintain strict inventory management to avoid unnecessary additional costs. In addition, the board is cautiously optimistic that the group’s future performance will remain satisfactory.”

Currently, the group’s total outstanding orderbook stood at RM269.54 million as at December 31, 2022 and is expected to contribute positively to the group’s revenue and profit over the next three years.

Chow said Samaiden is constantly seeking the contribution of revenue from all of its business segments, in line with the company’s aim is to be the one stop services and solutions provider in clean energy industry.

“Presently, the contribution from EPCC still the largest but we have been actively looking for the RE asset ownership so that we can have the recurring income.

“Environmental consultancy is always our foremost interest since our foundation year while O&M can be served as the complementary services for our customers.”

“Investing in a RE asset typically requires a significant amount of capital expenditure.

Chow said it was important to carefully evaluate the financing position of the investor before making any decisions to invest in RE assets.

“Our ideal contribution from RE asset ownership will be around five to 10 per cent but this value could be growing higher if we are financially ready.”

Towards the region for expansion

When asked if there were there any updates to the Cambodian venture exploring clean energy-related business opportunity, Chow said: “We are still in discussions with Management Venture Asia (Cambodia) Ltd and will make the necessary announcements when the group has something concrete in hand.

“Expanding in Southeast Asia is part of our five-year plan given the region’s growing population and its geographical advantages. Partnerships are key and MVA’s domestic market presence as well as experience in RE infrastructure will ensure that the group’s expansion plans in Cambodia are focused.”

Samaiden was also utilising corporate partnerships to help itself grow, such as the recent partnership with Thingnario Ltd (Thingnario) with its operation and maintenance (O&M) business.

The partnership centres around the provision of telemetry monitoring system support to Samaiden’s RE and energy efficiency (EE) businesses by Thingnario.

“What we are looking to provide are effective and efficient solutions to our O&M customers to optimise asset performance and improve these assets return on investment,” Chow said.

“Thingnario’s solutions align with the group’s EE business, which was launched in October 2022 to add further value to the O&M services.

“The EE business mainly focuses on energy saving measures to reduce electricity consumption by commercial and industrial owners. The EE business solution we offer comprise energy assessment and energy optimisation.”

Samaiden also has its joint venture (JV) with Aneka Jaringan Holdings Bhd (Aneka Jaringan) formed in August 2022 to explore engineering, procurement, construction and commissioning (EPCC) of solar photovoltaic (PV) systems and power plants in Indonesia.

“Indonesia presents lots of potential not just for EPCC of solar PV projects but also for the provision of environmental consulting and O&M services.

“The partnership with Aneka Jaringan enables us to leverage on its local knowledge, network and experience.”