The first quarter of 2023 saw a record number of investments in space startups, with investment in Europe surpassing the US for the first time, according to an industry report.

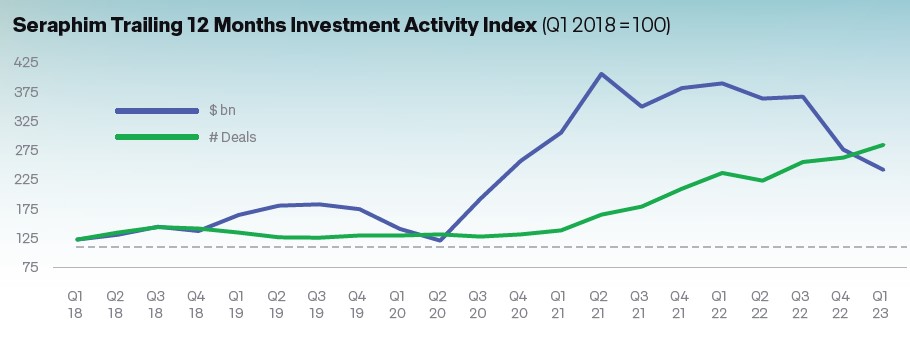

A total of US$1.4bn (£1.13mln) was invested in 141 private space startups, according to the Seraphim Space Index, up 75% from the final quarter of 2022, taking the total invested over the past 12 months to US$6bn.

Over a trailing 12-month period to end-March, investment declined across nearly all but one space industry subsector, with capital-intensive

subsectors experiencing the largest drops, which was expected after exceptionally large funding rounds between the second quarter of 2021 and early last year.

While early-stage deals remained the most common, there was a 120% increase in growth deals compared to the previous quarter, as many growth-stage companies returned to raise financing after delaying throughout 2022.

The 10 largest space technology deals made up 51% of the total sector investment in the past quarter, led by the US$165mln for Germany’s Isar Aerospace, which was the first European company to top the list since OneWeb in 2021, ahead of US-based Voyager Space (US$80mln) and Japan’s Astroscale (US$76mln).

Other Europeans in the top 10 include French space tug business Exotrail (US$58mln), Spain’s EOS-X Spaceship Company (US$54mln), Denmark#’s Agreena (US$49mln) and UK engine technology specialist Reaction Engines (£40mln).

“For the first time ever, private investment in spacetech in Europe surpassed that in the US, reflecting dramatic decreases in US investments and and increased European investments,” the report said.

“European governments and the EU have put an enormous focus on space sovereignty in launch, constellations, and communications in 2023, and it appears that private investors are catching up.”

It wondered if 2023 “could be Europe’s year”.European growth-stage companies thrived, securing five out of the top ten international round sizes.

Including Reaction Engines, UK space funding saw US$94.7mln of investment, making up 16.7% of European funding, from 10 deals.

Looking at SPAC (special purpose acquistion company) deals, via which many space companies floated on the stock market, valuations remained significantly below listing prices.

“We have seen that a lot of space SPACs have been struggling as the public markets become more conservative and risk-averse,” said Seraphim, which runs the Seraphim Space Investment Trust PLC (LSE:SSIT), where half-year results last month showed a 7% decline in NAV per share, with the shares down 65% over the past 12 months.

“Some of the companies that went public via SPAC have remained resilient, with AST, Blacksky and Rocket Lab share prices up from the end of the previous quarter. However, other companies like Satixfy and Virgin Orbit saw significant decreases in share price throughout Q1.”

Virgin Orbit, for instance, last month announced it was ceasing all operations and is currently planning an accelerated auction of its assets after filing for Chapter 11 bankruptcy.