The spot trading volume of leading cryptocurrency exchange Binance has plummeted by 48% last month, marking the second consecutive month of declines for the cryptocurrency trading platform.

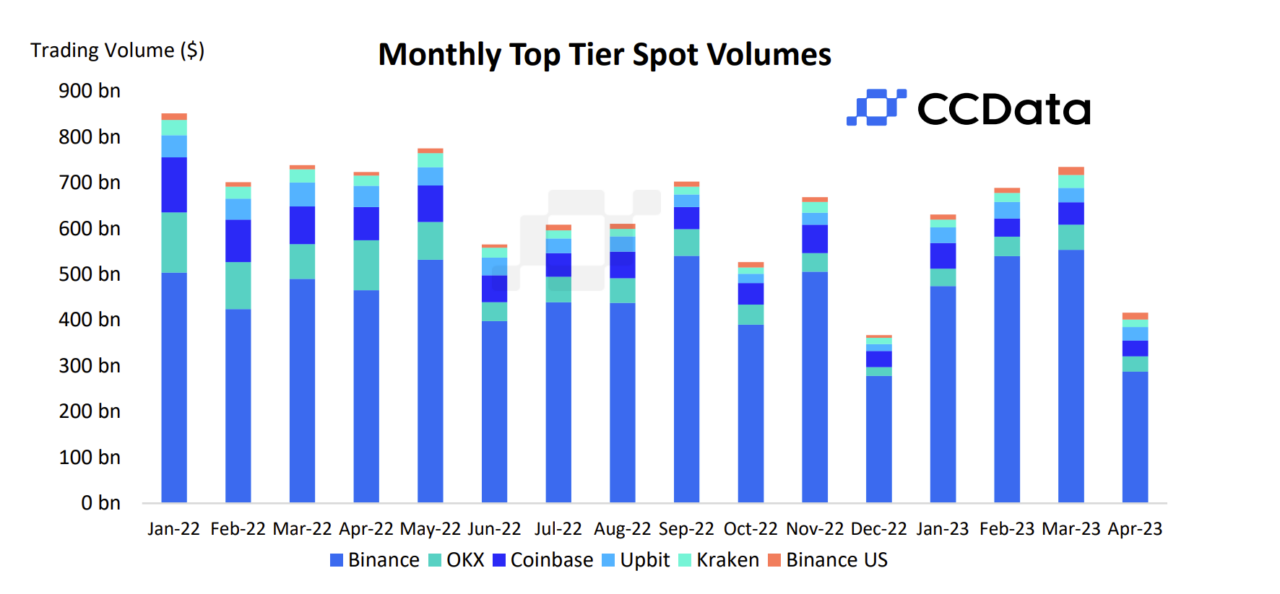

According to CCData’s latest Exchange Review report, Binance’s trading volume dropped to $287 billion last month, recording its second-lowest monthly trading volume since 2021. Its market share has also kept sliding, falling for the second consecutive month to 46.3%, its lowest market share since October 2022 prior to FTX’s collapse.

Binance is nevertheless still dominating the industry with a huge lead over its competitors. Coinbase and OKX, the second and third biggest exchanges by spot volume, only hold 5.60% and 5.39% of the total spot trading market share respectively, far behind Binance.

Binance’s lead has led to a massive boost in the BTC/TUSD trading pair, after it started offering its users zero-fee trading through it on March 22. The volumes hit a record high of $34 billion in April after a staggering 851% increase. TUSD also rose to the third place among stablecoins by trading volume on centralized exchanges, surpassing USDC for the first time in almost a year thanks to the move.

CCData’s report details that Binance’s volume fell during a month in which cryptocurrency spot trading volumes on centralized exchanges plummeted 40.2% to $621 billion, in a downturn that marked the lowest trading volumes since December 2022 and the second-lowest since July 2020, effectively bucking the year’s trend in trading activity.

The report also details that derivatives volumes dropped by 23.3% to $2.15 trillion, even though they reached a new record market share in the same month.

The volume drop this month can be linked to the uncertain macroeconomic situation, which involves possible recession risks and a halt of Fed rate hikes amid the turmoil in the banking sector.

Image Credit

Featured Image via Unsplash