UK ‘bottom of G7 growth league table’ despite avoiding winter recession

Despite expanding slightly over the last two quarters, avoiding a winter recession, the UK is still “bottom of the G7 league table” for growth since the Covid-19 pandemic, economists say.

Today’s GDP report shows that the UK economy was still 0.5% smaller in the first quarter of this year than in the last quarter of 2019 – just before Covid-19 hit the global economy.

In contrast, France’s economy is 1.3% larger, and Germany is just 0.1% smaller than in Q1 2019.

The US economy has raced ahead, and is 5.3% bigger than its pre-Covid size. The US economy benefited from several large stimulus packages, and also didn’t suffer as much of a jump in energy prices as Europe.

Today’s GDP data show 🇬🇧 is still the weakest performer in the G7 since late 2019, the last full quarter before the Covid pandemic.

But it’s worth noting that 🇩🇪 isn’t doing much better.

🇺🇸 is ahead of the pack by some margin. pic.twitter.com/8raWb9L2Ur— David Milliken (@david_milliken) May 12, 2023

This table, from this morning’s UK GDP report, shows the details:

As we covered earlier, the 0.1% growth in the UK in January-March beats Germany (no growth), but lags France, Italy and the US.

Samuel Tombs, economist at Pantheon Macroeconomics, says the UK is “still at the bottom of the G7 league table” since the pandemic.

Tombs told clients this morning:

The U.K. remains the only G7 country in which the main quarterly measure of GDP has not recovered to its pre-Covid peak yet; it still was 0.5% below its Q4 2019 level in Q1.

This chiefly reflects weakness in households’ real spending, which was 2.3% below its Q4 2019 level. But at least the magnitude of the underperformance is not increasing relative to other countries in Europe, which have faced a similarly enormous energy price shock.

Indeed, the U.K.’s quarter-on-quarter growth rate in Q1 matches the Eurozone’s 0.1% increase.

The TUC is concerned that the UK has been “flatlining” for more than a year.

TUC General Secretary Paul Nowak said:

Rishi Sunak still doesn’t have a plan to stimulate growth and get us out of this rut. And his ministers are making things worse by holding down pay while inflation is over 10%.

“Without pay growth, families are forced to cut back their spending, and business lose customers. That’s why a competent government would put pay growth at the heart of the UK’s economic plan.”

The UK economy has also suffered from weak business investment. It rose in the last quarter, but remains 1.4% below its pre-Covid levels.

NEW: @ONS data shows UK business investment rose by 0.7% in Q1 2023, outstripping the 0.1% rise in overall UK GDP & up from the 0.2% fall in Q4 2022.

But, business investment is still 1.4% below its pre-covid level vs GDP which is now 0.5% lower. pic.twitter.com/lwUmcSRBFK

— Suren Thiru (@Suren_Thiru) May 12, 2023

Key events

Royal Mail CEO Simon Thompson to step down

Newsflash: Royal Mail boss Simon Thompson is to step down, ending a turbulent two-year stint at the helm of the postal operator.

International Distributions Services, Royal Mail’s parent company, has just told the City that Thompson believes it is “the right time for the company to move forward under new leadership”, following the recent negotiators’ agreement between Royal Mail and the CWU union.

Thompson had been expected to step down this week, having been accused by unions of inflaming the bitter industrial dispute.

IDS says it is in “advanced stages of appointing a new CEO”; Thompson has agreed to remain with the business until 31 October 2023 as part of the transition.

Thompson’s credibility was put in question after a recent Commons select committee appearance, as my colleague Gwyn Topham explained on Monday:

A potential end to the long industrial dispute was reached last month in a provisional agreement with the Communication Workers Union, which has called strikes on 18 days in the past year. Members are voting on a three-year pay deal worth 10% that would also bring in Sunday working, but which the CWU said had headed off the “Uberisation” of Royal Mail jobs.

The union had accused the company’s management of “a complete lack of integrity” after changes to work practices that had not been agreed were imposed at offices across the country.

Thompson was accused of “incompetence or cluelessness” by MPs on the business committee after appearing before them in January and being recalled over questions about his evidence. They called on the regulator, Ofcom, to investigate whether the company had broken legal service requirements.

Today’s strikes on the railways will not help the economy to catch up with G7 rivals.

Members of Aslef, the train drivers’ union, have walked out today at more than a dozen train operators, disrupting services across England.

The leader of Aslef says pay negotiations with ministers have stalled over the past four months.

Aslef general secretary Mick Whelan said the union had seen “neither hide nor hair” from the Government since the beginning of the year, with “one token meeting” on January 6.

He told BBC Breakfast:

“They talk a good game, they don’t actually engage, they haven’t taken any ownership of this process as far as we’re concerned.

“The only people they talk to are the companies, they don’t talk to us.

Starmer: today’s GDP figures are “nothing to celebrate”

Sir Keir Starmer has said the latest economic growth figures were “nothing to celebrate” after UK gross domestic product (GDP) increased by 0.1% in the first quarter of this year.

Speaking to broadcasters during a visit to the Crick Institute in central London, the Labour leader said:

“This is nothing to celebrate and is yet more low growth on the back of 13 years of low growth.

“I think the essential question many people today will be asking themselves is, ‘Do I feel any better off now than I did 13 years ago when this Government started?’

“I think the resounding answer to that around the country will be, ‘No, I don’t’.”

Mark Sweney

As well as today’s UK GDP report, the other big news of the morning is that Mike Lynch, the billionaire founder of UK software group Autonomy, has been extradited to the US after losing his appeal in the High Court last month.

My colleague Mark Sweney reports:

Lynch is facing allegations that he duped the US firm Hewlett-Packard into overpaying when it struck an $11bn deal (£8.2bn) for his software firm Autonomy in 2011. He denies any wrongdoing.

Lynch, the founding investor of the British cybersecurity firm Darktrace, had said he was considering a last-ditch appeal to the European court of human rights after the high court ruling in London last month.

“On 21 April, the high court refused Dr Lynch’s permission to appeal his extradition,” a spokesperson for the Home Office said.

“As a result, the normal 28-day statutory deadline for surrender to the US applies. Dr Lynch was extradited to the US on 11 May.”

Analysts at UBS remain cautious on the UK’s growth outlook, despite the country avoiding recession over the last six months.

UBS economist Anna Titareva says:

With GDP growth showing marginal expansion in Q4 2022 and Q1 2023, two quarters which we previously expected to show the biggest contraction amid high energy bills, the UK has likely avoided a recession.

UBS are now reviewing their forecast that the UK economy would shrink by 0.4% this year – today’s GDP report suggests it could grow by 0.1% in 2023.

But higher business taxes, and mortgage costs, will weigh on growth, Titareva explains:

First, we expect the increase in the corporate tax (from 19% to 25%), the expiry of the super-deduction capital allowance (although somewhat offset by the new “100% First Year Allowance“) and tighter financial conditions to weigh on investment.

Second, higher mortgage repayments are likely to weigh on consumption.

Strikes knocked at least 0.1 percentage points off UK growth in January-March, estimates Cathal Kennedy, European economist at RBC Capital Markets.

Kennedy says:

Overall, reading from the falls in output in education (-0.7% q/q), transport (-1% q/q) and health (-0.5% q/q) we think that combined the direct impact of strikes shaved around 0.1ppt off Q1 growth (note that is just the direct impact and doesn’t take account of any indirect impacts).

That suggests UK growth could have been twice as fast in Q1 otherwise (+0.2%, not the +0.1% growth estimated this morning).

Resolution: the UK’s relative decline is clear

High inflation, and falling real wages, means that the current period of very weak economic growth will feel like a recession for many people.

James Smith of Resolution Foundation explains why, in this Twitter thread:

.@ONS GDP out for Q1 this morning and, despite weak data for March (-0.3% MoM), Q1 as a whole registered growth, albeit of just 0.1%. Clear that we’re not out of the woods of the cost of living crisis yet with economy continuing to flatline. A short thread to follow…

— JamesSmithRF (@JamesSmithRF) May 12, 2023

The good news: growth of 0.1% in Q1 2023 is clearly not the recession that many had been fearing. And was even a bit stronger than yesterday’s Bank of England forecast of flat GDP in Q1. pic.twitter.com/OWSaYF707k

— JamesSmithRF (@JamesSmithRF) May 12, 2023

Bad news: this is still very weak by historical standards and the economy flatlining will feel like a recession to many. Growth of just 0.2% over the past year is weaker than *quarterly* average growth before the pandemic! pic.twitter.com/0A29JIISNc

— JamesSmithRF (@JamesSmithRF) May 12, 2023

The picture is one of weak growth across major advanced economies in Q1 2023 with the UK is faring better than some… pic.twitter.com/ABChcM3xsW

— JamesSmithRF (@JamesSmithRF) May 12, 2023

…but if we zoom out and look at the post-pandemic period, the UK’s relative decline is clear – on a quarterly basis UK GDP is still below its pre-pandemic level in Q4 2019. We are the only G7 country in this position. pic.twitter.com/qfP4H63zjp

— JamesSmithRF (@JamesSmithRF) May 12, 2023

Stepping back, this chart reminds you that the Bank of England told us yesterday we’re in the midst of a period of stagnant growth – so looks likely that we’re likely to get more disappointing GDP growth in the coming months… pic.twitter.com/YaJAaBPN0m

— JamesSmithRF (@JamesSmithRF) May 12, 2023

And stepping back, you can see the blight of weak growth in recent years with GDP now a whopping 7% below its pre-pandemic trend. Clearly the first priority is defeating high inflation, but addressing this terrible growth performance will be the challenge for the decade ahead. pic.twitter.com/Oq0wzFrCF1

— JamesSmithRF (@JamesSmithRF) May 12, 2023

Analysis: Too early to sound the all-clear as impact of UK rate rises yet to be felt

Our economics editor, Larry Elliott, says it is still too soon to sound the all clear, let alone hang out the bunting, for the UK economy.

He points out that the economy is still 0.5% smaller than it was in late 2019, the date of the last general election and the period immediately before the start of the Covid-19 pandemic.

Larry explains:

The UK economy has been going nowhere for the past year. After rebounding most of the way out of its pandemic trough by early last year, there has been virtually no movement. In three of the last four quarters – including the first three months of 2023 – there was growth of 0.1%, and in the other the economy contracted by 0.1%.

This is unusual. Periods when the economy moves sideways are rare, especially ones that go for as long as a year. They tend to be followed either by recession or recovery, and while the signs are that it will be the latter, it is too soon to say for sure.

On the upside, the economy continued to expand through what was always going to be a tough winter. A combination of double-digit inflation and widespread strikes represented two serious headwinds to activity, and even 0.1% growth is better than most forecasters were expecting.

UK ‘bottom of G7 growth league table’ despite avoiding winter recession

Despite expanding slightly over the last two quarters, avoiding a winter recession, the UK is still “bottom of the G7 league table” for growth since the Covid-19 pandemic, economists say.

Today’s GDP report shows that the UK economy was still 0.5% smaller in the first quarter of this year than in the last quarter of 2019 – just before Covid-19 hit the global economy.

In contrast, France’s economy is 1.3% larger, and Germany is just 0.1% smaller than in Q1 2019.

The US economy has raced ahead, and is 5.3% bigger than its pre-Covid size. The US economy benefited from several large stimulus packages, and also didn’t suffer as much of a jump in energy prices as Europe.

Today’s GDP data show 🇬🇧 is still the weakest performer in the G7 since late 2019, the last full quarter before the Covid pandemic.

But it’s worth noting that 🇩🇪 isn’t doing much better.

🇺🇸 is ahead of the pack by some margin. pic.twitter.com/8raWb9L2Ur— David Milliken (@david_milliken) May 12, 2023

This table, from this morning’s UK GDP report, shows the details:

As we covered earlier, the 0.1% growth in the UK in January-March beats Germany (no growth), but lags France, Italy and the US.

Samuel Tombs, economist at Pantheon Macroeconomics, says the UK is “still at the bottom of the G7 league table” since the pandemic.

Tombs told clients this morning:

The U.K. remains the only G7 country in which the main quarterly measure of GDP has not recovered to its pre-Covid peak yet; it still was 0.5% below its Q4 2019 level in Q1.

This chiefly reflects weakness in households’ real spending, which was 2.3% below its Q4 2019 level. But at least the magnitude of the underperformance is not increasing relative to other countries in Europe, which have faced a similarly enormous energy price shock.

Indeed, the U.K.’s quarter-on-quarter growth rate in Q1 matches the Eurozone’s 0.1% increase.

The TUC is concerned that the UK has been “flatlining” for more than a year.

TUC General Secretary Paul Nowak said:

Rishi Sunak still doesn’t have a plan to stimulate growth and get us out of this rut. And his ministers are making things worse by holding down pay while inflation is over 10%.

“Without pay growth, families are forced to cut back their spending, and business lose customers. That’s why a competent government would put pay growth at the heart of the UK’s economic plan.”

The UK economy has also suffered from weak business investment. It rose in the last quarter, but remains 1.4% below its pre-Covid levels.

NEW: @ONS data shows UK business investment rose by 0.7% in Q1 2023, outstripping the 0.1% rise in overall UK GDP & up from the 0.2% fall in Q4 2022.

But, business investment is still 1.4% below its pre-covid level vs GDP which is now 0.5% lower. pic.twitter.com/lwUmcSRBFK

— Suren Thiru (@Suren_Thiru) May 12, 2023

Reuters: UK weakest G7 performer since pandemic

Despite growing slightly in January-March, Britain’s economy remained 0.5% smaller than in the fourth quarter of 2019, shortly before the coronavirus pandemic.

That’s a weaker rebound than any other major advanced economy, Reuters points out.

Today’s GDP data show 🇬🇧 is still the weakest performer in the G7 since late 2019, the last full quarter before the Covid pandemic.

But it’s worth noting that 🇩🇪 isn’t doing much better.

🇺🇸 is ahead of the pack by some margin. pic.twitter.com/8raWb9L2Ur— David Milliken (@david_milliken) May 12, 2023

Full story: UK economy shrank unexpectedly by 0.3% in March

Phillip Inman

The UK economy shrank unexpectedly in March, by 0.3%, as the cost of living crisis and industrial action took a toll, my colleague Phillip Inman writes.

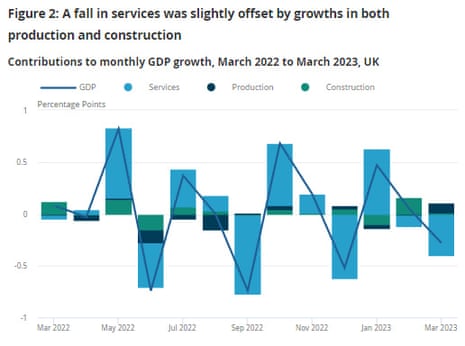

However, the economy grew by 0.1% over the first quarter as a whole, mainly because of a strong January, while growth flatlined in February, according to the Office for National Statistics. It followed 0.1% growth in the final quarter of 2022.

Darren Morgan, an ONS director of economic statistics, said:

“Despite the UK economy contracting in March, GDP grew a little over the first quarter as a whole.

“The fall in March was driven by widespread decreases across the services sector. Despite the launch of new number plates, cars sales were low by historic standards – continuing the trend seen since the start of the pandemic – with warehousing, distribution and retail also having a poor month.

“These falls were partially offset by a strong month for manufacturing as well as growth in gas production and distribution and also in construction.”

The Bank of England, which increased interest rates to 4.5% on Thursday, has forecast that the UK economy will stagnate this year – expecting growth of 0.25% – after tearing up a forecast last year that Britain was on course to suffer one of the longest recessions on record, stretching into 2024.

More here:

Economists are hopeful that the UK economy will avoid a technical recession this year, after growing slightly in the first quarter of 2023.

Thomas Pugh, economist at audit, tax and consulting firm RSM UK, predicts the UK economy will shrink in April-June, but won’t suffer two quarters of contraction in a row.

Pugh says:

‘The 0.1% q/q rise in GDP in Q1 means the UK has probably avoided a recession altogether this year. Admittedly, the economy will probably contract in Q2 due to the impact of bad weather, strikes and an extra Bank holiday. But we expect GDP to rebound in the second half of the year meaning there won’t be the two consecutive quarters of negative GDP growth needed to satisfy the usual definition of a recession. Of course, that is a technicality.

The big picture is that the economy is still 0.5% below its pre-pandemic level and is unlikely to regain that level until the end of the year at the earliest.

Ben Jones, CBI lead economist, says the economy is showing more resilience than expected, but warns that 2023 will still be difficult:

“The UK economy is proving more resilient than widely expected and it looks increasingly likely that the UK will avoid a recession this year. Underlying momentum appears to be firming, with our surveys showing growth expectations for the quarter ahead creeping back into positive territory for the first time in a year.

“Nonetheless, this is still going to be a difficult year for many UK households and businesses. Whilst we anticipate that inflation will slow rapidly through the summer, higher interest rates will act as a drag on spending. But we are likely to have weathered the worst of the storm, and expect a mild economic recovery in the year ahead.”

UK government minister Huw Merriman said the first-quarter growth statistics for 2023 were “good news” and had defied “more pessimistic” forecasts.

After the ONS reported GDP rose by 0.1% in January-March, the rail minister told Times Radio that “It is good news that we’re seeing signs of growth”.

Merriman added:

“Previously, the Bank of England had given a more pessimistic prediction, so that’s very positive.

“We need to stay on track, make sure we halve inflation, get the economy growing, but we’ve got to reduce debt as well.

“These are steps in the right direction. I’m keen that we maintain the momentum and make sure that the economy is in a stable place so we can continue to deliver the other priorities that people have for us.”

Comparing quarterly numbers to pre pandemic level, pattern across G7…UK still 0.5% smaller economy than back then, ie pretty much no growth since start of the Parliament… forecast to get there by end of year – 4 years without growth, Germany not quite as bad, others much better pic.twitter.com/JOggizUS8x

— Faisal Islam (@faisalislam) May 12, 2023

International comparisons

The UK economy lagged behind some major international rivals in the first quarter of this year, but did outperform Germany.

The 0.1% rise in UK GDP in January-March, reported this morning, matches the eurozone average of 0.1% in Q1 2023, but weaker than the European Union average of 0.3% growth.

France, though, grew by 0.2% in January-March, while Italy and Spain both expanded by 0.5%, and Portugal’s growth accelerated to 1.6%.

Germany’s economy stagnated in Q1 2023, though.

Further afield, the US economy grew at an ‘annualised rate’ of 1.1% in Q1, which is the equivalent of almost 0.3% quarterly growth.

Japan is forecast to have grown by an annualised 0.7% – or almost 0.2% during the quarter – in the first three months of 2023.

Canada is forecast to have grown by 2.5% on an annualized basis – or around 0.6% in the quarter.

ING: UK economy sees “surprise contraction in March”

The 0.3% contraction in the UK economy in March is a surprise, says James Smith, ING’s developed markets economist.

Smith warns that the economic data is “hard to read right now”, a problem that will be compounded by the extra Bank Holiday in May for the coronation.

But in general, falling gas prices and a resilient jobs market suggests the near-term recession risk has eased, Smith says. And it you strip out all the volatility, the economy “seems to be reasonably stagnant”.

Smith explains:

Monthly GDP shows an unexpected 0.3% fall in activity during March, owing to weakness across a range of sectors. March was memorably wet, so some of this underperformance can be attributed to bad weather, and to some extent also strike action. But that doesn’t seem to explain all of the disappointment, with a 0.8% fall in consumer-facing services, and casts doubt over the Bank of England’s tentative finding in yesterday’s Monetary Policy Report that private sector activity had staged a modest recovery throughout the first quarter.

Ultimately, the recent figures have been thrown around by several one-off factors, ranging from the Queen’s funeral last year, to strikes and even some knock-on effect from the World Cup at the end of last year.

That volatility will continue, given that the extra Bank Holiday this month for the Coronation will likely temporarily shave 0.5% off monthly GDP, only to be regained in June. While the impact of these additional holidays appears to have lessened compared to past decades, it’s probably enough to produce a 0.2% decline in overall second-quarter GDP.

While the UK has so far managed to avoid a technical recession, defined as two consecutive quarters of growth, March’s figures highlight show that the economic backdrop is sluggish.

So says Victoria Scholar, head of investment at interactive investor, who adds:

Stubbornly high inflation, negative real wage growth and general cost of living pressures are weighing on the consumer, and in turn the services industry which is typically a key growth engine for the UK economy. Today’s figures point to the importance of taming inflation, a daunting task facing the Bank of England and the government, in order to catalyse a revival in services.

The pound has come off its near one-year highs but is trading modestly higher against the US dollar after the Bank of England raise interest rates again to 4.5% on Thursday.”

Hunt: Good news that economy is growing

Chancellor Jeremy Hunt has responded to today’s GDP report, saying:

“It’s good news that the economy is growing but to reach the government’s growth priority we need to stay focused on competitive taxes, labour supply and productivity.

“The Bank of England Governor confirmed yesterday that the Budget has made an important start but we will keep going until the job is done and we have the high wage, high growth economy we need.”

Yesterday, the BoE said that the fiscal support in Hunt’s Spring Budget had helped to strengthen the economic outlook.

Hunt doesn’t mention, though, that the economy stalled in February, and contracted unexpectedly in March after a strong January.

It’s also not immediately clear how a ‘high wage, high growth’ economy will be achieved while the government is refusing to accept public sector pay demands, leading to strikes which are hitting growth.