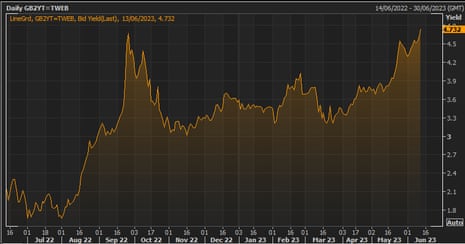

Newsflash: UK 2-year bond yields above Truss panic levels

Expectations that UK interest rates will keep rising are driving up the British government’s short-term borrowing costs ABOVE levels seen in Liz Truss’s brief premiership.

That’s bad news for people who looking to take out a mortgage, or remortage, soon.

The yield, or interest rate, on UK two-year government bonds has hit 4.73% this morning, up from 4.62% last night, after this morning’s jobs report showed regular pay growing at the fastest rate on record.

That is slightly higher than the peak seen in the turmoil after last autumn’s mini-budget, when chancellor Kwasi Kwarteng’s plan for unfunded tax cuts spooked the markets.

These two-year gilts are used to price fixed-term mortgages, and the recent increase in yields has already been forcing lenders to reprice deals, or pull them off the markets.

There could be more pain ahead too, as the money markets expect Bank of England base rate to hit 5.5% by the end of this year, up from 4.5% today.

Longer-dated government bond yields have also risen today, but are below their panic levels last autumn.

30 year yields still below the Trussonomics/LDI crisis level: 4.6% vs 5% then.

— Bond Vigilantes (@bondvigilantes) June 13, 2023

The surge in bond yields last autumn was partly driven by forced selling by pension funds who had followed Liability Driven Investment strategies, and by a lack of confidence in the Truss-Kwarteng plan.

Neil Wilson of Markets.com says the current situation is different, compared to last September when “the mini-Budget was doing its wrecking ball job”.

This time is different – LDI has unleveraged, and it’s not about the fiscal or political risk premium. It’s all about strong wage numbers driving expectations for the Bank of England to need to press hike button again and again.

We are now in wage-price spiral territory – private sector wage growth rose to 7.6% in the three months to April, whilst overall regular pay rose 7.2%. This only makes it harder for the BoE to cool inflation – a tougher stance is required but we know the dangers for the economy and notably the mortgage market if that happens.

Key events

US inflation falls to 4%

Newsflash: the cost of living squeeze in the US has eased.

The US Consumer Prices Index fell to an annual rate of 4% in May, which is the lowest reading since March 2021, down from 4.9% in April.

That’s much lower than in the UK, where inflation was 8.7% in April, partly because America did not suffer such a sharp surge in energy prices after the Ukraine war.

US core inflation, which strips out food and energy, fell to an annual rate of 5.3%, down from 5.5%.

US energy prices were 11.7% lower in May than a year ago, the inflation report shows, while food prices index increased 6.7% over the last year.

Headline inflation fell from 4.9% year-over-year to 4% in May, while core inflation fell from 5.5% year-over-year to 5.3%.

(Both were mostly in line with expectations: 4.1% headline expected, 5.2% core expected.) pic.twitter.com/pZ9VvVvRqh

— Steven Rattner (@SteveRattner) June 13, 2023

The gap in borrowing costs between London and Berlin has swelled today.

The selloff in UK two-year government bonds, which has pushed yields above their mini-budget panic levels, means it costs significantly more for the UK to borrow than for Germany.

While UK two-year gilts are now yielding 4.8%, German two-year bunds are trading at a yield of 2.96%.

The gap is even wider for borrowing over the next decade – UK 10-year gilts have a yield of 4.38% today, while Germany’s 10-year bunds trade at 2.36%.

Reuters’ Andy Bruce has the details:

Ugly symbolism – gap between 10-year UK and German bond yields blows out past 2 percentage points today. 👇

Outside of the minibudget, hasn’t happened since 1992.

Narrowing that gap after BoE independence in ’97 had been viewed by policymakers as a major achievement. pic.twitter.com/GMJGqi3eeN

— Andy Bruce (@BruceReuters) June 13, 2023

Slightly less scary (but still not good) from the BoE’s perspective is the 5-year/2-year swap, a market-based measure of longer term inflation expectations that the central bank watches closely pic.twitter.com/q6stRzbW90

— Andy Bruce (@BruceReuters) June 13, 2023

Skipton building society is raising the cost of its no-deposit 100% mortgage for first-time buyers but the deal remains available at current prices until Friday, Forbes are reporting.

The deal was only announced last month (on the day when Halifax reported house prices were falling), but now needs to be repriced due to the jump in UK bond yields as interest rate expectations climb.

The mutual lender’s Track Record product, a 100% mortgage deal which launched last month, is a five-year fixed rate deal at 5.49%. This rate will be available until 10pm on Thursday (15 June) so borrowers need to act fast if they want to secure this deal.

Skipton says the rate will rise to 5.89% on Friday (16 June).

The rate increase also means the maximum loan a first-time buyer can borrow through the deal will reduce.

This is because the Track Record loan is structured so that the monthly mortgage payments cannot be more than the average of the last six months’ rental costs the applicant has paid.

Nick Mendes at broker John Charcol said:

At the time of launch the track record mortgage was priced on a 5 year fixed of 5.49%, which was higher than other higher LTV products at the time.

The rate had enough margin to take into account higher LTV risks and small increases in fixed rates.

Swaps have increased since the product was launched, average 5 year fixed rates are increasing, and the product is no longer viable to remain unchanged.

Here’s the BBC’s Faisal Islam on today’s bond market ructions:

NEW

UK 2 year gilt yield (a measure of borrowing costs for Govt for a two year loan) has just hit a 15 year high of 4.76% … exceeding the spike in the immediate aftermath of last Autumns mini budget… average 2 year fix mortgages now at 5.9% pic.twitter.com/sSoklp6x9i

— Faisal Islam (@faisalislam) June 13, 2023

Faisal also points out that NatWest are raising their Buy to Let stress rates

Deluge of mortgage market repricings going on… and also things like the “stress rates” for buy to let, ie the test that mortgage brokers are told to apply to rental income, whacked up to above 8%…

Inflation figures and rate decision next week.

— Faisal Islam (@faisalislam) June 13, 2023

WIRP curve – indication from Bloomberg of implied base interest rate, is now at 5.7% at the end of the year… that is very high. pic.twitter.com/JDCaTBVHOW

— Faisal Islam (@faisalislam) June 13, 2023

And here’s some international context:

UK 2y gilt rate (4.76) now notably above US 2 year… (4.57) that’s been pretty rare over past decade… for reference green line is Italian 2 year yields, (3.49) reflecting lower expected path across eurozone…Italian is where they were 3 months ago, UK was also below 4 back then pic.twitter.com/Jg5rS48vwU

— Faisal Islam (@faisalislam) June 13, 2023

The pound has rallied today, on expectations of further UK interest rate increases.

Sterling has gained more than half a cent against the US dollar, to $1.257, after this morning’s jobs and wages data.

Jon Camenzuli, senior corporate dealer, at Moneycorp, explains why:

“Today’s leap in basic wage growth to 7.2% is the first sure sign of the wage-price spiral Andrew Bailey warned us about.

“ING came out yesterday saying we likely won’t see any rate cuts until this time next year and they could well be right. This week is a huge one for data and all of it seems to be pointing to the same thing – further action is needed, regardless of what’s happening in Europe.

“We could see the pound continue its incredible rally if the UK avoids a recession and the Bank of England continues raising rates after the European Central Bank stops. This won’t be welcome news to UK businesses that rely on euro income, but there are no easy decisions in the current economic environment.”

Financial markets now think UK borrowing costs could leap to a high of 5.75%, up more than a percentage point from their current level of 4.5%, as the Bank of England attempts to fight inflation.

That’s based on the rates of sterling overnight index swaps – which indicate how the markets expect interest rates to move.

UK FINANCIAL MARKETS NOW FULLY PRICE IN PEAK BANK OF ENGLAND INTEREST RATE OF 5.75% – OIS CURVE

If Bailey and co get bounced into this it will have been one of the worst failures of policy and communication I think I’ve ever seen – should have gone much harder at the start

— Neil Wilson (@marketsneil) June 13, 2023

Today’s wage data indicates there is no sign, yet, that the UK labour market is cooling, warns NIESR, the economic forecaster.

Paula Bejarano Carbo, associate economist at NIESR, says:

Today’s ONS estimates suggest that average weekly earnings, excluding bonuses, grew by 7.2 per cent across the whole economy in the three months to April, representing the largest growth rate in regular pay recorded outside of the pandemic period.

The private and public sectors saw regular pay growth of 7.6 per cent and 5.6 per cent, respectively. The employment rate increased by 0.2 percentage points to 76 per cent in this three-month period, while total hours worked reached a record high, surpassing pre-pandemic levels. It seems that the cooling labour market that high-frequency indicators have been pointing to is yet to materialise.”

Odey shuts Swan Fund, gates redemptions on other fund

In the City, the crisis at Odey Asset Management following the publication of sexual assault allegations against its founder, Crispin Odey, is deepening today.

Odey Asset Management has just announced that it is shutting its Swan fund and gating two other funds, following a surge in redemption requests from investors keen to take their money out.

The firm has suspended all dealings in the Odey Swan fund and will redeem investors by September 4, according to a letter dated Monday.

The letter says the the board of Odey Asset Management also decided to suspend the issue, conversion and redemption of Swan Fund shares in order to “efficiently manage the redemptions and in the best interests of Shareholders”.

A subsidiary of Odey Asset Management has stopped investors from withdrawing money from the Brook Developed Markets fund in the wake of sexual misconduct allegations against Crispin Odey.

Redemptions have been gated following a higher volume of requests from investors to withdraw, which exceeded 10% of the fund’s net asset value.

This comes after a number of female employees made allegations of sexual misconduct against multimillionaire Conservative donor Crispin Odey.

On Saturday, the executive committee of Odey Asset Management said that Odey would “no longer have any economic or personal involvement in the partnership”. Yesterday it emerged that Crispin Odey’s name will be removed from hedge fund he founded.

Odey told the Guardian last week that the allegations had not been proven in court and he had done nothing illegal.

Update: JPMorgan is terminating its relationship with Odey Asset Management, the Financial Times is reporting.

Goldman Sachs International CEO Richard Gnodde has told Bloomberg the bank is “in the process of moving away” from its prime-brokerage relationship with Odey Asset Management.

Here’s Victoria Scholar, head of investment at Interactive Investor, on the jump in the 2-year UK gilt yield over its peak after last September’s mini-budget:

It comes after this morning’s UK labour market statistics which saw a rise in the number of people in employment to an all-time high and the fastest pace of growth since records began for basic pay (excluding the anomalous pandemic period).

These both underscore the tightness in the labour market, which could inhibit the decline of inflation, prompting the Bank of England to carry out further interest rate increases to cool price pressures.

Financial markets are pricing in further moves to tighten monetary policy from the current bank rate of 4.5% to 5.5% by year-end, which would add to pressure on consumers and businesses through higher borrowing rates.

Resolution Foundation have pulled together a handy thread on this morning’s UK labour market report -and are hopeful that the squeeze on real wages could be ending:

💸The UK’s real wage squeeze may be ending (for now).

📈But the rate rising cycle is likely to be extended.

A quick 🧵on today’s labour market stats…

— Resolution Foundation (@resfoundation) June 13, 2023

Good news: pay grew by 7.2% in the 3 months to April. If that is matched by a fall in inflation we could have already returned to real pay growth (given the data is lagged). pic.twitter.com/5lf4n5Cvna

— Resolution Foundation (@resfoundation) June 13, 2023

No so good news: both public and private sector pay are still falling in real terms – by 2.8% and 1.0% respectively. pic.twitter.com/YQ1iKQig4G

— Resolution Foundation (@resfoundation) June 13, 2023

Worth remembering that strong pay growth (while welcome news for workers) may well worry the Bank, and by extension anyone looking to remortgage, as it adds to the case for raising interest rates for longer.

— Resolution Foundation (@resfoundation) June 13, 2023

The labour market also continued to grow – with economic inactivity down and employment up.

Two key milestones have been passed in recent months, with employment levels and working hours both back above pre-pandemic levels. pic.twitter.com/Llcsqdyf37

— Resolution Foundation (@resfoundation) June 13, 2023

Lastly, it’s worth noting how the number of people out of work due to long-term sickness continues to rise, reaching a fresh record high of 2.55 million.

Tackling this issue will hold the key to further boosting the size of Britain’s workforce. pic.twitter.com/dk3hw8oQGD

— Resolution Foundation (@resfoundation) June 13, 2023

Bank’s new policymaker: lowering inflation to 2% will be hard

The newest Bank of England interest rate setter has warned that it will be tough to return inflation to the UK’s 2% target.

Megan Greene was speaking to the Treasury Committee this morning, as short-term bond yields continue to climb.

Greene, an economist who is joining the Bank’s MPC from consultancy group Kroll in July, told MPs that the BoE should act against signs of persistence in inflation.

She told the committee that halving inflation from its peak last winter will be easier than bringing it down to target, saying:

“I think that there is some underlying persistence and so getting from 10% to 5% … is probably easier than getting from 5% to 2%.”

Greene also says getting inflation from 5% to 2% is likely to be harder than from 10% to 5%. BoE will need to lean against inflation pressures.

— David Milliken (@david_milliken) June 13, 2023

Significantly, Greene then warns about the risks of relaxing monetary policy too soon.

She says:

“If you engage in stop-start monetary policy, you may end up having to tighten even more and generating an even worse recession on the other side.

“And also that inflation expectations can’t be allowed to become de-anchored or you end up in that situation.”

Looking at the inflation lessons of the 1970s, incoming Bank of England policymaker Megan Greene says it’s important to avoid stop-start policy or letting inflation expectations get de-anchored. (Lessons she thinks the BoE has absorbed.)

— David Milliken (@david_milliken) June 13, 2023

UK short-term borrowing costs have continued to soar above their mini-budget peak last autumn.

The yield on two-year gilts now trading at 4.83%, the highest since the 2008 financial crisis, up from 4.62% last night.

Newton-Smith doesn’t rule out CBI name change

Q: Is the CBI planning to change its name, Ian Lavery MP asks…

Rain Newton-Smith says the CBI’s name isn’t the most important issue, but doesn’t deny that a rebrand is an option.

She says the CBI’s listening exercise with business leaders found they believe the UK need a strong collective voice on business, and want the CBI to focus on issues such as sustainable growth, and improving employment and skills.

The CBI’s director-general tells MPs:

At some stage, if we change our name, would we move away from being the Confederation of British Industry? Again, it’s really one for our members.

In April, the Financial Times reported that “the crisis-stricken CBI will be renamed as part of efforts to demonstrate that it has reformed its toxic workplace culture”.

Ian Lavery MP asks whether the CBI is now unnecessary, as other business groups have “stepped up to the plate” since it was forced to pause its work.

[for example, the British Chambers of Commerce has launched a new Business Council to bring business leaders together]

Rain Newton-Smith says the CBI has been, and can be a really important voice on key issues – such as high inflation and the cost of living crisis, and weak growth.

She cites this Spring’s budget, which took on the CBI’s work on childcare reform, and work helping firms to decarbonise.