London’s Gatwick airport faces eight days of strikes over pay

Nearly a thousand workers are set to take eight days of strike action at Gatwick Airport in July and August in a dispute over pay, which unions say will disupt the summer holiday getaway.

The Unite union has announced that 950 staff working for ASC, Menzies Aviation, GGS and DHL Services Ltd will take part in a four-day strike from Friday 28 July to Tuesday 1 August, and a second four-day strike from Friday 4 August to Tuesday 8 August.

All four companies conduct outsourced operations for major airlines, including ground handling, baggage handling and check in agents roles.

Given the scale of the industrial action, disruption, delays and cancellations are inevitable across the airport, Unite says.

Unite regional officer Dominic Rothwell said:

“Strike action will inevitably cause severe delays, disruption and cancellations across Gatwick’s operations but this dispute is entirely of the companies own making.

They have had every opportunity to make our members’ a fair pay offer but have chosen not to do so.”

Key events

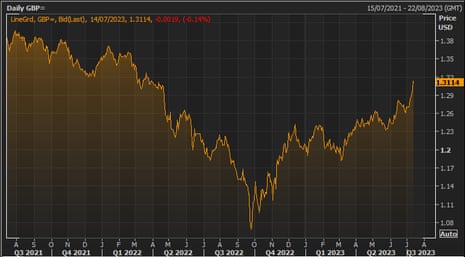

Pound on track for best week of 2023

Expectations that interest rates will rise faster in the UK than the US in the coming months have put the pound on track for its best week of the year.

Sterling has gained around three cents this week, rising from $1.2836 to a 15-month high over $1.314 earlier today.

That’s the strongest week since November 2022, and a gain of 2.2% against the US dollar since Monday morning.

The dollar has weakened against other major currencies this week. US inflation dropped to just 3% on Wednesday, lower than most other advanced economies, leading to speculation that the US Federal Reserve may raise interest rates for the final time in the current cycle later this month.

But with UK inflation expected to remain over 8% in June, the Bank of England is forecast to raise Bank Rate to 6% by December, from 5% today.

This week’s rally has come despite concerns that the UK economy could have contracted in the second quarter of 2023, after GDP fell by 0.1% in May.

This morning’s warning of a sharp drop in the number of advertised job openings in England (see earlier post) has not, yet, caused wobbles in the market.

The FTSE 100 index of blue-chip shares is up 0.3% today, on track to gain around 2.8% this week after a strong rally on Wednesday. That would be its best week since March.

Haleon CEO: job cuts are “the first of a series of changes”

After the Guardian revealed yesterday that swinging job cuts were underway at GSK spin-off Haleon, its CEO Brian McNamara emailed all staff this afternoon about the layoffs.

He notes that the hundreds of job cuts are just “the first” of a “series of changes” (insiders expect thousands of workers to be made redundant worldwide).

McNamara wrote:

All,

Earlier this year, we announced a three-year productivity programme to transform our ways of working, reduce complexity and make us more cost conscious.

In an ever-changing world, we can’t stand still. We know we need to go beyond and constantly adapt and evolve, so we stay ahead of our competitors and continue to be a leader in consumer health.

When we created Haleon, we did what mattered most and prioritised business continuity so we could deliver for our consumers and customers. But today, we know that life at Haleon can feel complicated and slow. We need to make changes to our organisation so we can operate with speed and agility.

This week, we began to make changes to how we are organised. Colleagues who are impacted have already been informed and you’ll hear more from leaders in the coming weeks, allowing for consultation periods in some markets.

We know that change is unsettling, particularly when accompanied by media coverage which can create more anxiety and raise more questions. The changes we are proposing have not been made lightly. I do believe, however, that they are critical for our company to set us up for success for years to come. I can assure you that all changes have been well considered and will be thoughtfully implemented. They are the first of a series of changes across our business that we will make to improve how we perform and enable more growth.

Thank you.

Brian.

Aubrey Allegretti

Over in Westminster, the government is trying to avoid being drawn into the pay row between Unite and the four Gatwick service providers that has led to the strikes announced today, my colleague Aubrey Allegretti reports.

Rishi Sunak’s spokesperson told reporters it was “not for me to dictate to private companies what pay they set their staff” and added it was up to the businesses involved to decide “what is appropriate”.

They pointed out that private sector wages had risen by between 5-7% over the past year – in line with the offers made to public sector workers on Thursday.

The strikes scheduled at Gatwick later this month, and in August, are just one of several possible causes of disruption this summer.

At Birmingham Airport, for example, around 100 security officers and terminal technicians will begin continuous strike action from July 18. That could lead to flight delays, the Unite union has said,

There is also industrial action planned or already underway across Europe, as this factbox from Reuters shows:

EUROCONTROL

One of the Eurocontrol trade unions has announced a six-month period when industrial action could take place in the Network Manager Operations Centre, which oversees traffic across the European airspace, the pan-European organisation said on July 7. The union has not set specific dates for a strike.

BELGIUM

Ryanair pilots in Belgium will strike on July 15-16 in demand of higher wages and better working conditions, their union said on July 7. The strike could affect around 140 flights from Charleroi airport, but it is yet unclear how many pilots will join and how many flights will need to be cancelled.

FRANCE

Repeated air traffic control (ATC) strikes in France, related to President Emmanuel Macron’s plan to raise pension age, have led to delays and limited flights across the country, causing more air space congestion in Europe.

Ryanair, which has asked the European Commission to protect overflights from strike disruption, cancelled more than 900 flights in June mainly due to French ATC strikes.

ITALY

Multiple unions have called a nationwide airport staff strike on July 15 related to talks for a new collective contract. Air traffic controllers, baggage handlers and check-in personnel along with Italian pilots of Vueling will walk out between 10 a.m and 6 p.m. local time. Malta Air pilots and flight attendants will join them from noon for four hours.

Talking to Italian media, Transport Minister Matteo Salvini said the companies and workers would meet the following week to continue negotiations.

Air traffic control company ENAV has confirmed there will be no strikes in the Italian air transport sector between July 27 and Sept. 5 due to a summer exemption provided for in the industry regulations.

PORTUGAL

Easyjet cancelled 350 flights arriving to or departing from Portugal ahead of a cabin staff strike on July 21-25, the SNPVAC union of civil aviation flight personnel said. It will be the union’s third strike since the beginning of the year.

SPAIN

Pilots at Iberia Regional Air Nostrum, who had been striking every Monday and Friday since Feb. 27, went on a daily indefinite strike from June 6 amid a pay dispute. As of July 14, Iberia said on its website some flight routes could be affected.

Back at Gatwick, easyJet has said further talks between its ground handler DHL and Unite were taking place next week.

With eight days of strike action looming, EasyJet says:

“We urge them to reach an agreement as soon as possible.”

PMorgan Chase & Co. and Wells Fargo & Co. both beat analyst expectations for second-quarter earnings on Friday, helped by rising interest rates and strong trading revenue.

JPMorgan’s earnings per share of $2.73 beat analysts’ estimates of $2.68, while Wells Fargo’s earnings per… pic.twitter.com/elJzu1V7Gw

— Christopher de Chalain (@ChrisDechalain) July 14, 2023

Another US bank, Wells Fargo, has also benefited from the rise in interest rates hitting consumers.

Wells Fargo has reported a 57% rise in second quarter profits, as it earned more from customer interest payments. The bank has also raised its annual forecast for net interest income (NII).

Chief Executive Officer Charlie Scharf explains:

“We reported solid results in the second quarter, with net income of $4.9 billion and revenue of $20.5 billion. Our strong net interest income continued to benefit from higher interest rates, and we remained focused on controlling expenses.

But, like JP Morgan, Wells Fargo has set aside more money to cover bad debts.

Its allowance for credit losses has risen by $949m, primarily for commercial real estate office loans, as well as for higher credit card loan balances.

The jump in profits at JP Morgan in the last quarter highlights how higher interest rates are good for bank profitability.

Chris Beauchamp, chief market analyst at IG Group, explains:

JPMorgan’s numbers have demonstrated the overwhelming strength of big banks over their smaller competitors, after it unveiled a 67% surge in profits for Q2.

Higher interest rates will continue to drive strong performance, it added. This looks like a very healthy set of numbers, and will boost hopes that earnings have begun to recover, something that might drive further stock gains in the second half of the year.

JP Morgan’s Dimon warns of risks, after lifting credit loss provisions

Just in: Wall Street giant JP Morgan has set aside more funds to cover potential losses from customers defaulting on their debts as high inflation and interest rates hit consumers.

In its second-quarter financial results, just released, JP Morgan has increased its provision for credit losses to almost $2.9bn, up from $1.1bn in the second quarter of 2022.

The increase is partly due to JP Morgan having rescued regional lender First Republic earlier this year. It set aside $1.2bn to cover credit losses at First Republic – so exclude that, and the provision was $1.7bn.

JP Morgan also reported a $2.7bn “bargain purchase gain” on its takeover of First Republic at the start of May, after the second-biggest bank failure in US history.

Overall, net income rose to $14.4bn in the quarter, or 67% higher than a year ago.

CEO Jamie Dimon said the US economy continues to be resilient, but warns of several risks:

Consumers are slowly using up their cash buffers, core inflation has been stubbornly high (increasing the risk that interest rates go higher, and stay higher for longer), quantitative tightening of this scale has never occurred, fiscal deficits are large, and the war in Ukraine continues, which in addition to the huge humanitarian crisis for Ukrainians, has large potential effects on geopolitics and the global economy.

Recession ‘may be imminent’ as job vacancies fall

A sharp drop in the number of advertised job openings in England is raising fears that the UK will slip into recession this year.

Bloomberg are reporting that the number of jobs listed with Reed Recruitment in the April-June quarter are down 24.4% year on year, and over 26% lower than before the pandemic in 2019.

Chairman James Reed in the prospects for the UK.

“The alarm bell is sounding a lot louder now than it was, as the labor market is beginning to loosen.

This continued contraction in job postings, which have been falling since this time last year, therefore suggests that a recession may well be imminent.”

Vacancies are a good gauge of corporate confidence, and whether firms feel demand is strong enough to justify taking on more staff.

On Tuesday, the Office for National Statistics reported that vacancies fell by 85,000 on the quarter to 1,034,000 – just as the cost of living squeeze pressed more people back into the labour market.

Reed’s data is more timely, and “the picture isn’t pretty”, says Bloomberg, adding:

Vacancies on Reed’s platform, adjusted to account for seasonal fluctuations, fell by 16,127 between the first and second quarters of this year — a 10% plunge.

A decline of that scale, if mirrored in the official statistics, historically has been associated with a 0.6% contraction in GDP in the same quarter, said Dan Hanson at Bloomberg Economics. In this case, that would mean a sharp contraction in the quarter that ended on June 30.

More here: England’s Falling Job Advertisements Ring a Recession Alarm

There could be additional strike action at Gatwick this summer too, on top of what’s just been announced.

That’s because Unite is also balloting its members at DHL Gatwick Direct, Red Handling and Wilson James who are employed at Gatwick.

All three ballots will close at the end of the month – if workers vote for industrial action, then strikes in these companies could begin by mid-August.

@unitetheunion is also balloting its members at DHL Gatwick Direct, Red Handling and Wilson James. All three ballots will close on Monday 31 July if workers vote for industrial action, the strikes in these companies could begin by the middle of next month.

— Taj Ali (@Taj_Ali1) July 14, 2023

The airlines affected by the strikes at Gatwick will include British Airways, Easyjet, Ryanair, TUI, Westjet and Wizz, Unite say.

Britain’s cost of living crisis is forcing more people to eat into their savings, according to official data which also shows that renters are at greatest risk of financial vulnerability.

The Office for National Statistics reports that around three in 10 people are using their savings because of the rise in cost of living, up from 25% when previously polled in April.

When asked about the important issues facing the UK today, the most reported issues continue to be:

🛒Cost of living (92%)

🚑 NHS (88%)

💷 economy (79%)

🌍 climate change and the environment (62%)— Office for National Statistics (ONS) (@ONS) July 14, 2023

The ONS also reports that renters are 4.7 times more likely to experience financial vulnerability compared with those who own their home outright, while mortgage holders are twice as likely.

That difference may be because, on average, renters spend 21% of their disposable income on rent (21%), while mortgage holders spend on averare 16% of their disposable income on their mortgage, ONS research shows.

Today’s report shows that over 4 in 10 renters are finding it difficult to afford their rent payments, compared with almost 3 in 10 (28%) mortgage holders.

And around 1 in 20 of adults reported that in the past two weeks they had ran out of food and had been unable to afford more.

5% of adults said they’d run out of food in the past 2 weeks and couldn’t afford more. This was higher in some groups, those:

▪️ supported by charities (45%)

▪️ lone parents (household with one adult and at least one child) (28%)

▪️ receiving benefits or financial help (21%) pic.twitter.com/UAFe7fCpy8— Office for National Statistics (ONS) (@ONS) July 14, 2023