Bank of England forecasts £150bn loss from asset purchase scheme

The Bank of England has raised its estimate for the losses it will incur on its bond-buying stimulus programme to £150bn, up from £100bn.

Its latest quartely report on the Asset Purchase Facility, the Banks outlines how it expects to incur losses as the bonds bought under its quantitative easing scheme mature, or are sold off.

That will require cash transfers from the Treasury to the Bank to effectively bail it out, and cover those losses.

The Bank bought almost £900bn of UK government bonds (and some corporate debt) through the QE programme which started after the financial crisis and was boosted once the pandemic began.

In its early years the APF was profitable – bond prices rose (partly because the BoE was a willing buyer), and it banked coupon payments (interest on the debt).

That boosted the public finances, because in 2012 chancellor George Osborne decided the profits from QE should be used to reduce government debt, yielding around £120bn.

But the Bank is now trying to unwind QE, at a time where rising interest rates and inflation have pushed down bond prices, meaning the Bank may be selling at a loss.

As this chart shows, the Bank expects to make losses of around £150bn over the next decade if interest rates follow market expectations (the pink line).

Back in April, the Bank had forecast a total financial loss of around £100bn.

Losses would be lower if the path of interest rates were lower than the markets expect, but higher if rates are higher than forecast.

The BoE says:

Looking ahead, future cash flows are uncertain and highly sensitive to the assumptions used for market interest rates and how quickly the portfolio is unwound.

It’s another example of the impact of rising inflation and interest rates, which is expected to leave the UK with the highest debt interest bill in the developed world (see opening post).

Key events

How Bank of Mum and Dad exacerbates inequality

The Bank of Mum and Dad is allowing some people to buy homes earlier and cheaper than those who can’t draw on its support, new research from the Bank of England shows.

May Rostom, head of the modelling team at the Bank, has analysed the impact of parental financial support on the UK housing market.

She did this by crunching the borrower demographics and loan details on mortgages, to spot which borrowers had a down-payment beyond their savings levels, presumably from the Bank of Mum and Dad’, or Bomad.

She concludes that “the results are extraordinary.”

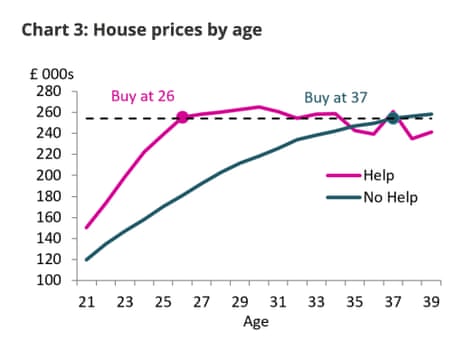

The average 26 year old with help paid about £254,000 for their first home. Those with no help waited a decade – until they were 37 – to buy a property for an equivalent sum.

Rostom says there are three takeaways from her work:

First, getting help is fairly common. Chart 1 shows over 10% of first-time buyers (FTBs) younger than 45 are getting financial help from someone else. This number rises to 28% for the under 25s.

Second, the support is substantial.

Chart 2 shows that, on average, deposits are two and a half times larger, loans are 30% smaller, and houses cost £15,000 more for those getting help, compared with those who are not. This means ‘Bomad borrowers’ are typically less-leveraged and have lower mortgage payments, leaving more leeway for them to save or spend their incomes on other things.

Third, recipients of financial support buy their first homes earlier – on average four years earlier, at the age of 26 instead of 30. And, as above, they tend to buy more expensive homes.

In conclusion, Rostom adds, whether and when you receive a gift can affect your entire homeownership trajectory – exacerbating the differences not just across generations, but within them.

You can read the full piece on the BoE’s excellent Bank Underground blog, here.

BU on the “Bank of Mum and Dad”. Estimates that:

i) 10% of under 45s / 28% under 25s get parental help buying 1st house

ii) BoMaD boosts deposit 2.5-fold

iii) BoMaD assisted buyers buy larger houses + get 1st house 4 years earlier than other FTBshttps://t.co/Yrvs1E3pe7 pic.twitter.com/rTGcH2kSdP— Bank of England Research (@BoE_Research) July 25, 2023

US consumer confidence has improved this month, as fears of a recession ebb.

The Conference Board’s Consumer Confidence Index has risen again in July to 117.0, up from 110.1 in June. That’s a two-year high.

Americans’ view of the present economic situation improved, as did their economic expectations.

The Conference Board says:

Despite rising interest rates, consumers are more upbeat, likely reflecting lower inflation and a tight labor market. Although consumers are less convinced of a recession ahead, we still anticipate one likely before yearend.

Bank of England rates set to peak at 5.75% by year-end: Reuters poll finds

City economists predict UK interest rates will peak at 5.75%, their highest level since 2007.

A Reuters poll has found that the City expects the Bank of England to raise Base Rate by a quarter of one percent at its meeting next week, from 5% to 5.25%.

Two further rate increases are expected before the end of 2023, as the Bank continues to fight inflation.

To er is human, Musk finds, in rebranding drive

Hibaq Farah

Elon Musk has faced a hiccup in his drive to rebrand Twitter as X after police stopped work to remove the old name from the sign at the company’s San Francisco headquarters.

On Monday, workers were seen removing the first letters of the word Twitter before the local police department stopped them from continuing the “unauthorised work,” according to an alert sent by the department.

According to police, the social media firm had failed to communicate with security and the building’s owner its plans to remove the sign at the Market Street headquarters. Police were then called amid the confusion, though later concluded that no crime had been committed.

After the initial work by a worker on a cherrypicker, only the blue bird and the letters “er” were left on one side of the sign.

UK to be second worst economy in the G7 in 2023 despite upgrade, says IMF

The UK is expected to be the second slowest-growing economy in the G7 this year, despite the IMF making a major upgrade to the country’s prospects.

Today’s new forecasts predict the UK’s output to grow by 0.4% during 2023, faster than Germany (which is set to shrink by 0.3%), but slower than any other country in the G7.

The UK’s new forecast is an upgrade by 0.7 percentage points compared to the IMF’s previous forecast from April, but not a surprise as the Fund said in May that the UK would avoid recession.

Growth in the US is expected to be the most rapid of all G7 countries at 1.8%.

This will be followed by Canada (1.7%), Japan (1.4%), Italy (1.1%), France (0.8%), the UK (0.4%) and Germany (-0.3%).

IMF: global activity is losing momentum

The global economy continues to gradually recover from the pandemic and Russia’s invasion of Ukraine, says Pierre-Olivier Gourinchas, the IMF’s economic counsellor.

Explaining today’s new forecasts, Gourinchas says supply-chain disruptions have returned to pre-pandemic levels, while economic activity in the first quarter of the year was “resilient”.

But he warns it is “too early to celebrate”, with growth forecast to slow to 3% this year from 3.5% last year.

Gourinchas says:

The slowdown is concentrated in advanced economies, where growth will fall from 2.7 percent in 2022 to 1.5 percent this year and remain subdued at 1.4 percent next year. The euro area, still reeling from last year’s sharp spike in gas prices caused by the war, is set to decelerate sharply.

By contrast, growth in emerging markets and developing economies is still expected to pick-up with year-on-year growth accelerating from 3.1 percent in 2022 to 4.1 percent this year and next.

He warns that signs are growing that global activity is losing momentum, as higher interest rates bite.

The global tightening of monetary policy has brought policy rates into contractionary territory. This has started to weigh on activity, slowing the growth of credit to the non-financial sector, increasing households’ and firms’ interest payments, and putting pressure on real estate markets.

In the United States, excess savings from the pandemic-related transfers, which helped households weather the cost-of-living crisis and tighter credit conditions, are all but depleted.

In China, the recovery following the re-opening of its economy shows signs of losing steam amid continued concerns about the property sector, with implications for the global economy.

UK interest rates need to stay higher for longer to beat inflation, says IMF

Larry Elliott

Interest rates in the UK will need to stay higher for longer than previously forecast in order to tackle stubbornly high inflation, the International Monetary Fund warns.

The IMF’s regular update on the state of the global economy singled out the US Federal Reserve and the Bank of England as two central banks that will need to raise official borrowing costs more aggressively than it assumed only three months ago.

While the UK’s growth prospects are now thought to be brighter than predicted in April, it has taken longer than expected for cost of living pressures to ease. The Washington-based body now assumes it will take until the middle of 2025 for inflation to return to the British government’s 2% target – six months later than its previous estimate.

As a result, the expected peak in UK interest rates – put at 4.5% when the IMF last published forecasts in April – has now been raised to 5-5.5% and it thinks Threadneedle Street will need to keep policy tight until the end of 2024.

After being the fastest growing of the G7 economies in 2021 and 2022, the UK is expected to be the second most sluggish economy this year, despite an upgrade on its performance since April. Only Germany, which is forecast to contract by 0.3%, is predicted to grow more slowly.

The IMF predicts that the UK will be a growth laggard this year, although Germany is forecast to shrink, and be at the back of the pack of advanced economies.

Here are the IMF’s latest growth forecasts for this year, just released:

Growth Projections: 2023

USA🇺🇸: 1.8%

Germany🇩🇪: -0.3%

France🇫🇷: 0.8%

Italy🇮🇹: 1.1%

Spain🇪🇸: 2.5%

Japan🇯🇵: 1.4%

UK🇬🇧: 0.4%

Canada🇨🇦: 1.7%

China🇨🇳: 5.2%

India🇮🇳: 6.1%

Russia🇷🇺: 1.5%

Brazil🇧🇷: 2.1%

Mexico🇲🇽: 2.6%

KSA🇸🇦: 1.9%

Nigeria🇳🇬: 3.2%

RSA🇿🇦: 0.3%https://t.co/8pKjgg8udm #WEO pic.twitter.com/AoipC7b84G— IMF (@IMFNews) July 25, 2023

IMF: extreme weather could keep inflation high

The IMF also warns that the balance of risks to global growth are tilted to the downside.

That’s despite the US debt ceiling standoff has been resolved since its last update in April, and the crisis in US and Swiss banking has been contained.

Its updated WEO report cites the risks from extreme weather:

Inflation could remain high and even rise if further shocks occur, including those from an intensification of the war in Ukraine and extreme weather-related events, triggering more restrictive monetary policy. Financial sector turbulence could resume as markets adjust to further policy tightening by central banks.

China’s recovery could slow, in part as a result of unresolved real estate problems, with negative cross-border spillovers. Sovereign debt distress could spread to a wider group of economies.

On the upside, the IMF adds, inflation could fall faster than expected. That would reduce the need for tight monetary policy (high interest rates).

IMF lifts 2023 global growth forecast to 3%, from 2.8%

Newsflash: The International Monetary Fund has warned that global economic growth “remains weak by historical standards”, despite lifting its forecasts for this year.

The IMF now expects global growth of 3.0% in 2023 and 2024, a slowdown on the 3.5% recorded in 2022. Back in April, it forecast 28% growth in 2023, but has now nudged that higher.

In an update to its World Economic Outlook, the IMF says:

The rise in central bank policy rates to fight inflation continues to weigh on economic activity.

Global headline inflation is expected to fall from 8.7% in 2022 to 6.8% in 2023 and 5.2% in 2024.

Underlying (core) inflation is projected to decline more gradually, and forecasts for inflation in 2024 have been revised upward.

Bank of England forecasts £150bn loss from asset purchase scheme

The Bank of England has raised its estimate for the losses it will incur on its bond-buying stimulus programme to £150bn, up from £100bn.

Its latest quartely report on the Asset Purchase Facility, the Banks outlines how it expects to incur losses as the bonds bought under its quantitative easing scheme mature, or are sold off.

That will require cash transfers from the Treasury to the Bank to effectively bail it out, and cover those losses.

The Bank bought almost £900bn of UK government bonds (and some corporate debt) through the QE programme which started after the financial crisis and was boosted once the pandemic began.

In its early years the APF was profitable – bond prices rose (partly because the BoE was a willing buyer), and it banked coupon payments (interest on the debt).

That boosted the public finances, because in 2012 chancellor George Osborne decided the profits from QE should be used to reduce government debt, yielding around £120bn.

But the Bank is now trying to unwind QE, at a time where rising interest rates and inflation have pushed down bond prices, meaning the Bank may be selling at a loss.

As this chart shows, the Bank expects to make losses of around £150bn over the next decade if interest rates follow market expectations (the pink line).

Back in April, the Bank had forecast a total financial loss of around £100bn.

Losses would be lower if the path of interest rates were lower than the markets expect, but higher if rates are higher than forecast.

The BoE says:

Looking ahead, future cash flows are uncertain and highly sensitive to the assumptions used for market interest rates and how quickly the portfolio is unwound.

It’s another example of the impact of rising inflation and interest rates, which is expected to leave the UK with the highest debt interest bill in the developed world (see opening post).

In an unusual development, wargaming company Games Workshop has revealed it has accidentally paid an unlawful dividend.

It has told the City that a “technical issue” has been discovered with the interim dividend paid out last November, saying:

When the Company paid the Interim Dividend, the Company had sufficient distributable profits to do so and had prepared interim accounts showing the same, however those interim accounts were not filed at Companies House prior to the payment of the dividend.

As a result, the Interim Dividend was paid in technical contravention of the Companies Act 2006. The Interim Dividend amounts to an unlawful dividend only to the extent that it exceeded the amount of distributable reserves available to pay the Interim Dividend shown in the prior audited accounts, being £700,000.

As a result of this minor technical breach, it is understood that the Company may have potential claims against shareholders who were recipients of the dividend and against its directors for declaring the dividend. The Company has no intention of bringing these claims.

Instead, Games Workshop is proposing a special resolution to fix this somewhat embarrasing problem…

General Motors has raised its profit target for the year by around $1 billion and reported second-quarter earnings which beat analysts expectations.

GM now expects to make underlying profits of between $12bn and $14bn this year, up from a previous forecast of $11bn-$13bn.

The forecast is dependent on GM successfully negotiating new labor agreements without a work stoppage, says chief executive Mary Barra.

Barra told shareholders:

The biggest driving force behind our financial results is customer demand for our vehicles, which have now led the U.S. industry in initial quality for two consecutive years.

We have earned four consecutive quarters of higher retail market share in the U.S. versus a year ago with continued strong pricing and incentive discipline, we’re leading in both commercial and total fleet deliveries calendar year to date, and we’re growing profitably in international markets such as Brazil and Korea.

Ukrainian activists are continuing to urge Unilever to withdraw from Russia.

Valeriia Voshchevska of the Ukraine Solidarity Project, says:

“Unilever’s continuing operations in Russia are turning into a real nightmare.

Their global sales are up: but it’s hard to hear their champagne corks popping over the sound of Russian shelling.

The business and political world is looking at them aghast. Their customers are horrified at the prospect of complicity in war crimes. Russian profits and share of turnover are down.

And now Unilever is staring down the barrel of having to facilitate the conscription of the Russian workers it claimed to be protecting. It’s economically wrong-headed, morally repulsive and reputationally disastrous. Unilever needs to pack up and ship out of Russia before it’s too late.”

Unilever continue to lead the FTSE 100 after beating expectations this morning, with its shares up 4.66%

Chris Beauchamp, chief market analyst at IG Group, says:

Traders are buying up Unilever with abandon this morning after its solid set of numbers.

A solid recovery in activity across the group and a rosy outlook chime with hopes that the UK economy can avoid a recession. But with the CMA’s focus on prices turning to the supply chain, Unilever needs to tread carefully when celebrating this morning’s numbers.

The news that Unilever’s European prices are up 14.2% this year, lifting sales by 6.4% (with volumes falling by 6.8%) does focus attention on the price pressures fuelling consumer price inflation.

Supermarket, who buy from Unilever and pass on (or swallow) these higher prices, have insisted they aren’t profiteering…..

A glimmer of good news – the decline in UK manufacturing orders has eased this month.

The CBI’s monthly’s healthcheck on British industry has found that manufacturing orders declined in July at the weakest rate this year. This lifted its monthly balance of new orders to -9 from -15 in June, the highest reading since December.

Recent falls in output have bottomed out, with firms predicting a pick-up in production over the next quarter.

Encouragingly for consumers, expectations for increases in selling prices cooled further too.

Business sentiment rose, with bosses more optimistic about their export prospects, but investment intentions for the year ahead weakened.

The July CBI Industrial Trends Survey found that output volumes were flat in the quarter to July, ending five consecutive rolling months of decline. Firms expect output to expand in the next three months. #ITS pic.twitter.com/vwrpj5noTY

— CBI Economics (@CBI_Economics) July 25, 2023

Growth in average costs accelerated in the quarter to July, breaking four consecutive quarters of easing cost growth . Manufacturers expect cost inflation to slow next quarter. Domestic price growth eased significantly through the quarter. #ITS pic.twitter.com/lMroT3C2KQ

— CBI Economics (@CBI_Economics) July 25, 2023

Investment intentions for the year ahead generally weakened. Manufacturers expect to raise investment in training & retraining, with investment expected to be broadly stable in product & process innovation, plant & machinery and buildings. #ITS pic.twitter.com/i4HxD2y3eS

— CBI Economics (@CBI_Economics) July 25, 2023

Business sentiment rose for the first time in two years, with export optimism for the year ahead also rising for the first time since October 2021. #ITS pic.twitter.com/RAEkevkCmX

— CBI Economics (@CBI_Economics) July 25, 2023

Heathrow asks airlines to carry excess fuel due to supply problems

Jasper Jolly

Airlines flying to Heathrow have been told to carry as much fuel as possible in their tanks because of supply problems at Britain’s largest airport, in a controversial practice that can increase carbon emissions.

The airport asked airlines to carry excess fuel on the way to London and to avoid carrying too much when departing, citing supply issues, in a notice sent on Sunday. The notice covered nine days from Sunday 23 July to Monday 31 July.

Heathrow said there had been no impact on passengers or flights from the request.

Fuel tankering is controversial because the practice significantly increases the weight of kerosene stored in the aircraft’s wings. That extra weight increases the amount of fuel burned on a flight, and therefore its carbon footprint. Yet despite the extra cost and carbon emissions, it can be financially worthwhile for airlines if fuel is cheaper at one airport than at another.

NatWest under pressure as Gove says bank has ‘further to go’ in rectifying Farage row

NatWest bank remains under pressure this morning over the controversial decision to close former Ukip leader Nigel Farage’s accounts at its exclusive private bank, Coutts, and the misreporting of the move.

Cabinet minister Michael Gove has said this morning that NatWest has “further to go” in resolving the matter.

Amid claims in the Daily Telegraph that chief executive Dame Alison Rose’s career is hanging in the balance, Gove told Sky News:

“I have a lot of sympathy for the position Nigel Farage has found himself in.

“As far as I can tell the decision that was taken to deprive him of banking facilities was a big mistake, something done for the wrong reasons.

“But it’s not for me to determine what the company should do but I definitely think he was owed an apology, he’s got one, but I think the company has further to go in order to make sure this matter ends appropriately.”

Last night, the BBC wrote to Farage to apologise for reporting that Coutts closed the account because he was no longer sufficiently wealthy to hold one, and that it was not a political decision.

Simon Jack, the BBC’s business editor who landed this now-corrected story, also apologised… and revealed the line came from “a trusted and senior source.”

The headline on the Farage story has been clarified and an update posted. It should have been clearer at the top that the reason for Mr Farage’s account being closed was commercial – was what a source told the BBC. That has been corrected.

— Simon Jack (@BBCSimonJack) July 21, 2023

The information on which we based our reporting on Nigel Farage and his bank accounts came from a trusted and senior source. However the information turned out to be incomplete and inaccurate. Therefore I would like to apologise to Mr Farage.

— Simon Jack (@BBCSimonJack) July 24, 2023

NatWest offered Farage its own apology last week, after the politician revealed that an internal Coutts report said he was “considered by many to be a disingenuous grifter”, and “has – and projects – xenophobic, chauvinistic and racist views”.

The report, from last November, recommended keeping Farage as a client “for now”, and setting a “glide path to exiting” him on commercial grounds once his mortgage expired this summer.

But, NatWest CEO Rose is now in the firing line, with the Daily Telegraph suggesting that chairman Sir Howard Davies may face a “fateful decision”.

Boris Johnson argued last weekend that Rose “really needs to go” if she was in any responsible for the misreporting of the circumstances behind Farage’s exit from Coutts.

Johnson wrote in the Daily Mail:

As a subsidiary of NatWest, Coutts belongs nearly 40 per cent to you and me, the taxpayers, because we bailed it out in 2008; and Alison Rose is publicly accountable for her decisions and her £5.2million salary.

That matters because what this bank has done is — paradoxically — disastrous for the reputation of UK financial services.

Conservative MP Jacob Rees-Mogg told Farage’s TV show last night that Rose’s position was “really difficult” following the BBC’s apology:

As we’re about to enter the UK bank reporting season, NatWest will present its latest financial results on Friday morning, so it can’t escape more questions about the issue…