ExodusPoint Capital Management LP decreased its holdings in Axon Enterprise, Inc. (NASDAQ:AXON – Free Report) by 92.5% during the 1st quarter, according to the company in its most recent filing with the SEC. The institutional investor owned 5,459 shares of the biotechnology company’s stock after selling 67,590 shares during the quarter. ExodusPoint Capital Management LP’s holdings in Axon Enterprise were worth $1,227,000 at the end of the most recent quarter.

ExodusPoint Capital Management LP decreased its holdings in Axon Enterprise, Inc. (NASDAQ:AXON – Free Report) by 92.5% during the 1st quarter, according to the company in its most recent filing with the SEC. The institutional investor owned 5,459 shares of the biotechnology company’s stock after selling 67,590 shares during the quarter. ExodusPoint Capital Management LP’s holdings in Axon Enterprise were worth $1,227,000 at the end of the most recent quarter.

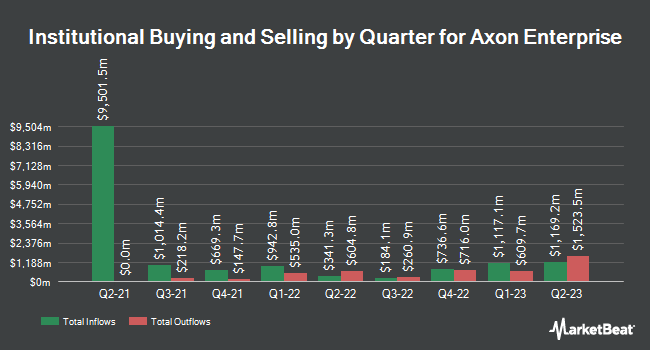

Several other large investors have also added to or reduced their stakes in AXON. Jennison Associates LLC bought a new position in shares of Axon Enterprise during the 4th quarter worth approximately $347,000. Versor Investments LP bought a new position in shares of Axon Enterprise during the 1st quarter worth approximately $702,000. Avantax Advisory Services Inc. lifted its position in shares of Axon Enterprise by 24.1% during the 1st quarter. Avantax Advisory Services Inc. now owns 2,344 shares of the biotechnology company’s stock worth $527,000 after buying an additional 455 shares in the last quarter. Advisor Group Holdings Inc. lifted its position in shares of Axon Enterprise by 32.0% during the 4th quarter. Advisor Group Holdings Inc. now owns 32,121 shares of the biotechnology company’s stock worth $5,329,000 after buying an additional 7,780 shares in the last quarter. Finally, Huntington National Bank lifted its position in shares of Axon Enterprise by 124.0% during the 4th quarter. Huntington National Bank now owns 1,230 shares of the biotechnology company’s stock worth $204,000 after buying an additional 681 shares in the last quarter. Institutional investors own 76.52% of the company’s stock.

Analyst Ratings Changes

Several brokerages have recently issued reports on AXON. Needham & Company LLC restated a “buy” rating and set a $240.00 price target on shares of Axon Enterprise in a research note on Wednesday, August 9th. Barclays decreased their price target on shares of Axon Enterprise from $256.00 to $239.00 and set an “overweight” rating for the company in a research note on Wednesday, August 9th. Northland Securities raised their price target on shares of Axon Enterprise from $227.00 to $235.00 and gave the stock an “outperform” rating in a research note on Friday, August 11th. Morgan Stanley began coverage on shares of Axon Enterprise in a research note on Tuesday, August 22nd. They issued an “equal weight” rating and a $230.00 price objective for the company. Finally, StockNews.com began coverage on shares of Axon Enterprise in a research note on Wednesday, August 23rd. They issued a “hold” rating for the company. Two research analysts have rated the stock with a hold rating and nine have given a buy rating to the company’s stock. Based on data from MarketBeat.com, Axon Enterprise has a consensus rating of “Moderate Buy” and a consensus price target of $244.73.

Get Our Latest Stock Analysis on AXON

Axon Enterprise Stock Up 1.2 %

AXON opened at $215.39 on Monday. The company has a fifty day moving average price of $193.33 and a 200-day moving average price of $203.53. The firm has a market capitalization of $16.10 billion, a P/E ratio of 160.74 and a beta of 0.87. The company has a debt-to-equity ratio of 0.47, a current ratio of 3.38 and a quick ratio of 2.98. Axon Enterprise, Inc. has a one year low of $109.31 and a one year high of $229.95.

Axon Enterprise (NASDAQ:AXON – Get Free Report) last released its quarterly earnings results on Tuesday, August 8th. The biotechnology company reported $0.80 EPS for the quarter, beating analysts’ consensus estimates of $0.33 by $0.47. Axon Enterprise had a net margin of 7.24% and a return on equity of 10.88%. The firm had revenue of $374.61 million during the quarter, compared to analyst estimates of $347.53 million. Equities research analysts expect that Axon Enterprise, Inc. will post 1.96 earnings per share for the current fiscal year.

Insider Transactions at Axon Enterprise

In other news, President Joshua Isner sold 26,883 shares of Axon Enterprise stock in a transaction on Monday, July 3rd. The shares were sold at an average price of $193.10, for a total transaction of $5,191,107.30. Following the completion of the sale, the president now directly owns 290,965 shares of the company’s stock, valued at approximately $56,185,341.50. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. In other Axon Enterprise news, insider Jeffrey C. Kunins sold 22,900 shares of the business’s stock in a transaction on Monday, July 3rd. The shares were sold at an average price of $193.12, for a total value of $4,422,448.00. Following the completion of the sale, the insider now directly owns 241,076 shares of the company’s stock, valued at $46,556,597.12. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, President Joshua Isner sold 26,883 shares of the business’s stock in a transaction on Monday, July 3rd. The stock was sold at an average price of $193.10, for a total transaction of $5,191,107.30. Following the completion of the sale, the president now directly owns 290,965 shares of the company’s stock, valued at $56,185,341.50. The disclosure for this sale can be found here. In the last ninety days, insiders sold 51,265 shares of company stock valued at $9,905,331. Insiders own 6.10% of the company’s stock.

Axon Enterprise Company Profile

Axon Enterprise, Inc develops, manufactures, and sells conducted energy devices (CEDs) under the TASER brand in the United States and internationally. It operates through two segments, Software and Sensors, and TASER. The company also offers hardware and cloud-based software solutions that enable law enforcement to capture, securely store, manage, share, and analyze video and other digital evidence.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat’s editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Axon Enterprise, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and Axon Enterprise wasn’t on the list.

While Axon Enterprise currently has a “Moderate Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

Click the link below and we’ll send you MarketBeat’s guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.