Oil hits $90/barrel as Saudi Arabia and Russia extends cuts

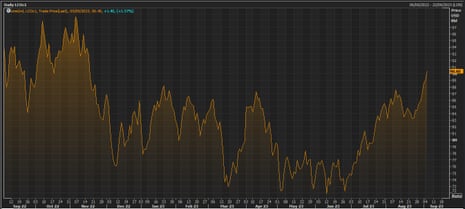

The oil price has hit its highest level of the year, as Saudi Arabia and Russia announce they will extend their voluntary production cuts until December.

Brent crude is up 1.6% at $90.40 per barrel, the highest level since last November.

According to a source in the Saudi energy ministry, the Kingdom will extend the voluntary cut of one million barrels per day, which began in July. It has already been extended to cover August and September, and is now being extended for another three months.

It means Saudi Arabia will produce around 9 million barrels of oil per day in October, November, and December.

The source added that this voluntary cut decision will be reviewed monthly to consider deepening the cut or increasing production. The move is meant to “reinforce the precautionary efforts” made by OPEC countries and their allies to balance the oil markets, they say.

Russia will extend its voluntary reduction in oil exports by 300,000 barrels per day (bpd) until the end of the year “to maintain stability and balance” on oil markets, Deputy Prime Minister Alexander Novak said in a statement today.

Rising oil prices will alarm central bankers, as they try to battle inflation, and could push up the cost of fuel higher, above the highs seen this week (see earlier post).

Key events

Afternoon summary

A quick recap:

The oil price has hit $90 per barrel for the first time this year, as Saudi Arabia and Russia announce they will extend their voluntary production cuts until December.

The move risks pushing up fuel prices, undermining efforts to cool inflation….

….at a time when petrol prices have hit their highest level of the year.

Britain’s private sector economy shrank in August, for the first time since January, as firms were hit by higher interest rates and weak demand.

But car sales have risen for the 13th month running, with electric vehicles taking 20% of the market in August.

Fears about the health of the global economy have intensified following downbeat news about service sector activity in China and the eurozone, as well as the UK.

The discount chain B&M has struck a deal to buy 51 Wilko stores for up to £13m as the stricken retailer’s administrators rush to seal last-minute deals with the fate of thousands of jobs hanging in the balance.

But…. the GMB union has said that administrators for Wilko have confirmed they will make 1,332 workers redundant and close 52 stores, with workers being informed at the latest by 10am on Wednesday.

Birmingham city council, the largest local authority in the country, has in effect declared itself bankrupt after issuing a section 114 notice, signalling that it does not have the resources to balance its budget.

More than half of shoppers fear that they have fallen victim to “skimpflation”, the practice in which basic items are reduced in quality but not in price.

UK chip designer Arm will be valued at up to $52bn when it floats on the US stock market, a new regulatory filing shows.

The success of the weightloss drug Wegovy has helped its Danish manufacturer to overtake the French luxury group LVMH as Europe’s most valuable company.

Companies with a smaller market cap than Novo Nordisk…

• JPMorgan Chase

• LVMH

• Tencent

• Mastercard

• J&J

• Samsung

• Oracle

• Chevron

• Nestlé

• Coca-Cola— Morning Brew ☕️ (@MorningBrew) September 5, 2023

PA: Administrators have confirmed 1,332 further redundancies at Wilko, says GMB

The GMB Union has said that administrators for Wilko have confirmed they will make 1,332 workers redundant and close 52 stores, with workers being informed at the latest by 10am on Wednesday, PA Media reports.

It said that 24 of these sites will close on Tuesday September 12, and the remaining 28 will be closed two days later. This will lead to 1,016 redundancies, GMB said.

The job losses also include 299 at the company’s two warehouses. These workers will be invited to a meeting on Wednesday after which they will be allowed to go home, GMB said.

There will be a further 17 redundancies among the company’s digital team at its support centre.

The GMB also said that PwC is still working with a bidder for Wilko “who has made an offer for a significant part of business”.

It added:

“Whilst there remains a possibility that this fails to deliver, we are working extremely hard and doing everything we can to help it over the line.”

Birmingham city council’s declaration of financial distress today will hurt the community it serves, warns insolvency specialist Tom Davey, director and co-founder at litigation finance broker Factor Risk Management.

He explains:

“The ‘effective bankruptcy’ of Birmingham City Council reveals how the shockwaves of the financial restrictions imposed by the UK government after the 2008 financial crisis are still reverberating.

“As with the RAAC enforced school closures, known risks are left until it is too late, and councils are left in a dire financial state. We have seen this with not only Birmingham, but also with the recent section 114 notice issued by Woking Borough Council.

“This is a story where there are few winners. Stripping back funding to all but the most essential needs, the community will suffer as the local authority runs out of money, and increased pressure is placed on already under-funded and over-stretched services.”

The jump in the oil price today is “bad news on the inflation front”, says Michael Hewson of CMC Markets, and bad for consumers in general.

He adds:

We’re already seeing the impact of this trend in higher input prices in today’s PMI numbers pointing to the prospect that inflation is likely to remain sticky in the weeks and months ahead.

Here’s George Pavel, general manager at Capex.com Middle East on today’s surge in the oil price after Russia and Saudi Arabia extended their production cuts for the remainder of the year.

The strategy has sustained the market’s climb until now and has lifted prices from this year’s dip. As a result, crude prices could continue to see new highs this year even though traders could continue to monitor the demand side. In this regard, the market was briefly under pressure earlier in the day as traders reacted to a series of weaker-than-expected data in Europe and China.

In the Eurozone, PMI figures showed a faster-than-expected decline in economic activity which could affect demand expectations from the area. The eurozone continues to see weak economic growth and high inflation and remains exposed to the ECB’s monetary policy. The European Central Bank could raise interest rates again to fight inflation and could affect demand for oil in the process.

In China, services PMI figures showed a slowdown in activity levels, adding to the concerns about the Chinese economic recovery and its impact on oil demand. Traders could remain focused on any new measures from the Chinese government to boost the economy.

More economic news: Orders at US factories have plunged, ending a run of four monthly gains.

Orders for US manufactured goods fell by 2.1% in July, the Commerce Department says.

That’s slightly better than the 2.3% expected by economists, but still indicates a weakening of demand.

Orders for long-lasting, or durable, goods fell by 5.2%.

*BRENT CRUDE OIL HITS $90 A BARREL FOR FIRST TIME SINCE NOVEMBER, *RUSSIA TO EXTEND 300K B/D OIL EXPORT CUTS THROUGH DECEMBER, *SAUDI TO EXTEND VOLUNTARY CUT OF 1M B/D UNTIL END OF DEC. 2023

— Special Situations 🌐 Research Newsletter (Jay) (@SpecialSitsNews) September 5, 2023

Shares in oil giants listed in London have pushed higher too.

BP has gained almost 2%, making it the top riser on the FTSE 100 index, while Shell are 1.3% higher.

US crude oil has also jumped since Saudia Arabia and Russia pledged to extend their production cuts until December.

NYMex light crude is up almost 2% at $87.21 per barrel.

Oil hits $90/barrel as Saudi Arabia and Russia extends cuts

The oil price has hit its highest level of the year, as Saudi Arabia and Russia announce they will extend their voluntary production cuts until December.

Brent crude is up 1.6% at $90.40 per barrel, the highest level since last November.

According to a source in the Saudi energy ministry, the Kingdom will extend the voluntary cut of one million barrels per day, which began in July. It has already been extended to cover August and September, and is now being extended for another three months.

It means Saudi Arabia will produce around 9 million barrels of oil per day in October, November, and December.

The source added that this voluntary cut decision will be reviewed monthly to consider deepening the cut or increasing production. The move is meant to “reinforce the precautionary efforts” made by OPEC countries and their allies to balance the oil markets, they say.

Russia will extend its voluntary reduction in oil exports by 300,000 barrels per day (bpd) until the end of the year “to maintain stability and balance” on oil markets, Deputy Prime Minister Alexander Novak said in a statement today.

Rising oil prices will alarm central bankers, as they try to battle inflation, and could push up the cost of fuel higher, above the highs seen this week (see earlier post).

Pump price of unleaded petrol climbs to highest level this year

The price of petrol on UK forecourts has risen to its highest level so far this year, in a blow to drivers, reports PA Media.

The average pump price of a litre of unleaded petrol stood at 151.7p as of September 4, up from 150.7p the previous week.

It is the seventh weekly jump in a row.

The rise is being driven by an increase in the cost of oil, which has gone up by nearly 12 US dollars a barrel since the start of July to more than 88 US dollars, due to producing group Opec+ reducing its supply.

This has caused the wholesale cost of fuel – what retailers pay – to go up, which in turn has been passed on to drivers.

The average price of a litre of unleaded petrol is now at its highest level since the end of December 2022 and has increased by 9p since early June.

But it is still some way below the peak of 191.6p reached in July 2022.

The average price of diesel has also been rising in recent weeks, climbing from 144.6p a litre in mid-July to 154.7p as of Monday.

All figures have been published by the Department for Energy Security and Net Zero.

The pound dropped to its lowest level since mid-June today, amid concerns over the economic outlook.

Sterling lost almost one cent against the US dollar at one stage, hitting $1.253, a 12-week low.

Concerns about a global economic contraction led by China are hitting the pound today, says Samer Hasn, market analyst at XS.com.

This weakness in the Sterling today came with more negative data coming out of China.

Today, we witnessed the services PMI figures for the month of August, as we saw the slowest pace of growth in service activities in China since December last year, with a reading of 51.8, which was below expectations of 53.6. While the services sector figures came after the manufacturing PMI numbers we saw last week, which came at the highest levels since last February and outperformed expectations that were predicting a continued contraction in manufacturing activities.

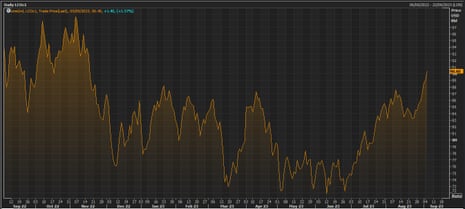

The UK has paid a record high interest rate today, as it turned to investors to borrow £5bn for the next 40 years, Reuters reports.

Here’s the details:

Britain sold £5bn of a British 40-year government bond at a record-high yield on Tuesday, despite attracting more than £59bn pounds in orders from investors during the syndication sale process.

The United Kingdom Debt Management Office said the gilt would pay a yield of 4.6562%. This is the highest yield ever across British government bond syndications dating back to 2005, reflecting the sharp rise in borrowing costs over the past year as the Bank of England hiked rates above 5% to curb inflation.

The previous record was set in June 2009, when £7bn of 25-year gilts sold with a yield of 4.646%.

Regular gilt auctions, which sell smaller volumes of gilts, usually with shorter maturities, have seen even higher yields in recent months.

Some expensive UK government borrowing today: a yield of 4.656% for £5 billion of 40-year bonds.

By my reckoning, that’s the highest at any gilt syndication going back to 2005 (just pipping the previous record in 2009).

Recent auctions have seen higher yields, though. pic.twitter.com/l14q09xxGq

— David Milliken (@david_milliken) September 5, 2023