Odds of interest rate rise falls after inflation drops

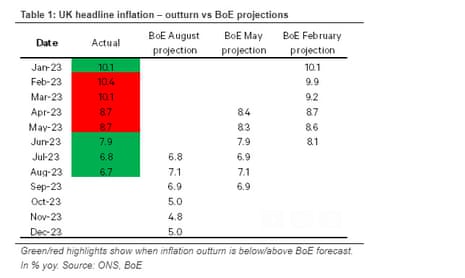

The financial markets have slashed their chances of another increase in UK interest rate at noon on Thursday, following the drop in UK inflation to 6.7% in August.

The money markets indicate that a quarter-point rise in UK interest rates tomorrow (from their current level of 5.25%, to 5.5%) is just a 55% chance, down from around 80% yesterday afternoon.

NEW

Following today’s inflation data the probability of a quarter percentage point @bankofengland interest rate increase tomorrow has just dropped from around 80% to around 55%.

As reflected in money markets…— Ed Conway (@EdConwaySky) September 20, 2023

The odds of no-change have risen from around 20% to 45%.

As this post shows, the market-implied peak of UK interest rates has dropped, with investors no longer certain that rates will hit 5.5%.

Sorry Jon. The yellow line reflects the expected path for UK rates yesterday. The green line reflects the expected path currently… after today’s CPI figures.

— Kyle Rodda (@Kyle_Rodda) September 20, 2023

The yield, or interest rate, on UK government bonds is also falling this morning, as investors cut their forecasts for how high UK interest rates will rise.

That could be a boost to people looking to remortgage in the coming months, as the yield on two-year UK bonds is used to price those home loans.

Key events

The details of today’s inflation report show that food inflation pressures eased, but items were still much pricier than a year ago.

On an annual basis, prices of food and non-alcoholic beverages rose by 13.6% in August, down from 14.8% in July.

Within that, there were dramatic differences – sugar is 55% more expensive than a year ago, while low-fat milk cost 4.4% more.

Restaurants and hotels price inflation also cooled, with prices up by 8.3% per year in August, down from 9.6% (with prices down 0.2% in August alone).

Inflation for furniture and household goods dropped to 5.1%, down from 6.2%.

While miscellaneous goods and services price inflation eased to 5.6%, from 6%.

“Annual #CPI inflation was 6.7 per cent in August, marginally down from 6.8 per cent in July, driven by falling food price inflation which was partially offset by rising motor fuel prices. Despite the minimal fall in the headline rate, it is encouraging that

1/3

— National Institute of Economic and Social Research (@NIESRorg) September 20, 2023

measures of underlying #inflation fell substantially: core CPI rose by 6.2 per cent in the year to August, down from 6.9 per cent in July; annual services CPI inflation fell to 6.8 per cent in August from 7.4 per cent in July; and NIESR’s trimmed-mean CPI inflation estimate

2/3

— National Institute of Economic and Social Research (@NIESRorg) September 20, 2023

decreased to 7.9 per cent in August from 8.6 per cent in July. Today’s data imply that if the #MPC opt for a rate hike at tomorrow’s meeting, it could potentially be the last hike of the current monetary tightening cycle, conditional on future inflationary developments

3/3

— National Institute of Economic and Social Research (@NIESRorg) September 20, 2023

Charles Hepworth, investment director at GAM Investments, predicts that the Bank of England will probably raise interest rates by a quarter of one percent tomorrow, from 5.25% to 5.5%, and that this will be the peak.

Hepworth predicts a ‘dovish final hike’ at noon tomorrow:

“UK inflation came in less than forecast in August, rising 6.7% year on year against market expectations of a 7.0% rate. Core inflation which excludes energy and food inflation fell to 6.2% – a much larger drop from the previous months rate of 6.9%.

This welcome drop in inflation against forecasts will be perceived positively by the government that its plan is working and may even lead to some division at the Bank of England’s meeting tomorrow. However, we should probably still prepare ourselves for a dovish final hike in rates in this cycle.”

Just in: UK rents have continued to climb, as tenants suffer badly from the cost of living squeeze.

The Office for National Statistics reports that private rental prices paid by tenants in the UK rose by 5.5% in the 12 months to August 2023, up from 5.3% in the 12 months to July 2023.

That’s the highest rate since the ONS started tracking this data, in 2016.

BRACE: Avg rental prices inc by 5.5% in the 12mths to Aug 23. Within Eng, London had the highest annual % change since the London data series began in Jan 06 to 5.9%. While the North East & South West saw the lowest, 4.8%. Not to be outdone Scotland inc’d 6% & Wales 6.5% @ONS pic.twitter.com/DkfCOgPL9o

— Emma Fildes (@emmafildes) September 20, 2023

On Monday, estate and letting agent Hamptons reported that the average rent on a newly-let property jumped by 12.0% year-on-year in August, the fastest growth since its index started in 2014.

The ONS data covers all tenants, not just those signing new contracts.

Berenberg: Final BoE rate hike on a knife edge

The question of whether the Bank of England raises interest rates tomorrow for a 15th, and likely final, time in a row is “on a knife edge”, says Kallum Pickering, senior economist at Berenberg Bank.

Pickering writes this morning:

By and large, the downside surprise to August inflation is the result of weakening domestic price pressures exceeding the inflationary effect of the rising oil price.

This will be welcome news for policymakers at the Bank of England (BoE) as they deliberate this week whether or not to further raise the bank rate from 5.25% in order to add even more downward pressure to domestic demand and thus prices. The BoE decision will be announced at 12:00 (BST) tomorrow.

The market for overnight index swaps (OIS), which had dramatically cut its bets for the peak bank rate in recent weeks (from a high of 6.5% in early July – which we had pushed back against), has now lowered its bet on a further final 25bp hike to a c50% chance from a virtually certainty yesterday.

The right-wing thinktank, the Institute of Economic Affairs, finds itself in rare agreement with the TUC this morning,

Like the trade union movement (see earlier post), Julian Jessop, economics fellow at the IEA, argues that the Bank should leave interest rates on hold tomorrow:

“Today’s better than expected UK inflation data show why forecasters and policymakers should pay more attention to monetary aggregates.

Inflation was widely expected to jump due to higher fuel prices. In fact, it fell, which is consistent with the sharp deceleration in the growth of the money supply over the last year.

“The Bank of England should have hit the pause button on interest rates several meetings ago to assess the full impact of the tight squeeze that is already in place. Even if the MPC does decide to hike one more time this week, they should signal that rates are then on hold for a long period – and that the next move is just as likely to be a cut.”

JRF: Inflation damage means costs of essentials are literally unaffordable

Although inflation is now falling, it remains high – and “the real damage has largely been done”, points out Alfie Stirling, chief economist at the Joseph Rowntree Foundation.

Sterling says:

For 7.3 million low-income households, the costs of essential goods and services have reached a level that is literally unaffordable. For those already skipping meals and going without hot water, the rate at which prices continue to rise is now secondary.

He adds that people are “increasingly being squeezed from all sides”:

Not only is the price of money itself rising rapidly – in the form of interest on credit cards, loans and overdrafts – but this is slowing wider spending in the economy too, increasing the risk of lost work and earnings.

“Government can and should be doing much more to protect living standards for those on the lowest incomes. This starts with following the existing rules and raising benefits at least in line with inflation. And poverty charities, national health organisations and the wider public now all agree that the next step is a new guarantee that as a minimum benefits must always cover the cost of essentials.”

At 6.7% inflation remains high, but the damage has largely been done.

For 7.3 million low-income families, essential items are already unaffordable.

For those already skipping meals & going without hot water, the rate at which prices continue to rise is now secondary. 1/ pic.twitter.com/OjFXe0f4tr

— Alfie Stirling (@alfie_stirling) September 20, 2023

Food & energy feature disportionately in the basket for the lowest income households.

Adding these to the picture basically breaks the scale. 2/ pic.twitter.com/kh1tMg5Uew

— Alfie Stirling (@alfie_stirling) September 20, 2023

This morning’s fall in inflation will fill the nation’s mortgage holders with hope that “the tide has well and truly turned”, says Ben Thompson, deputy CEO at Mortgage Advice Bureau.

Significant month-on-month falls ramp up the likelihood that the Bank of England will hold off on increasing rates right now. This will likely be a breath of fresh air for those on variable rates or trackers, especially if this means that interest rates are near, or at, their peak.

“There is better news for those looking to remortgage and, indeed, prospective buyers. This is due to the steady decline of swap rates, meaning many lenders have reduced rates on various deals. Although swap rates remain high in comparison to the past decade, they are some of the lowest rates we’ve seen in the past year.

Simon French, chief economist at City investment bank Panmure Gordon, argues that of the Bank of England raises interest rate tomorrow it “would have the hallmarks of a policy mistake”.

He told clients this morning:

The latest UK inflation data continues a trend of softer price setting behaviour in the UK economy since the start of Q3 [the July-September quarter].

With a range of other relevant indicators also telling the Bank of England to pause for breath, we think anything else at the September MPC meeting would have the hallmarks of a policy mistake.

The UK is not out of the woods on inflation – with murmurings in oil and soft commodity markets demanding vigilance – but the recoupling with global price trends that we have expected all year is now well underway.

Financial markets now seeing UK rate decision as 50/50 tomorrow. Having been 80/20 in favour of a hike first thing. Bailey allowing the markets to dictate financial conditions, rather than leading them. Not my preferred approach, and in stark contrast to the Fed. https://t.co/nm0FGz0KKs

— Simon French (@shjfrench) September 20, 2023

Shares in UK housebuilders are rallying this morning, as City traders anticipate that UK mortgage rates may drop sooner and faster than previously thought.

Taylor Wimpey (+5.2%) and Barratt Development (+4.5%) are leading the risers on the FTSE 100 index of blue-chip shares this morning.

Housebuilders have warned that the increase in mortgage rates this year has cooled demand for new homes.

This has helped to lift the FTSE 100 by 0.5%.

The smaller FTSE 250 index of medium-sized companies, which is more closely linked to the health of the UK economy, has jumped over 1%.

Victoria Scholar, head of investment at interactive investor, explains,

“The FTSE 100 and the FTSE 250 which is more closely correlated to the UK economy, are staging gains while the pound is under pressure after UK inflation fell in August, despite forecasts for a slight uptick.

UK housebuilders like Taylor Wimpey, Barratt Development, Land Securities and Berkeley Group are trading near the top of the FTSE 100 thanks to the better-than-expected inflation print.