UK government borrowing costs fall as City anticipates 2024 rate cuts

UK government bonds are rallying today, after the Bank of England’s chief economist indicated that interest rates could be cut next year.

With prices rising, the yield (or interest rate) on UK two-year government bonds has fallen to the lowest level since June.

Two-year gilt yields, which are sensitive to interest rate expectations, are down almost 10 basis points at 4.625%, down from 4.723% last night.

These two-year bonds are also used to price fixed-term mortgages.

The rally comes after BoE chief economist Huw Pill indicated yesterday that the central bank could start to lower interest rates next summer.

Pill told an online presentation that the pricing in financial markets, indicating the first rate cut could come in mid-2024, “doesn’t seem totally unreasonable, at least to me.”

Pill explained:

“It is at that point you might consider or reassess, if nothing new has happened, where we are going to have to be.”

Today, the financial markets are indicating that Bank rate will have been cut to 4.5% by the end of 2024, down from 5.25% today.

Last week, the Bank’s governor Andrew Bailey insisted it was “much too early” to think about cutting borrowing costs, though.

Key events

Closing post

Time for a recap.

UK government bonds are rallying today as the City bets that UK interest rates will fall next year.

The yields, or interest rates, on shorter-dated UK gilts fell, after Bank of England chief economist Huw Pill indicated last night that the central bank could start lowering borowing costs next summer, as markets expect.

The yield on two-year UK bonds, and five-year bonds, both fell to their lowest level since June.

The move came after Pill said last night that market expectations for cuts next summer were not “unreasonable” – while cautioning that the outlook was likely to change over the next nine months .

The money markets are now indicating that UK interest rates will be cut to 4.5% by December 2024, down from 5.25% at present.

Falling interest rates could help the UK housing market strengthen.

Prices rose by 1.1% on a monthly basis in October, new figures from Halifax show, helped by a shortage of products. They were still 3.2% lower than a year ago, though.

Fears of weaker demand have also hit the oil price today, with Brent crude dropping 2% to $83.31, the lowest since August.

Fears that the UK is heading for a recession this winter have intensified amid signs Britain’s hard-pressed households are cutting spending as they save for Christmas and higher fuel bills.

Recession fears are on the rise in Germany too, after a disappointing fall in factory output in September.

German industrial production dropped by 1.4% month-on-month in September, which ING said suggested the country could be in a technical recession by the end of this year.

The UK’s cost of living squeeze has eased, with supermarket inflation falling into single-digits for the first time in over a year.

The UK government is planning a ban on the creation of new leasehold houses in England and Wales, through a shake-up of the housing market announced in the King’s speech today.

In the banking sector, UBS has reported a $785m (£637m) quarterly loss, its first in nearly six years, as the Swiss banking group counted the costs of rescuing its rival Credit Suisse earlier this year.

PwC’s chair has defended plans to cut up to 600 jobs rather than cut partner pay amid a slowdown in client demand, saying it was important to offer “competitive” pay packages to senior staff.

Stocks have dipped slightly in New York at the start of trading.

The Dow Jones industrial average is down 40 points, or 0.1%, to 34,055 points.

Energy stocks are sliding, following the drop in the oil price today.

Technology stocks are stronger, though, with the Nasdaq composite index up 0.35%.

Meanwhile in London, mining company shares are also weaker, as commodity prices are hit by growth fears.

Kalyeena Makortoff

PwC’s chair has defended plans to cut up to 600 jobs rather than cut partner pay amid a slowdown in client demand, saying it was important to offer “competitive” pay packages to senior staff.

The accounting and consultancy firm said it was trying to right-size the business after weaker growth, rising costs and a drop in the number of employees quitting on their own accord, in a process usually referred to as natural attrition.

PwC’s own attrition rate has dropped to 10% from 15% in recent months, against a backdrop of falling job vacancies at rival firms and startups.

More here.

The selloff in the oil market today has pushed price of a barrel of US crude down below $80 per barrel.

David Morrison, senior market analyst at Trade Nation, says concerns over weak demand are hitting the oil price:

Without a quick rebound, the next significant target for the bears comes in around $77.50.

Crude prices have been declining steadily since 20th October. Yesterday’s attempted rally petered out later in the day and prices continued to slide overnight. This accelerated following the release of China’s trade surplus, which fell unexpectedly sharply last month. Traders will be paying close attention to China’s CPI and PPI which are released on Thursday. On Sunday Russia and Saudi Arabia confirmed that their respective supply cuts will remain in place, and this briefly supported prices.

Traders still don’t see the current Middle Eastern hostilities spreading out and affecting supply. Instead, it’s the demand side which is the focus, with concerns of economic weakness in China and elsewhere capping prices.

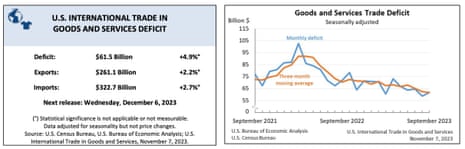

US trade deficit widens

Just in: America’s trade deficit has widened in September, as it imported more goods than a month earlier.

The US trada deficit rose by almost 5% to $61.5bn in September, a $2.9bn increase on the $58.7bn recorded in August.

Imports rose by 2.7%, outpacing the 2.2% rise in exports.

The goods deficit rose by $1.7bn to $86.3bn, while the services surplus fell by $1.2bn to $24.8bn.

Imports of goods increased by $7bn, including a $2bn increase in consumer goods such as mobile phones and other household goods, a $1.9bn rise in automotive vehicles, parts, and engines, and a $1.6bn rise in capital goods (such as computing equipment, industrial machinery and civilian aircraft parts).

The US trade deficit had originally been measured at $58.3bn in August, which was the lowest since late 2020.

Naked Wines shares slump after latest warning

Shares in online drinks business Naked Wines have plunged by a third today, as its pandemic hangover worsened.

Naked issued a rather dire statement to the City this morning, in which it warned that tradinng in the US has been weaker than anticipated.

It has now slashed its revenue forecasts, predicting a fall of between 12% and 16% this financial year (down from an 8%-12% fall previously forecast).

Earnings expectations, on an adjusted EBIT basis, have been cut to £2m-£6m, down from £8m-12m.

Naked says that trading in the UK and Australian markets has been broadly in line with expectations in the last quarter, but trading in the US has been weaker than anticipated.

In particular, the “repeat business” has missed expectations, as the company has struggled to make much money from new customers.

Chief exeutive Nick Devlin is carrying the can, by standing down as CEO so he can focus on running the US business.

Chairman Rowan Gormley, who founded Naked, will become executive chairman while a successor is sought.

Gormley says:

“It is disappointing to be warning of underperformance against a recent forecast. While trading in the UK and Australia has been in line with the Board’s expectations, current trading in the US has fallen well behind, both in terms of sales and margin. Customer attrition remains at historically low levels.

My view is that this shortfall is largely to do with execution, which in turn is largely due to Nick Devlin splitting his time across both the role of CEO and US President.

🍇 Naked Wines plc 🍷

US market trading not as strong as expected due to execution😕

Updated guidance for this year:

Revenue expectations down to -12% to -16%

Adjusted EBIT expectations lowered to £2-6m

CEO Nick Devlin stepping down#NakedWines $WINE $WINE.L pic.twitter.com/XXA5Rnfq3A— Alexandru DRAGUT (@alex_dragut) November 7, 2023

Shares in Naked have sunk by 35% to 29p today, a record low.

Back in 2021 they peaked above 900p, when the pandemic was driving a boom in internet shopping.

In the currency markets, the pound has dropped half a cent against the US dollar today.

Sterling has dropped back to $1.2296 against the dollar, falling away from the seven-week high hit yesterday.

The dollar has also strengthened against the euro, after a US central bank policymaker said more work was needed to bring America’s inflation rate down.

Federal Reserve Bank of Minneapolis president Neel Kashkari said yesterday that the U.S. central bank likely has more work ahead of it to control inflation.

Kashkari told Fox News:

“The economy has proved to be really resilient even though we’ve raised interest rates a lot over the past couple of years. That’s good news,.

“We haven’t completely solved the inflation problem. We still have more work ahead of us to get it done.”

The parent firm of Primark has revealed a jump in profits and sales as shoppers continued to shop “enthusiastically” at the fashion chain despite price rises and budget pressures.

Associated British Foods which also runs large grocery, ingredients and agriculture operations, said the backdrop is still “challenging” for consumers but stressed that it has seen inflationary pressure ease over the past year.

ABF reported a 25% rise in pre-tax profits in the year to 16 September, to £1.34bn, with revenues up 16%.

The company says that it posted “significant growth in Group sales driven in large part by pricing actions”.

King Charles: ministers will help bring inflation down to target

Over in parliament, King Charles has told parliament that the government will take”responsible” decisions on spending and borrowing, to help bring inflation down to the UK’s 2% target.

In the first king’s speech in seven decades, Charles outlined the government’s plans for the new parliamentary session, saying:

My ministers will support the Bank of England to return inflation to target by taking responsible decisions on spending and borrowing.

These decisions will help household finances, reduce public sector debt and safeguard the financial security of the country.”

The king has also announced there will be new measure to reform the housing market, saying:

My ministers will bring forward a bill to reform the housing market by making it cheaper and easier for leaseholders to purchase their freehold and tackling the exploitation of millions of homeowners through punitive service charges.

Renters will benefit from stronger security of tenure and better value, while landlords will benefit from reforms to provide certainty that they can regain their properties when needed.

Our Politics Live blog has all the action from Westminster:

Insolvencies have risen in Germany – in another sign that Europe’s largest economy is struggling.

The Leibniz Institute for Economic Research Halle (IWH) has reported that 1,037 partnerships and corporations in Germany fell into insolvency in October – 44% more than a year ago, and 2% more than in September.

The number of bankruptcies was 12% above the October average for the years 2016 to 2019, reported IWH. They expect the number of insolvencies to rise significantly again in the coming months.

If you haven’t seen enough bad German data today, you can check out the latest insolvency trends below. Notably number of employees is above pre pandemic levels now https://t.co/j7qWgXf33t

— Oliver Rakau (@OliverRakau) November 7, 2023

The prices charged by eurozone producers inched up in September, but were still sharply lower than a year ago.

The eurozone producer prices index shows that prices rose by 0.5% during the month in the euro area, but were 12.4% lower than in September 2022.

The monthly rise was due to more expensive energy products, which rose by 2.2% in September.

But on an annual basis, energy cost 31.3% less than in September 2022, reflecting the fall in the oil and gas prices.

🇪🇺EUROZONE PPI YOY ACTUAL -12.4% (FORECAST -12.5%, PREVIOUS -11.5%)

🇪🇺EUROZONE PPI MOM ACTUAL 0.5% (FORECAST 0.5%, PREVIOUS 0.6%) $MACRO

Report👇https://t.co/12nUO8gT4N

— Chetta 🐯 (@Chetta_Cheetah) November 7, 2023

Back in the bond market, five-year UK government bond prices are also rallying.

This has pulled the yield on five-year gilts down to the lowest since June, at 4.227%.

That’s another sign that City investors are lowering their expectations for UK interest rate levels, with cuts expected to begin next summer.

Kalyeena Makortoff

Ex-NatWest CEO Alison Rose has welcomed an apology from the UK’s information watchdog (see Monday’s blog) after it back-peddled on statements suggesting she had broken privacy rules by discussing Nigel Farage’s bank accounts with a BBC journalist.

Rose’s team lodged a complaint with the Information Commissioner’s Office (ICO) last month, after it originally said Rose had breached data protection laws but would not face any repercussions given that she had already resigned over the controversy.

The ICO on Monday apologised to Rose for suggesting she breached the law, despite the fact that she wasn’t the target of its investigation, and that it had not approached her for a response.

Rose responded on Tuesday, saying:

“The recent publication of the outcome of a complaint from Nigel Farage by the ICO, wrongly stated that I had broken data protection rules. On top of that, I had not even been aware of the existence of the investigation, nor been asked any questions.

The ICO has now acknowledged that they did not find that I breached data protection law. I welcome the clarification and accept the ICO’s apology.

Oil price lowest since August

The oil price, a gauge of global growth prospects, has fallen to its lowest level since late August this morning.

Brent crude has dropped by 2% to $83.50 per barrel. Prices declined after China reported a 6.4% drop in exports, year-on-year, in October, suggesting weak economic demand.

This takes Brent below its levels on 6th October, the day before Hamas’s attack on Israel prompted a jump in energy prices, on fears of supply disruption.

Fall in Germany factory output raises recession risks

The warning lights are flashing on Germany’s economy again today, as it teeters near recession.

German industrial production dropped by 1.4% month-on-month in September, following a 0.1% drop in August.

On an annual basis, German industrial output was down -3.7% year-on-year.

There is no end in sight for the weakness in German industry, which has become more broad-based in Q3. Hard to pick out any positives.

German industrial production now a staggering 17% below the trend from 2010s, meaning over a hundred billion Euros in lost output. pic.twitter.com/vflSSx3j9J

— Daniel Kral (@DanielKral1) November 7, 2023

Carsten Brzeski, global head of macro at ING, says the “disappointing data release” suggests that Germany is likely to end the year in a technical recession (GDP fell in July-September, so another fall in Q4 would mean a recession).

Brzeski writes:

Germany’s macro horror show continues, and we are almost getting to the point where kids ask their parents where they were the last time Germany produced a series of positive macro data.

Today’s industrial production data is unfortunately no exception to the longer-lasting trend. German industrial production dropped once again in September for the fifth consecutive month.

Brzeski points out that German industrial production is now more than 7% below its pre-pandemic level.

UK government borrowing costs fall as City anticipates 2024 rate cuts

UK government bonds are rallying today, after the Bank of England’s chief economist indicated that interest rates could be cut next year.

With prices rising, the yield (or interest rate) on UK two-year government bonds has fallen to the lowest level since June.

Two-year gilt yields, which are sensitive to interest rate expectations, are down almost 10 basis points at 4.625%, down from 4.723% last night.

These two-year bonds are also used to price fixed-term mortgages.

The rally comes after BoE chief economist Huw Pill indicated yesterday that the central bank could start to lower interest rates next summer.

Pill told an online presentation that the pricing in financial markets, indicating the first rate cut could come in mid-2024, “doesn’t seem totally unreasonable, at least to me.”

Pill explained:

“It is at that point you might consider or reassess, if nothing new has happened, where we are going to have to be.”

Today, the financial markets are indicating that Bank rate will have been cut to 4.5% by the end of 2024, down from 5.25% today.

Last week, the Bank’s governor Andrew Bailey insisted it was “much too early” to think about cutting borrowing costs, though.

Average UK mortgage rates have dropped today.

Moneyfacts reports that fixed-term rates for two and five-year loans have both dipped.

They say:

-

The average 2-year fixed residential mortgage rate today is 6.26%. This is down from an average rate of 6.29% on the previous working day.

-

The average 5-year fixed residential mortgage rate today is 5.84%. This is down from an average rate of 5.87% on the previous working day.