Insolvencies in England and Wales rise

Newsflash: More companies and individuals across England and Wales fell into insolvency last month, as high interest rates continue to weigh.

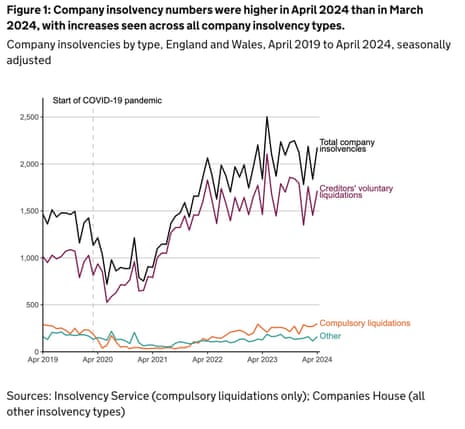

Company insolvencies jumped by 18% in April to 2,177, the Insolvency Service has reported.

This included 300 compulsory liquidations, 1,715 creditors’ voluntary liquidations (CVLs), 144 administrations and 18 company voluntary arrangements (CVAs).

CVLs allow the directors of an insolvent company to voluntarily wind the company upm while CVAs allow insolvent companies to keep trading, if their creditors agree.

Companies are being hit by high borrowing rates, rising costs, and higher staff wages, explains David Hudson, restructuring advisory partner at FRP:

“Last week’s GDP figures suggests that the UK economy is finally emerging from its lengthy post-Covid hangover. But while there is optimism this growth can be sustained, the coming months will continue to be turbulent with more business faltering as they weather the legacy of high interest rates, input costs and wage growth.

“Indeed, while we anticipate monthly fluctuations as insolvency levels settle, our own data suggests the profile of firms going into administration is increasingly that of larger employers which will ultimately have a more pronounced effect on supply chains and the labour market.”

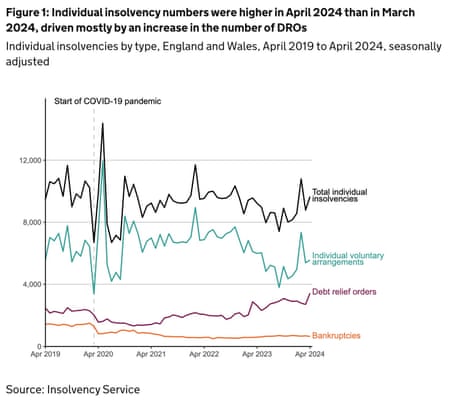

Seperate data shows that 9,651 individuals entered insolvency in England & Wales in April 2024, 10% higher than in March and 5% higher than in April 2023.

Key events

Hunt: Royal Mail bid would face national security review

A takeover bid for Britain’s Royal Mail would be subject to “normal” national security scrutiny, says chancellor Jeremy Hunt.

But Hunt also indicated that the government would not be opposed in principle to an overseas buyer taking control of the postal operator.

Asked about Czech billionaire Daniel Křetínský £3.5bn proposal to buy Royal Mail, Hunt told reporters:

“As a rule, we welcome international investment in British companies”.

Hunt argues that this open approach has helped the UK attract “greenfield foreign direct investment”, bringing in capital and expertise from overseas.

The chancellor adds:

“We will continue with that approach. But we do always look at national security considerations and make sure that in terms of our core infrastructure, there are no risks to those going forward.

Any bid for Royal Mail will go through that normal process.”

Landsec: Workers returning to the office

Julia Kollewe

Landsec, one of Britain’s biggest developers, said more workers were returning to its offices, especially in the West End, but wrote down the value of its City of London office portfolio by nearly 14%.

The company said the number of workers coming into its offices rose 18% across London in the past year. Chief executive Mark Allan explained that numbers were growing across all five weekdays but most strongly between Tuesdays and Thursdays.

Allan added:

“Being sat here in the City on a Friday morning and it was fairly busy on the way in, so I think things are continuing to grow steadily.”

The company’s loss before tax narrowed to £341m in the year to 31 March from £622m the year before. It has invested heavily in the West End, where 72% of its London offices are, up from 48% three years ago. Landsec is also building more offices in Victoria and the South Bank and has a couple of projects in the City, the financial district that has been hit by the move to hybrid working.

Allan said:

“Our consented pipeline [projects with building permission] continues to focus in the main on the South Bank because it benefits from Waterloo station and London Bridge station as two of the three busiest overland stations in London. It’s got all of the well established immunity and vibrancy down there that employers and employees are looking for. So we expect to be investing into that Southbank portfolio for the next few years.”

Virtually all of Landsec’s West End office space is occupied (99.6%) compared to 93.7% of City offices. It wrote down the value of the City office portfolio by 13.9%. Its shopping centres and outlets are 95.4% full. It owns malls such as Buchanan Street in Glasgow, Westgate in Oxford and Bluewater in Kent. Landsec has sold more than £600m of non-core assets such as hotels and retail parks in the last seven months.

Allan said the UK property market was starting to recover, after high interest rates hampered developers’ ability to refinance. He had predicted “a period of at least 18 months of relatively limited transactional activity” in November 2022.

“So we are pretty much now at the end of that 18-month period, and we are starting to see clear evidence of investors looking more seriously at some of these sectors again.”

Today’s increase in insolvencies will be of no surprise to anyone who has been paying any attention to the economy recently, says Tom Pringle, restructuring and insolvency partner at the law firm Gowling WLG.

Companies continue to weather the storms of Brexit, labour shortages and high inflation, often with balance sheets that are struggling to recover from the hit of the economic climate, and with the cost-of-living crisis hitting employees and customers alike.

Now, a prolonged higher interest rate environment is chipping away at margins and threatening to pick companies off as they need to refinance or reconsider their survival-based options.

Directors of struggling companies need to be aware that there are many options now available to them to save or rescue their businesses, as long as they get the right advice as early as possible and engage with key stakeholders. The longer this is delayed, the fewer options remain.”

Insolvencies in England and Wales rise

Newsflash: More companies and individuals across England and Wales fell into insolvency last month, as high interest rates continue to weigh.

Company insolvencies jumped by 18% in April to 2,177, the Insolvency Service has reported.

This included 300 compulsory liquidations, 1,715 creditors’ voluntary liquidations (CVLs), 144 administrations and 18 company voluntary arrangements (CVAs).

CVLs allow the directors of an insolvent company to voluntarily wind the company upm while CVAs allow insolvent companies to keep trading, if their creditors agree.

Companies are being hit by high borrowing rates, rising costs, and higher staff wages, explains David Hudson, restructuring advisory partner at FRP:

“Last week’s GDP figures suggests that the UK economy is finally emerging from its lengthy post-Covid hangover. But while there is optimism this growth can be sustained, the coming months will continue to be turbulent with more business faltering as they weather the legacy of high interest rates, input costs and wage growth.

“Indeed, while we anticipate monthly fluctuations as insolvency levels settle, our own data suggests the profile of firms going into administration is increasingly that of larger employers which will ultimately have a more pronounced effect on supply chains and the labour market.”

Seperate data shows that 9,651 individuals entered insolvency in England & Wales in April 2024, 10% higher than in March and 5% higher than in April 2023.

Bank of England to expand in Leeds

The Bank of England is expanding its Leeds office, in a drive to enhance its staff presence across the country.

The BoE has announced details of plans for an expanded and permanent presence in the city (whose football team is on the verge of a return to the top flight).

It aims to have a headcount of at least 500 staff in Leeds by 2027, or around one in ten of its workforce. This will be done through voluntary internal relocations and new Leeds-based recruitment.

The BoE says:

The increased office space in Leeds aims to improve trust and wider understanding of the Bank’s work across the UK, ensure as an organisation it better represents the people it serves, help tap into wider talent pools across the UK, and retain talented colleagues.

Three years ago, the Bank announced it would create a new northern hub in Leeds. But in November 2022, it put the plans on ice as it tried to examine ‘post-pandemic ways of working’.

The Sunday Times also reports that the biggest risers on this year’s list are:

-

Barnaby and Merlin Swire and family, the family’s two-century-old business owns a significant stake in Cathay Pacific and has extensive interests in Hong Kong (£8.82bn)

-

Idan Ofer, is the son of Sammy Ofer, who built a shipping empire after serving in the Royal Navy during the Second World War (£6.96bn)

-

John Frederiksen and family, Fredriksen, a Norway-born Cypriot oil and tanker tycoon, has twin daughters who stand to inherit his empire. He owns a Chelsea mansion with a ballroom (£4.556bn)

Today’s rich list is a reminder that those at the top of the wealth. pile are continuing to “coin it in”, says TUC General Secretary Paul Nowak:

“We need an economy that rewards work not just wealth.

“But as millions of families struggle to cover even the basics, the super-rich are amassing even greater fortunes.

“The Conservatives have turned Britain into a land of grotesque extremes and rampant wealth inequality.

“UK workers are in the worst cost of living crisis in generations with real wages still worth less than in 2008.

“Meanwhile those at the top continue to coin it in.

“This inequality is bad for living standards, bad for the economy and is holding the country back.”

Bernie Ecclestone, the ex-Formula 1 boss, has roared into second place on the list of the UK’s largest taxpayers, a new entry, having handed over £652.6m in tax last year.

But this largesse follows Ecclestone’s tax fraud conviction last year.

And indeed, the Sunday Times describe Ecclestone as a “reluctant” entry – he agreed to pay £652m to HM Revenue and Customs after pleading guilty to fraud after being accused of not declaring more than £400m of overseas assets.

Financial trader Alex Gerko is top of the taxpayers’ podium, having paid £664.5m, while. Denise, John and Peter Coates of Bet365 paid £375.9m of tax.

British asylum housing tycoon breaks into Sunday Times rich list

Rupert Neate

An Essex businessman who won government contracts paying his firm £3.5m a day for transporting and accommodating asylum seekers has been named among the 350 richest people in the UK.

Graham King, the founder and majority owner of a business empire that includes Clearsprings Ready Homes, which won a 10-year Home Office contract for housing thousands of asylum seekers, was on Friday named alongside King Charles III, the prime minister and Sir Paul McCartney on the Sunday Times rich list of the wealthiest people.

King, 56, is estimated to have amassed a £750m fortune from “holiday parks, inheritance and housing asylum seekers for the government”. Clearsprings Ready Homes made £62.5m in profits after tax for the year ending January 2023, more than double its profits of £28m the previous year.

King, ranked 221st, is one of several new entries to the 2024 rich list alongside Formula One driver Sir Lewis Hamilton and Tony and Cherie Blair’s son Euan, whose apprenticeship firm Multiverse is said to be worth £1.4bn.

British billionaire total shrinks

Britain is losing billionaires.

This year’s Sunday Times rich list found there are 165 billionaires this year, down from 171 last year and a peak of 177 in 2022. This is the biggest drop since the list started being compiled in 1989, and shows – according to the ST – that the super-rich are. falling out of love with the UK.

One lost billionaire is caravan park tycoon Alfie Best, now worth £947m, who shifted to Monaco six weeks ago. Best argues that Britain’s tax system and business regulations are “sterilising” wealth creators.

The list cites some other examples:

The tech entrepreneur Johnny Boufarhat has relocated to Switzerland. John Grayken, a Boston-born private equity tycoon, has quit London for Ireland. Telis Mistakidis, who built his fortune at the mining giant Glencore, has returned to Greece.

The Norwegian shipping heir Trond Mohn and Nathan Kirsh, the South African owner of the City block once known as the NatWest Tower, have left the Rich List for the same reason.

Yelena Baturina, once Russia’s wealthiest woman and who made her home in London, now lives in Austria.

This exodus could accelerate if the Labour Party win the next election and clamp down on the non-dom system, which allows the wealthy to avoid paying tax here on earnings abroad.

Chemicals billionaire Sir Jim Ratcliffe’s wealth shrank by over £6bn last year, according to this year’s rich list.

That’s due to a 40% tumble in profits at Ineos, the energy giant which Ratcliffe build up, and which suffered from the jump in energy costs, plus inflation and higher interest rates.

Ratcliffe’s wealth is this year estimated at £23.5bn, down from £29.7bn a year ago.

Brexit-backing billionaire inventor Sir James Dyson also became poorer (although these things are relative….), with his estimated wealth dropping to £20.8bn from £23bn, despite his Dyson company continuing to produce new hair styling and cleaning products.

Hinduja family top the rich list again

The Hinduja family, led by Gopi Hinduja, retain their place at the top of the rich list this year.

The Hinduja’s wealth rose by almost £2.2bn last year to £37.196bn, from a property-to-industrial conglomerate, which also covers energy and finance, from London.

They recently transformed the Old War Office building in Whitehall into a Raffles hotel with 120 rooms, 11 restaurants and 85 serviced flats.

In second place, with £29.246bn, is Sir Leonard Blavatnik. His investment group Access Industries holds a majority stake in Warner Music. Its value has jumped this year, lifting Blavatnik from third place a year ago.

That bronze medal slot is now occupied by David and Simon Reuben and family, with £24.977bn. The Reubens are property tycoons, having first made a fortune in metals trading – purchasing Russian aluminium before buying up large tracts of London’s landmark buildings.

Denholm: Musk is ‘absolutely’ committed to Tesla

Tesla chair Robyn Denholm was also asked what Musk might do if he loses the upcoming vote on his $56bn pay deal.

Denholm says:

“There is always a risk, but he’s not holding a gun to anybody’s head . . . He hasn’t said one way or another quite frankly. And do I believe he’s committed to Tesla? Absolutely.”

Rishi Sunak and Akshata Murty rise up Rich List

Prime minister Rishi Sunak and his wife Akshata Murty have climbed up the list of the UK’s richest people, after their combined fortune rose by over £120m last year.

The latest Sunday Times Rich List, just released, shows that Sunak and Murty are now worth £651m, up from £529m in 2023.

That places them in 245th place on the List, up from 275th last year.

Once again, Murty’s stake in Indian tech company Infosys provided the bulk of their fortune – over the last year, it has risen by £108.8m to nearly £590m.

In contrast, Sunak’s tax details released in February showed that he had earned around £2.2m last year.

But despite this jump in wealth, the couple are poorer than in 2022, when they burst onto the Rich List with around £730m.

The Sunday Times helpfully runs through the couple’s assets:

The couple’s main London home is a five-bedroom Kensington mews house worth an estimated £7 million. Soon after the row over Murty’s tax status erupted, the family moved out of Downing Street and back into their west London home.

They also own a flat on Old Brompton Road in Kensington, usually used for hosting friends and family, and a Georgian manor house in the North Yorkshire village of Kirby Sigston, bought to serve as a constituency home in 2015 for £1.5 million. Estate agents estimate that additions including a gym, yoga studio, hot tub, tennis court and 12m x 5m indoor swimming pool have pushed the property’s value beyond £2 million. Then there is their £5.5 million penthouse in Santa Monica, California, bought from its developer in 2014.

🔺 REVEALED: The Sunday Times Rich List 2024

It features the King, the prime minister, inventors and industrialists, as well as some exciting new names, but what does the record fall in the number of billionaires mean for Britain? ⬇️— The Times and The Sunday Times (@thetimes) May 17, 2024

Introduction: Tesla must climb ‘Mount Everest’ to win shareholder vote, chair warns

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Tesla faces a climb up “Mount Everest” as it tries to persuade shareholders to appprove a relocation to Texas and sign off – again – a $56bn pay deal for Elon Musk, according to the electric car company’s chair.

Robyn Denholm, chair of Tesla’s board, is battling to win over shareholders ahead of an annual meeting next month.

Denholm told the Financial Times:

“We’re very early days of the campaign and we will be meeting with [shareholders] all the way through to the day of the vote.

The vote’s pretty important for us as a company, but I also think it’s important for corporate America as well.”

The controversial pay deal has already been backed once by shareholders, back in 2018, but was vetoed by a Delaware judge in January.

But Tesla is refusing to let the matter lie, and has decided to put it to investors again – and also approve a decision to move the company’s state of incorporation from Delaware to Texas.

The pay vote is a simple majority, but to shift the incorporation requires a majority of all shares outstanding.

That’s why Denholm sees a struggle; she says:

“It’s like Mount Everest. It’s a huge hill to climb because getting 50 per cent of the shareholders to vote, let alone what they vote for, is quite tough.”

The package grants stock option awards allowing Musk to buy Tesla stock at heavily discounted prices as escalating financial and operational goals are met. He must hold the acquired stock for five years.

Denholm insists that every shareholder that she’s spoken to felt the pay deal worked, and “drove a lot of shareholder value.”

This year has been tougher for Tesla, though. Shares are down 30% so far this year, it reported a 48% drop in profits in the last quarter, and Musk has fired almost all of Tesla’s electric-vehicle charging division.

The agenda

-

9am BST: Bank of England policymaker Catherine Mann speech on ‘cost of capital: measurement and implications for business investment”

-

10am BST: Eurozone inflation report for April

-

3pm BST: Conference Board leading economic index on the US economy

-

5pm BST: Russia’s GDP for Q1 2024