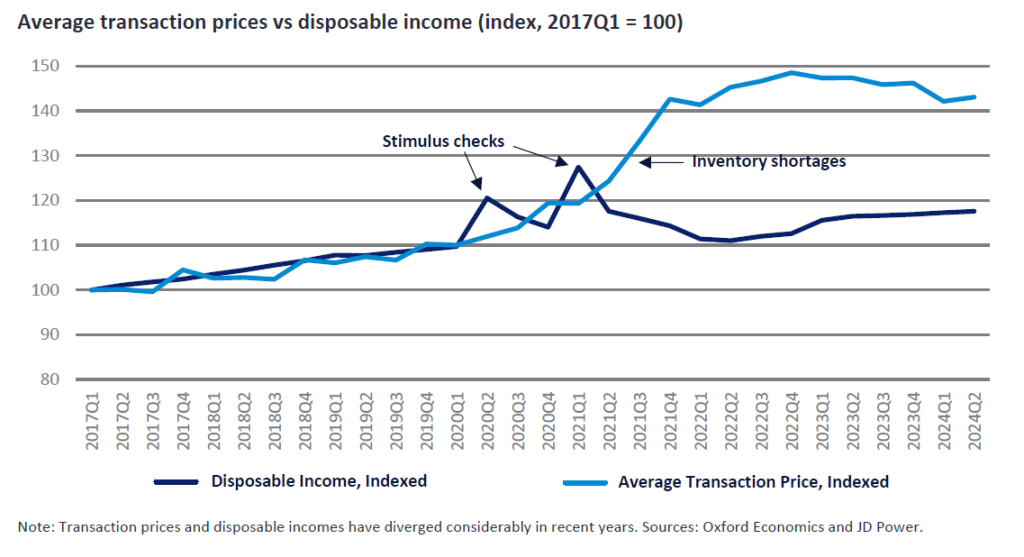

No, it isn’t your imagination – vehicles really have become significantly more expensive over recent years. Before the COVID-19 pandemic began, Light Vehicle (LV) prices mostly tracked with inflation in the wider US economy, and average disposable incomes were also rising in line with prices, creating a relatively stable environment. Furthermore, interest rates were low for around a decade following the Financial Crisis, peaking at 2.5% in 2019. The conditions were ideal for the LV market, which responded by delivering more than 17 million sales each year between 2015 and 2018. Although rates were cut both before and after the pandemic reached American shores, the global supply chain disruption that originated with COVID-19 restrictions sent vehicle prices skyrocketing. In just two years between Q2 2020 and Q2 2022, average US transaction prices rose from roughly US$35,000 to over US$45,000, according to JD Power data. By the latter date, the Federal Reserve had started raising interest rates, compounding affordability problems for those hoping to finance a new vehicle.

The old adage “what goes up, must come down” does not seem to apply here. Even now, as we head towards the final quarter of 2024, average US transaction prices are sitting at around US$43,800. Inflation may have eased, coming in at 2.5% YoY in August, but average disposable incomes have hardly increased for the past four years, after having been artificially boosted by stimulus checks during the pandemic. In other words, cars are far more expensive relative to incomes as compared to the pre-pandemic period.

Of course, there are some factors attempting to push pricing in a downward direction. Incentives have risen from a low of US$922 in the second half of 2022, to US$3,069 in August 2024. Furthermore, automakers have not yet exhausted all their options in terms of discounting, as incentives as a percentage of MSRP were still higher before the pandemic. We believe that it is feasible that average incentives could increase to around US$5,000 over the next year or so, especially given that MSRPs themselves are higher than ever. Leasing can also be a way to keep monthly payments down, even though drivers lose out in the longer term as they have no equity in the vehicle, unlike traditional financing. Therefore, it has not been surprising to see leasing account for a growing share of US sales over the past two years, from 15% in October 2022 to around 21% today, according to JD Power data.

And yet, affordability does not seem likely to disappear as a headache for the industry any time soon. A range of factors will probably continue to put upward pressure on pricing. As vehicles become more technologically complex, electrification increases and labour costs rise under new contracts, it appears that prices will remain elevated even if OEMs offer more generous incentives and interest rates fall. Moreover, simply looking at transaction prices fails to take into account the total cost of ownership of a vehicle. One major consideration for car buyers today is the sharply climbing cost of insurance, which has risen by somewhere between 15% to 25% over the past year. Repairs and maintenance are also becoming much more expensive, which is another unfortunate by-product of the increasing complexity of vehicles, as well as general inflation and a shortage of skilled technicians.

Despite all of this, we should be careful not to overreact when forecasting total US sales. The Federal Reserve’s recent fifty basis point interest rate cut is likely a sign of a lower interest rate environment in the coming years, and the US economy is currently expected to keep growing, supporting private consumption. We still think that there is scope for US LV sales to rise from the current level of around 15.9 million units in 2024 (according to our latest forecast). However, we may never again see 17.0 million units sold in one year, as consumers of more modest means are priced out of the new car market.

David Oakley, Manager, Americas Vehicle Sales Forecasts, GlobalData

Access the most comprehensive Company Profiles

on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Company Profile – free

sample

Your download email will arrive shortly

We are confident about the

unique

quality of our Company Profiles. However, we want you to make the most

beneficial

decision for your business, so we offer a free sample that you can download by

submitting the below form

By GlobalData

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center.