Stay informed with free updates

Simply sign up to the UK house prices myFT Digest — delivered directly to your inbox.

UK house prices rose much more than expected in November and at the fastest pace in two years, helped by solid wage growth and declining mortgage rates, according to figures from lender Nationwide.

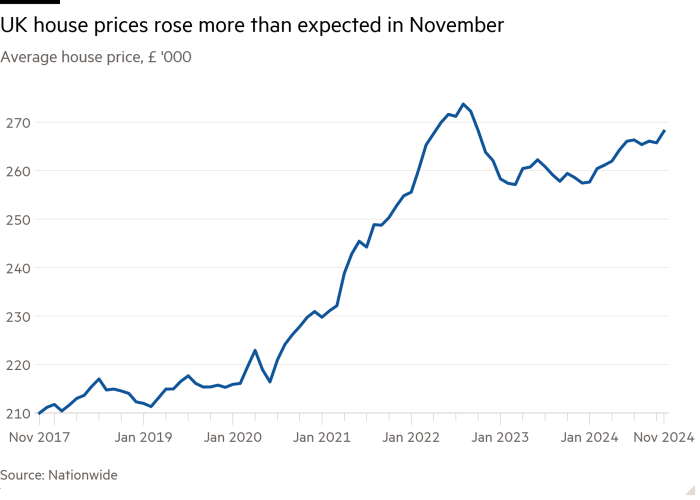

The price of a typical UK home rose 3.7 per cent year on year in November, up from the 2.4 per cent recorded the previous month and marking the fastest rate of annual growth since November 2022, Nationwide said.

House prices were up 1.2 per cent month on month, taking the average cost to £268,144 — just 1 per cent below the all-time peak in 2022.

Economists polled by Reuters had expected a 0.2 per cent rise month on month and a 2.4 per cent annual increase.

Robert Gardner, Nationwide’s chief economist, said: “Solid labour market conditions, with low levels of unemployment and strong income gains, even after taking account of inflation, have helped underpin a steady rise in activity and house prices since the start of the year.

“Household balance sheets are also in good shape with debt levels at their lowest levels relative to household income since the mid-2000s,” he added.

Separate data published last week by the Bank of England showed that mortgage approvals in October rose to the highest level since August 2022.

The property market has been helped by a decline in mortgage rates from their peak in the summer of 2023 as receding inflation has allowed the BoE to cut interest rates twice this year to the current 4.75 per cent.

The figures come after UK chancellor Rachel Reeves confirmed at her October 30 Budget that a temporary stamp duty holiday would end in March. As a result, first-time buyers, for example, will from April 2025 start paying stamp duty for properties worth £300,000 and over instead of £425,000.

Gardner said that the pick-up in prices was unlikely to be related to the stamp duty changes as the majority of mortgage applications commenced before the Budget announcement.

However, he added that gauging the underlying strength of the market “will be more difficult” in the coming months as the upcoming stamp duty changes would provide an incentive for buyers to bring forward house purchases to avoid paying additional tax.

Estate agents are already reporting unusually strong activity.

Matt Thompson, head of sales at the estate agency Chestertons, said: “November’s property market saw an increasing number of first-time buyers who were and still are motivated to purchase a property before the stamp duty changes in April 2025.”

Similarly, Guy Gittins, chief executive of Foxtons, said: “The market traditionally pauses for breath during the festive period, however, we’re seeing a flurry of activity driven by buyers looking to secure stamp duty relief before next April’s deadline.”

Gardner said he expected the recovery of the property market to continue “providing the economy continues to recover steadily, as we expect”.