Sports need to offer “super access” to fans by putting them closer to star athletes and offering more experiences that can appeal to the next generation, according to the president of the group that owns Ultimate Fighting Championship and World Wrestling Entertainment.

TKO Group president Mark Shapiro has told the Financial Times that watching a game in the “old fashioned way just isn’t enough” for fans in a world where they want to get closer to the field of play than ever before.

“They want special treatment, they want to be up close and personal,” he says. “They want to take pictures with their athletes. They want to know everything about the athletes. They want super access . . . As long as you can deliver and provide that kind of access for special privilege, exclusive access, you’re going to win.”

Sports are still grappling with how to engage a new generation of audiences. Younger viewers prefer highlights, short clips or even memes to the traditional formats on linear television. A YouGov report recently found that less than a third of global sports fans aged 18-24 watch live matches, compared with 75 per cent of those 55 and over.

“Half of our fan base is in the demo of 18-34 so, if you’re looking for a young audience, a passionate audience, a fever pitch audience who loves sports, competition and entertainment, you’re going to find it all one-stop-shopping right here at TKO,” Shapiro says.

As president of TKO Group, Shapiro oversees a $23bn company by market capitalisation, centred on the mixed martial arts series UFC and the scripted wrestling promotion WWE. UFC is synonymous with the antics of Dana White, the burly chief executive who is an ally of Donald Trump. The president-elect is also a member of the WWE hall of fame, following a long-standing association with the company.

Together, UFC and WWE generated more than $2.1bn of revenue in the first nine months of this year, with around 64 per cent coming from media rights and content. TKO expects to generate $2.57bn to $2.65bn in the full year.

“When you control and own the league like we do with the WWE [and] UFC, we’re the owner, commissioner, and the coach all in one,” Shapiro points out. “We’re only limited by our creativity.”

WWE’s live events business generated $245mn to UFC’s $155mn during the same nine month period. The wrestling promoter also made more revenue from selling replica belts and other consumer products than UFC, at $85mn versus roughly $40mn. But UFC’s $184mn sponsorship revenue was more than three times the amount WWE attracted in that category.

Earlier this year, to create a wider offer to sports marketers, TKO combined the WWE-UFC global partnerships teams into one unit. According to TKO finance chief Andrew Schleimer: “While it’s early innings, we’re seeing some real strong tailwinds in global partnerships by virtue of the joint effort.”

In another major shift, Netflix is set to screen WWE’s flagship weekly show, Raw, in the US from January. And, outside of the US, the global streamer will become home to all of WWE’s programming.

WWE is part of Netflix’s expansion into live events and sport. So far, this has included Mike Tyson’s fight against American YouTuber Jake Paul — an event that the streamer said had an average minute audience of 108mn live viewers. And, later this month, Netflix will carry a Christmas Day screening of two National Football League games. NFL star Tom Brady has already appeared in a so-called “roast”, a live Netflix show in which the legendary quarterback became the butt of the joke in a comedy special hosted by actor Kevin Hart.

“They know people aren’t used to going to Netflix for live events, and they open that door with the Tom Brady Roast,” Shapiro explains. “And now they’re sprinting through it. NFL, Raw, more made for TV specials. I think they’re finding that sports is going to be an antidote for subscriber acquisition as much as retention.”

Separately, UFC is set for crucial talks over its next US media rights deal. Disney’s ESPN, its existing partner, has an exclusive window from January to April next year. The current agreement runs to the end of 2025. Shapiro has said that UFC sees a “long-term future” with ESPN and Disney, but has pointed to interest from rival broadcasters and platforms in mixed martial arts rights.

It is now 19 months since the deal to unite UFC and WWE was announced, which led to the creation of TKO, but he reckons there is still “a lot more upside in cost and revenue synergies”.

TKO Group was billed as a “pure-play” live sports and entertainment company when it brought UFC and WWE under the same corporate structure. But, in October, TKO said it was buying sports agency IMG, hospitality business On Location, and the Professional Bull Riders league from its largest shareholder, the Silver Lake-backed Endeavor, in an all-stock transaction.

The $3.25bn all-share deal was not initially welcomed by the market. In the words of analysts at investment bank Citi: “We suspect the Street may not like this transaction because it has the potential to muddy TKO’s relatively clean story (as a pure play sports company).”

Shapiro defends the deal, however. “PBR is much smaller, a fraction of what WWE and UFC are, but nonetheless it falls right into the wheelhouse,” he argues. “Having the leader [IMG] in sports rights negotiations around the globe underneath our hood is a strategic advantage,” he adds.

Hospitality is a natural fit, also, Shapiro suggests. “Our fan base doesn’t want to just buy a ticket, come to the game, sit down, have a hot dog and cheer on their team. They want personalised, customised experiences. On Location does this better than anybody”.

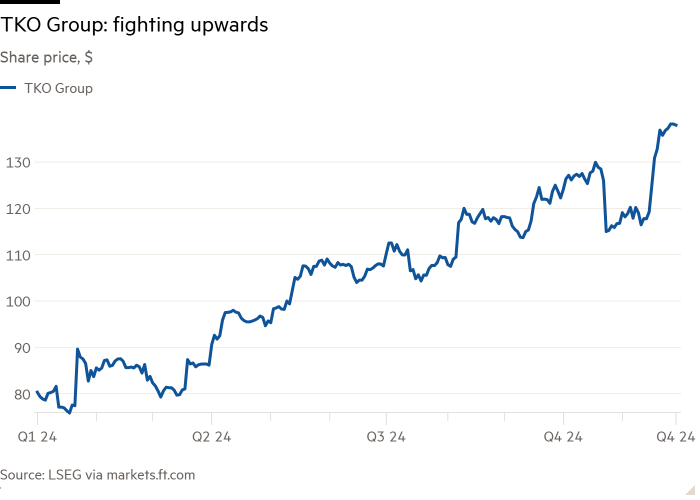

TKO’s share price fell on the day the acquisition was announced but has since rebounded

“We’re going to have to be very transparent,” Shapiro says. “The Street wants to be educated on these assets. And when we segment out the business, we’ll give them the transparency they need to model this appropriately and keep the story clean and simple.”

For now, Shapiro is focused on integrating recent acquisitions and organic growth, although he does not rule out further deals if the right assets became available. “We’re not looking to acquire any other properties right now,” he says. “We’ve got our hands full with the integration.”