Join our daily and weekly newsletters for the latest updates and exclusive content on industry-leading AI coverage. Learn More

The 2025 GDC survey revealed the impact of industry-wide layoffs in 2024 where one of every 11 game developers lost a job. It also showed game developer opinions about AI, funding challenges and unionization.

The survey is conducted each year by the Game Developers Conference, which takes place from March 17 to March 21 in San Francisco. Along with Matthew Ball’s recent analysis of the state of gaming and last year’s report, I believe this helps give a solid picture of gaming’s reality today.

The 13th annual State of the Game Industry Survey reflects key trends and changes within the games industry based on responses from more than 3,000 game developers who took part in the survey, said Beth Elderkin content marketing manager for GDC, in an interview with GamesBeat.

“One in (eleven) developers reported new layoffs in the past year. Last year it was 7%. Overall, 41 percent of developers reported the impact of these layoffs on their companies. 29 percent said their direct colleagues were let go. 18 percent said developers on other teams were let go. And 4 percent noted that their studios or companies were shut down, which is something we have seen happen in the headlines over the past year,” said Elderkin.

The analysis of the State of the Games Industry Survey results revealed that developers continue to feel both direct and indirect impacts from ongoing industry-wide layoffs, they also believe that generative

artificial intelligence (AI) is having a negative impact on game development.

The survey results also marked that developers are increasingly focusing development on the PC platform, and survey respondents have begun to lose interest in developing live-service titles, the responses indicate that self-funding has been the primary way for developers to back their games, and many more insights directly from the developer community.

The full survey, which includes more insight into the game development community’s thoughts on these topics and a multitude of other facts and details, can be downloaded for free here. Key insights from the survey can be found below.

Layoffs continue to tear through the industry

According to this year’s survey, which was conducted in October, about 11% of developers reported being laid off in the past year. Roles in the narrative field saw the most impact, with 19% of respondents.

Business and Finance saw the least reported layoffs, impacting only 6% of respondents. And 41% have reported feeling the impact of these layoffs, with 29% observing their direct colleagues being let go and 18% witnessing developers on other teams being let go. 4% reported being laid off due to their studios being closed down.

“When we asked developers what their concerns about future layoffs were, the numbers did not change much. 58% said they had some level of concern for job security, which is pretty similar to last year,” said Elderkin. “We also, one thing we did this year was we asked developers to share what companies told them were the reasons for the layoffs. When it came to company explanations, the most popular response was 22% who said restructuring. 18% was declining revenue, 15% was market or industry shifts. And 19% of developers said they were not given a reason by their company.”

Also of note, the number of developers who were not concerned about layoffs decreased by 5% this year, with 30% reporting no concerns, compared to 35% a year ago.

Unions?

These are the top three themes the survey found in regards to a question about how developers felt the industry could be improved: unionization/improved working conditions; better mentoring/internships/training; and more sustainability/stability in industry.

Union support stayed consistent with 58% of respondents saying game industry workers should unionize,10% saying they shouldn’t, and 31% saying maybe or they don’t know. That’s about the same as what people said in 2024.

One-fifth (22%) of developers said they’ve talked about unionizing at their companies in the past 12 months. Of those who have talked about unionization, 29% said their companies have been supportive, 19% mixed, and 12% opposing.

When asked to share their thoughts on the game industry’s ongoing unionization efforts, most responses were in support—arguing that unions could help improve working conditions, reduce crunch, and advocate for marginalized developers. Some also suggested profit-sharing, residuals, and employee-owned studios. Those who were opposed said unions could harm indie studios, stifle creativity, and force companiesto either close or move their jobs overseas.

On an anecdotal basis, the GDC also captured the commentary of those who were laid off.

“We wanted to give developers, if they were comfortable, an opportunity to share what their experience has been. They lost their job. The majority of developers implemented generative AI in some capacity One third said they personally use it. That is up from 31% last year,” Elderkin said.

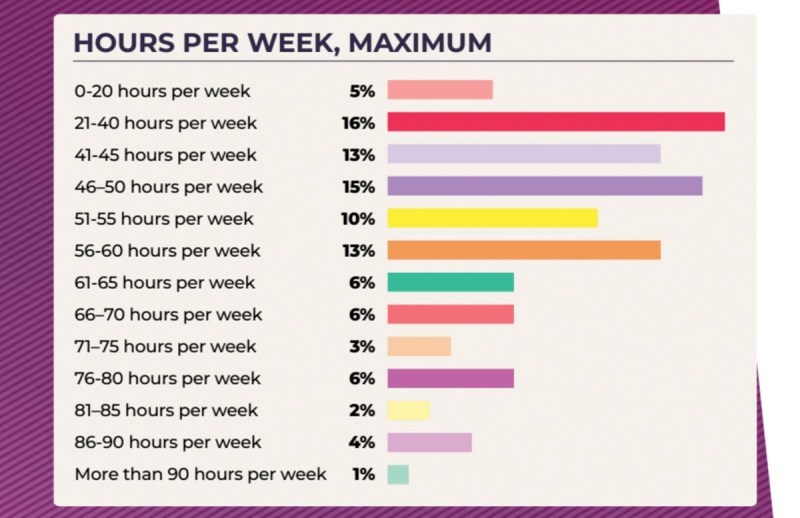

As for hours worked, the survey showed the number of hours worked went up this year after some years of decline. Perhaps fear of layoffs was the reason.

Developers are ever hesitant about generative AI

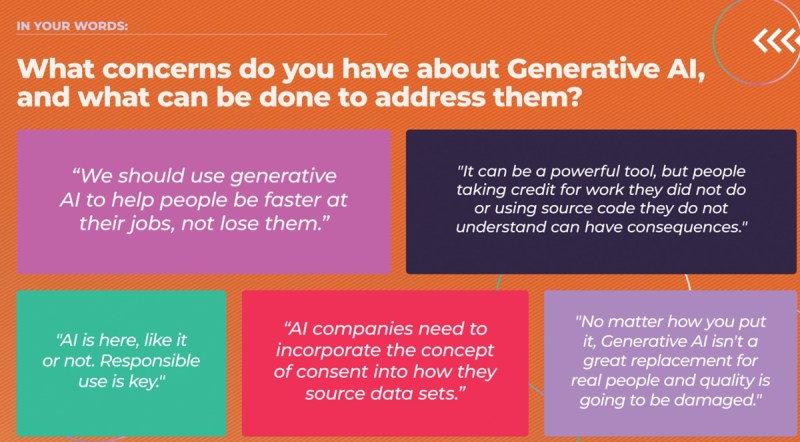

30% of respondents reported that they believe that generative AI is having a negative impact on the games industry, which is a 12% increase from last year. Developers pointed to intellectual property theft, energy consumption, a decrease in quality from AI-generated content, potential biases within AI programs and regulation issues as the main factors behind their discontent with the technology.

The majority of developers surveyed (52%) work for companies that have implemented generative AI

and one-third (36%) personally use them. Respondents within Business and Finance Roles in companies

were most likely to use Artificial intelligence tools (51%), followed by Production and Team Leadership

(41%) and Community, Marketing and PR (39%).

When the usage of AI was corroborated with the survey respondent’s age, it turns out that older developers are more likely to use generative AI than younger ones. 47% percent of developers over the age of 55 listed that they do use these tools whereas only 28% of developers between 18-34 incorporate them into their work.

She noted one of the biggest changes from 2024 and 2025 was when devs answered the question about what impact they think AI is having on the game industry.

“In 2024, it was 21% positive and 18% negative. As you can see, those numbers have flipped quite dramatically. For 2025, it’s 13% positive and 30% negative,” Elderkin said.

PC Continues To Be The Platform Of Choice

Last year, 66% of developers reported that they were working on games for PC and this year that number has climbed up to 80%. While the reason for this is unclear, it could be at least partially attributed to the rising popularity for Valve’s Steam Deck.

While the Steam Deck wasn’t specifically listed as an option for developers to list as a platform they’re developing games for, of the respondents who chose the ‘Other’ option, 44% of them listed the Steam Deck as a platform they’re interested in.

Interestingly, web browser games are also climbing in popularity, as 16% of developers noted that they’re working on releases for web browsers (compared to 10% last year and 11% the year before). This marks the most interest game studios have in browser games across the past decade.

For those who did, there was a marked increase in web browser game development. The survey found 16% of developers said they’re working on releases for game browsers. It has hovered around 10% to 11% over the past decade.

“In fact, this is actually the most interest we’ve seen in browser games across the past 10 years. We also saw an increase in mobile game development for the first time in several years,” Elderkin said.

Mobile game development has also increased 5% over last year – with 29% of respondents developing games for Android and 28% developing for iOS.

There were also interesting results related to DEI (diversity, equity and inclusion) at game companies, as you can see in the above chart.

Console preferences

In terms of console development, Sony’s PlayStation family continues to lead over Xbox, with 38% developing content for the PlayStation 5 and 34% working on games for the Xbox Series X|S. On the flipside, 13% of developers are creating games with the aim to release them on Xbox Game Pass whereas 9% are doing the same for PlayStation Plus.

Asked about their favorite platforms for game development, game developers almost invariably say they like making games for the PC. That holds steady at around two-thirds of game devs. But this year, 80% of devs said they are working on PC games.

“Now the reason for this exact reason is unclear, but based on the information we have, we believe it could be at least partially attributed to the rising popularity of Valve,” Elderkin said. “We will note that in the survey this year, we did not include Steam or Steam Deck as a platform option — the main reason being that those are both embedded in the hub for PC and Mac games. However, we did also give developers an opportunity to write in their own responses.”

As for Nintendo, 20% of developers said they are currently making games for Nintendo Switch, and 8% for Nintendo Switch 2.

VR development?

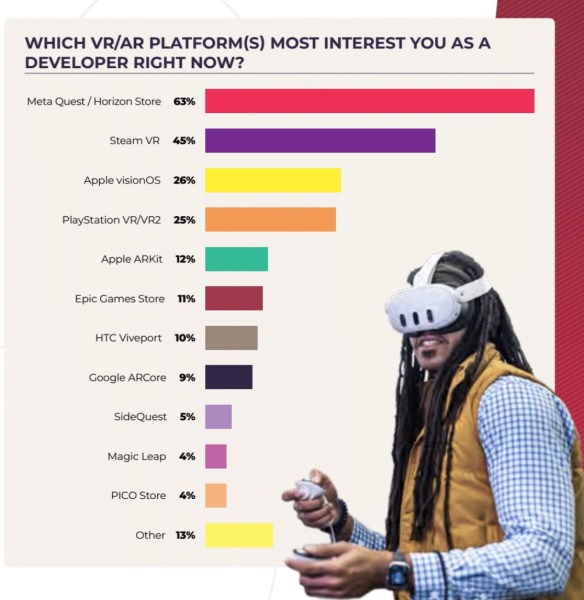

About 35% of all game developers work in VR/AR development. The number of developers working in virtual and augmented reality has stayed consistent, as have the platforms of choice. According to the survey, the Meta Quest / Horizon Store remains the dominant space for VR/AR developers, with 59% currently making games for the platform.

This is followed by Steam VR (31%) and PlayStation VR/VR2 (16%).Although only 8% of VR/AR developers are currently making games for Apple vision OS, the platform looks to be growing its foothold. Almost one-fifth (18%) of respondents say their next games will be on the platform, and one-fourth are interested in Apple’s VR headset. The GDC can’t accurately compare these numbers to previous years, as this was the first time these questions were asked exclusively of VR/AR developers.

Game engine choices?

Unity and Unreal remained in the top list among game engines.

In September 2024, Unity announced it would be reversing its controversialRuntime Fee policy, which threatened to charge developers an extrafee based on revenue or installs. First reported by Game Developer, this announcement came on the heels of a yearlong backlash against the proposed fee, one that drove some developers away from Unity.

This year, the GDC once again asked developers to identify the engines they’re using to make their games, to see if there have been any notable changes following the backlash. Like last year’s survey, Unity and Unreal Engine remain the most used game engines for developers, tied at 32% each.

This is largely unchanged from 2024, when it was 33% each. At this time, it appears that few developers have moved on from Unity.

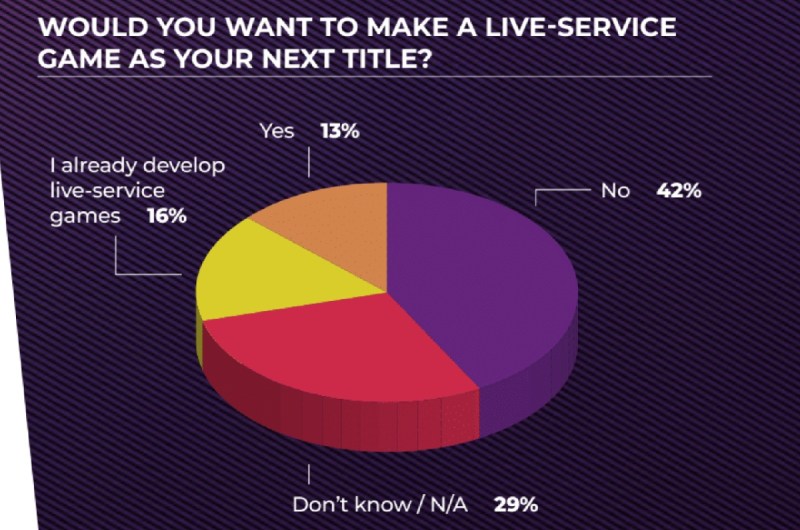

A third of triple-A devs are doing live service games

One in every three triple-A developers surveyed (33%) noted that they are working on a live-service title. Across the entire survey base, 16% are currently working on a live-service game, and while 13% noted they are interested in developing live service games, 41% expressed that they were not interested at all.

Developer opinions of the value of live service games largely vary. On the positive side, developers

recognized the financial and community-building benefits of the strategy whereas those who expressed

concern with declining player interest, creative stagnation, predatory practices, microtransactions and

the risk of burnout, Elderkin said.

One of the biggest concerns surrounding live-service gaming was market oversaturation, with many developers noting how hard it is to build a sustainable player base. The survey was done after the failure of Sony’s Concord live service game last year.

Most games are financed through self-funding

More than half (56%) of survey respondents reported that they have put their own money into funding

the creation of their game. That’s nearly double the next most option of project-based or publishing

deals, which 28% noted was where their funding had come from.

“We found that more than half of developers said they put their own money into developing their games. This was the most popular response by far,” Elderkin said. “We break it down. If you look at indie developers or those who work for indie studios, 82% of those developers said they put their own money into their games. And 40% at double-A studios have done so, and 29% at triple-A studios. When we looked at overall satisfaction and success of the financial methods, self-funding actually seemed to be a pretty good option. 89% of respondents said it was at least somewhat successful.”

Co-development contracts have observed the highest rate of satisfaction, with one-third (37%) calling

the method “very successful.” Accelerators were seen as the least viable option, with 43% calling the

option “not successful at all.” This was followed by venture capital at 32% and crowdfunding at 31%.

Based on just the data, financially, things seem to be going okay in the gaming industry. However, the developers themselves tell a different story. When asked about the challenges in providing or securing funding nowadays, the response from developers was overwhelmingly negative, frustrated or exhausted. The most cited issues were time, market instability, lack of industry experience or connections, discrimination, creative conflicts and too much competition, Elderkin said.

Climate change impacts a notable number of developers

In 2024, the impacts of climate change continued to be felt across the gaming industry, with 16% of developers saying they or their company have been impacted by natural disasters. 76% said they haven’t been impacted whereas 8% opted for the didn’t know option.

When asked to specify what natural disasters they or their company faced, 73% of respondents referenced floods, hurricanes, storms and other water-related events. Other disasters referenced include extreme heat, wildfires, and earthquakes. This survey was done before the recent Los Angeles wildfires, which have affected a lot of game industry people.

Methodology

The Game Developers Conference surveyed over 3,000 game developers as part of the 13th annual State of the Game Industry survey and report, which provides a snapshot of the game industry and highlights industry trends through collaboration with Game Developer editors and Omdia researchers. The margin of error is 2%. While the GDC collected responses by country this time, it noted there were not significant differences among the results based on country location.

READ SOURCE