Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

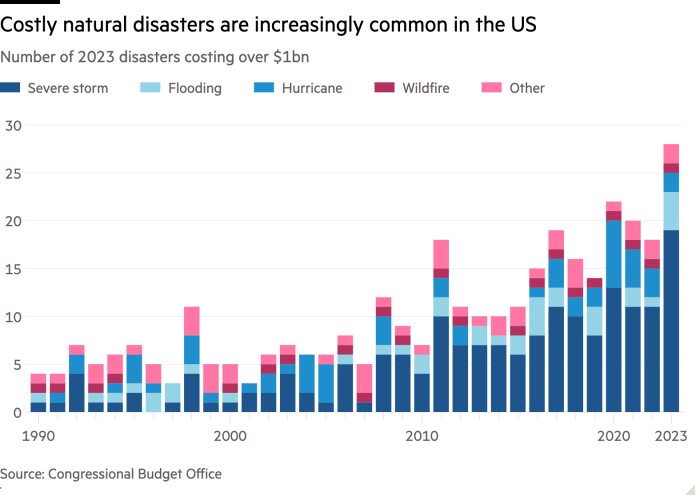

The Los Angeles fires were exceptional in their scale, ferocity and cost. But billion-dollar-plus disasters are increasingly commonplace in the US. They occur once every three weeks on average, compared with every four months for equivalent events in the 1980s. As insuring high-risk homes becomes increasingly hard and costly, cracks in the US housing market will widen.

The plight of many California homeowners is particularly grim. A series of costly wildfires drove insurers’ average loss ratio — payouts compared to premiums — in the south-west region of the US up to 82 per cent, more than two-fifths higher than the national average in the five years to 2022. As long-standing regulations kept the lid on premiums, insurers reined back. That left many homeowners reliant on the FAIR Plan, a non-profit insurer of last resort. A tenth of homes are estimated to have no cover at all.

Regulators responded to the shortage by relaxing the cap. Insurer Allstate, for example, got a green light to raise rates for California customers by an average of 34.1 per cent last year. After the latest fires, premiums could rise even faster, putting downward pressure on house prices. Consider, as a simplified example, a $1mn property generating a 5 per cent rental yield which currently pays a $3,000 insurance premium. Doubling the insurance costs would reduce the rental income to $47,000 and the capital value to $940,000.

This problem is not confined to California, or wildfires. Residential properties in the US are overvalued by $121bn to $237bn for flood risks alone, according to a 2023 paper in the journal Nature. First Street Foundation, a New York-based non-profit research group looking at climate risk, calculates that nearly 7mn US properties have already been hit by higher fire, flood and wind insurance costs. It argues that nearly six times as many face similar insurance-related corrections in the future.

Calculations of this sort fuel financial stability concerns. Worryingly there is evidence that financially stretched households are more likely to have overpaid for their homes relative to their level of climate risk, according to the US Treasury’s Office of Financial Research. US consultancy DeltaTerra Capital expects escalating ownership costs to cause a Great Recession-like correction in asset values affecting about a fifth of homes. Its founder Dave Burt was one of the “Big Short” investors who called the 2008 mortgage crisis.

The modelling behind such predictions is open to debate, as is the speed at which climate risks will be capitalised into house prices. But the Los Angeles fires provide a terrible illustration of the physical toll inflicted by extreme weather. Growing appreciation of the risks will cause wider damage to homeowners’ equity as well.