- USDT minting activities on TRON have risen significantly over the past week, nearing an all-time high

- TRX’s movement seemed to be unaffected as whale and retail investor activity dropped

At press time, TRX seemed to be flashing bullish signs for a potential recovery. In fact, it gained by 1.49% over the last 24 hours, discontinuing its previous week’s losses of 9.18%.

The aforementioned market gains were likely influenced by USDT minting and the surge in addresses hitting a new high. However, further analysis by AMBCrypto revealed that the price of TRX might not hold strong for long. Especially since whales and retailers aren’t actively buying.

USDT minting on TRON surges — What’s next?

The minting activity of USDT on the TRON network has surged significantly over the past week, with $1 billion added to the total supply. At the time of writing, figures for the same stood at $61.7 billion, with the same indicated by the purple cloud on the chart.

That’s not all though as the current supply seems to be approaching its previous high – A sign of strong demand for USDT or stablecoins in the market, whether from retail participants or whales.

Such activity implies a positive development for TRON, which could affect TRX’s price movement. Hence, AMBCrypto analyzed whether TRX whales and retail investors are part of the market cohort seeking additional USDT and what to expect from its price going forward.

Whale and retail investor activity declines

There’s been a surge in the number of TRX addresses in the market, crossing a new all-time high of 124.34 million addresses in the last 24 hours. Such an address surge typically alludes to growing network adoption. However, the price has remained in a corrective mode.

Further insights revealed that the price not following the upward trajectory of address growth stems from reduced participation by retail and whale investors.

According to IntoTheBlock’s data, retail addresses holding between $10,000 and $100,000 saw an 8.7% decline in transaction activity. Whales, specifically those holding between $100,000 and $1 million and $1 million to $10 million, declined by 49.54% and 45.44%, respectively, over the last 24 hours.

A decline among these cohorts, which typically play a major role in price movement, is a sign of reduced interest and weak conviction to buy the asset.

TRX on the chart — A loop

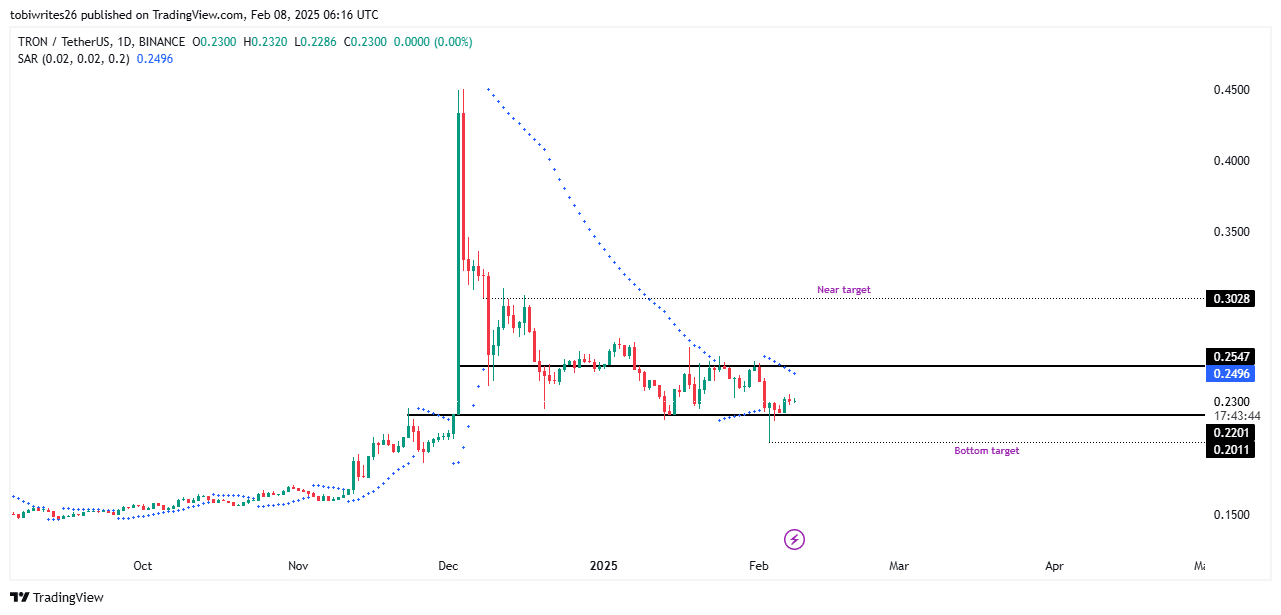

TRX, at press time, was consolidating within a defined range on the chart between $0.2201 and $0.2547. This move might precede a potential major price shift, with an upper target of $0.30 and a lower target of $0.20.

A closer look into this range revealed that TRX has just reacted off a support level and trended higher. However, momentum might be weak as the candle formations appeared somewhat fragile.

Additionally, the Parabolic SAR hinted at a possible decline as the dotted markers were positioned above the price candles.

If the bearish trend fully materializes, there may be two points of interest. The first would the support level at $0.2201, which could trigger a rebound. However, failure to hold this level may result in a drop to $0.20.