- Unlike other altcoins, Binance’s BNB did not see capitulation with Binance allegedly accused of market manipulation.

- Wintermute’s SOL balance charts fitting perfectly into Binance’s meant the MM was used to dump prices for most altcoins.

The crypto community has spiked discussions, citing allegations of market manipulation linking the Binance [BNB] exchange and Wintermute.

Their Solana [SOL] balances show synchronized activity, suggesting the Market Maker (MM) was an alleged accomplice in dumping prices.

Binance’s SOL balance peaked at 1.7 million, then dropped to 0.5 million. Meanwhile, Wintermute’s balance spiked to 1.2 million and then fell to 0.6 million.

This suggests that one million SOL moved to crash prices from $300 to $150.

The same was true for most altcoins, leading to over $110 billion being eliminated in the altcoin market, as analyst Marty Party noted on X (formerly Twitter).

If Binance’s alleged manipulation persists, SOL could drop to $140, sparking panic selling across the broader crypto market.

Liquidation and chain’s trading volume

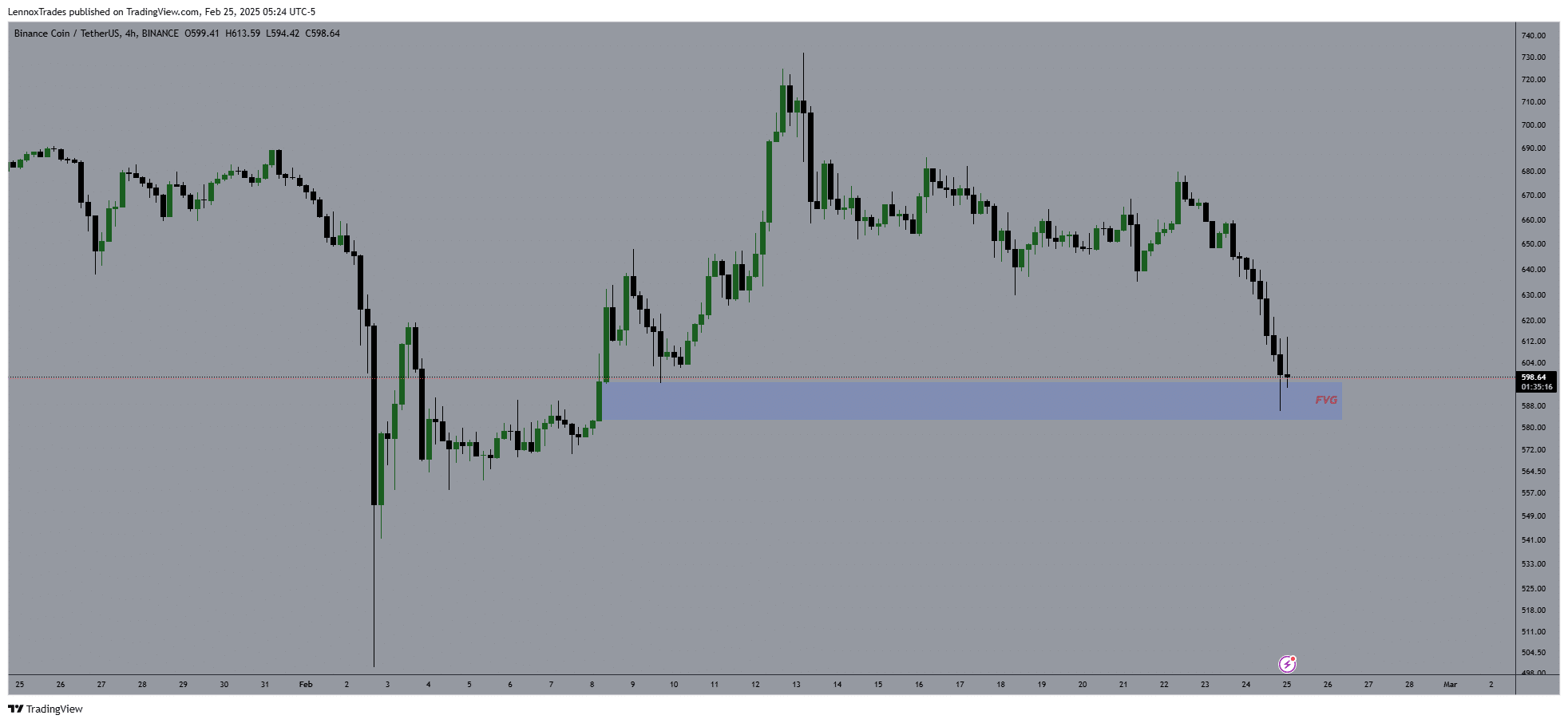

Following this activity, BNB did not see capitulation as seen in other altcoins. The heatmap revealed key liquidation levels between $640 and $660 before the price sharply dropped to around $620.

This sharp drop to $620 was key for BNB, as it likely triggered many stop-loss orders, suggesting a possible support level.

A sustained move above these levels could signal a stronger recovery phase, potentially challenging higher resistances towards $680.

Conversely, failing to reclaim the $640 level could see BNB test lower supports, possibly around the $600 mark.

Source: Coinglass

For on-chain trading volume, PancakeSwap, a BNB-based decentralized exchange, surged to dominate with a daily trading volume of $2.1 billion.

This value surpassed Uniswap’s [UNI] $607.2 million, Raydium’s [RAY] $439.1 million, Hyperliquid’s [HYPE] $312.5 million, and PumpDotFun’s $98.7 million. These totaled $1.4575 billion.

PancakeSwap’s market share was driven by low fees and BNB Chain’s efficiency. This milestone reflected growing DeFi adoption on the BNB Chain. PancakeSwap’s volume hit a 21.87% market share.

If this trend continues, PancakeSwap could solidify its position, but volatility remains a risk as competitors adapt.

How will BNB’s price react?

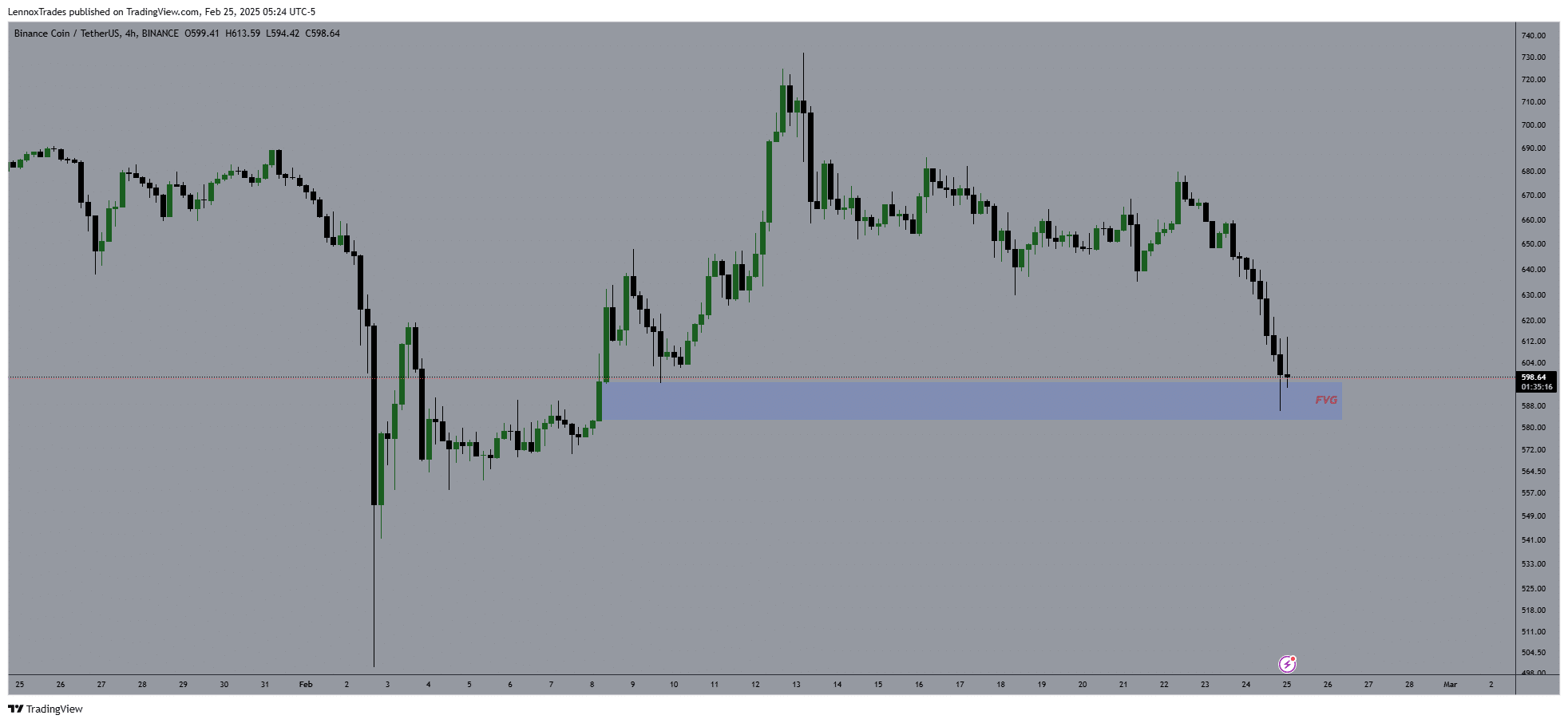

Linking these developments with the price action of Binance Coin chart showed a sharp decline, reaching a key support zone at $594.64, marked as a Fair Value Gap (FVG).

If BNB rebounds from this level, it could potentially test resistance levels near $612 and then $640.

Source: Trading View

Conversely, if it fails to hold this support, the price could slide further to find lower support around $580 or $560, testing previous lows. A drop below the true closes could see BNB test levels below $500.

The rapid descent into the FVG likely suggests a reaction. Investors should remain cautious due to the strong bearish momentum, especially as Binance currently faces backlash from the community.