Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

UK rental prices rose at the slowest annual rate in more than three years in January as tenant demand eased, according to data that signals a softening in the prolonged squeeze on renters’ finances.

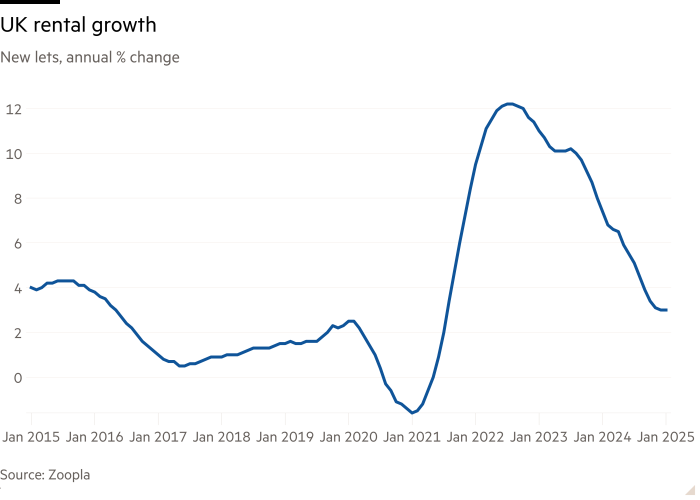

Monthly rent for new tenancies increased by an annual rate of 3 per cent in January, taking the average cost to £1,284, according to data published by Zoopla on Tuesday.

The reading from the property portal was down from 7.4 per cent the year before and the lowest rate since July 2021. It was also well below the peak of 12.2 per cent registered in the summer of 2022.

Richard Donnell, executive director at Zoopla, said the slowdown would “be welcome news for renters after three years where rents have risen rapidly”.

“Affordability remains the primary constraint on rental inflation rather than increased supply and greater choice of homes for rent,” he added.

Zoopla said UK rental demand dropped by 17 per cent in the four weeks to February 23 compared with the same period in 2024, with weaker figures across all regions and nations.

Higher rental costs were probably “suppressing demand for new lets, encouraging renters to stay put for longer”, the portal noted, adding that an increase in first-time buyer demand had contributed to weaker rental demand.

House prices and property sales involving a mortgage have recovered as mortgage rates have fallen from their mid-2023 peaks on the back of interest rate cuts by the Bank of England.

Rents have surged in recent years as landlords passed on higher borrowing costs to tenants, and more households turned to tenancies because they could not afford higher mortgage costs.

Easing rental pressures appear in most measures of new tenancies, including those kept by tenant referencing company Homelet and property listings group Rightmove.

They have also become visible in the official measure of rental prices, which tracks both new and existing tenancies.

Data published by the Office for National Statistics last month showed that UK rents rose by 8.7 per cent in the 12 months to January 2025, down from their peak of 9.2 per cent in March 2024.

In London rents rose by 11 per cent in the year to January, reaching an average of £2,227, according to official figures.

Zoopla said that despite weakening demand, supply remained a problem, with 12 renters chasing each property available for rent.

While the figure was almost half the level of competition for rented homes recorded between 2022 and 2024, when rental demand was at its strongest, it was still double pre-pandemic levels.

The portal also warned that the government’s Renters’ Rights bill risked further limiting the number of properties available for rent in England.

The legislation — which is going through parliament and will end Section 21 “no fault” evictions, as well as tightening standards for the conditions and maintenance of rented homes — had “the potential to reduce the supply of rental homes, as landlords reconsider their position in the market”, said Allison Thompson, national lettings managing director at the property services group Leaders Romans.

When the bill was introduced to parliament last year, deputy prime minister Angela Rayner said: “There can be no more dither and delay. We must overhaul renting and rebalance the relationship between tenant and landlord.”