- TON has declined by 19.97% over the past month.

- Toncoin’s on-chain activity dipped, with revenue and market cap hitting a yearly low.

Over the past two months, Toncoin [TON] has experienced significant struggles on its price charts and in fundamentals. In fact, TON is currently experiencing considerable challenges fundamentally.

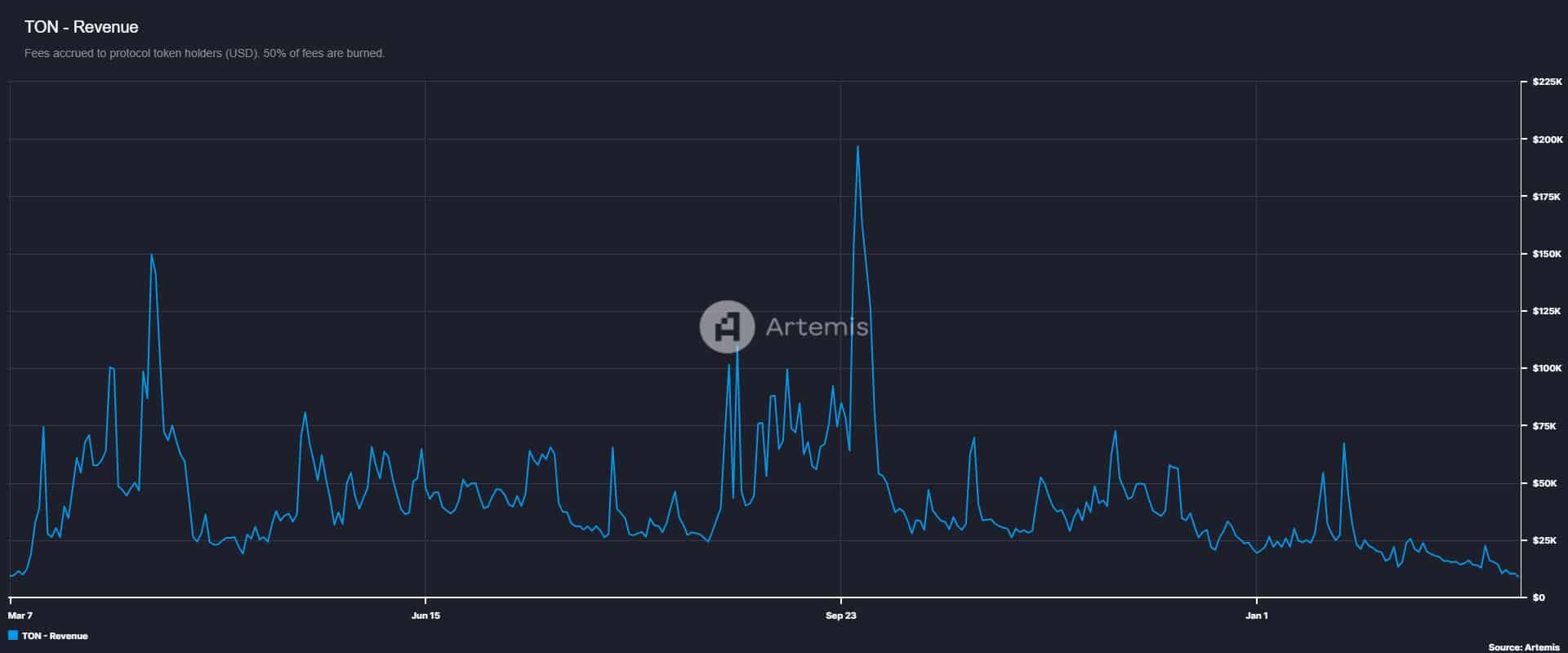

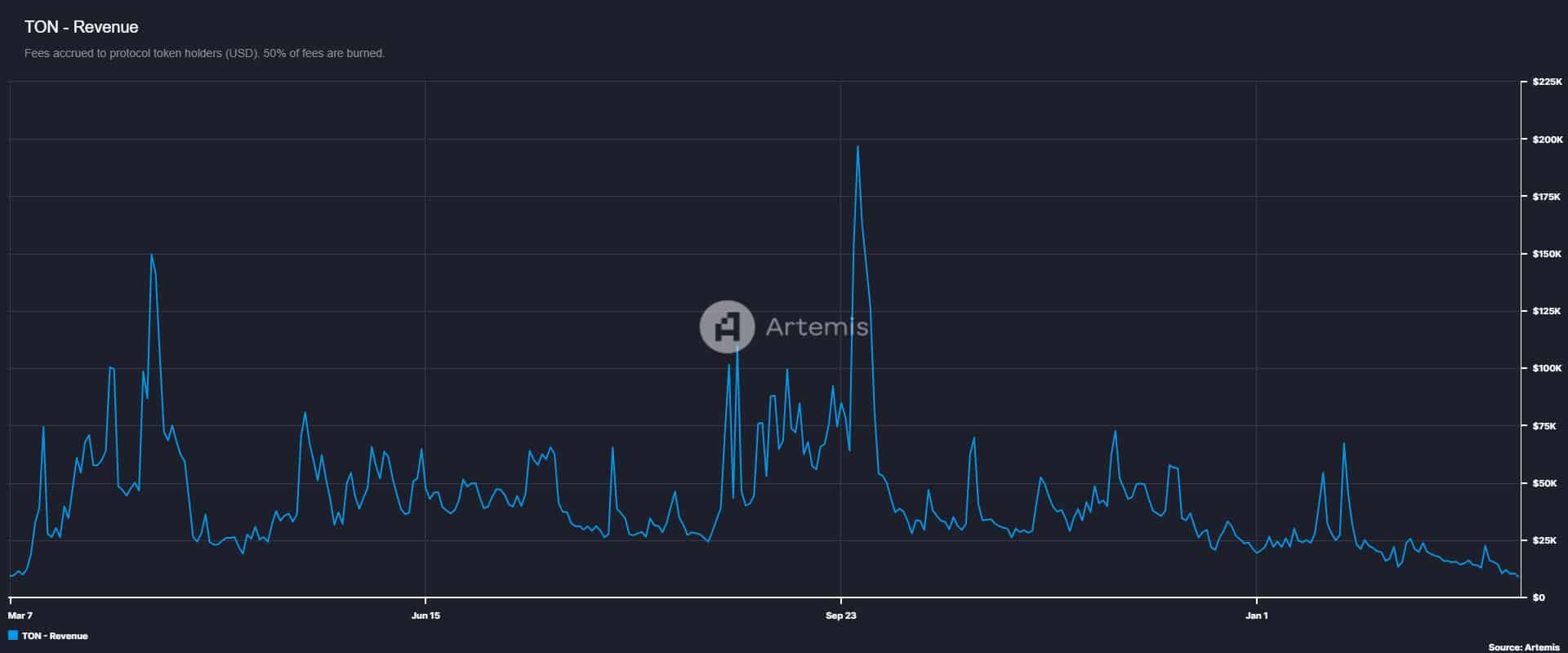

Inasmuch, AMBCrypto’s analysis shows that Toncoin’s on-chain activities have seen a sustained decline over the past year.

Source: Artemis

For starters, Toncoin’s revenue has fallen to a yearly low of $9.1k, indicating a significant decline in the blockchain’s economic activity. This downturn suggests reduced transactions, DeFi activity, and trading, pointing to a sharp drop in demand.

The decline in economic activity is further highlighted by a recent decrease in market capitalization.

Toncoin’s market cap has hit a yearly low of $7.5 billion. The simultaneous drop in revenue and market cap reflects lower network usage and reduced demand for block space.

The reduction in demand for block space results in higher inflation, since it implies less deflationary pressure. Historically, higher inflation precedes lower prices.

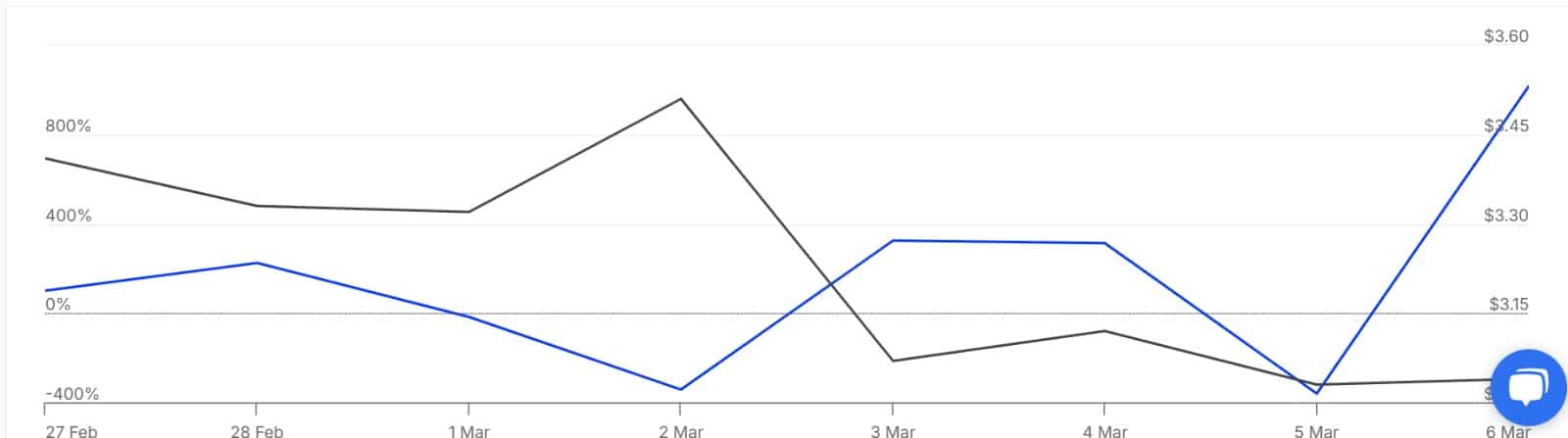

Equally, we can see this reduced on-chain activity as Adjusted Price DAA Divergence has turned negative.

With the price DAA at a negative zone, it confirms low network engagement, implying that Ton’s price could decline further to meet the actual network demand.

What next for Toncoin

Undoubtedly, the declining demand and network usage reflect strong bearish sentiments, with investors selling as prices decline.

AMBCrypto observed rising selling pressure as Toncoin RSI has dropped to hit oversold territory, at press time. With the RSI at this level, it suggests that sellers are dominating the market with no buyers available in the market.

This seller’s dominance is further evidenced by CMF which has declined to hit a negative value.

This selling pressure is particularly evident among whales. Toncoin’s Large Holders Netflow to Exchange Netflow Ratio has jumped significantly from -359.99 to 1016%.

This sharp increase indicates that many large holders are transferring TON to exchanges for selling, intensifying the selling pressure. Such activity from whales reflects low market confidence, reinforcing bearish sentiment.

Currently, Toncoin faces strong bearish trends, leading to reduced network usage and on-chain activity. Lower demand, combined with strong selling pressure, could result in further losses for TON’s price.

If bearish sentiment persists, TON might drop to $2.83. However, with the RSI in oversold territory, a buying opportunity emerges for investors looking to buy the dip.

If accumulation starts and buyers return, a trend reversal could push Toncoin to reclaim $3.5.