Dollar hits three-year low as Trump’s attacks on Powell worry investors

Good morning, and welcome to our rolling coverage of business, the financial markets, and the world economy.

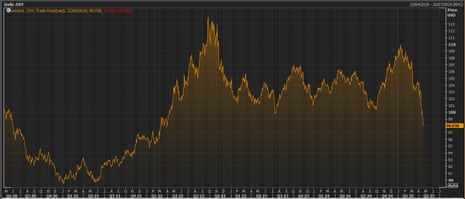

The US dollar has sunk to a three-year low as the exodus from US assets gathers pace.

Traders are anxious after Donald Trump launched another blistering attack on America’s top central banker yesterday, calling Jerome Powell “Mr. Too Late” and “a major loser”, as the US president intensified his calls for US interest rate cuts.

This has pushed the dollar down against a basket of currencies to its lowest level since March 2022.

Against the yen, the dollar has hit a seven month low, trading at ¥140 for the first time since last September.

Last week, Trump posted that “Powell’s termination cannot come fast enough”.

Tony Sycamore, market analyst at IG, says Trump’s attacks on Powell are leading to a lack of confidence in the markets:

Their relationship has long been contentious. Despite appointing Powell in 2017, Trump has since expressed regret, criticising Powell for “bad decisions” and being “always too late and wrong.”

Powell has countered by warning that Trump’s tariffs could spur higher inflation and slower growth, contradicting Trump’s claims of his policies’ economic benefits.

Yesterday (when European markets were closed), there were further losses on Wall Street, where the Dow Jones Industrial Average lost another 2.5%, or almost 1,000 points.

Investors are also disappointed at the lack of progress in trade talks, following the hefty tariffs announced by Trump earlier this month.

This is creating a worrying situation, in which the dollar, the US stock markets and US government bond prices are all falling. Typically in a crisis, US government debt and the dollar would rally as traders sought out a safe haven.

“The market reaction is arguably more about broader investor concerns that less credible US policy-making may erode the exorbitant privilege that has allowed the US to run high twin deficits than it is about the specific risk of political influence over the Fed’s rates policy,” explains Jim Reid, market strategist at Deutsche Bank.

The International Monetary Fund (IMF) will give its verdict on the economic consequences of the US trade war later today, when it releases the latest forecasts in its World Economic Outlook.

Central bank governors, finance ministers, and other economic leaders are heading to Washington for the annual IMF-World Bank Spring Meetings.

The agenda

-

9am BST: ECB Survey of Professional Forecasters

-

2pm BST: International Monetary Fund releases its latest World Economic Outlook.

-

3pm BST: European Union Consumer Confidence report

-

3.15pm: IMF releases its Global Financial Stability Report

Key events

Chart: Winners and losers since ‘Liberation Day’.

Deutsche Bank have helpfully created a chart showing how major assets have performed since Donald Trump’s “Liberation Day” tariff announcement.

The top performer is gold, followed by German government debt.

In last place, it’s big US technology stocks, followed by oil, for whom April 2 was more like Demolition Day.

Deutsche Bank’s market strategist Jim Reid explains:

Given that US assets went into Liberation Day as the most expensive in the world, and given that our previous work highlighted that US capitalism has benefited most from free trade globalisation, it’s not a surprise to see US assets generally at the bottom of the pile since the announcement. US equity valuations were on a par with the all-time peak in 2000 in Q1, mainly driven by tech. Since Liberation Day, the Mag-7 are down -12.6% and bottom of this pile. They are now -24.6% YTD and are still historically expensive.

Gold leads the way, with Bunds attracting flight to quality bond flows, mostly in relative terms to an underperforming US Treasury market. Indeed, the week after Liberation Day saw the biggest weekly widening in the 10yr UST-bund spread (+50bps) in data back to German reunification in 1990.

The DAX and Stoxx 600 are both down just over -5% in local currency terms, but are now slightly higher in USD terms which shows the global portfolio reallocation that is continuing. An impressive out-performance.

US conglomerate 3M has predicted that new US tariffs will hurt its earnings this year.

In its latest financial results, 3M suggest that ariffs could impact its full-year 2025 earnings by up to 40 cents a share.

3M predicted it would post adjusted 2025 earnings of $7.60 to $7.90 a share, with “additional tariff sensitivity” of 20 cents to 40 cents a share.

Argentex shares suspended after dollar slump causes margin calls

Currency risk management firm Argentex has suspended the trading of its shares, blaming the plunge in the value of the US dollar following Donald Trump’s tariff announcements and US government spending cuts.

The fall in the dollar has caused a flurry of margin calls on Argentex’s foreign exchange contracts, hurting its near term liquidity position.

In a statement to the City, Argentex says it has been exposed to “significant volatility in foreign exchange rates” this month, which had a “rapid and significant impact on its near term liquidity position”.

The turmoil triggered by Donald Trump’s tariffs has triggered a sharp drop in investor confidence among clients at investment platform Hargreaves Lansdown.

Hargreaves Lansdown reports that investors’ confidence plummeted across the board in April, with a 35% drop in confidence in North American markets and a 28% drop in the UK.

Confidence in UK economic growth also dropped significantly (down by 43%) among HL clients.

Victoria Hasler, head of fund research at Hargreaves Lansdown, says:

“In what has been an incredibly volatile time for both markets and politics, investor confidence has tumbled.

The first week of April saw President Trump introduce tariffs across virtually all its trading partners and pretty much all goods. The extent and level of tariffs imposed sent shockwaves through markets and our survey shows that investors lost confidence in droves.

While Trump later announced a 90-day rollback on the tariffs, this came too late to be reflected in our data and, regardless, has done little to calm investors.

BoE’s Greene says US tariffs likely to be disinflationary for the UK

Bank of England policymaker Megan Greene has predicted that Donald Trump’s tariffs “represent more of a disinflationary risk than an inflationary risk” to the UK.

Speaking on Bloomberg TV, Greene explained that Britain is likely to become a destination for cheaper goods from Asia and the European Union, as it is not levying its own reciprocal tariffs in response to the US trade war.

She says:

“I think that the tariffs actually represent more of a disinflationary risk than an inflationary risk, though. And so we’ll have to see how that develops going forward.

Greene, seen as one of the more hawkish members of the Bank’s monetary policy committee, also explained that she has been on the more cautious side of the BOE’s rate-setting panel due to concerns over supply-side restraints, high wage growth and persistent inflation in the services sector.

Megan Greene, one of the BOE’s most hawkish policymakers, says Trump’s tariffs “represent more of a disinflationary risk than an inflationary risk” in UK due to diversion of cheap Asian exports, a weaker dollar and the softening of demand https://t.co/RuReJKDTGF

— Bloomberg (@business) April 22, 2025

Pound on longest winning streak against the dollar since 1971

Our counterparts at Bloomberg have spotted that the pound is on track for its longest winning streak against the US dollar in over 50 years.

Sterling has risen against the dollar for the last 10 days, gaining around six cents since early April.

If it posts an 11th gain today, it’ll be the longest run of daily rises since 1971, Bloomberg say here.

Experts ponder Trump and Powell’s options

City analysts are pondering whether Donald Trump is likely to give Jerome Powell the boot, and even if he could do so.

As things stand, it appears that Trump cannot legally fire the Fed chair. Last week, Powell affirmed that the Federal Reserve’s independence “is a matter of law”, and that Fed governors cannot be removed “except for cause.”

However, a case going through the supreme court may alter the power the president has over federal agencies, as explained here:

Paul Ashworth, Chief North America Economist at Capital Economics, argues that firing Powell would “just be the beginning of the Fed’s end”, telling clients:

If Trump is set on lowering interest rates then he will have to fire the other six Fed Board Members too, which would trigger a more severe market backlash, with the dollar falling and rates at the long end of the yield curve rising.

Bill Blain, principal of Wind Shift Capital Advisors, reckons there is “certainly a non-zero risk” that Trump fires Powell.

Blain writes:

As we approach 100 days of Trump some market thinkers reckon Trump has learnt critical lessons and will dial down his flippity-flop destabilisation of the US economy. I disagree. I predict the pace of instability and uncertainty will increase – not diminish.

We are moving on from Stage 1; Trump’s initial blitz of headline-grabbing orders and executive over-reach into Stage 2: the blame-game – who will be shot because it isn’t working?

On the other hand, the White House could conclude they should keep Powell at the Fed, to have someone to blame if the US economy turns sour.

Neil Wilson, Saxo UK investor strategist, explains:

It actually makes sense to keep Powell around to use as a scapegoat, plus it’s going to be very tough to shift him…the fact it’s being talked about in the open is enough to unsettle markets.

But what should the Fed chair do?

Professor Costas Milas, of the University of Liverpool’s management school, suggests some options Powell could pursue:

1) He should invite Trump to the Fed for an informative discussion (off cameras, of course) about the functioning of monetary policy. It is then up to Trump to stay quiet or (most likely) keep attacking Powell.

2) Powell and the Fed should also provide a detailed research note assessing the inflationary and recessionary risks of tariff hikes based on alternative scenarios. Doing so will strengthen the Fed’s credibility for choosing (so far) not to cut rates. Up to now they haven’t done this which allows Trump to keep attacking.

Danish consumer sentiment has dropped to a two year low, as new US tariffs fueled pessimism for the export-driven Nordic economy.

The recent selloff on US government debt (Treasuries) means the gap between US and safe-haven German borrowing costs has widened.

Good Morning from #Germany, which is increasingly seen as a new safe haven. The yield gap between 10y US Treasuries and German Bunds has widened to 1.95ppts — the highest since Feb — as investors pull capital out of the US and shift it into Europe. pic.twitter.com/Zs9LAt7Og4

— Holger Zschaepitz (@Schuldensuehner) April 22, 2025

Reuters: German firms fear impact of Trump tariffs

More than 80% of German companies in manufacturing and the information technology industry expect a negative impact on the German economy from tariffs imposed by the U.S., according to a survey by the Leibniz Centre for European Economic Research ZEW.

Reuters reports that the survey showed that 20% of the 800 companies surveyed now even fear “very negative” effects on the economy from the policies of the new U.S. government.

In industry, 46% of the companies expect negative effects on their business, with as many as 64% fearing negative consequences for the entire sector, the ZEW survey showed.

Half of the companies in industry with U.S. exports fear that Donald Trump’s presidency will have a negative impact on them. At 42%, companies without exports to the United States also expect negative effects, according to the ZEW survey.

The futures market is indicating that Wall Street will open higher, after yesterday’s sharp falls following Donald Trump’s attack on Jerome Powell.

U.S. S&P 500 E-MINI FUTURES UP 0.85%, NASDAQ 100 FUTURES UP 0.84%, DOW FUTURES UP 0.72%

— First Squawk (@FirstSquawk) April 22, 2025

Analyst fears ” historic crash in US equities” if Trump keeps undermining the Fed

Donald Trump’s attacks on Jerome Powell could lead to a Wall Street crash, fears Jochen Stanzl, chief market analyst at CMC Markets.

Stanzl told clients that the “Trump trade” has devolved into what some are calling the “Sell-America trade.”

When stocks, the U.S. dollar, and Treasury bonds decline simultaneously, it signals a fundamental issue within the market. In this context, the DAX remains relatively stable partly because there is no challenge in Germany to the independence of the European Central Bank. The DAX being an outperformer during these tumultuous times sends a positive signal, as investors maintain their diversification in European equities to perform relatively better compared to U.S. stocks.

However, if Trump continues to undermine the independence of the U.S. Federal Reserve, a historic crash in U.S. equities could loom on the horizon. Stock prices are already below their levels when he won the election and are nearing his own past buy recommendations. The ongoing tariff disputes have caused significant damage to the market’s integrity. Internationally, the U.S. government’s approach is being perceived as coercive. Trump’s public attempts to undermine Jerome Powell not only add further risks but also cross a critical threshold for investors. When the fallout from these actions became too severe, the U.S. administration backed off its hardline stance on tariffs, praising Trump for “correcting his mistakes.” This raises questions about what the Republican’s ultimate intentions really are.

The independence of the Federal Reserve from political influence in the White House is crucial. Should it be compromised, the trust in the U.S. dollar—along with its status as the world’s reserve currency—could collapse. Investors are left in the dark: Is there a deliberate plan to devalue the dollar, or is Trump merely playing the provocateur once again? In times of uncertainty, investors naturally tend to express their concerns by hitting the sell button.”

Analyst: Dollar suffering from confidence bleed

The dollar “confidence crisis” is going “prime time”, fears Stephen Innes, managing partner at SPI Asset Management, as traders pile into the yen, euro and Swiss franc instead.

Innens writes:

The dollar is slipping on more than just thin liquidity and soft data — it’s slipping on faith. Markets are starting to question one of the bedrock assumptions behind the dollar’s reserve currency status: an independent, inflation-fighting Fed.

With President Trump ramping up public pressure on Powell to slash rates “now,” we’re not just flirting with jawboning—we’re staring down the barrel of a credibility unwind.

Let’s be clear: US dollar weakness isn’t just about economic cracks forming. This is a broader confidence bleed. Trump’s rhetoric signals that even the White House is front-running a slowdown. And that means the usual fallback narrative—“we’re strong, the Fed has our back”—is starting to fray.

UBS are advising investors to prepare for “a volatile path ahead”, which could mean considering gold, quality bonds, and hedge funds.

With fears over the independence of the US Federal Reserve rising, Mark Haefele, chief investment officer UBS Global Wealth Management, explains:

“Removing the Fed Chair before the end of his term in May 2026 could call into question the ability of the central bank to set interest rates without political interference, and hence the outlook for price stability.

Markets are therefore likely to be sensitive to any indication that the White House will press ahead with efforts to remove Powell, or to replace him with a more ‘malleable’ candidate after his term expires.”