- ARB jumped 12% after listing on Robinhood, with minimal sell pressure from exchanges.

- A bullish divergence on the daily chart suggested the recovery could be extended.

Arbitrum [ARB] crypto pumped 12% after Robinhood listed it on its platform, offering new liquidity and trading avenues for the L2 token. The token jumped from $0.378 to $0.435, a nearly 15% surge, before easing to 12% as of this writing.

Despite the double-digit bounce, ARB was still down 65% from its December highs of $1.2. This begs the question – Can the Robinhood listing drive sustainable recovery?

Arbitrum crypto accumulation

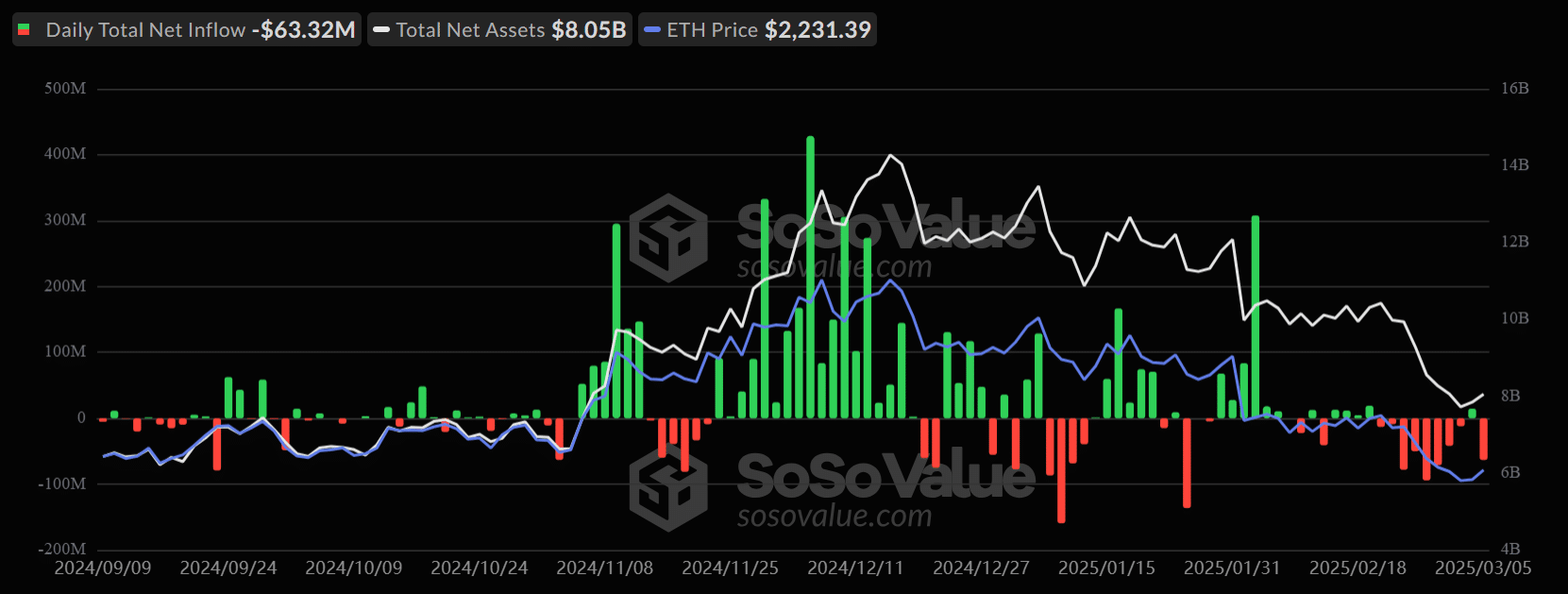

Per Coinglass data, nearly $7 million worth of ARB was withdrawn from exchanges (red bars) this week. About $20 million ARB has been moved out of exchanges in the past three weeks, a bullish sign despite the recent pump.

In most cases, a sharp rise in netflows (exchange selling pressure, green bars) always coincides with local tops. Simply put, the negative netflow meant reduced sell pressure, which could further fuel ARB’s recovery outlook.

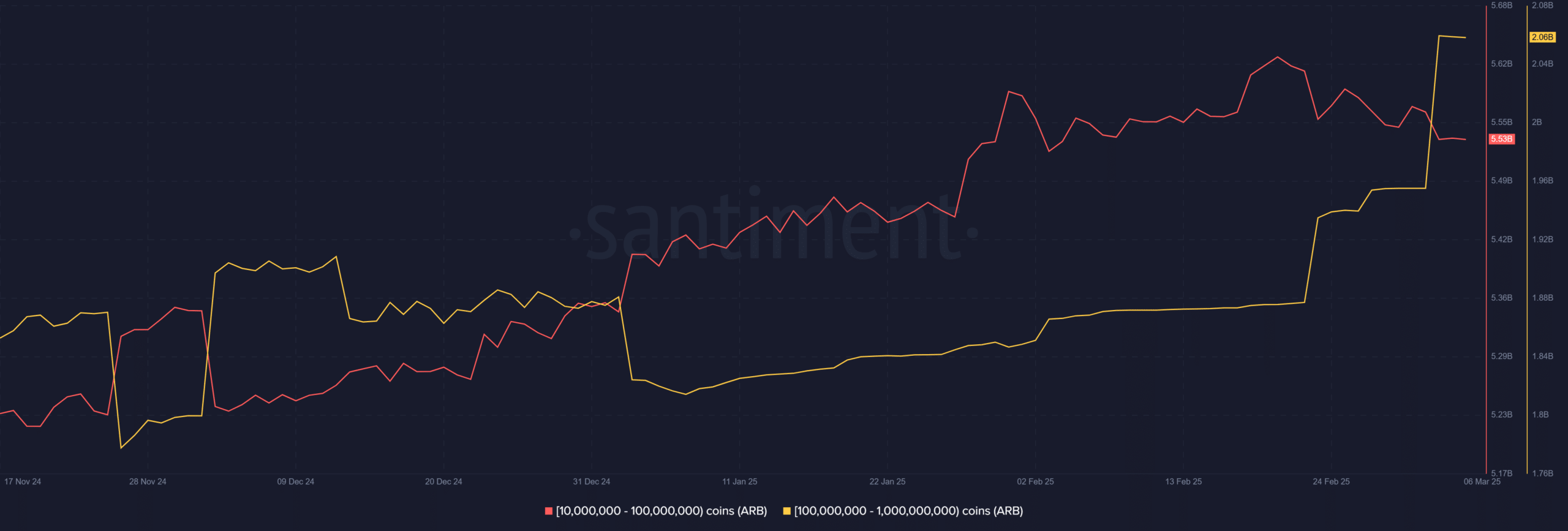

In fact, one of the largest ARB whale cohorts (100 million – 1 billion tokens, yellow), increased holdings from 1.96 billion ARB to 2.06 billion coins. That’s a whopping 40 million ARB accumulated in the past few days.

The strong accumulation could improve ARB’s recovery odds despite increased dumping from the 10 million – 100 million ARB whale holder.

However, the short-term outlook could be dented if the broader market sentiment sours.

ARB’s bullish divergence

On the daily chart, ARB formed a bullish divergence, with the RSI rising while the price made lower lows. This pattern suggests a potential price reversal to the upside, indicating ARB’s upward momentum could continue.

However, traders should remain cautious about the resistance below $0.5, a key support in late 2024 that was recently breached.

If ARB achieves a decisive move above this sell zone, it could strengthen the asset’s recovery trajectory.