Hunt economic advisor: Bank of England must create recession to curb inflation.

The Bank of England must “create a recession” to curb inflation, according to Karen Ward, chief market strategist EMEA at JP Morgan Asset Management.

Ward, who is also a member of chancellor Jeremy Hunt’s economic advisory council, told Radio 4’s Today programme there are “certainly signs” that a price-wage spiral is emerging, which the central bank “has to nip in the bud”.

Speaking after inflation remained stubbornly high at 8.7% in May, Ward explained:

“The difficulty for the Bank of England – I mean, no-one envies them their job at the moment – is they have to therefore create a recession.

“They have to create uncertainty and frailty, because it’s only when companies feel nervous about the future that they will think ‘Well, maybe I won’t put through that price rise’, or workers, when they’re a little bit less confident about their job, think ‘Oh, I won’t push my boss for that higher pay’.

“It’s that weakness in activity which eventually gets rid of inflation.”

One of the Chancellor’s economic advisers, has called for the Bank of England to ‘create a recession’ to curb inflation.

Speaking to @MishalHusain, Karen Ward, who works for JP Morgan, said: ‘It’s that weakness which eventually gets rid of inflation.’#R4Today pic.twitter.com/CxGqzdPbBv

— BBC Radio 4 Today (@BBCr4today) June 21, 2023

Ward is also a member of The Times’s shadow monetary policy committee, a group of experts who are today calling for the actual MPC to raise interest rates by half a point tomorrow, to 5%.

Ward argued that the Bank of England’s “earlier hesitancy” has put it in an uncomfortable spot.

With her shadow MPC hat on, Ward told The Times:

It hoped for too long that inflation would go away on its own accord and underestimated the second-round effects now evident in accelerating wage growth.

It did not adhere to the “stitch in time saves nine” principle and now will have to raise rates by more and cause a deeper downturn to bring inflation back to target.

Key events

Core inflation in the UK could remain higher than in the US or euro area until late next year, Capital Economics fears.

Ruth Gregory, their deputy chief UK economist, explains:

Inflation in the UK has stayed higher than elsewhere as the UK has endured the worst of both worlds – a big energy shock (like the euro-zone) and labour shortages (even worse than the US).

Admittedly, the upward influence of the energy supply shock is fading.

But the tighter labour market will probably mean that UK core inflation stays higher than in the US and the euro-zone until late-2024.

America’s central bank chief has warned that interest rates in the US will head higher.

Earlier this month, the Federal Reserve paused (or possibly skipped) an interest rate, by voting to leave its benchmark rate on hold.

But today, Jerome Powell told Congress that most policymakers on the Federal Reserve’s FOMC committee expect to push rates higher at future meetings.

In prepared remarks for the House Financial Services Committee, Powell says:

“Nearly all FOMC participants expect that it will be appropriate to raise interest rates somewhat further by the end of the year.

Powell also says the Fed is “squarely focused” on its dual mandate to promote maximum employment and stable prices, adding”:

My colleagues and I understand the hardship that high inflation is causing, and we remain strongly committed to bringing inflation back down to our 2 percent goal.

Price stability is the responsibility of the Federal Reserve, and without it, the economy does not work for anyone. In particular, without price stability, we will not achieve a sustained period of strong labor market conditions that benefit all.

The pound has lost ground today, reflecting concerns that higher interest rates will trigger a recession.

Sterling has lost half a cent against the US dollar, dropping below $1.27 for the first time since last Thursday.

That suggests that the possibility of higher borrowing costs, and possibly a bumper half-point hike on Thursday, is worrying traders.

As Kit Juckes, chief global FX strategist at Société Générale, explains:

The risk of a 50bp rate hike tomorrow has increased, the risk of a deeper slowdown has increased even more.

Today’s upward inflation surprise increases the pressure on the Bank of England and raises the risk of a return to an oversized hike at tomorrow’s meeting, say the Markets 360 team at BNP Paribas.

But, their base case is for a quarter-point increase, accompanied by “more decisive language” in the minutes of this month’s meeting, or other post-meeting communications.

They predict interest rates will peak at 5.5%, a whole percentage point above today’s levels:

The bottom line, regardless of the size of tomorrow’s move, is that the MPC has a lot more work to do to bring underlying inflation under control – we stick to our terminal rate call of 5.50%.

Downing Street has insisted Rishi Sunak is still sticking with his pledge to halve inflation by the end of the year, despite inflation remaining stickily high.

The Prime Minister’s official spokesman told reporters:

“That remains the target.”

Asked if they are on track to fulfil the promise, the spokesman said the government was (despite inflation coming in above target for the last few months):

“Yes. Despite some of the coverage at the time (of the announcement of the pledge) this was never something that was straightforward.

“It was rightly an ambitious target that we remain committed to and it can only be achieved with fiscal discipline.”

Here are more details from the IFS’s new report into the financial hit from rising mortgage payments, which warns that 1.4m mortgage holders will lose 20% of their disposable income to rising borrowing costs.

Those in their 30s will see the biggest increases to their monthly mortgage payments, paying almost £360 more on average – a 11% hit to their disposable incomes.

1.4 million mortgage holders, half of which are under 40, will see their disposable incomes fall by over 20%.

[4/8] pic.twitter.com/ES7I0vkn8M

— Institute for Fiscal Studies (@TheIFS) June 21, 2023

Londoners will face the largest hits from rising mortgage payments, with their monthly payments rising on average by £520, around 12% of disposable income.

The South East, East and South West of England will see hits to their disposable income of above 9% on average.

[5/8] pic.twitter.com/Y1re4tbFX3

— Institute for Fiscal Studies (@TheIFS) June 21, 2023

8.5 million people, around 60% of mortgage holders, will end up paying more than a fifth of their family income on mortgage payments if interest rates remain at 6%.

This is substantially higher than in 2008 when rates were at their previous high.

[6/8] pic.twitter.com/lPBA047wzT

— Institute for Fiscal Studies (@TheIFS) June 21, 2023

IFS: Interest rate hikes could cost 1.4m people a fifth of their disposable income

Richard Partington

Newsflash: Millions of households across Britain are expected to lose at least 20% of their disposable incomes thanks to the surge in mortgage costs expected before the next election, the UK’s leading economics thinktank has warned.

Sounding the alarm as mortgage costs reach the highest levels since the 2008 financial crisis, the Institute for Fiscal Studies said that almost 1.4m mortgage holders would see at least a fifth of their disposable income erased.

It warned the heaviest blow was reserved for those under the age of 40 with larger mortgages, with the biggest financial hit for households in London and the south east of England where property prices are typically higher than the national average.

The biggest rise is for those in their 30s, for whom payments will jump by £360 per month, or 11% of disposable income.

On average, mortgage holders will see their mortgage payments rise by £280 per month – equivalent to 8.3% of their disposable income (i.e. income after mortgage payments).

NEW: Interest rate hikes could see 1.4 million people lose 20% of their disposable income to rising mortgage payments, with mortgage holders in their 30s and in London hit hardest.

THREAD on our briefing on what rising interest rates mean for households with mortgages [1/8]: pic.twitter.com/4bXyfzt20l

— Institute for Fiscal Studies (@TheIFS) June 21, 2023

Tom Wernham, a Research Economist at IFS, explains that many borrowers face a serious shock when they remortgage.

“Many families bought homes – often with sizable mortgages – when interest rates were very low. As people’s fixed term offers come to an end they are going to be exposed to much higher interest rates.

For many, the increase in monthly repayments is going to come as a serious shock – on average it will be equivalent to seeing their disposable income fall by around 8.3%. And for 1.4 million mortgage holders – half of whom are under 40 – mortgage payments are set to rise by an eyewatering 20% of disposable income or more.

Given the cost of living pressures people are already facing due to high food and energy price inflation, these significant increases in mortgage costs could not come at a worse time.”

Back in parliament, Rishi Sunak has said it is vitally important that savers are treated fairly, following concerns that savings rates have not risen in line with borrowing costs.

Chancellor Jeremy Hunt will discuss this matter when he meets with UK banks on Friday, the PM added.

Martin Lewis of MoneySavingExpert.com says he was called to an “urgent private meeting” with Jeremy Hunt today to discuss mortgages.

Lewis says he explained that banks should offer “proper forbearance” to struggling mortgage-holders, and not ramp up their profit margins:

Just left 11 Downing Street, after being invited to an urgent private meeting with @Jeremy_Hunt to discuss mortgages. I can’t detail the discussion, but rest assured all the points I’ve been making about the need for banks not to ramp margins & proper forbearance were made. pic.twitter.com/XpmXO7TuqL

— Martin Lewis (@MartinSLewis) June 21, 2023

Duncan Robinson of The Economist questions which of the pair are actually in control….

Our economics correspondent, Richard Partington, spots some interesting detail in the UK inflation report:

The Beyonce effect comes to Britain?

Gig tickets and computer games were among the biggest drivers of inflation in May. The ONS says a number of expensive gig tickets at major UK venues were picked up in its monthly data

— Richard Partington (@RJPartington) June 21, 2023

This contributed to the shock jump in core inflation to 7.1% – the highest level since 1992.

Recreation and culture prices are notoriously volatile. BUT this data feeds into core.

So are surging gig prices and computer games going to push the BOE to hike?

— Richard Partington (@RJPartington) June 21, 2023

UK consumer price #inflation remains sticky at 8.7% overall. While essentials inflation has come down, it’s still around 13%, and core inflation is increasing. In May 2023, a growing proportion of inflation came from hospitality, recreation, and culture.#dataisbeautiful pic.twitter.com/chzxbtgyHy

— Tera Allas (@TeraPauliina) June 21, 2023

Over in parliament, Labour leader Sir Keir Starmer has asked prime minister Rishi Sunak if he agrees that Britain is facing “a mortgage catastrophe” (as Conservative MP Lucy Allan warned last weekend).

Sunak replies that “it is right” to help those with mortgages, which is why the right priority is to halve inflation.

Sunak says;

Inflation is what is driving interest rates up. Inflation is what erodes people’s savings and pushes up prices, and ultimately makes them poorer.

Sunak adds that he highlighted the importance of tackling inflation before he became PM, and adds that the IMF have backed the government’s approach.

An unimpressed Starmer replies that Britain is suffering from 13 years of economic failure and last autumn’s ‘kamikaze’ budget.

Q: How much will the Tory mortgage penalty cost the average homeowner?

Sunak claims Starmer isn’t aware of the ‘global macroeconomic situation’ (earning much heckling).

Sunak says the government has taken steps to protect borrowers, including lifting support for the UK’s mortgage interest scheme (details here), the new protections agreed with the FCA, and tens of billions of costs of living support.

Starmer gives him the answer – £2,900 per year, for those who need to remortgage from 2024 (that’s according to Resolution Foundation).

Sunak shoots back that interest rates have risen in other countries, such as the US, Australia, Canada and New Zealand, and a two-decade high in the eurozone.

Our Politics Liveblog has all the action:

Hunt: Banks must live up to the commitments we agreed

Chancellor Jeremy Hunt says he wants to ensure UK banks are “living up” to commitments made to help struggling borrowers.

Hunt has held a meeting with consumer champion Martin Lewis today, a day after Lewis said the mortgage “ticking timebomb” he warned the UK government about last December has “exploded”.

Speaking after today’s meeting, Hunt says he knows many people are worried about their mortgage repayments.

He adds:

Today I spoke to @MartinSLewis ahead of my meeting with lenders on Friday.

I want to ensure banks are living up to the commitments we agreed in December, and what more they can do to help.

The FCA’s finalised guidance include options such as extending the term of a mortgage, or letting borrowers make reduced monthly payments for a temporary period.

Large increases in UK interest rates used to be rare. When the Bank of England lifted base rate by 50 basis points (half a percent) last August, it was the biggest rise in 27 years (since 1995).

That was followed by half-point hikes in September, December and February, with a monster 75-basis point rise thown in at the November meeting, before the Bank returned to smaller quarter-point hikes in March and May (up to 4.5%).

The sustained strength in UK inflation in May “cements the case” for the Bank of England to deliver further tightening at its meeting tomorrow, says Gurpreet Gill, macro strategist for Global Fixed Income at Goldman Sachs Asset Management.

Gill, who predicts rates will peak at 5.25%, says a half-point rise tomorrow can’t be ruled out:

“While our base case is for a 0.25% rate hike at this week’s meeting, the data opens the door to an increased pace of a 0.5% rate rise.

“Core and services inflation, alongside food prices, continue to diverge from moderating trends observed in other advanced economies like the US, complicating the path towards the Bank’s target.

“We see upside risks to our terminal rate forecast of 5.25%. However, downside growth risks may exert disinflationary pressure later this year.”

Here’s Sky News’s Paul Kelso on the financial market reaction to the UK May inflation report:

Zero cheer in inflation figures or the consequences. Core inflation up so BofE nailed on for 0.25-0.5pp rate rise tomorrow. Markets forecast peak of 6% with two-year fixed mortgage already at 6.15% & 2Y gilt yields (set cost of Govt borrowing & measure market confidence) 5%+🥃

— Paul Kelso (@pkelso) June 21, 2023

UK exporters have been hit by falling exports this month, but price pressures appear to be easing too.

The Confederation of British Industry (CBI)‘s monthly healthcheck of UK factories has found that order books recoveedred last month. However, the export order balance fell again to -29 from -26, the weakest since February 2021.

Total order books were reported as below “normal” in June, to a broadly similar extent as in May. Export order books were also seen as below normal, deteriorating further from last month. #ITS pic.twitter.com/kWmSajP1L3

— CBI Economics (@CBI_Economics) June 21, 2023

And on inflation….UK manufacturers expect to raise prices by the smallest amount since February 2021 over the next three months.

The CBI’s monthly index of manufacturers’ average selling price expectations slowed to +19 in June from +21 in May, its lowest in more than two years but well above its long-run average of +7.

CBI deputy chief economist Anna Leach said:

“Total order books have improved a touch in recent months, but they remain fairly soft. And although output expectations have turned positive again, growth is expected to be quite weak in the three months to September.”

The latest CBI Industrial Trends Survey found that output volumes fell in the three months to June. Manufacturers expect output to return to growth in the three months to September. #ITS pic.twitter.com/w16HPKCTy6

— CBI Economics (@CBI_Economics) June 21, 2023

Rising interest rates, and rising prices, are both hurting the budgets of low-income families.

New research from the Joseph Rowntree Foundation this morning show that the numbers of low-income households going without essentials or in arrears has not improved for over a year.

Latest inflation out today still at 8.7%.

Chart below shows comulative inflation, earnings growth & benefit uprating since Apr 2021.

This is why people are hurting. pic.twitter.com/eL67iE9Svb

— Alfie Stirling (@alfie_stirling) June 21, 2023

JRF senior economist Rachelle Earwaker warns that 5.5 million low-income households have had to cut down on or skip meals because they can’t afford food. Four million reported going hungry, and 2.7 million have reported having a poor diet because of the cost of living crisis.

Earwaker adds:

Low-income households are struggling to afford their bills, with 4.5 million in arrears, and 2.6 million holding high cost credit loans with loan sharks, doorstep lenders, payday lenders or pawnshops.

The JRF are calling for the Government to implement an Essentials Guarantee, to ensure that the basic rate of Universal Credit will at least always covers life’s essentials.

📈 Today’s about more than #inflation – we’ve just published the latest edition of our #CostOfLiving tracker.

📢 “We are seeing these levels of hardship persist & it has become a horrendous new normal”

– Senior Economist @r_earwakerWhat this looks like & what can be done – 🧵:

— Joseph Rowntree Foundation (@jrf_uk) June 21, 2023

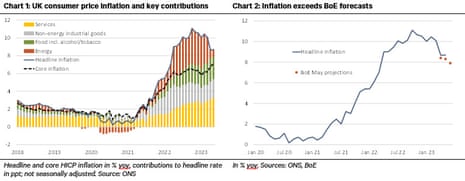

UK inflation surprised to the upside today, for the fourth month in a row, reports Berenberg Economics.

They have now lifted their forecasts for UK interest rates – predicting Bank Rate will have risen to 5.25% (was 5.0%) at the end of 2023 and 4.0% (was 3.5%) one year later.

Berenberg warns that UK inflation is changing its nature, and becoming more domestically driven, saying:

By and large, imported inflation caused by last year’s spike in energy and food prices is receding on trend as energy prices correct and the 2022 surge in these prices washes out of the yoy comparison. The yoy rate for goods prices eased to 9.7% from 10.0% despite higher prices for used cars.

However, the more domestically driven increase of services prices advanced from 6.9% to 7.4%. Many services are labour intensive and thus affected by strong wage gains. As reported last week, the rise in weekly average earnings (ex-bonus) accelerated to 7.5% in April from 7.1% in March.

Helped by resilient gains in employment (1.2% yoy in April), most households continue to open their wallets despite the gradually building headwind from higher mortgage rates.

Resolution Foundation’s chief executive, Torsten Bell, points out that there are winners from higher interest rates:

This is wrong but does make an important (currently totally ignored) point that there are winners for every loser from higher rates. They broadly are:

– foreigners

– older households

– really rich households (where volume of assets with higher returns outweighs mortgage hit) https://t.co/5QHBjK7cE2— Torsten Bell (@TorstenBell) June 21, 2023

Another big winner from this rate rise cycle? Employer sponsors of defined benefit pension schemes who overnight will no-longer have to contribute billions into those schemes to close their deficits – this effect is huge and basically never discussed https://t.co/BHam7jXy8f

— Torsten Bell (@TorstenBell) June 21, 2023

But he’s not impressed by claims that Liz Truss and Kwasi Kwarteng are somehow vindicated over last year’s mini-budget debacle:

Those people arguing that rates rising now shows Trussonomics/the associated rate rise wasn’t that bad have lost the plot. The idea stubborn inflation today (which is why rates are rising) supports case for what was a massive (£45bn) fiscal stimulus is galactic level stupidity

— Torsten Bell (@TorstenBell) June 21, 2023

Had big tax cuts/looser fiscal policy gone ahead we’d be looking at even bigger rate rises right now

— Torsten Bell (@TorstenBell) June 21, 2023

Sticky inflation is extending the cost-of-living crisis for everyone in Britain, and hardening the mortgage crunch for the seven million households who have a mortgage.

That’s the warning from the Resolution Foundation today.

James Smith, Resolution’s research director,

“The latest data will reinforce market expectations of how high interest rates will go, and put more pressure on the Bank. This is bad news for anyone with a mortgage, who will be looking out for more positive signals before their current deal comes to an end.”

Resolution have calculated that mortgage repayments are set to rise by £15.8bn a year by 2026, meaning an average hit of £2,900 for households remortgaging.

Three-quarters of that £15.8bn hit will fall on the richest 40% of households, they add, as higher-income households are more likely to have a mortgage.

But rising prices hit poorer households more.

They add:

Inflation rates for the poorest tenth of households are 25 per cent higher than those for the richest tenth of households as they spend more of their income on food and energy bills.