‘Better than 50-50 chance energy bills won’t rise in April’, Martin Lewis says

Money saving expert Martin Lewis has predicted that there’s a more than 50% chance that the UK government will abandon plans to raise energy bills in April.

Lewis has been pushing for the government not to raise its Energy Price Guarantee, which caps the cost of electricity and gas, in April. As things stand, the EPG is set to rise by 20% in April, pushing a typical household bill up to £3,000 per year, from £2,500.

Yesterday, energy regulator Ofgem cut its price cap by around £1,000 per year, to £3,280 – meaning bills would still be set by the EPG, as it is lower.

Ofgem’s price cap is forecast to drop below the price guarantee in July, due to falling wholesale energy costs.

[reminder, the price cap and the EPG do NOT cap the maximum bill, just the maximum cost of each unit of power].

Lewis argues that increasing prices for three months would be an “act of national mental health harm”.

He told LBC’s Tonight with Andrew Marr last night that bills are likely to fall in the summer – so it would be a mistake to hit households with higher costs until the cap is next changed in July.

Lewis said:

The prediction is from July the price cap will drop below the price guarantee so we’ll start to see prices drop.

“That was the reason I wrote to the Chancellor three weeks ago, now supported by 85 charities.”

Addressing the government last night, Lewis said:

“Don’t do it! Protect people from getting the letters, protect people from inflation going up, it is a national act of mental health harm.

He argued that politically, increasing the cap is “not a very clever move either”…

“because it’s the government that sets prices, not the regulator, not firms, it’s the government.”

And in what would be a relief to millions of households, Lewis says he thinks there’s a good chance that the Energy Price Guarantee will not be raised:

“Reading the runes, and I’m careful with my phrasing here, I think we may get a win here. I think there’s a better than 50/50 chance of it not going up…”

Lewis also suggests the decision can’t wait until the Budget, on 15th March, explaining:

Because if you leave it to the budget, energy companies are obligated to write to people saying that their bills are going up 20%.”

Yesterday, Dame Clare Moriarty, chief executive of Citizens Advice, warned there would be “catastrophe for millions of households” if the government dropped its plan to raise the energy price guarantee to £3,000.

Dame Moriaty said:

“Unless the government changes course on planned reductions to the level of support for households under the Energy Price Guarantee, we estimate the number of people unable to afford their bills will double, from one in 10 to one in five.

“The government must keep the EPG at its current level of £2,500. Recent drops in wholesale prices mean they have the headroom to do this. The alternative is millions more people unable to keep their house warm and keep the lights on.”

Key events

Sainsbury’s “plans to close two Argos depots”

Supermarket giant Sainsbury’s has said it plans to close two Argos depots over the next three years in a move that will impact 1,400 jobs, PA Media reports.

The Unite union says there is no “economic justification” for closing the Argos warehouses in Basildon and Heywood, in Greater Manchester, by 2026.

Closing both warehouses will lead to the loss of over 750 jobs, Unite says, and also put at risk the jobs of HGV drivers employed by Wincanton, on an outsourced contract.

Unite national officer Matt Draper says the union will pursue ‘all avenues’ to protect jobs:

“Management at Argos/Sainsbury’s has yet to provide any form of business case for the loss of these jobs. Unite will be fighting to preserve every job and will put forward an alternative business case to the company to preserve employment at these two sites.

“This is an incredibly wealthy company which should be investing in its loyal workforce rather than dumping workers in pursuit of short-term profits.

“If Sainsbury’s doesn’t drop its closure plans then Unite will pursue all avenues to preserve employment at these sites.”

Goldman Sachs boss warns of stickier inflation

Over in America, the boss of Goldman Sachs has said that business leaders are a little more confident about the economic outlook.

David Solomon told CNBC that the general consensus is inflation is likely to be ‘stickier’ than hoped – meaning it won’t fall back to 3%, or 2%, as quickly as hoped.

That will mean higher interest rates for longer, and sluggish growth. But, Solomon says there is “a better chance that we can muddle through with a softer landing”.

There’s a little more optimism, he reckons, because people’s businesses have been performing better, and consumers have been more resilient.

Downing Street has said that the plan to lift household energy bills by 20% in April are being kept under review.

The prime minister’s official spokesman was asked about Grant Shapps’ comments today (see earlier post) that he was “very sympathetic” to calls to scrap the increase in typical bills to £3,000 per year in April.

The PM’s official spokesman said today (via PA Media):

“All I would say on this is it’s something we are just keeping under review. I don’t think there’s a specific time we are working to.”

He added:

“All I would emphasise is the amount of support we have already put in to support the public and businesses, paying around half of a typical household’s energy bill.

“By the end of June the energy price guarantee will have saved the typical household in Great Britain around £1,000 since it began.”

Over in parliament, Conservative MP Richard Fuller has criticised Ofgem’s performance in the energy crisis.

Fuller told the Commons that better oversight of the energy regulator was needed, and questioned why CEO Jonathan Brearley was still in position, PA Media reports.

It emerged last week that Ofgem was facing a boardroom overhaul, with ministers planning to recruit new directors to fill five of the eight seats on the board, including the role of chair.

Fuller, though, says more is needed, telling MPs:

“Many on this side will be wondering what on earth Ofgem has been doing. It is supposed to be a regulator, it is supposed to look after consumer interests?

“It blunders around, it blundered around with the price cap, it blundered around with its market-entry strategy, meaning that energy companies essentially could put all of their bill payers’ money on red in a casino.

“It has ended up with billions of taxpayers’ money being put into bailouts. Please can we have something more than the efforts by the Government to look at new non-executive directors?

“Surely it is time to say, ‘why is the chief executive remaining in post?’ And can we please have better oversight of this regulator and other regulators in general? They are getting away with ripping off consumers and allowing companies to do exactly the same.”

In response, energy Secretary Grant Shapps said he was meeting with Brearley, and such meetings would continue. He told MPs:

“I think it’s always right that we keep what our regulators do under very close watch.”

Shapps added:

“I’ve called them out when I’ve been concerned. I thought they had the wool being pulled over their eyes by the energy companies, and I’ll continue to ensure that whatever happens will be appropriate for the future of this market.”

Competition watchdog to examine home building and renting

Britain’s competition watchdog has launched two new inquiries today, into the UK’s housing crisis.

The Competition and Markets Authority (CMA) has launched a market study into housebuilding, and will start a separate consumer protection project related to rented accommodation.

The move could lead to housebuilders being forced to change their practices, or mean extra protections for tenants.

The CMA is responding to “widespread concerns about housing availability and costs”, it says.

This follows concerns that builders are not delivering enough homes, or building them fast enough to meet people’s needs.

The inquiry into home building will examine four points – housing quality; land management and whether the practice of ‘banking’ land is anti-competitive; local authority oversight of developers; and what factors are holding back innovation such as more sustainable, net zero homes.

The CMA’s work on the rental sector will examine “the end-to-end experience” of being a tenant in the UK, and consumer protection issues that tenants may face.

Sarah Cardell, Chief Executive of the CMA, says the regulator will take action if it sees evidence of anti-competitive conduct:

The quality and cost of housing is one of the biggest issues facing the country. Over the last few years, the CMA delivered real change for leaseholders, with tens of thousands of homeowners receiving refunds after being overcharged unfair ground rents.

With that work nearly finished, we’re now looking to probe in more detail two further areas – the housebuilding and the rental sectors.

If there are competition issues holding back housebuilding in Britain then we need to find them. But we also need to be realistic that more competition alone won’t unlock a housebuilding boom.

In the same vein, we want to explore the experiences people have of the rental sector and whether there are issues here that the CMA can help with.

We will of course be guided by the evidence, but if we find competition or consumer protection concerns we are prepared to take the steps necessary to address them.

Around 33,000 more civil servants in Britain, including those working for the tax office, have voted to stage a strike on Budget Day next month in a dispute over pay, pensions and job security, the Public and Commercial Services (PCS) union has announced.

They will join 100,000 civil servants across other government departments who were already scheduled to strike on 15 March.

PCS General Secretary Mark Serwotka said in a statement.

“Unless ministers put more money on the table, our strikes will continue to escalate, beginning on March 15,”

The PCS reballoted ten groups of members where the turnout was just below 50% in its original ballot for strike action in November.

The union is holding strike action to support its campaign for a pay rise of at least 10%, pensions justice, job security and no cuts to civil service redundancy pay.

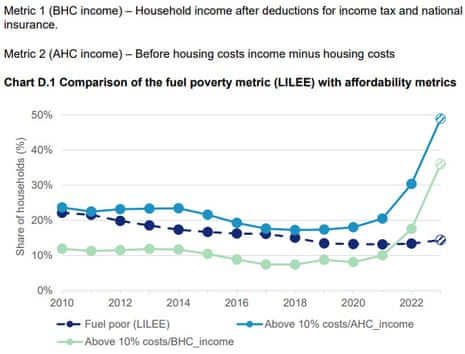

Fuel poverty crisis expected to worsen this year

The number of families in England suffering fuel poverty rose last year, despite government efforts to cap bills.

In 2022, there were an estimated 13.4% of households, or 3.26m, in fuel poverty in England under the Low Income Low Energy Efficiency (LILEE) metric, official figures show today.

That’s up from 13.1%, or 3.16m, in 2021.

Under the LILEE metric, a household is considered to be fuel poor if a) they are living in a property with a fuel poverty energy efficiency rating of band D or below, and b) spending the amount needed to heat their home would leave them with a residual income below the official poverty line.

Alarmingly, the problem is expected to get worst this year – underlining the need to not raise bills in April.

Today’s report, from the Department for Energy Security and Net Zero, says:

It is projected that in 2023, fuel poverty will increase to 14.4 per cent (3.53 million) with the average fuel poverty gap rising by 31 per cent in real terms to £443 (in 2022 prices).

An estimated 53.5 per cent of all low income households are projected to live in a property with a fuel poverty energy efficiency rating (FPEER) of band C or better.

Additionally, the number of households who had to spend more than 10% of their income, after housing costs, on domestic energy soared last year.

In 2022, 7.39 million households, or 30.3%, exceeded this threshold up from 4.93 million, or 20.5%, in 2021.

Adam Scorer, the chief executive of fuel poverty charity National Energy Action, says the data does not show the full scale of the crisis.

Scorer says:

‘Over 3.2 million households in England are in fuel poverty according to Government data released today but the worst of the energy crisis is not represented – people being forced to self-disconnect, struggling with ice on the inside of their windows and living with damp and cold.

And the situation will not get better. From April the average annual bill will rise from £2,500 to £3,000 and that means without Government intervention – both for energy efficiency measures and financial support with bills – the number in fuel poverty will continue to rise.’

The Scottish Government has also called for the UK Government to continue the energy price guarantee at its current rate of £2,500 per year in April.

On Monday, energy secretary Michael Matheson the cut in Ofgem’s price cap strengthened the case for the UK Government to reverse its plan to scrap the energy price guarantee.

Matheson said yesterday:

“This remains an incredibly unsettling time for many thousands of households.

“What matters now is that the UK Government urgently re-assesses the measures it has in place which, at present, would see the average domestic bill increasing from £2,500 to £3,000 from April 1 at the same time as its £400 Energy Bills Support Scheme is ended,” he said.

Mr Matheson said the increase will result in there being 980,000 households in Scotland in fuel poverty – an increase of 120,000.

“I call, once again, on the UK Government to provide additional, targeted support for vulnerable households who are struggling with their energy costs”

Grant Shapps ‘very sympathetic’ to calls to scrap energy bills rise

Interestingly, energy secretary Grant Shapps is reportedly “very sympathetic” to calls to protect people from a 20% rise in their energy bills in April.

This adds to the pressure on the chancellor to act, given the calls from charities and from Martin Lewis to freeze the energy price guarantee at £2,500 per year for a typical household.

Speaking to The Times, Shapps said he was “working very hard” on the issue with Jeremy Hunt, as consumer groups and energy companies urged the government to scrap the planned increase.

Shapps said:

“I completely recognise the argument over keeping that price guarantee in place, and the chancellor and I are working very hard on it.

I’m very sympathetic to making sure that we protect [people]. We’re looking at this very, very carefully.”

This chart shows how average bills are set to jump 20% to £3,000 in April, even though Ofgem is lowering its price cap from £4,279 to £3,280 (as announced yesterday).

‘Better than 50-50 chance energy bills won’t rise in April’, Martin Lewis says

Money saving expert Martin Lewis has predicted that there’s a more than 50% chance that the UK government will abandon plans to raise energy bills in April.

Lewis has been pushing for the government not to raise its Energy Price Guarantee, which caps the cost of electricity and gas, in April. As things stand, the EPG is set to rise by 20% in April, pushing a typical household bill up to £3,000 per year, from £2,500.

Yesterday, energy regulator Ofgem cut its price cap by around £1,000 per year, to £3,280 – meaning bills would still be set by the EPG, as it is lower.

Ofgem’s price cap is forecast to drop below the price guarantee in July, due to falling wholesale energy costs.

[reminder, the price cap and the EPG do NOT cap the maximum bill, just the maximum cost of each unit of power].

Lewis argues that increasing prices for three months would be an “act of national mental health harm”.

He told LBC’s Tonight with Andrew Marr last night that bills are likely to fall in the summer – so it would be a mistake to hit households with higher costs until the cap is next changed in July.

Lewis said:

The prediction is from July the price cap will drop below the price guarantee so we’ll start to see prices drop.

“That was the reason I wrote to the Chancellor three weeks ago, now supported by 85 charities.”

Addressing the government last night, Lewis said:

“Don’t do it! Protect people from getting the letters, protect people from inflation going up, it is a national act of mental health harm.

He argued that politically, increasing the cap is “not a very clever move either”…

“because it’s the government that sets prices, not the regulator, not firms, it’s the government.”

And in what would be a relief to millions of households, Lewis says he thinks there’s a good chance that the Energy Price Guarantee will not be raised:

“Reading the runes, and I’m careful with my phrasing here, I think we may get a win here. I think there’s a better than 50/50 chance of it not going up…”

Lewis also suggests the decision can’t wait until the Budget, on 15th March, explaining:

Because if you leave it to the budget, energy companies are obligated to write to people saying that their bills are going up 20%.”

Yesterday, Dame Clare Moriarty, chief executive of Citizens Advice, warned there would be “catastrophe for millions of households” if the government dropped its plan to raise the energy price guarantee to £3,000.

Dame Moriaty said:

“Unless the government changes course on planned reductions to the level of support for households under the Energy Price Guarantee, we estimate the number of people unable to afford their bills will double, from one in 10 to one in five.

“The government must keep the EPG at its current level of £2,500. Recent drops in wholesale prices mean they have the headroom to do this. The alternative is millions more people unable to keep their house warm and keep the lights on.”