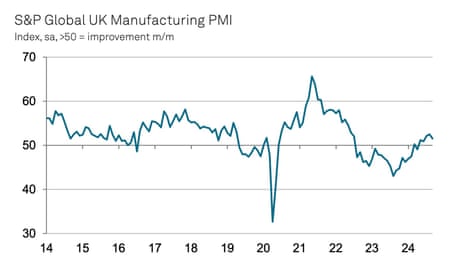

Biggest drop in UK manufacturing confidence since March 2020

Newsflash: Worries about this month’s budget, and the Middle East crisis, have hit confidence across UK manufacturing last month.

Data provider S&P Global has reported that business confidence among factory bosses fell to a nine-month low last month, and at the fastest pace since the Covid-19 pandemic hit the UK four and a half years ago.

They say that the autumn budget led to a “wait-and-see approach” to decision making, with production and new business slowing last month.

[That fits with this morning’s warning from the Institute of Directors that bosses are gloomier, following the warnings that Rachel Reeves’s first budget will be tough].

Although output and new order growth eased, S&P’s UK manufacturing PMI has remained in growth territory at 51.5, down from August’s 26-month high of 52.5.

That suggests there was a “solid expansion” in the UK manufacturing sector last month.

Rob Dobson, director at S&P Global Market Intelligence says:

“The UK manufacturing sector is still expanding at a solid, albeit slightly slower, pace. Output rose for the fifth successive month in September, underpinned by a resilient domestic market.

However, manufacturers have become more nervous about the outlook, suggesting that the current spell of impressive growth is fading, with business optimism about the year-ahead slumping to a nine-month low.

The extent of the drop in confidence was striking, beaten only by that seen in March 2020 prior to COVID lockdowns. Uncertainty about the direction of government policy ahead of the coming Autumn Budget was a clear cause of the loss of confidence, especially given recent gloomy messaging, though firms are also worried about wider global geopolitical issues and economic growth risks.

The PMI survey has also showed that input cost inflation accelerated to a 20-month high last month, which led manufacturers to further push up their selling prices.

Dobson explains:

Freight cost rises are a big factor underlying the resurgence in the price measures, as supply chains continue to feel the strain of the Red Sea crisis and global conflicts.”

Key events

Columbia Threadneedle: Pound could hit $1.50 next year

Despite recent falls in UK business confidence, City firm Columbia Threadneedle has predicted the pound will recover to its highest level since the 2016 Brexit vote.

Bloomberg reports that Steven Bell, Columbia Threadneedle’s chief EMEA economist, has predicted that sterling will move toward $1.50 next year.

The forecast is based on the prospect that the UK will have comparatively high interest rates, as the Bank of England is more cautious about cutting borrowing costs due to inflation fears.

Bloomberg explain:

Bell’s prediction implies the pound stands to strengthen almost 13% from its current level around $1.33, already near the highest in two and a half years. The UK currency is the best-performer in the G-10 this year, advancing nearly 5% versus the greenback.

Bell shrugged off concerns that the tax hikes and austerity measures expected in the UK budget at the end of the month will derail the pound’s gains. With higher taxes likely centered around capital gains, their impact on demand will be limited and are unlikely to shake consumer confidence, he said.

On the night of the EU referendum eight years ago, the pond briefly touched $1.50, before plunging to $1.32, and then to $1.20 by January 2017.

After the mini-budget two years ago, it briefly hit an alltime low of $1.038.

Dangers of another IT scandal unless Post Office ‘untouchables’ rooted out, inquiry hears

Mark Sweney

The former chair of the Post Office has warned of another Horizon-style scandal if the s0-called “untouchable” investigators and executives involved in the prosecution of subpostmasters are not fired before the organisation rolls out its new IT system.

Henry Staunton, who was sacked by the former business secretary Kemi Badenoch in January, told the inquiry into the scandal on Tuesday that there remains millions of pounds still in dispute between what subpostmasters have recorded and what the Post Office has in their records.

Staunton said that before the replacement for the Horizon system is implemented in the future, which itself is full of bugs and has seen projected costs double to more than £800m, the Post Office must deal with staff involved in wrongful prosecution of more than 700 subpostmasters.

“This is not something that relates to the past, it is something that relates to the future,” he said:

“Before we implement [the new] Horizon we will be doing a path-clearing exercise. There are millions of pounds in dispute between postmasters and what is on their records and what is in the Post Office account.”

The inquiry has previously heard about the so-called “untouchables” within the organisation, a phrase attributed to outgoing chief executive Nick Read, referring to a group of Post Office investigators who would never face disciplinary action relating to the Horizon IT scandal.

Saf Ismail, one of two subpostmasters who sit on the current board of the Post Office, has also referred to a “red” list of 23 other employees deemed high-risk given their involvement in the scandal in one way or other, none of whom who have even been suspended.

“There are these people called the ‘Untouchables’ in the investigations team, or ‘reds’ or whatever,” said Staunton.

He explained:

“[They were] Involved with all the issues in the past of finding postmasters guilty. I am very afraid if [subpostmasters] are investigated [after the new IT system is implemented] by the so-called untouchables we could have another debacle – not to the same extent – but we could have hundreds of subpostmasters having to pay out monies. This is a big issue going forward, the involvement of the untouchables.”

Staunton said that Read, who is due to appear at the inquiry for three days next week, had used the phrase “Untouchables” to him in a private conversation.

He added that Read also used the phrase in a meeting with all of the Post Office’s non-executive directors.

Asked by counsel for the inquiry what exactly he understood an “Untouchable” employee was, Staunton said:

“They are people that were involved in prosecuting postmasters previously and are still in their roles,” he said.

“And therefore would be involved in any future investigations. [They were] classified under various colours, the same as so-called reds, and would be involved in future investigations. And that seems utterly wrong.”

There are 48 people employed in the investigations team, the inquiry heard, although how many of them are considered “Untouchables” is unknown.

Here’s a list of the 17 Dobbies garden centres that are to close (see earlier post):

Larger stores

-

Altrincham, Greater Manchester

-

Antrim, Northern Ireland

-

Gloucester, Gloucestershire

-

Gosforth, Newcastle-upon-Tyne

-

Harlestone Heath, Northamptonshire

-

Huntingdon, Cambridgeshire

-

Inverness, Scotland

-

King’s Lynn, Norfolk

-

Pennine, Huddersfield, West Yorkshire

-

Reading, Berkshire

-

Stratford-upon-Avon, Warwickshire

Little Dobbies

-

Cheltenham, Gloucestershire

-

Chiswick, Greater London

-

Clifton , Bristol

-

Richmond, Greater London

-

Stockbridge, Edinburgh, Scotland

-

Westbourne Grove, Greater London

Dawn has broken at ports on the East Coast of the US, where around 45,000 workers began a strike at midnight last night.

Dockworkers at 36 ports from Maine to Texas hit picket lines early this morning, in a dispute over wages and automation.

Here’s the scene:

The pre-market drop in Boeing’s shares today also follows news that more than 40 foreign operators of 737 airplanes may be using planes with rudder components that may pose safety risks.

The warning came from the US National Transportation Safety Board, which last week issued urgent safety recommendations about the potential for a jammed rudder control system on some Boeing 737 airplanes after a February incident involving a United flight.

The NTSB also disclosed on Monday that it had learned that two foreign operators suffered similar incidents in 2019 involving rollout guidance actuators.

“We are concerned of the possibility that other airlines are unaware of the presence of these actuators on their 737 airplanes,” NTSB chair Jennifer Homendy said Monday in a letter to Federal Aviation Administration chief Mike Whitaker.

Investment bank Peel Hunt has said finance deals activity has slowed in recent weeks, amid uncertainty around the upcoming autumn Budget and the US election.

In a trading statement this morning, Peel Hunt said:

Market activity has slowed again in recent weeks ahead of the upcoming Budget and US election.

Consequently, despite better first half revenues, we expect full year performance to be in line with market expectations and we remain well positioned across all parts of our business to take advantage of increased activity when market confidence returns.

Inflation is no longer of concern in the euro area.

So declares analysts at Nomura this morning, after consumer price inflation fell below the ECB’s 2% target.

They predict that euro area disinflation will continue in earnest during this and next year.

Nomura told clients:

Part of the rationale for expecting underlying momentum in inflationary pressures to continue abating is based on our expectation of weak domestic demand.

We believe the consumer-led recovery that many forecasters expect is increasingly unlikely to happen (the Bloomberg consensus expects consumer spending growth of 1.4% y-o-y by the end of 2025, we expect half that).

Consumers have less available cash than prior to the pandemic, real wage growth is slowing more sharply than expected, and consumption confidence remains notably weak.

Garden centre group Dobbies to shut 17 stores

Garden centre group Dobbies is to shut 17 stores, in a move which will hit 465 jobs, PA Media reports.

Dobbies Garden Centres said the proposed closures are part of a restructuring plan to help return the business to profit and reduce its rent bill.

The plan, which will need approval by creditors, will see the firm shut 11 larger Dobbies sites and six little Dobbies by the end of the year.

Sites will continue to operate as normal until the restructuring process is given the green light.

Sarah Butler

Mothercare has suspended trading in its shares as the maternity and babywear brand has been forced to delay publication of its annual accounts while it attempts to finalise a refinancing package.

The group, which no longer has its own stores in the UK – only outlets in Boots stores – but trades from more than 500 stores and 50 websites run by franchise partners across 32 countries, said it was unable to publish its annual results by a deadline of 30 September but expected to do so “in the next few weeks”.

The company said it was looking to raise funds from the sale of “certain IP assets”, likely to include some brand names, as well as talking to its lender.

Mothercare, which is listed on London’s Aim junior stock market, has been attempting to renegotiate the terms of a lending facility to reduce costs for at least a year. The group, which was once a stalwart of UK high streets before it shut all stores in the country in 2019, has seen its share price has slump more than 50% in the past year to just 3.4p, valuing it at just £20m.

In a previous statement issued in May, the company said the loan had reached £19.7m, up from £19.5m last September, on which it was paying 19.2% interest and which would require waivers on lending terms given poor sales in its key middle east market which now accounts for nearly half the group’s sales.

The company said in May it was also looking at financing alternatives to including offering lenders a stake in the business.

On Tuesday it added: “the challenges facing our Middle Eastern operations” remained “broadly unchanged”.

Horizon IT inquiry hears government “dragged their feet” over compensation

Mark Sweney

Over at the Horizon IT Inquiry, the former chair of the Post Office has said that there was no interest at all in the exoneration of postmasters, and that the organisation and the government “dragged their feet” making compensation payments.

Henry Staunton, who was sacked by the former business secretary Kemi Badenoch in January, said that his first impression upon taking up the role in late 2022 was that there wasn’t an acceptance among management of the conclusions of damning High Court judgements that the Post Office had been wrong to pursue prosecutions.

“They didn’t fully accept it, that was my impression, that somehow the case hadn’t been put well or whatever,” said Staunton, giving testimony at the public inquiry into the Horizon IT scandal on Tuesday.

“There wasn’t a feeling that this was absolutely wrong, [what] had happened. It was a feeling across the piece with the team.”

He also said that from his first meeting it was obvious that the Horizon IT system was “completely and utterly unreliable”.

Staunton, who has accused the last government of wanting to delay payments to postmasters until after the general election, said that his second takeaway when he started was that there was “No appetite at all for exoneration.Those were the two things that came through strongly to me”.

He described the Post Office’s investigations department as “powerful” and “quite brutal” in the way they dealt with subpostmasters.

Staunton said that he was shocked at the attitude of the remediation process designed to evaluate and compensate postmasters.

He cited examples including a reluctance to “pause” subpostmasters having to repay money while they were being evaluated in the scheme as that might result in more subpostmasters coming forward to join the scheme.

“What surprised me was we shouldn’t not be doing something because it would generate claims,” he said. “That is not the basis the remediation committee should be working. I formed a view over a period of months regarding bureaucracy and an unsympathetic and adversarial approach.”

This same attitude was taken when a discussion about expanding the scheme relating to a death in the family of a postmaster.

He said:

“The view was if we widened the principles we open ourselves up to more claims.

That seemed pretty unsympathetic to me.

With respect to remediation the government and Post Office were dragging their heels.”

Staunton added that one Post Office executive said that the organisation did not owe the same duty of care to subpostmasters as it did to the organisation’s own employees.

After all they have been through “we owed them a greater duty of care compared to our own employees,” Staunton said.