- Bitcoin Cash was on the verge of seeing a bullish structure shift.

- Traders looking to go short could look for opportunities to enter above the $400 mark.

Bitcoin Cash [BCH] has rallied 21% for the day, and a daily session close above $351 would mark a bullish structure shift.

The price of BCH was $387 at press time, which meant there was a good chance the daily structure would shift bullishly.

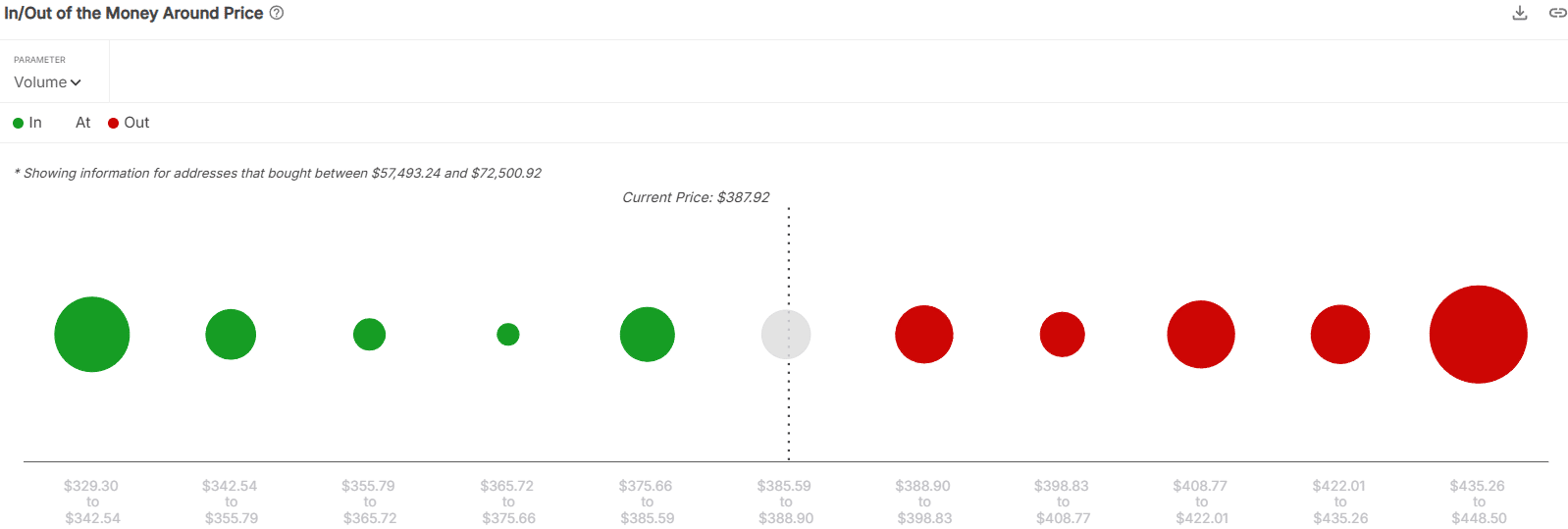

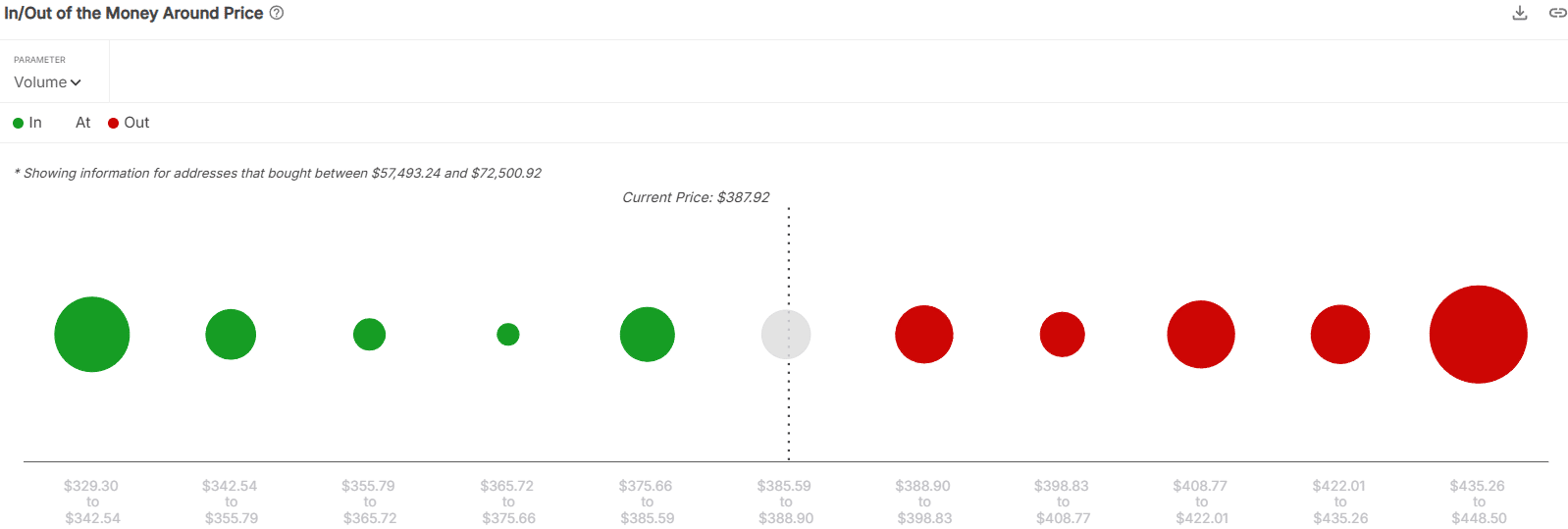

Source: IntoTheBlock

The BTC hard fork had a +0.8 correlation with Dogecoin [DOGE] and Chainlink [LINK] and only +0.71 with Bitcoin [BTC].

The price action in recent hours was backed by strong demand, and accompanied by a BTC move higher. Could Bitcoin Cash reclaim the psychological $400 level?

Key resistance zone overhead

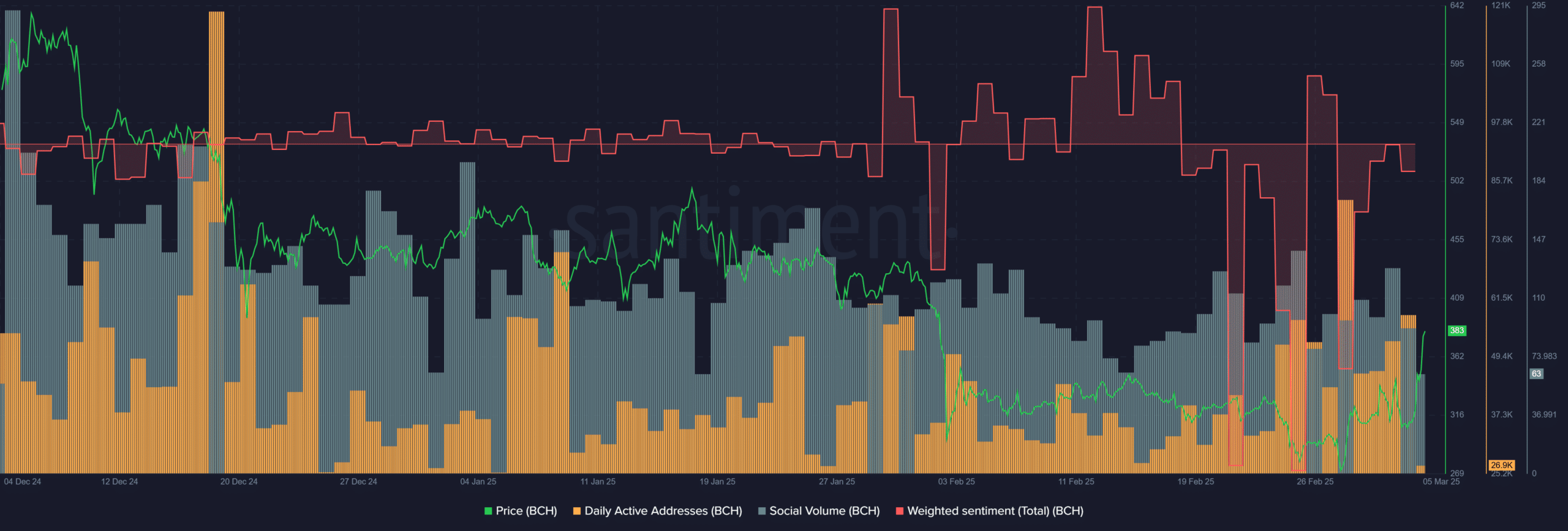

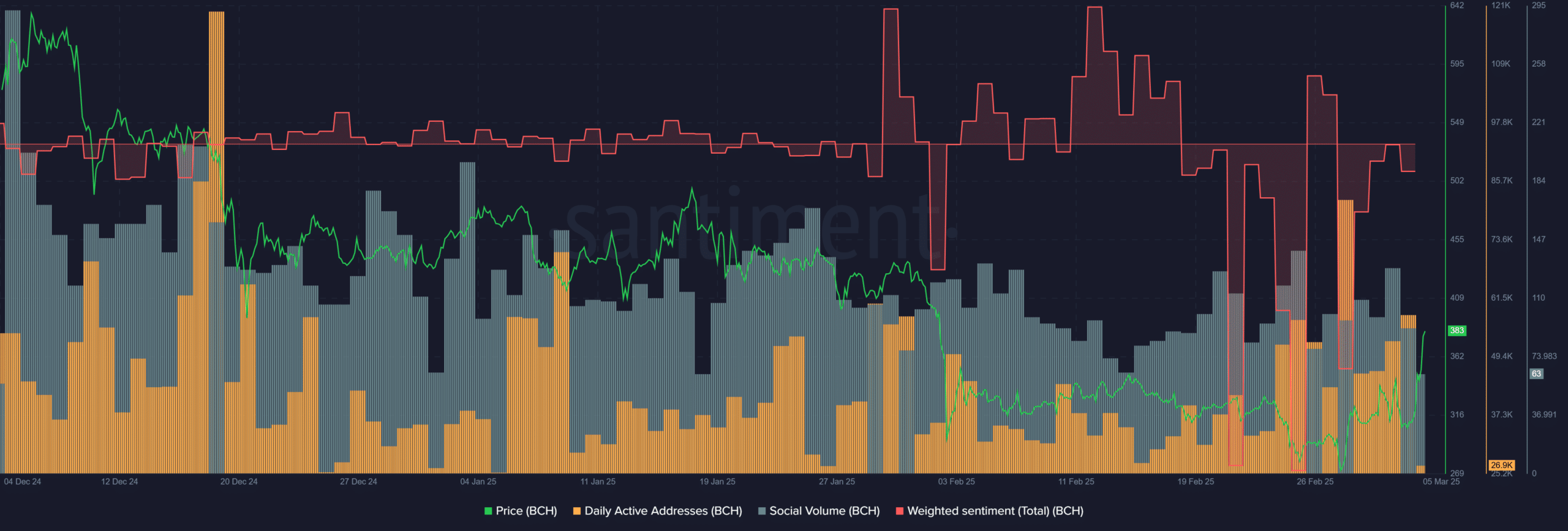

Source: Santiment

The social volume was roughly the same in the past three weeks and had picked up from the dip it saw in mid-February. Also, daily active addresses soared last week.

The fall to the local lows could have seen increased selling on-chain. Similarly, Sunday’s bounce was also accompanied by heightened activity on-chain.

Source: IntoTheBlock

The In/Out of the Money around price showed that the $408-$422 was a sizable resistance zone. Beyond that, the area just below the $450 round number would oppose the bullish advance.

To the south, the $329-$342 saw a large volume of purchases. Hence, it was reasonable that it would act as a firm support if retested.

The price action chart showed a bullish outlook after the market structure shift (orange) that would occur if the 1-day trading session closes above $351.

The volume bars showed heightened trading activity alongside the move, another sign of bullish conviction.

The $400 level (white) marked the lower low made in January, making it easier to spot the bearish order block (red) at $425.

This was also the support zone from December and bordered by the 61.8% retracement level based on the drop from $500 to $275.

Traders can expect a rejection from this order block.

Even though the sub-structure was on the verge of seeing a bullish shift, the swing structure was bearish, making $414-$425 a good risk-reward area to look for short entries.

Meanwhile, a breakout beyond $452 would invalidate the bearish argument.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion