Crypto investment products saw decent capital inflows last week, with Bitcoin, Ethereum and XRP leading, despite the market turbulence.

For context, the crypto market is grappling with a major correction, with Bitcoin tumbling from its all-time high of $108,000 to the current price of $94,980. This drop has reverberated across the scene, bringing the global market capitalization down to $3.28 trillion.

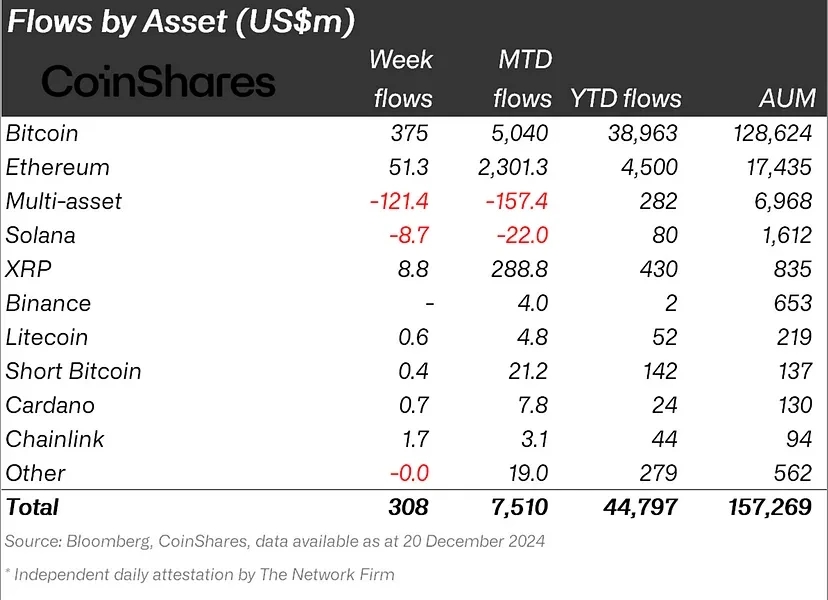

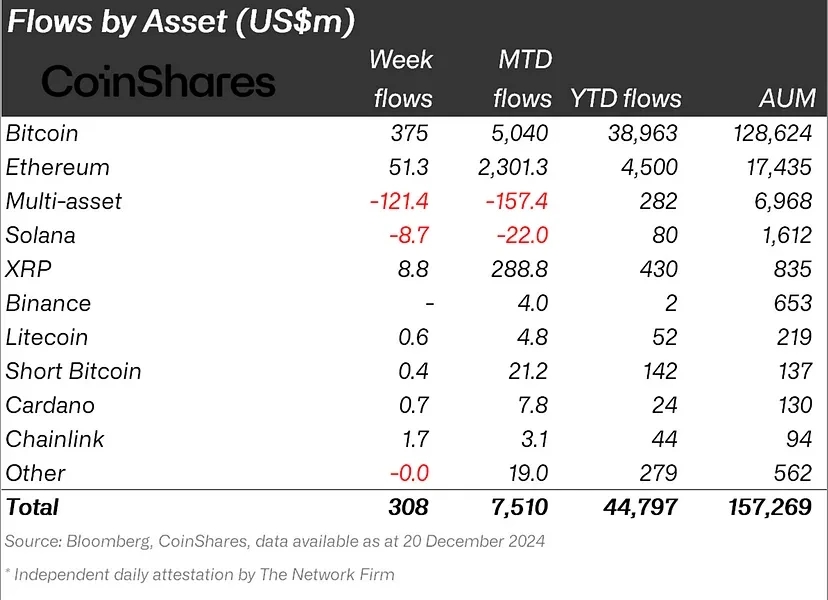

Hawkish remarks from Federal Reserve Chair Jerome Powell fueled bearish sentiment. Despite this downturn, the latest fund flow report from CoinShares confirms that crypto investment products managed net inflows of $308 million last week.

This resilience contrasts with sharp outflows of $1 billion during the final two days of the week, including $576 million on December 19 alone.

Even with these withdrawals, weekly inflows remained positive, confirming investor optimism in leading assets like Bitcoin, Ethereum, and XRP. However, recent corrections shaved $17.7 billion off the total assets under management (AUM) for digital asset products.

Bitcoin, Ethereum, and XRP Dominate Asset Flows

Bitcoin emerged as the top choice for investors, recording $375 million in weekly inflows and $5.04 billion for the month. Ethereum followed, attracting $51.3 million over the week and $2.3 billion in December. Meanwhile, XRP secured $8.8 million in inflows for the week and $288.8 million for the month.

However, multi-asset products suffered the largest weekly outflows of $121.4 million. This confirms a shift toward investments in individual crypto assets. Interestingly, Solana also recorded negative flows, with $8.7 million in weekly outflows despite positive reports around a staking ETP in Europe.

Investment Providers See Mixed Results

Among providers, BlackRock’s iShares ETFs led with impressive weekly inflows of $1.59 billion and monthly inflows of $6.83 billion. In an interesting turn of events, BlackRock’s products were the only ones that recorded net inflows last week.

Notably, Fidelity ETFs led the weekly outflows with $293 million in net outflows but a positive $697 million for the month. CoinShares XBT and ARK 21Shares saw net weekly outflows of $44 million and $171 million, respectively.

ARK 21Shares is also witnessing outflows in December, currently worth $149 million. Meanwhile, Grayscale Investments registered significant weekly outflows of $339 million, with monthly outflows amounting to $824 million.

Country-Specific Trends

Regarding countries, the United States dominated investment flows, contributing $567 million in weekly inflows and $7.4 billion in December.

Germany and Switzerland showed contrasting patterns. Notably, Germany saw outflows of $74.7 million last week but positive monthly inflows of $73.7 million. Switzerland recorded $95.1 million in weekly outflows but a $93.1 million inflow for the month.

Canada and Sweden experienced significant weekly outflows, at $60.1 million and $42.3 million, respectively. Smaller markets, including Australia and Brazil, witnessed positive inflows of $10.2 million and $16.6 million for the week.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.