Bond yields jump after strong jobs report

US government bond prices are weakening following today’s strong jobs report, as traders anticipate that interest rates could rise higher – and stay there for longer than hoped.

This is pushing up the yield, or interest rate, on US debt (yields rise as prices fall).

10-year US Treasury bonds have hit their highest level since the financial crisis, as have longer-dated 30-year Treasury yields.

Benchmark 10-year notes reached 4.887% and 30-year yields hit 5.053%, both the highest since 2007, Reuters data shows.

⚖️❗️*TREASURY 5- TO 30-YEAR YIELDS RISE 15 BASIS POINTS ON DAY

🔺*TREASURY 30-YEAR YIELD RISES TO 5.04%, HIGHEST SINCE 2007 pic.twitter.com/QK5gum9ZHj

— Cable FX Macro (@cablefxmacro) October 6, 2023

Global bond markets were already on edge. A hot US labor market is the last thing they needed. Today’s payrolls data are a +1.8 standard deviation surprise (horizontal), causing a jump in 10-year Treasury yield of 15 bps (vertical), 3 times more than normal (black dotted line)… pic.twitter.com/FultHYPVG2

— Robin Brooks (@RobinBrooksIIF) October 6, 2023

Richard Carter, head of fixed interest research at Quilter Cheviot, explains:

“As the market looks to come to terms with higher interest rates for longer, today’s US job numbers confirm this scenario is most likely to play out. The surge in new jobs was unexpected and adds to the belief that the US economy remains too hot, and that interest rate cuts will not be seen for a while.

“Bond yields have been rising over the past month and it is data prints like this that make the risk of inflation spiking again appear more of a reality. The fact is that interest rates are not yet having the complete desired effect of dampening demand and tightening conditions. We are entering a scenario now where the data prints are going to be increasingly volatile and the soft landing the Federal Reserve wishes for becomes harder to achieve.”

Key events

Closing post

Time to wrap up…after a surprisingly strong US jobs report reignited speculation that US interest rates will be raised even higher to cool the economy, despite risks of a recession.

Here’s today’s main stories:

The US Federal Reserve will be “agonising” about how high it should push US interest rates, says Charles Hepworth, Investment Director at GAM Investments:

Hepworth says:

“The US jobs report for September smashed all expectations with 336,000 new additions to the workforce, compared to a forecast of a much more modest addition of 171,000 jobs.

This hot jobs report saw strong gains in the service sector, with hospitality recording big increases in new hires. This augers well for the sector as obviously increased hiring reflects buoyant demand. However, it would be remiss to ignore that some of this re-hiring is just normalisation back to levels pre-pandemic. It certainly isn’t reflective of an economy that is slowing perhaps as quickly as the Federal Reserve hopes for.

Even if wage growth increased less than expected, the odds of a further hike from current levels has to be higher than it was prior to this report (and it was high already). Bond bears are still in full control with yields across the Treasury curve pushing to near term highs and this is reflecting in a level of angst for equity markets which remain under pressure with the higher for longer narrative now having to be finally accepted.

The Fed must also be agonising of how much it needs to continue to do before the economy succumbs to higher and higher rates.”

Dollar on track for 12th weekly gain in a row

Having strengthened following today’s jobs report, the US dollar is on track for its 12th week of gains in a row.

That hasn’t happened since 2014.

The dollar has gained around 8% over those 12 weeks, lifted by expectations that the US Fed will raise interest rates again.

$DXY Dollar spiked on jobs data but has faded giving back most all of its gains although Treasuries have only taken back roughly half of their losses. pic.twitter.com/Rs233kcys4

— Scarlett’s Grandpa (@KASDad) October 6, 2023

Today’s bumper US payrolls report has prompted a choppy session pulling European markets off their highs of the day, as we look to close out a third week of declines on a positive note, reports Michael Hewson of CMC Markets.

He adds:

The DAX has struggled this week, slipping to a 6-month low a couple of days ago, while the FTSE250 fell to an 11-month low.

The FTSE100 has performed slightly better managing to hold above its September lows, but the pressure being exerted by the prospect of higher long-term rates is certainly taking its toll on appetite for stocks.

Currently the FTSE 100 index is up 13 points, or 0.17%, at 7464 points.

President Biden’s council of economic advisers have published a handy thread on today’s jobs report:

Today’s employment report shows the U.S. economy added 336,000 jobs in September, substantially above expectations. The average monthly gain over the past 3 months is now 266,000. 1/ pic.twitter.com/1wjRUB0ZM0

— Council of Economic Advisers (@WhiteHouseCEA) October 6, 2023

Employment growth in July and August was revised up by a combined 119,000 jobs. This upward revision is driven by higher government employment than previously estimated. 2/

— Council of Economic Advisers (@WhiteHouseCEA) October 6, 2023

The headline unemployment rate was steady at 3.8% in September. The broadest measure of underemployment, U-6, ticked down to 7.0%. Both have remained around these low rates since March 2022. 3/ pic.twitter.com/AYe9jxyhWm

— Council of Economic Advisers (@WhiteHouseCEA) October 6, 2023

Note that employment measures in the Establishment and Household surveys are defined differently and can diverge significantly. Household employment grew by 86,000 in September, and fell by 7,000 when adjusted to use the same definition as the Establishment Survey. 4/ pic.twitter.com/WdI6oOBsxR

— Council of Economic Advisers (@WhiteHouseCEA) October 6, 2023

Note too that the error bands around job gains between these two surveys are quite different. For the Establishment Survey, the 90% confidence interval is about +/- 130K; for the Household Survey it’s about +/- 620K, meaning its employment growth estimates are more uncertain. 5/

— Council of Economic Advisers (@WhiteHouseCEA) October 6, 2023

Labor force participation (LFPR) stayed at its pandemic recovery high of 62.8% in September. The prime-age (25-54 year-olds) participation rate, which is less sensitive to the aging of the population, also held steady at 83.5%; this rate has not been higher since May 2002. 6/ pic.twitter.com/UedBtt9fw8

— Council of Economic Advisers (@WhiteHouseCEA) October 6, 2023

The prime-age employment-to-population ratio (EPOP) ticked down 80.8%. For women, the prime-age employment rate held steady at 75.3%, its sixth straight month of reaching or tying an all-time high. 7/

— Council of Economic Advisers (@WhiteHouseCEA) October 6, 2023

Together, these LFPR and EPOP results suggest that both labor supply and labor demand remain strong. 8/

— Council of Economic Advisers (@WhiteHouseCEA) October 6, 2023

Monthly nominal average hourly earnings growth was 0.2% in September, the same rate as August. Year-on-year, nominal wage growth ticked down to 4.2%. Inflation data for September have not been released yet. 9/ pic.twitter.com/WrELTDJjmG

— Council of Economic Advisers (@WhiteHouseCEA) October 6, 2023

Three-month growth in nominal average hourly earnings was 3.4% annualized in September, the lowest three-month rate since March 2021. 10/ pic.twitter.com/xcIaRE96Ex

— Council of Economic Advisers (@WhiteHouseCEA) October 6, 2023

Today is National Manufacturing Day. In September, manufacturing added 17,000 jobs, bringing the total added since January 2021 to 815,000. Manufacturing employment is up almost 2% since February 2020, the strongest manufacturing jobs growth in any post-1953 business cycle. 11/ pic.twitter.com/mTPZVQvnpb

— Council of Economic Advisers (@WhiteHouseCEA) October 6, 2023

Finally, @BLS_gov began publishing new data from the household survey on teleworking. In September, 20% of employed adults teleworked or worked at home for pay, up from 18% last October when the new questions were introduced. The comparable rate in Feb 2020 was about 9%. 12/

— Council of Economic Advisers (@WhiteHouseCEA) October 6, 2023

As the Administration stresses every month, the monthly employment and unemployment figures can be volatile, and payroll employment estimates can be subject to substantial revision. 13/ pic.twitter.com/SiWzArp7cE

— Council of Economic Advisers (@WhiteHouseCEA) October 6, 2023

Therefore, it is important not to read too much into any one monthly report, and it is informative to consider each report in the context of other data as they become available. 14/

— Council of Economic Advisers (@WhiteHouseCEA) October 6, 2023

Back in the UK, the Financial Times are reporting that a group of Metro Bank bondholders offered the bank a £600m capital injection on Monday.

However, Metro – which said yesterday it was evaluating various options to bolster its capital – has yet to accept the offer, according to two people familiar with the matter.

The challenger bank sent representatives for the consortium of bondholders a letter on Friday morning that acknowledged the offer, which is still on the table, according to one of the people.

The bondholders’ offer came before Metro approached investors this week about a separate fundraising plan for a similar amount to shore up its balance sheet. Existing investors, who could lose money if the bank fails, are looking to bolster its capital position and avoid it running into difficulty.

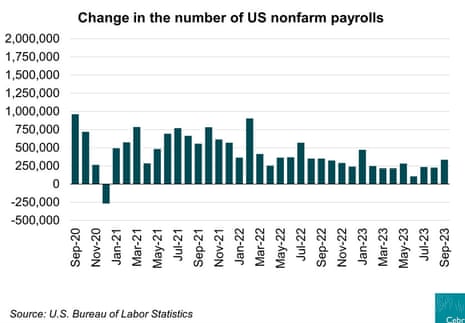

Strongest monthly jobs growth since January

The 336,000 new jobs created in the US in September is the most for any month since January.

It is also above the average monthly gain of 267,000 over the prior twelve months.

Pushpin Singh, senior economist at the CEBR thinktank, says:

The latest data signals a still-hot labour market amidst historically low unemployment, elevated wage growth and strong job additions in recent months, suggesting that there is still more to be done before inflation is brought back under control.

In light of this, Cebr expects the Fed to raise rates by another 25 basis points before the end of the year, before leaving interest rates at a restrictive level for some time to fully curb demand-side pressure.”

Mike Bell, Global Liquidity Market Strategist at J.P. Morgan Asset Management, agrees that today’s very strong payrolls data increases the probability of another rate hike from the Federal Reserve this year.

However, the more investors believe a recession can be avoided, the more likely an eventual recession becomes, Bell fears.

Here’s why:

“If enough people believe that rates can stay high without causing a recession, then the subsequent rise in long bond yields that we have seen in recent months increases the eventual risk of recession by raising borrowing costs.

“Our base case is therefore still for a mild recession sometime in 2024. But even in a recession, we don’t expect rates to be cut back down to zero.

UK government bonds are also weakening, pushing up the cost of borrowing.

The yield, or interest rate, on benchmark 10-year gilts has risen to around 4.62%, from 4.55% last night.

The yield on the UK’s 10-year Gilt surged past the 4.6% threshold, hovering around its highest level since August 22. Bonds are being sold off globally. US 30 year bond 5.01%. 10 year now approaching 5%. US adds more jobs than expected. Equity needs to be sold off to save bonds. pic.twitter.com/CGLcIm0cLe

— Winston (@WKyaw7) October 6, 2023

There’s a weak start to trading on Wall Street, after the strong jobs report fuelled concerns over high interest rates.

The Dow Jones industrial average has lost 174 points, or 0.5%, to 32,945 in early trading, while the broader S&P 500 is down 0.75%.

DOW JONES DOWN 80.51 POINTS, OR 0.24 %, AT 33,039.06 AFTER MARKET OPEN

S&P 500 DOWN 22.79 POINTS, OR 0.54 PERCENT, AT 4,235.40 AFTER MARKET OPEN

NASDAQ DOWN 94.82 POINTS, OR 0.72 PERCENT, AT 13,125.01 AFTER MARKET OPEN

— First Squawk (@FirstSquawk) October 6, 2023

Jobs report will spook bond market

The odds of another rise in US interest rates in 2023 have risen, reports Janet Mui, head of market analysis at wealth manager RBC Brewin Dolphin.

Mui says:

“The jaw-dropping strength of the US nonfarm payroll report is bound to spook the bond market further as the “higher for longer” interest rate narrative gains more support.

While the resilience in jobs is to be celebrated, markets currently are in “bad news equals good news” mode as the bond market just doesn’t want to stomach hot data.

The 336K job gains blows past even the most bullish estimate. Despite the Federal Reserve’s aggressive interest rate increases and some pockets of weakness in the US economy, this report raises concern the labour market can remain too hot for too long.

Perhaps the only solace is that wage growth has slowed modestly and came in below estimate.

But with the recent rebound in US jobs opening and a lack of increase in the labour participation rate, the Federal Reserve may remain concerned about underlying inflation pressure on the economy.

Traders have boosted the probability of another Fed rate hike by the end of the year from 1/3 to around 50% after the report.”

Bond yields jump after strong jobs report

US government bond prices are weakening following today’s strong jobs report, as traders anticipate that interest rates could rise higher – and stay there for longer than hoped.

This is pushing up the yield, or interest rate, on US debt (yields rise as prices fall).

10-year US Treasury bonds have hit their highest level since the financial crisis, as have longer-dated 30-year Treasury yields.

Benchmark 10-year notes reached 4.887% and 30-year yields hit 5.053%, both the highest since 2007, Reuters data shows.

⚖️❗️*TREASURY 5- TO 30-YEAR YIELDS RISE 15 BASIS POINTS ON DAY

🔺*TREASURY 30-YEAR YIELD RISES TO 5.04%, HIGHEST SINCE 2007 pic.twitter.com/QK5gum9ZHj

— Cable FX Macro (@cablefxmacro) October 6, 2023

Global bond markets were already on edge. A hot US labor market is the last thing they needed. Today’s payrolls data are a +1.8 standard deviation surprise (horizontal), causing a jump in 10-year Treasury yield of 15 bps (vertical), 3 times more than normal (black dotted line)… pic.twitter.com/FultHYPVG2

— Robin Brooks (@RobinBrooksIIF) October 6, 2023

Richard Carter, head of fixed interest research at Quilter Cheviot, explains:

“As the market looks to come to terms with higher interest rates for longer, today’s US job numbers confirm this scenario is most likely to play out. The surge in new jobs was unexpected and adds to the belief that the US economy remains too hot, and that interest rate cuts will not be seen for a while.

“Bond yields have been rising over the past month and it is data prints like this that make the risk of inflation spiking again appear more of a reality. The fact is that interest rates are not yet having the complete desired effect of dampening demand and tightening conditions. We are entering a scenario now where the data prints are going to be increasingly volatile and the soft landing the Federal Reserve wishes for becomes harder to achieve.”

Glassdoor’s lead economist Daniel Zhao has analysed today’s jobs report, and says:

“The summer weather is sticking around in the labor market as the September jobs report shows hot job gains. As the labor market stays in its holding pattern, we’re one month closer to exiting without a recession. Resilient jobs growth shows there is some cushion for the Federal Reserve’s efforts to cool inflation without causing job losses.”

Today’s jobs report shows signs of an unexpected surging payroll growth with 336,000 jobs added. Leisure and hospitality sector provided well above average monthly job gains (+96,000) jobs, likely due to the ramp of the upcoming holiday season.

While labor force participation held at 83.5%, female labor participation decreased to 77.4%. In future months, we are watching this number closely as expiring federal childcare funding could sideline working mothers.