Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Boohoo Group’s chief executive will step down and the company is to launch a strategic review of its operations, the fast-fashion retailer said on Friday, as it announced a £222mn debt refinancing.

Boohoo, which owns brands including PrettyLittleThing, Karen Millen and Debenhams, the former department store chain, said its board believed the group remained “fundamentally undervalued” and had “decided to undertake a review of options for each division to unlock and maximise shareholder value”.

It said chief executive John Lyttle would step down having served for five years, but would work with its leadership until a successor is found.

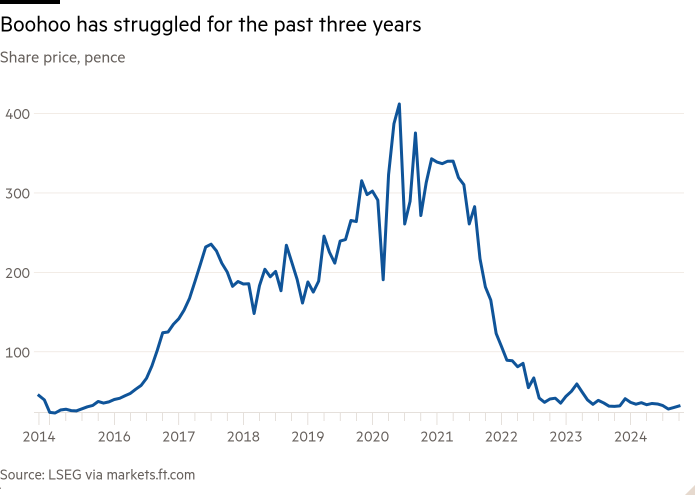

Boohoo shares have lost more than 90 per cent of their value since their peak in mid-2020 when it was buoyed by a boom in online shopping during the pandemic. Since then, it has had to contend with more subdued demand and higher day-to-day costs such as returns.

The retailer is also under threat from relatively new entrants such as online fast-fashion player Shein, whose UK operations surpassed £1.5bn last year, ahead of Boohoo, and similar to Asos, despite only starting selling in the UK in earnest in the past few years.

Boohoo’s gross merchandise value after returns fell 7 per cent in the six months to the end of August to £1.2bn, the company said on Friday, while adjusted profits dropped by £10mn to £21mn. It added that it expected performance to improve in the second half of the year compared with the previous six months.

Boohoo was founded by Mahmud Kamani and Carol Kane in 2006 in Manchester to sell fashionable clothes online straight to shoppers, cutting out the retail middlemen.

Nick Bubb, an independent retail analyst, said that one option for the struggling group would be to break itself up, adding there were “no prizes for guessing which bit Mike Ashley will want”.

Ashley’s Frasers Group is a shareholder in Boohoo, as well as rival Asos.

The sportswear billionaire battled with Boohoo for control of Debenhams after the department store’s collapse in 2019.

Frasers also gatecrashed Boohoo’s deal to buy ailing fashion rival Missguided in 2022, and bought competitor I Saw It First, set up by Kamani’s brother.