Join our daily and weekly newsletters for the latest updates and exclusive content on industry-leading AI coverage. Learn More

“Data is the new oil,” an adage coined by British data scientist Clive Humby back in the distant year 2006, has only gained in popularity in the last few years thanks to the generative AI boom.

But if that’s true, why can’t you buy and sell data as easily as you could barrels of crude, as the commodity, as so many companies and people conceive of it? Instead, we’re undergoing years of court battles and well reported pieces documenting how AI providers (among other companies) have scraped the web for their data in apparent disregard, and potential violation, of copyright.

Shouldn’t there be a “one-stop shop” for companies to buy clean, fully licensed data and use it to power their business models and applications — a kind of iTunes for data, or Amazon for data?

That’s the thinking behind Carbon Arc, a new startup emerging from stealth today with $55 milllion in seed funding led by Liberty City Ventures, with participation from K5 Global, Raptor Group, and Wasserman Media GroupAI Data Utility and real-time Insights Exchange.

It’s designed to help businesses consume, trade, and integrate structured intelligence without the inefficiencies of traditional data acquisition.

The company was founded in March 2021 with a simple but ambitious idea: “For all the data that exists in the world, very little of it makes it into the hands of decision-makers,” said Kirk McKeown, Carbon Arc’s Co-founder and CEO, in an interview with VentureBeat conducted in a cafe in New York City last week.

Carbon Arc is addressing that problem by transforming unstructured, siloed datasets into AI-ready insights. Through its proprietary ontology framework, the platform standardizes private data and makes it available on demand—offering an alternative to bulk data contracts that often leave enterprises paying for information they don’t fully use.

Freeing trapped, real world transaction, behavioral and sentiment data

While data is everywhere, much of it remains trapped within corporate balance sheets, enterprise silos, and legacy systems.

McKeown describes it as “private data is locked on every balance sheet in the world. The economy generates enormous exhaust—receipt data, healthcare claims, trade claims, credit cards—but it’s not flowing to decision-makers.”

At the same time, AI-driven enterprises are facing a shrinking pool of usable public data. With large language models (LLMs) rapidly depleting public datasets, businesses must seek out differentiated, proprietary intelligence to remain competitive.

“More data means better questions,” McKeown said. “The big players are going to need more and more differentiated data assets as they come to market.”

Carbon Arc’s solution is to treat data like a financial asset, creating a structured market for data the way equities, bonds, and derivatives trade today. This shift introduces price discovery, demand discovery, and real-time access—bringing liquidity to a historically illiquid data economy.

“The intelligence age should be no different from past revolutions—every major technology shift in history has required a transformation in the underlying feedstock for power,” McKeown added.

How Carbon Arc’s data marketplace works

Carbon Arc has built a two-sided marketplace where data owners contribute their datasets, and businesses pay per-megabyte for the insights they use.

- Consumption-based pricing model – Shifting data purchases from large CAPEX expenditures to microtransactions, where density and velocity of consumption drive value.

- API-driven access – Companies can integrate structured intelligence directly into analytics workflows, AI models, and enterprise tools.

- Granular data selection – Unlike platforms that blend KPIs, Carbon Arc ensures raw, unfiltered insights, with McKeown emphasizing, “We don’t blend KPIs because we don’t want to introduce subjective decisions—what you select is exactly what you get.”

- Scalable architecture – Designed for high-frequency intelligence streaming across industries such as finance, retail, AI development, and media.

While consumption-based pricing provides flexibility, it can also be difficult to manage. “Consumption-based pricing is a great trade, but it scares people because it’s hard to manage,” McKeown admitted. To address this, Carbon Arc is introducing a wallet structure that gives customers better control over their spending.

Already powering enterprises across sectors

The platform is already being leveraged across multiple industries:

- Financial institutions & hedge funds – Using real-time market intelligence for investment models.

- AI-native companies & LLM developers – Enhancing AI training with structured, proprietary datasets.

- Retail & consumer brands – Tracking consumer spending, optimizing merchandising, and forecasting demand.

- Media & healthcare organizations – Improving supply chains, consumer engagement, and operational efficiency.

- Sports teams – The Florida Panthers NHL team used Carbon Arc’s insights to analyze fan preferences, leading to new entertainment partnerships.

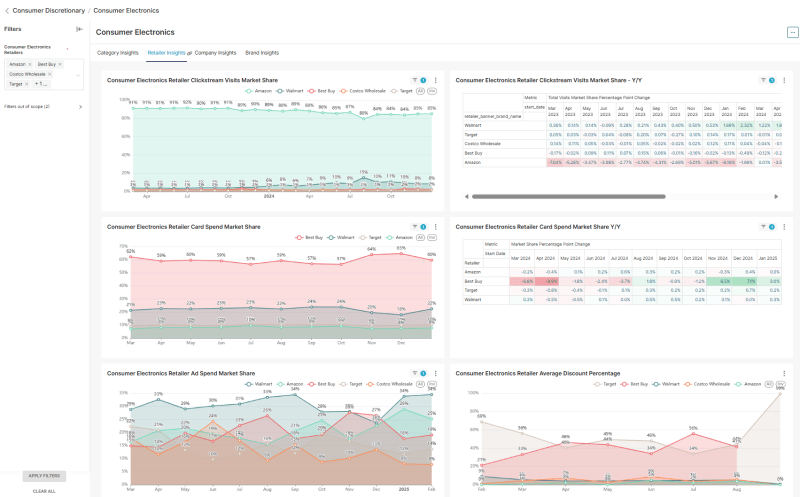

A clean and easy-to-navigate user interface with automatic dashboards and charts

Carbon Arc’s platform is designed for ease of use, with interactive data visualizations, API connectivity, and real-time intelligence streaming.

Key Interface Features:

- Customizable filters – Users can segment data by category, company, product brand, and key metrics.

- Interactive data dashboards – Charts display insights such as website traffic, POS spending, and supply chain data.

- Graph-based relationship mapping – Users can explore connections between brands, products, and competitors.

- API-driven integration – Ensures structured intelligence flows seamlessly into business intelligence tools and AI models.

For retailers, the platform provides real-time comparisons of market share, sales trends, and consumer behavior across competitors like Lululemon, American Eagle, and Abercrombie & Fitch.

In enterprise analytics, users can track spending trends across major retailers like Walmart, Kroger, and Target—enabling data-driven merchandising and pricing strategies.

What it means for developers and data decision-makers

Software developers and data scientists often face significant challenges when dealing with unstructured data. Carbon Arc simplifies this process by automatically structuring raw data, providing real-time insights via API, and eliminating the need for extensive preprocessing.

Instead of committing to bulk data contracts, businesses can consume only the insights they need, reducing operational overhead and budget constraints.

Key benefits include:

- Improved data accessibility – High-value datasets become available without complex extraction or manual processing.

- Flexible pricing model – Organizations can pay based on actual data consumption, optimizing costs.

- API-driven integration – Data insights can be incorporated directly into existing analytics tools, dashboards, and decision-making workflows.

- Historical and continuously updated datasets – Companies gain up-to-date insights without relying on slow-moving, fragmented data pipelines.

“AI predictions will only get better over time, but they will always need historical data as a foundation,” McKeown explained, stating that Carbon Arc has data going back centuries, yet continuously adds new updates on a weekly or daily basis, depending on the specific segment.

Additionally, the company ensures its data is backed up in multiple locations.

“We’re maniacal about redundancy,” McKeown told me. “I never want to be leveraged by a single data provider—we have multiple sources to protect against pricing hikes or supply disruptions.”

Turning data from a research product into a tradable asset

McKeown sees Carbon Arc’s platform as part of a larger shift in how data is valued and exchanged.

“We’re building a market for data the way equities, bonds, and derivatives trade today—bringing price discovery and demand discovery into a structured exchange.”

This fundamental shift in data economics could reshape AI, finance, and business intelligence, making real-time insights more accessible and cost-effective.

With $55 million in funding, Carbon Arc is well-positioned to redefine how enterprises access, trade, and integrate intelligence. By turning data into a fluid, tradable asset, the company is addressing one of the biggest challenges in AI and business decision-making today—ensuring that data is no longer locked away, but actively driving insights and innovation.

READ SOURCE