- Cardano’s price formed a triangle pattern as the price reclaimed MAs and tested its key resistance

- Retail activity rose, while derivatives volume surged as well

Cardano [ADA], at the time of writing, seemed to coil within a narrowing symmetrical triangle – Hinting at a volatile breakout ahead. In fact, ADA was trading at $0.6461, following gains of 2.61% in 24 hours.

According to AMBCrypto’s analysis, this consolidation, combined with thinning volatility, could prime the asset for a decisive 27% move.

At press time, the altcoin’s price structure revealed that ADA has been steadily compressing between converging trendlines, supported by a long-term ascending base and capped by descending resistance from January’s peak. The immediate support stood near $0.5618, while the major resistance zone lat at $0.7545–$0.7581.

Furthermore, ADA reclaimed both the 9-day and 21-day moving averages, with both sitting at $0.6252 and $0.6263 respectively. Such a reclaim often precedes trend continuation, especially when paired with tight ranges.

A decisive breakout above the upper boundary may project a rally towards $0.81, while a breakdown below the ascending base could help the crypto revisit the $0.46-range.

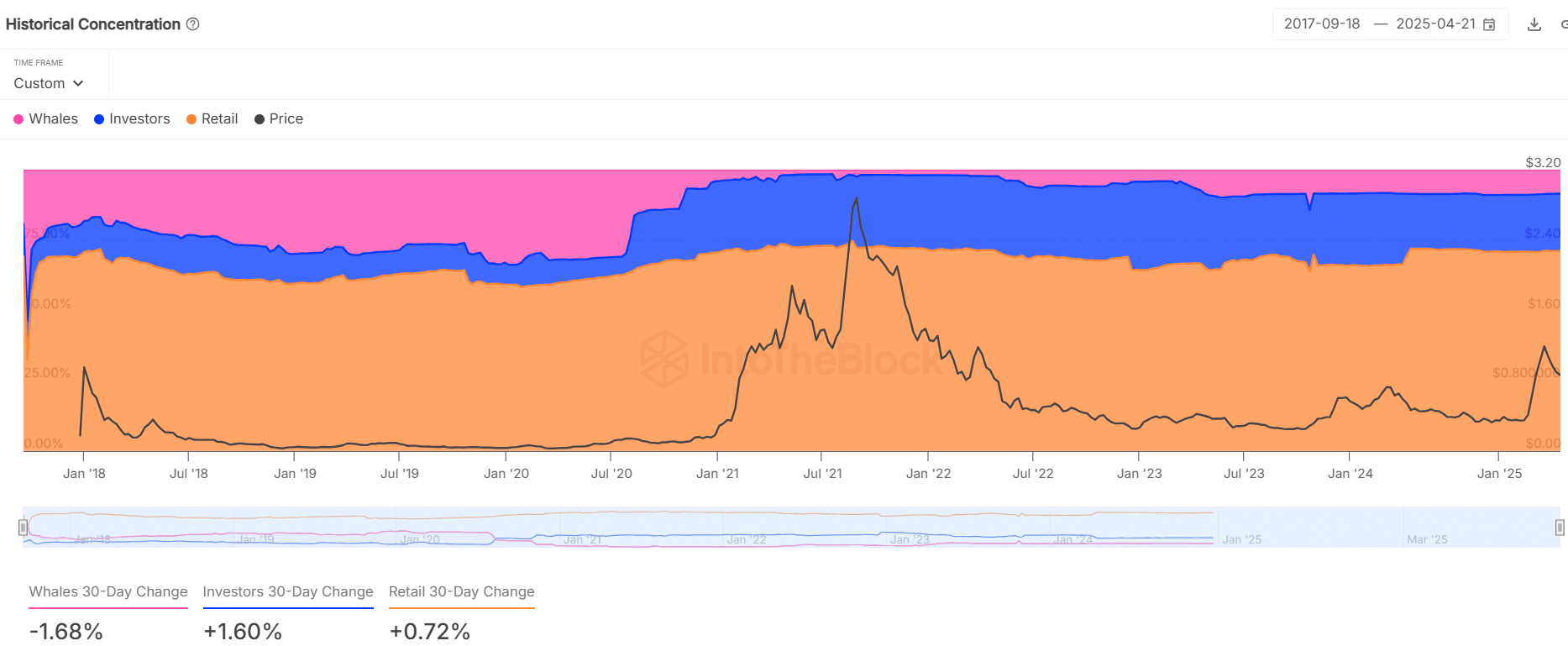

Are Cardano whales retreating as retail interest climbs?

Ownership data highlighted a steady shift from large holders to smaller participants. In the last 30 days, whale wallets trimmed their ADA exposure by 1.68%, while investors expanded holdings by 1.60%. Simultaneously, retail ownership edged higher by 0.72%.

This trend suggested growing interest from grassroots participants, even as large holders seemed to be cautious. Historically, such retail-led environments tend to amplify post-breakout momentum. Particularly when confidence spreads across broader market segments.

Is address growth a signal of growing network traction?

On-chain activity showed a sharp uptick in participation. Over the past 7 days, new addresses climbed by 4.79%, while active addresses surged by 11.99%. Additionally, zero-balance addresses rose by 12.26%, pointing to intensified network churn.

These metrics indicated rising transactional activity and user engagement – Factors that often precede or accompany significant price volatility. As more users return to the network, market responsiveness to directional moves increases.

Are rising volumes masking uncertainty in derivatives markets?

Finally, in the derivatives segment, Cardano saw a notable 67% spike in trading volume, reaching nearly $987.5 million. Open Interest also rose modestly by 3.04% – A sign of growing speculative positioning.

However, the Options market told us a different story – Volume collapsed by 92.94%, and Open Interest dipped by 0.27%, reflecting traders’ reluctance to commit to long-dated strategies.

This divergence alluded to short-term confidence, but long-term hesitancy, emphasizing the market’s cautious anticipation of the breakout.

Will ADA’s triangle resolve with strength or surrender?

In light of rising retail activity, the hike in network engagement, and surging short-term volumes, ADA might be ready to make a bold move soon.

However, the muted Options market reflected caution under the surface. Whether Cardano breaks to the upside or crumbles through the support, the breakout will likely carry enough momentum to define its next directional trend.