Moody’s cuts China’s credit outlook to negative

Newsflash: Credit rating agency Moody’s has cut its outlook for China’s government bonds to negative, from stable, due to concerns over its rising debts and slowing economy.

Moody’s slashed its outlook due to concerns that Beijing’s government will need to provide fiancial support to “financially-stressed regional and local governments and State-Owned Enterprises”.

This would pose broad downside risks to China’s fiscal, economic and institutional strength, Moody’s says.

Moody’s also warns that China faces “structurally and persistently lower medium-term economic growth”, saying:

Moody’s expects that China’s annual GDP growth will be 4.0% in 2024 and 2025, and average 3.8% from 2026 to 2030, with structural factors including weaker demographics driving a decline in potential growth to around 3.5% by 2030

The agency also points to the “downsizing” taking place in China’s property sector, where many developers such as Evergrande are trying to restructure debts.

The changes in the property sector is “a major structural shift in China’s growth drivers”, and could be a more significant drag to China’s overall economic growth rate than expected, they say.

Moody’s move underscores deepening global concerns about the level of debt in the world’s second-largest economy.

It has maintained China’s credit rating at A1, which is its fifth-highest rating (the top ‘upper medium grade’) and comfortably in ‘investment grade’. But lowering the outlook is a sign that the credit rating could be cut in future.

Key events

Closing post

Time for a recap….

The outlook on China’s sovereign credit rating has been cut to negative today by rating agency Moody’s Investors Service.

Moody’s warned that Beijing would need to bail out local and regional governments and state-owned enterprises that were struggling with rising debts, hampering efforts to boost investment and growth.

China’s finance ministry said it was “disappointed” with Moody’s decision when the economy was on the mend. It said the agency’s concerns were “unnecessary” when the recovery “has been advancing steadily”.

Rupert Soames, the former chief executive of the outsourcing company Serco, has been named as the next president of the Confederation of British Industry, as the scandal-hit lobby group aims to rehabilitate its image following allegations of sexual misconduct.

Soames, the chair of Smith & Nephew, a London-listed medical tech group, will take up the role in the new year before being formally elected by CBI members at its next annual general meeting in June.

Trading in London today has been disrupted by technical problems that temporarily prevnted the buying and selling of small company shares.

Only stocks on the FTSE 100 and 250 indices, plus some overseas companies, were tradable during two different outages today, as the LSE battled to fix its latest technical problems.

In the energy industry, a Guardian investigation has shown that Sellafield, Europe’s most hazardous nuclear site, has a worsening leak from a huge silo of radioactive waste.

Ministers are facing calls for answers, after the Guardian revealed Sellafield had been hacked by groups linked to Russia and China.

In retail, UK households are expecting to spend an extra £105 this Christmas, as shrinkflation hits the size of festive chocolates, mince pies and cheese.

UK retailers are on course for a budget Christmas after shoppers cut back on the purchase of non-essential items in November to cope with rising food prices.

But in better news for households, grocery inflation has slowed:

UK car sales have risen again, with a 9.5% increase in registrations last month.

But sales of electric cars fell 17%, which analysts are attributing to a fall in Tesla sales.

Troubled Thames Water is likely to be called back to be questioned by MPs over concerns raised by its auditors that its parent company could run out of money by April.

In the US, job vacancies have fallen to the lowest since 2021, with 8.7m openings recorded.

Inflation across the OECD has hit a two-year low….just as bond prices rally as investors bet that interest rates have peaked….

Reports: Brussels proposes three-year delay to EV sales tariffs

The Financial Times are reporting that Brussels has proposed delaying the introduction of tariffs on electric vehicle sales between the UK and EU by three years.

They say:

The European Commission will on Wednesday approve the plan, officials familiar with its thinking told the Financial Times. The 27 member states must then agree, with the vast majority in favour.

This should please the automotive industry in the UK, and across Europe, which had been pushing for the tariffs to be delayed.

Under the Brexit trade agreement, from 1 January any electric vehicle exported from the EU to the UK or vice versa must be at least 45% made in either the EU or the UK or it will be subjected to a tariff.

Several manufacturers have called for the tariff to be suspended for three years to allow time for new battery factories and their associated supply chains to get up and running.

Bloomberg is also reporting that the European Commission is set to recommend delaying tariffs on electric vehicles traded with the UK by three years.

They explain:

France has long resisted a straightforward extension, preferring instead alternatives to mitigate the impact of the tariffs on the industry. Paris had signaled in recent weeks that it was open to finding a flexible solution.

In another worrying sign from the US economy, the the RealClearMarkets/TIPP Economic Optimism Index has dropped.

The index, which measures consumer sentiment, fell 10.1% in December to 40.0, and has now remained in negative territory for 28 consecutive months.

US job openings lowest since 2021

Newsflash: Job openings across the US economy have fallen, a sign that America’s labor market could be weakening.

The number of job openings decreased to 8.7 million on the last business day of October, the U.S. Bureau of Labor Statistics reported today.

BREAKING: JOLTS Job Openings come in at just 8.73M vs expectations of 9.31

— Markets & Mayhem (@Mayhem4Markets) December 5, 2023

That’s a drop of over 600,000 compared with the previous month, when there were around 9.3 million vacancies, and looks to be the lowest since 2021.

More evidence of cracks in the labour market…

JOLTS Job Openings (Oct) 8.73M vs 9.3M Expected

Hard landing knocking on the door.

— Puru Saxena (@saxena_puru) December 5, 2023

The BLS expains:

The job openings rate, at 5.3 percent, decreased by 0.3 percentage point over the month and 1.1 points over the year.

Over the month, job openings decreased in health care and social assistance (-236,000), finance and insurance (-168,000), and real estate and rental and leasing (-49,000). Job openings increased in information (+39,000).

There was little change in the number of workers quitting their jobs, or being laid off, the JOLTS report shows.

The number of US job openings fell the most in October since March 2021, according to the latest JOLTS data. Yields on 10-year Treasuries continue falling, down 80bp from the high less than a month ago to below 4.2%, the lowest since August. pic.twitter.com/Ti0tMC4RUm

— Lisa Abramowicz (@lisaabramowicz1) December 5, 2023

Saxo Bank’s Outrageous Predictions for 2024

It’s that time of the year again when Saxo Bank makes eight strange predictions for the year ahead.

Saxo’s aim is to highlight the risk of unlikely but underappreciated events which would send shockwaves across the financial markets if they happened.

And they are…

-

With oil at $150, Saudis buy Champions League franchise

-

World hit by major health crisis as obesity drugs make people stop exercising

-

US heralds the end of capitalism with tax-free government bonds

-

Generative AI deepfake triggers a national security crisis

-

Deficit countries form ‘Rome Club’ to negotiate trade terms

-

Robert F. Kennedy Jr wins the 2024 US presidential election

-

Japan’s ‘lucky 7%’ GDP growth rate forces BoJ to abandon yield curve control

-

Luxury plunges as EU goes Robin Hood, introducing wealth tax

Saxo argues that the world has reached an inflection point, with “the familiar road of the last decade coming to an end”.

Saxo’s chief investment officer, Steen Jakobsen, says:

“The smooth road the world has travelled on since the Great Financial Crisis, with stable geopolitics, low inflation, and low interest rates, was disrupted during the pandemic years.”

Bonds rally as investors bet on rate cuts

Government bond prices are surging today, as investors bet that central banks will start to cut interest rates in 2024.

The yield, or interest rate, on UK two-year government bonds has touched its lowest since 21 November today, dropping below 4.5%.

Yields fall when price rise, which can be a sign that investors are anticipating lower interest rates in future.

The money markets are currently indicating that the Bank of England will make its first rate cut by May or June next year, from 5.25% to 5%, followed by at least two more quarter-point cuts by the end of 2024.

Eurozone government bonds are rallying today too, after European Central Bank board member Isabel Schnabel told Reuters that the “remarkable” fall in inflation means the ECB needn’t raise interst rates any more.

Inflation in the euro area is estimated to have dropped to just 2.4%% in November, nearer to the ECB’s 2% target.

CMA hears concerns over cloud computing sector

Britain’s competition watchdog has heard evidence that the UK’s cloud computing sector needs reform, as it investigates the £7.5bn market.

The Competition and Markets Authority has today published 17 responses to its inquiry, announced in October, into whether industry leaders Amazon and Microsoft, known as ‘hyperscale’ providers, are distorting competition.

Two former employees of UKCloud Ltd, a British cloud computing company, have told the CMA that their business went into compulsory liquidation last year, with the loss of 180 jobs, costing taxpayers £20m.

They say:

Several factors contributed to UKCloud’s demise, including government’s lack of support for UK cloud providers and inherent market bias toward hyperscale cloud providers. Each of these factors made inward investment progressively harder to secure.

They agree with the four “Theories of Harm” identfied by the CMA, but also add extra concerns, including Free Courses and Educational Programs provided by hyperscale operators, Free Usage Credits which lock customers in, and ‘obscure pricing regimes’.

Microsoft and Amazon together control up to 80% of the £7.5bn UK cloud computing market, with Google the next closest with up to 10%.

But Amazon’s web services arm also has concerns over Microsoft’s business practices. In its evidence, AWS accuses Microsoft of using licensing practices that restrict customer choice and make switching more difficult.

For its part, Microsoft has argued there are no features that materially “prevents, restricts or distorts competition” in connection with the supply of cloud services in the UK.

How Tesla caused sales of UK electric cars to fall last month

Jasper Jolly

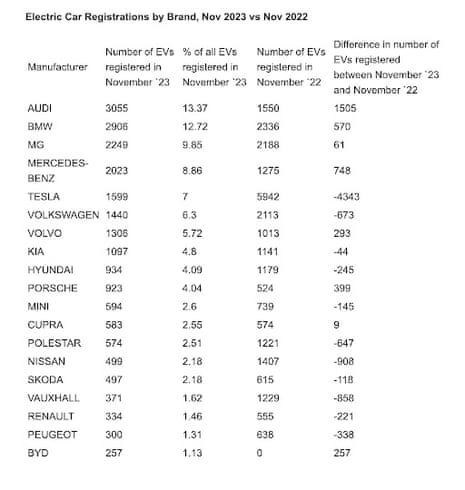

The number of electric cars sold in the UK has dropped sharply in November (as flagged at 9.19am).

There is one big reason for that: Tesla, my colleague Jasper Jolly explains.

The drop in sales comes a few weeks after Rishi Sunak delayed the ban on new petrol and diesel cars by five years, leading to concerns it could slow the electric car transition.

However, New AutoMotive, a thinktank, cautioned against over-interpreting volatile monthly sales data because of the large impact of production shutdowns at Tesla, the US electric car pioneer.

Electric car sales dropped by 5,000, or 17%, year-on-year to 24,300 in November, according to the Society of Motor Manufacturers and Traders, the industry lobby group, who also reported a 9.5% rise in all car registrations.

New AutoMotive’s analysis of the same data shows that Tesla sales fell by 4,300 cars during the month, accounting for the vast majority of the drop.

Tesla “suffered a series of setbacks in production in the second half of 2023”, said New AutoMotive. Analysts had predicted a slowdown in Tesla sales because of temporary shutdowns at its factories in Germany and China to upgrade equipment and prepare for the production of the updated Model 3 saloon and the new Cybertruck.

Ben Nelmes, New AutoMotive’s chief executive, said:

“Monthly car sales are highly volatile. This well-anticipated slowdown in sales of electric cars demonstrates the need for the government to make it cheaper and easier for people to access the benefits of going electric.”

Brazil has shrugged off fears that it could be on the brink of recession.

New GDP data today shows that Brazil’s economy grew by 0.1% in the third quarter of this year, beating forecasts for a contraction of 0.2% or 0.3%.

Year on year, the economy was 2% larger – better than the 1.8% expected.

*BRAZIL GDP (QOQ) (Q3) ACTUAL: 0.1% VS 0.9% PREVIOUS; EST -0.3%

*BRAZIL GDP (YOY) (Q3) ACTUAL: 2.0% VS 3.4% PREVIOUS; EST 1.8% pic.twitter.com/5FTAwEUqSw

— Special Situations

(@distressedbr) December 5, 2023

This followed better than expected growth of 0.9% in Q2, and is another boost to president Luiz Inácio Lula da Silva as he tries to lift living standards in Latin America’s largest economy.

Today’s technical problems on the London stock exchange don’t “bode well for the LSE as it isn’t the first time,” according to John Moore, head of trading at Berkeley Capital Wealth Management.

“Investors and traders may lose confidence when they cannot transact, as well as attract attention from the regulator as the issues persists. In this day and age we expect 100% uptime as per major stock indexes globally.”

Mark Sweney

Here’s our news story on Rupert Soames’s appointment as the CBI’s next president:

Revealed: Sellafield nuclear site has leak that could pose risk to public

Sellafield, Europe’s most hazardous nuclear site, has a worsening leak from a huge silo of radioactive waste that could pose a risk to the public, the Guardian can reveal.

Concerns over safety at the crumbling building, as well as cracks in a reservoir of toxic sludge known as B30, have caused diplomatic tensions with countries including the US, Norway and Ireland, which fear Sellafield has failed to get a grip of the problems.

The leak of radioactive liquid from one of the “highest nuclear hazards in the UK” – a decaying building at the vast Cumbrian site known as the Magnox swarf storage Silo (MSSS) – is likely to continue to 2050.

That could have “potentially significant consequences” if it gathers pace, risking contaminating groundwater, according to an official document.

More here, by Anna Isaac and Alex Lawson:

As flagged this morning (see 11.53am), Energy Security Secretary Claire Coutinho MP has written to the Nuclear Decommissioning Authority about the “serious and concerning” allegation.

On the MSSS, Coutinho has asked the NDA what efforts are being taken to speed up the work to stop the leak.

For the second time today, the London Stock Exchange says that the securities caught up in the technical problems “are now in regular trading”.

Back in the City of London, the stock market authorities are making a new attempt to resume trading.

The London Stock Exchange say that impacted instruments are being resumed, after trading in hundreds of small stocks was hit by a second technical glitch.

The LSE started a re-opening auction at 12:20pm.

It adds:

During this period, instrument status will be shown as Halted but customers will be able to manage their orders in the system.

Hopefully this will resolve the second outage of the day, and not be followed by a third….

At least trading in FTSE 100 and FTSE 250 stocks, and overseas stocks, has kept working today.

Coutinho demands answers over Sellafield cybersecurity

Claire Coutinho, the UK’s Secretary of State for Energy Security and Net Zero, has asked Britain’s Nuclear Decommissioning Authority for a full explanation about cybersecurity at Sellafield.

Following the Guardian’s revelation that the nuclear waste and decommissioning site had been hacked by groups linked to Russia and China, Coutinho has asked NDA chief executive David Peattie for a delivery plan and a timeline for how Sellafield will emerge from ‘enhanced regulatory scrutiny’.

Coutinho is also seeking assurances from the NDA that cyber security threats are bring treated with the highest priority, and that threats are recorded and acted upon.

Here’s the letter:

The reports of an alleged cyber attack at Sellafield are deeply concerning. While they have strongly refuted allegations of a successful cyber attack, I have written to the @NDAgovuk for a full explanation.

I will be speaking to the @NDAgovuk and @The_ONR today. pic.twitter.com/q9j1ZpUCjf

— Claire Coutinho MP (@ClaireCoutinho) December 5, 2023

My colleagues Anna Isaac and Alex Lawson reported yesterday that the Office for Nuclear Regulation (ONR) had found cybersecurity “shortfalls” during its inspections of Sellafield, and noted that it had taken “enforcement action” as a result.

They wrote:

The latest annual report from the ONR stated that “improvements are required” from Sellafield and other sites in order to address cybersecurity risks. It also confirmed that the site was in “significantly enhanced attention” for this activity.

Coutinho also told Peattie she has “zero tolerance for bullying or harassment in the workplace”, after our investigation uncovered a toxic workplace culture at Sellafield.

LSE ‘still investigating an issue’

The problems hitting small companies traded on the London Stock Exchange this morning appear to have resurfaced!

The LSE says:

We are still investigating an issue. Currently only FTSE 100, FTSE 250 and IOB securities are available for trading.

Several of the stocks which were frozen earlier seem to be having problems again.

Fevertree has been frozen for 12 minutes, while YouGov, for example, just traded after a half an hour pause.

Deliveroo just traded, too.

Inflation across OECD countries hits two-year low

Back in the global economy, inflation across the world’s richest countries has slowed to a two-year low.

Year-on-year inflation in the OECD, as measured by the Consumer Price Index (CPI), has fallen to 5.6% in October, down from 6.2% in September.

That’s the lowest level since October 2021, before the spike in energy and food prices in 2022 after Russia’s invasion of Ukraine.

The OECD reports that inflation fell in 28 of its members, but rose by at least one percentage point or more in Greece, Czechia, and Costa Rica.

It adds:

Inflation rates were close to zero in Denmark, turning negative in the Netherlands and remained negative in Costa Rica despite its increase.

The OECD also reports that food inflation continued to slow rapidly, dropping to 7.4% in October down from 8.1% in September.

It declined in 32 OECD countries but still exceeded 10% in Turkey, Iceland, Colombia, and the United Kingdom (where it was 10.1% in October).

Rupert Soames isn’t a stranger to taking on a challenge.

Serco was vying for the label of Britain’s most-reviled company when Soames heard it had sacked its CEO, and decided he’d like to do the job.

As my colleague John Collingridge wrote last year:

Soames got the job and joined in early 2014, when Serco was vying for the label of Britain’s most-reviled company. It was in the dock for having overcharged the Ministry of Justice (MoJ) tens of millions of pounds for electronically tagging offenders, some of whom were dead or still in prison; its shares were in freefall; and it was barred from winning new government work.

“I have a horrible habit of walking towards gunfire,” says Soames with a grin, sitting in the central London office of his public relations adviser, wearing his trademark blue shirt embroidered with the words “Serco and proud of it”. (He ordered a batch when he was appointed.)

The new chief executive’s approach combined gusto with a heavy dose of gallows humour. His initial appeal to staff was: “Bring out your dead.” In response, he says, “rather a lot of bodies came flying out”