US President Donald Trump speaks with the press as he meets with Indian Prime Minister Narendra Modi in the Oval Office of the White House in Washington, DC, on Feb. 13, 2025.

Jim Watson | AFP | Getty Images

This report is from this week’s CNBC’s “Inside India” newsletter which brings you timely, insightful news and market commentary on the emerging powerhouse and the big businesses behind its meteoric rise. Like what you see? You can subscribe here.

The big story

A 10% levy on all Indian goods entering the U.S. is markedly better than a 26% import tax. Sure.

But the threat of the higher figure being reimposed on India hasn’t disappeared.

U.S. President Donald Trump first tore apart the established international trading system by announcing worldwide “reciprocal” tariffs earlier this month and then reversed course on Wednesday by falling back to a 10% import tax rate on nearly all nations.

While that may come as a short-term relief, a free trade agreement-like deal with the U.S. is still up for grabs for India.

But unlike other emerging Asian economies that are overtly reliant on exports, India’s consumer-led economy gives it a stronger hand in any trade talks with the U.S, experts say.

Exports of goods, (and services that are not subject to tariffs), accounted for about a fifth of India’s economy in 2023, according to World Bank data. Meanwhile, exports were 65% and 87% of GDP for emerging market competitors like Thailand and Vietnam, respectively.

While the U.S. will impose tariffs on imports of goods, which account for 56.1% of India’s total exports, services have so far not been targeted. Some of India’s largest companies, such as TCS and Infosys, are unlikely to be directly impacted by the tariffs, and may only be exposed to the issue indirectly if a global economic slowdown were to occur given most of their clients are based overseas.

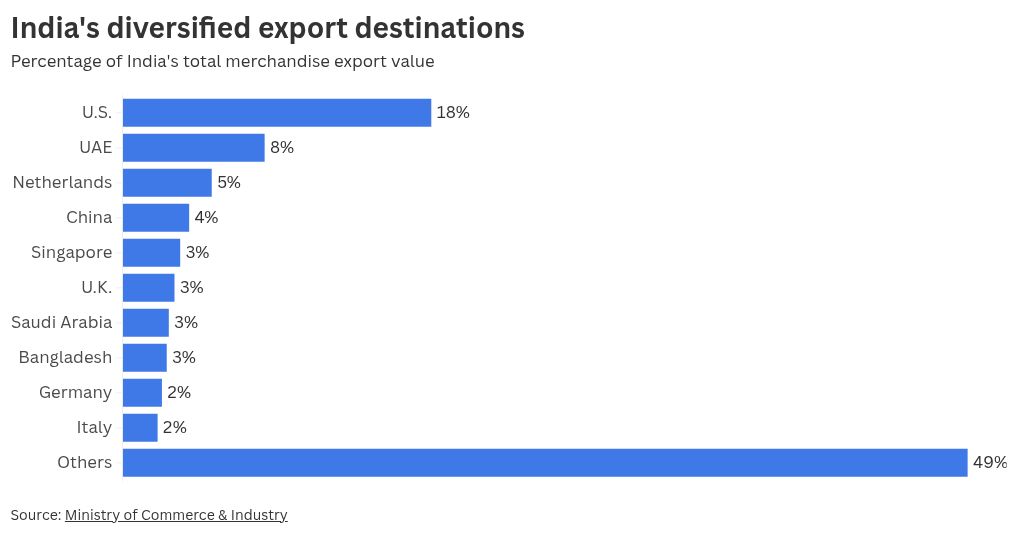

India’s export destinations for merchandise are also significantly diversified, with the U.S. accounting for only 18% of shipments in 2023-2024, according to India’s Ministry of Commerce & Industry.

“The structure of trade from India to the United States is very different than, let’s say China as an example, because of the services component,” James Sullivan, head of Asia Pacific equity research at JPMorgan, told CNBC’s Squawk Box Asia. “The U.S. administration is almost entirely focused on trade in goods, not trade in services, where the U.S. actually has a surplus.”

“If that narrative starts to shift, we have to recognise that the large majority of Indian exports to the United States are I.T. services,” Sullivan added. “Those stocks have taken a significant hit due to the risk of a recession in the United States, and the lack of corporate expenditure that would then hit the I.T. services topline.”

While India does have some strengths, the task facing Indian negotiators is likely to be made more challenging by competitors staring at a much worse scenario.

China now faces a total tariff rate of 125% (at the time of this keystroke), while Vietnam risks being reimposed with 46% ‘reciprocal’ import duties—among the highest rates the U.S. has imposed.

Their economic vulnerability, as exports to the U.S. are a large part of GDP, has led to diverging responses. While China has decided to respond with countermeasures, Vietnam has offered to wipe out all tariffs, potentially paving the path to a free trade agreement with the U.S.

“Just had a very productive call with To Lam, General Secretary of the Communist Party of Vietnam, who told me that Vietnam wants to cut their Tariffs down to ZERO if they are able to make an agreement with the U.S.”, Trump posted on social media websites Truth Social and X soon after unveiling his tariff program.

On Wednesday, Treasury Secretary Scott Bessent, who is leading the trade negotiations, revealed that he was meeting with Vietnam’s trade negotiators that day.

Vietnam had preemptively offered to slash tariffs on agriculture and energy imports from the U.S. Once the tariffs were unveiled, it went further by promising to buy aerospace, defense, and security products from the U.S.

The point is, that Vietnam is throwing the kitchen sink at the issue of tariffs and is eager for free trade. However, the move could also spur other nations to compete by offering the U.S. even more favorable terms of trade.

In the short term, while Apple is reportedly planning to ship more made-in-India iPhones to the U.S. to offset the steep tariffs on China, Cupertino executives might also wonder whether zero tariffs in Vietnam—if there is a deal—might be a better bet than India.

It would be natural for companies to think that while 26% tariffs on India are better than the 125% tariffs on China, 0% tariffs on Vietnam would be even better. And that school of thought isn’t going to be limited to California either.

Japanese electronics maker Sourcenext Corp this week announced plans to set up a new factory in Vietnam after its existing facility in China became impractical for exports to the U.S.

At first glance, all of this may appear to jeopardize India’s current relatively favorable position with the U.S.

“Although India wants to have their own solution to manufacturing industries it [U.S.-Vietnam deal] will surely have some impact on its [negotiations] with the U.S,” Mark Martyrossian, a director at Aubrey Capital, told CNBC’s Inside India. “And remember the bully is always more forgiving of those who succumb earlier to his charm. Those who hang out longer have him licking his chops.”

Aubrey’s global emerging markets fund has a 32% allocation to China and a 30% allocation to India.

Far from a race to the bottom to lower tariffs, though, Martyrossian believes India has leverage while negotiating with the U.S., pointing to the fact that exports in merchandise are a tiny proportion of India’s overall economy. Meaning, that Indian trade negotiators dealing with the U.S. are unlikely to have the mandate to make widespread concessions similar to Vietnam.

Others agree.

“The situation on tariffs is still evolving, but India is relatively well-placed due to its low merchandise export dependence and therefore may have some flexibility in working out its eventual position,” said Abhiram Eleswarapu, head of India equities at BNP Paribas. “Most sectors in India derive less than 10% of their revenue from exports to the U.S. with the exception of IT services and Pharmaceuticals.”

“India will not compromise on certain areas like agriculture, and is therefore in a better bargaining position,” said Gaurav Narain, principal advisor at the London-listed India Capital Growth Fund.

“My own sense is that India will try and offset the negative trade balance … by committing to higher imports in areas like oil / defence etc. However, it could lower tariffs to 0% in many areas like pharmaceuticals and autos, where India already has a very well developed, low-cost manufacturing base, and imports would only be of premium products.”

Narain added that, even in the short term, India will see “limited impact” from the tariffs, as supply chains cannot be easily changed, as the case with Apple highlights.

“I think companies will take a long-term, structural approach to de-risking their supply chains. India has the advantage of not being perceived as simply a reroute from China, which works in its favour,” Narain added.

For investors in Indian stocks, the market has been less forgiving. Aside from the tariff turbulence rocking markets, stocks in India are still considered too expensive due to their lofty valuations.

“Earnings estimates still need a reset lower,” said Aditya Suresh, head of India equity research, at Macquarie Capital. “We believe the worst is behind and we could see inflows in the coming months.”

Suresh also suggested that investors could hide from the current turbulence by investing in stocks that derive much of their revenues locally, instead of large-cap exporters. The Macquarie analyst said he favors telecom firm Bharti Airtel, oil and gas firm GAIL, and UltraTech Cement until the dust settles.

Need to know

The Reserve Bank of India lowers rates. On Wednesday, India’s central bank cut its policy rate by 25 basis points to 6%, marking its lowest level since September 2022 as growth concerns mount in the world’s fifth-largest economy. The rate cut was in line with expectations from analysts polled by Reuters. The RBI also cut its growth expectations for the financial year 2025-26 to 6.5% from 6.7%.

‘Optimistic’ forecast by RBI. Mridul Saggar, professor of economics at Indian business school IIM Kozhikode and a former RBI executive director, said the country’s growth could be around 6% this year and called the RBI’s projection “optimistic.”

The Indian government expects to meet growth target. Despite disruptions caused by Trump‘s tariffs, India is likely to hit its projected gross domestic product expansion of 6.3%-6.8% — a figure from the Indian government’s Economic Survey in January — for financial year 2025-26, an Indian finance ministry official, who spoke on the condition of anonymity, said Monday.

Tariffs on European Union cars might be slashed. According to a Reuters report quoting sources, India Prime Minister Narendra Modi’s government is considering reducing its tariffs on EU car imports to 10% from 100% in stages. However, domestic automakers want tariffs at 30% minimally and for electric vehicle duties to be left unchanged at 110%.

What happened in the markets?

Indian stocks fell on Thursday, bucking the trend in Asian equities. The Nifty 50 index closed lower by 0.6%, heading for a 2.2% loss this week. The index has fallen by 5.3% this year.

The benchmark 10-year Indian government bond yield has ticked lower slightly to 6.43%, down by 3 basis points from last week.

On CNBC TV this week, Pranjul Bhandari, HSBC’s chief India economist, estimated that Trump’s 26% tariffs on India could shave off 0.5 percentage points from the country’s economic growth. If global trade patterns shift, such as China exporting more goods to India, that could also hurt India’s domestic manufacturing sector. “Direct or indirect, our sense is that growth will need help” in the next few quarters, Bhandari added.

Meanwhile, Sonal Varma, Nomura chief economist for India and Asia ex-Japan, said that there are two factors making portfolio and direct investments in India attractive. First, the difference in degree of tariffs between India and China is in favor of India, which would “make sense” for multinational companies to divert their production to India. Second, India is a strategic ally of the U.S., and is working with the world’s biggest economy on long-term trade plans.

What’s happening next week?

China’s economic growth for the first quarter, out Wednesday, will be the main economic event to look out for in the upcoming week. Consumer price index reports for India, Japan and U.K. will give a picture on the state of inflation in those economies.

April 11: India consumer price index for March, industrial and manufacturing production for February, China imports and exports for March, U.S. producer price index for March, U.K. gross domestic product for February

April 14: India wholesale price index for March

April 16: China gross domestic product for first quarter, U.S. retail sales for March, euro zone consumer price index, final, for March, U.K. consumer price index for March

April 16: European Central Bank press conference

April 18: Japan consumer price index for March