- FTX token, POPCAT, and Wormhole emerged as the week’s biggest winners.

- In contrast, Notcoin, Ethena, and Lido DAO topped the losers chart.

This week brought plenty of market volatility, with Bitcoin [BTC] facing a pullback. Despite this, a few altcoins managed to break away from the trend and posted notable gains.

Data from CoinMarketCap highlighted an overall bearish sentiment dominating the market, with fewer than 10% of the top 100 cryptocurrencies ending in the green.

Biggest winners

FTX Token [FTT]

FTX Token [FTT] re-entered the spotlight two years after its collapse, opening the week with a strong gain of over 57%.

It opened the week trading at around $1.4009 and closed near $2.6921, becoming the top-performing crypto of the week, with an impressive 60% gain.

This recent price action was fueled by speculation surrounding the defunct crypto exchange, FTX, which gained traction on social media. As a result, a significant spike in trading volume was observed.

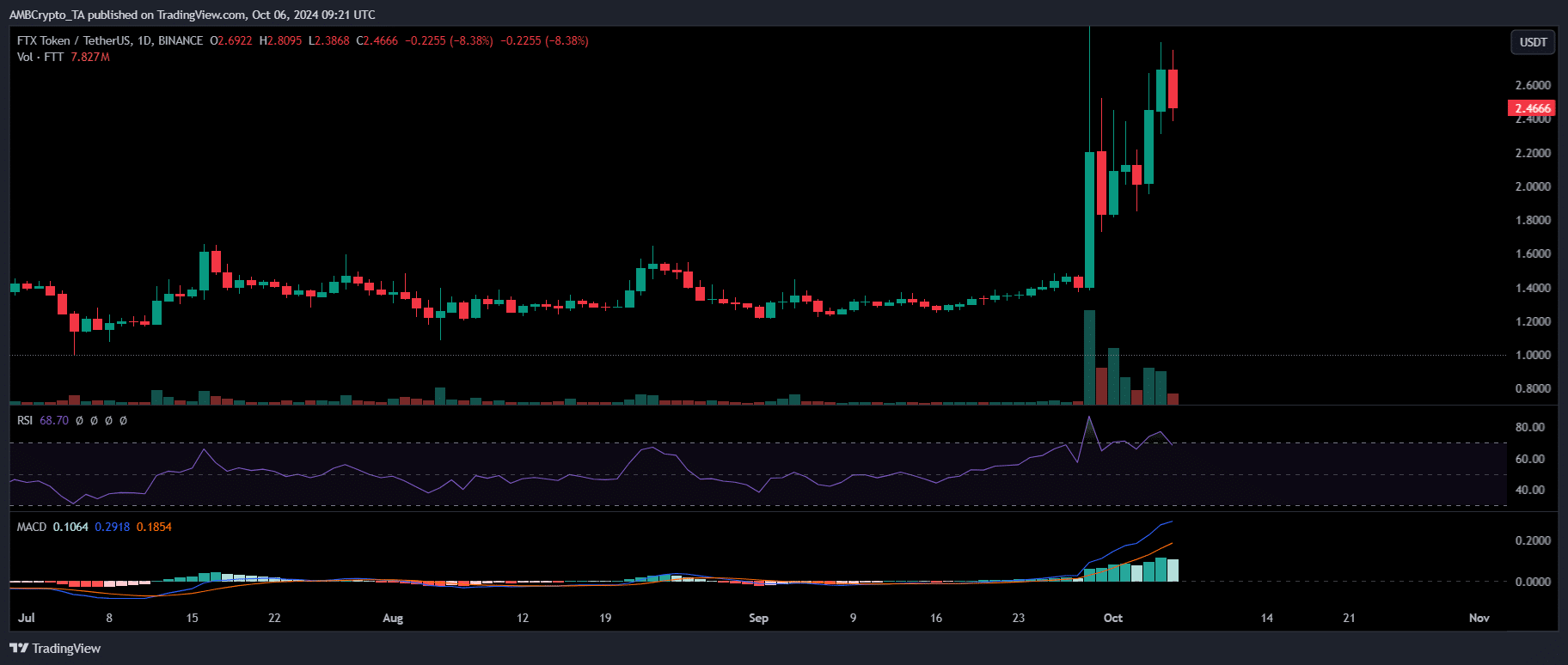

The MACD indicator reveals a bullish crossover, with the MACD line (blue) crossing above the signal line (orange). The histogram shifted into positive territory, indicating an increase in bullish momentum.

However, despite this uptick, the Relative Strength Index (RSI), which spiked during the crossover, has since reversed downward. This indicated that the initial buying strength may be waning.

As a result, the long-term upside potential could remain elusive for the time being.

As of this writing, FTT has seen a pullback of over 3% from the previous day’s close, accompanied by a significant drop in trading volume, which has dropped more than 65% to 25 million.

Currently, its market capitalization stands at $850 million, reflecting a 7% increase over the week.

Popcat [POPCAT]

Solana-based memecoin POPCAT has emerged as the second-largest gainer of the week. It began the week with a 7% rise to $0.9820.

This upward movement reversed the bearish trend and allowed POPCAT to consolidate for four days straight.

The most significant spike happened on the 4th of October, when a breakout pushed POPCAT above $1, after a remarkable 21% gain for the day.

POPCAT opened the week at around $0.9216 and closed near $1.2134, achieving a weekly gain of over 30%, based on data from CoinMarketCap.

This bullish momentum boosted POPCAT’s market capitalization to $1.19 billion, with a current value increase of 0.46%.

Wormhole [W]

Wormhole [W] closed the week in the top three, achieving a weekly rise of over 15%. It opened the week with a 4% rise to $0.3003.

However, it quickly shifted gears with a 7% decline the following day, which erased all the gains made earlier.

The trading volume surged to 290 million on the 2nd of October from 75 million the day before, marking a staggering 286.67% rise. This spike was the most notable of the week, with W closing at $0.3438.

A significant pullback to $0.3180 occurred the day after, but this was soon challenged, allowing W to close the week at $0.3411.

Despite this, its trading volume has dropped by 37% in the last 24 hours, while its market capitalization currently stands at $877 million, with a 2% decline.

Biggest winners of the top 500

Sudeng (HIPPO) took the lead with a staggering 135% increase, trading at around $0.01442 in the broader market.

Following closely was DIA (DIA) which rose by over 100% to $0.8321. SPX6900 (SPX) came in third with a 99% rise, trading at approximately $0.2153.

Biggest losers

Notcoin [NOT]

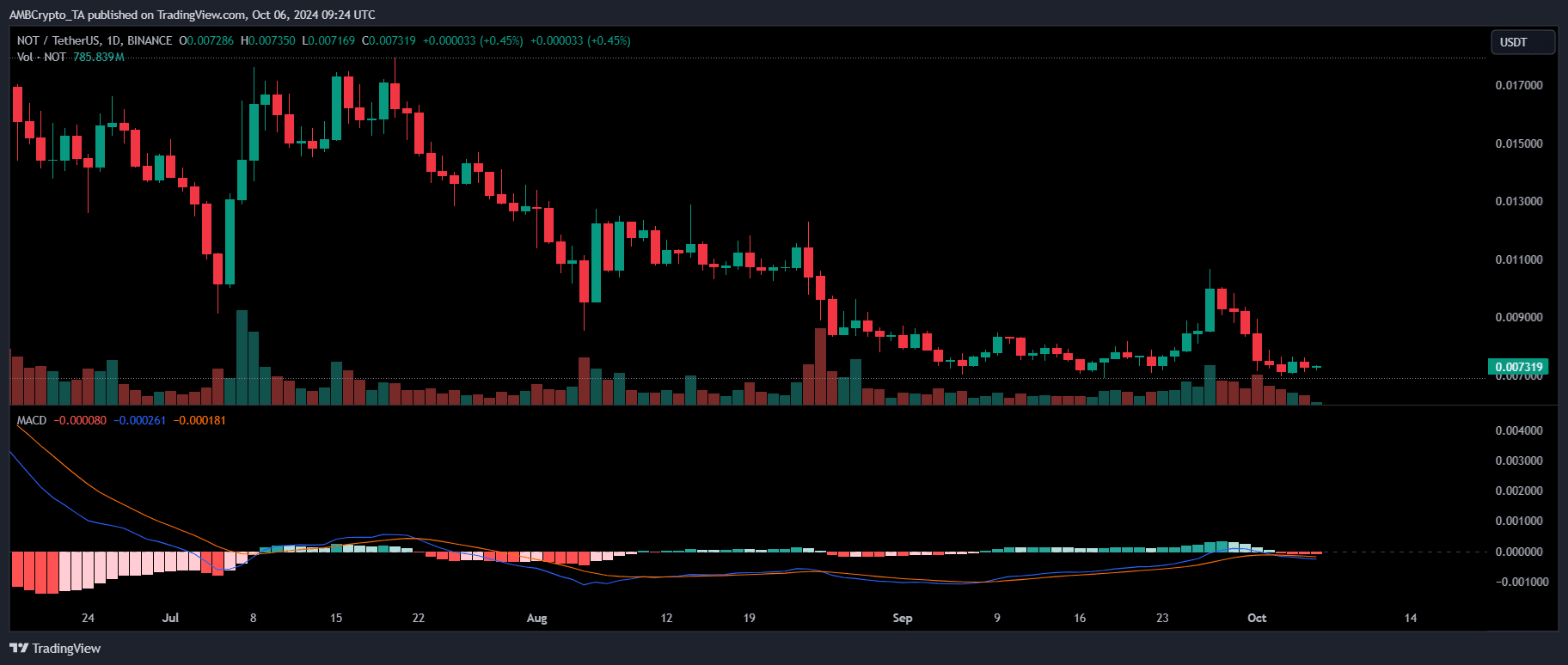

Notcoin [NOT] hit daily new lows, resulting in a 12% drop, making it the biggest weekly loser. It opened the week with a slight dip and experienced a sharper 8% decline the following day.

Trading volume also dropped significantly, plummeting from 8 billion to 3 billion over the past seven days.

NOT entered October with a bearish crossover, as the MACD line (blue) crossed below the signal line (orange). Despite this, a spike in trading volume on the 4th of October prevented a deeper pullback.

Despite a slight rise to $0.007305 as of this writing, NOT’s trading volume has decreased by 25% in a day to $69 million. Its market capitalization was $748 million at press time, down by 2.5%.

Ethena [ENA]

Closing in on NOT is Ethena [ENA], poised to be the next biggest weekly loser, according to CoinMarketCap data.

After opening the week at $0.3389 with a 6% rise, ENA faced a strong depreciation, resulting in over a 20% weekly drop and closing at $0.2750.

ENA’s trading volume has seen a significant 50% drop, now sitting at $49 million. Its market cap stands at $789 million, down by 5%.

Lido DAO [LDO]

Marching closely behind the top two weekly losers is Lido DAO [LDO], which also recorded a decline of over 20%, making it the third-largest loser of the week.

Similar to NOT, LDO faced a challenging week with consistent lows, highlighted by a bearish crossover of the MACD line on the first day of October.

The coin opened at $1.334 and ended the week at $1.051, with a slight recovery made a day prior. Its trading volume has dropped by 43%, settling at around $44 million, while its market cap fell by 2% to almost $942 million.

Biggest losers of the top 500

The biggest loser in the top 500 was Aleo (ALEO), dropping around 40% to $3.90. Following closely was Moo Deng (MOODENG), which dropped 38% to trade at $0.137.

BinaryX (BNX) also faced a setback, recording a 31% decline and trading at approximately $0.7117.

Conclusion

This week’s recap highlights the biggest gainers and losers in the cryptocurrency market. It’s essential to remember the market’s volatile nature, where prices can fluctuate rapidly.

Always conduct your own research (DYOR) before making any investment decisions to stay informed and minimize risks.