Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Like Hansel and Gretel, Deutsche Pfandbriefbank is deep in the woods. The Germany property lender was lured in by the prospect of sweet returns in commercial real estate. Now it is suffering thanks to an interest rate shock and a collapse in demand for offices.

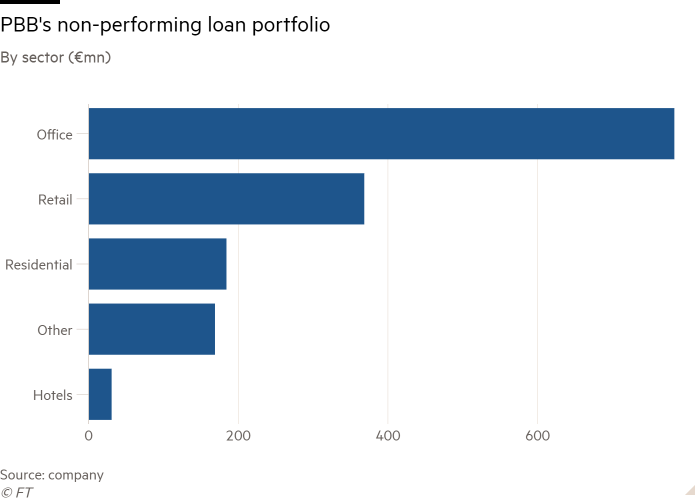

US property exposure is the glaring concern. PBB’s shares have more than halved in the past year. Valuations for US offices have tumbled and vacancy rates are hovering around 20 per cent. PBB’s non-performing US loans doubled to €600mn in 2023, as results last week showed.

The optimistic PBB chief executive Kay Wolf said funding needs were in place for the next six months, backing up this claim with €6bn of liquidity and a CET1 ratio of almost 16 per cent. He expects lower provisions and higher profits this year.

PBB also confirmed it would go ahead with discretionary coupon payments on its AT1 capital buffer bonds. These begin absorbing losses if the bank’s CET1 ratio falls below 7 per cent. The bonds’ price doubled to 40 euro cents as fears eased that the payment would have to be scrapped.

But Wolf is betting on a very soft landing in Europe, where valuations adjust more slowly than stateside. Germany is PBB’s biggest market with 44 per cent of its commercial real estate loans, many to office owners. German office vacancies are around 5 per cent. But the signs of stress are there.

Its development portfolio — with about €3bn of loans tied up in land and building sites — looks particularly troubled. The riskiest projects started when interest rates were at rock bottom and valuations at their peak. Once work on a project stops, loan losses can soar.

Such loans added about €400mn to the total €1.5bn pile of bad debts last year. These will test PBB’s claim that it has the expertise to work these out and avoid dumping assets into falling markets. Either will be difficult. Loan to value ratios for development NPLs are undisclosed and so are probably already above 100 per cent.

Current provisioning still looks thin. Total NPL coverage stands at just 17 per cent once legacy UK shopping centre loans are excluded. That compares with over 30 per cent on average for European banks. Coverage for harder to recover development loans is just 12 per cent. Bringing those closer to the average could cost €200mn of new provisions, thinks Citi.

That is almost as much as the total hit to profits from loss allowances as last year. Do not bank on a fairytale ending for PBB.