- Gold’s parabolic surge sparks risk-off warnings, but Ethereum’s rally hints at risk appetite returning.

- Divergence grows as gold and ETH both climb — signal of macro shift or just market noise?

As gold rips into parabolic territory, seasoned market watchers are raising red flags.

Michael Van De Poppe, known for his timely macro calls, warns that the metal’s vertical climb could mark the onset of a broader risk-off reversal.

Yet, in a curious twist that challenges this cautionary tone, Ethereum [ETH] has bounced back above $1,700; hinting that the risk-on trade may still have breath left in it.

So what gives? Is this an early warning of a macro shift, or are markets merely pausing before their next leg up?

The gold signal

Gold’s breakout is sharp — almost euphoric — with price action accelerating into what Van De Poppe describes as a “wild” move.

But history suggests such vertical rallies often signal exhaustion rather than strength. According to him, this kind of parabolic run tends to precede broader risk aversion.

With recession fears resurfacing, bond market volatility rising, and capital rotating into safe-haven assets, gold’s surge may not be just a bullish trend. It could be the first tremor of a larger macro unwind.

Ethereum: The countermove

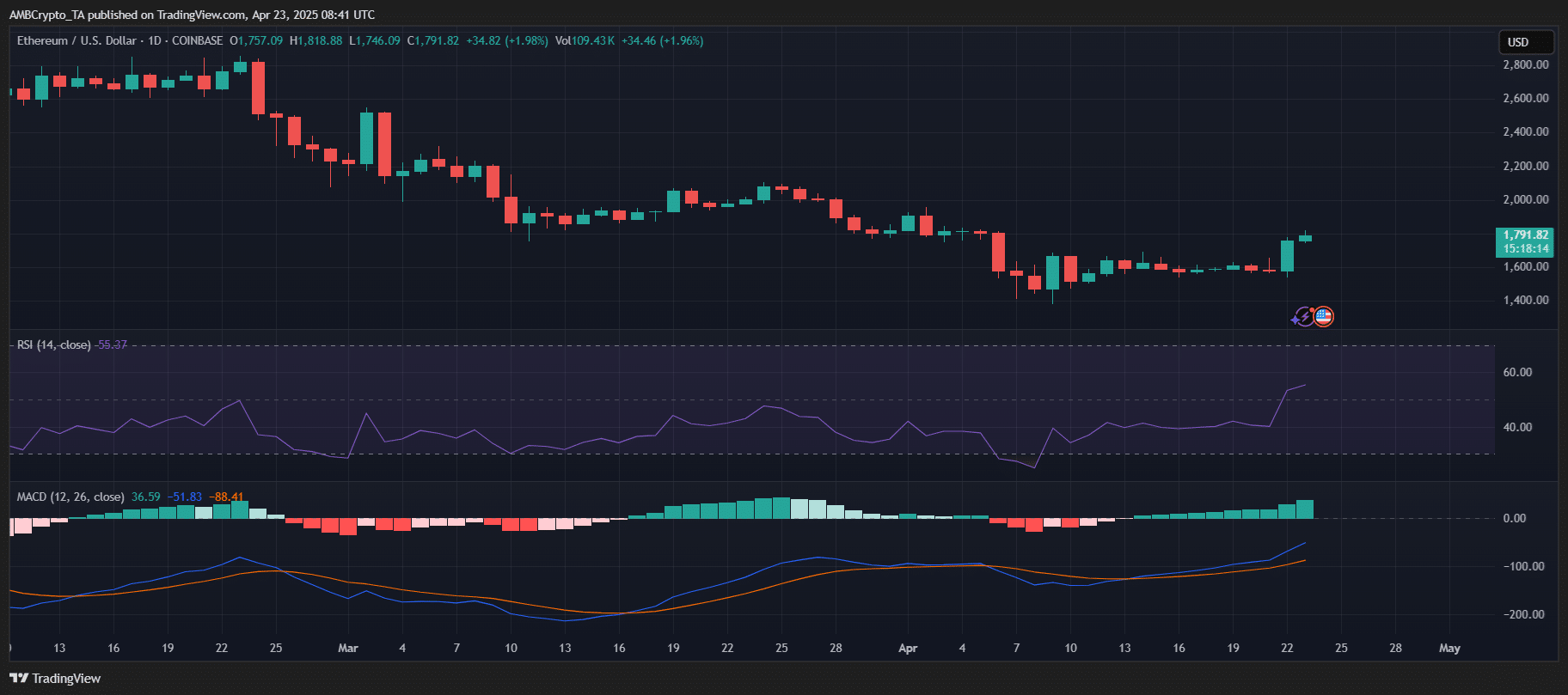

While gold moves in classic risk-off fashion, Ethereum has unexpectedly rebounded, reclaiming the $1,700 level.

At first glance, this appears contradictory — ETH typically thrives during risk-on environments, not amid flight-to-safety behavior. So what’s behind the strength?

On-chain data suggests renewed whale accumulation and a rebound from oversold conditions following recent drawdowns.

Technical indicators back the move, with the RSI climbing above 70 and a bullish MACD crossover forming. Whether this signals a meaningful decoupling or if it is merely noise remains unclear.