Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The EU should create a taxpayer-funded disaster relief fund and a publicly-backed reinsurance scheme to fill the growing gap for insuring against natural catastrophes such as floods and wildfires, regulators have said.

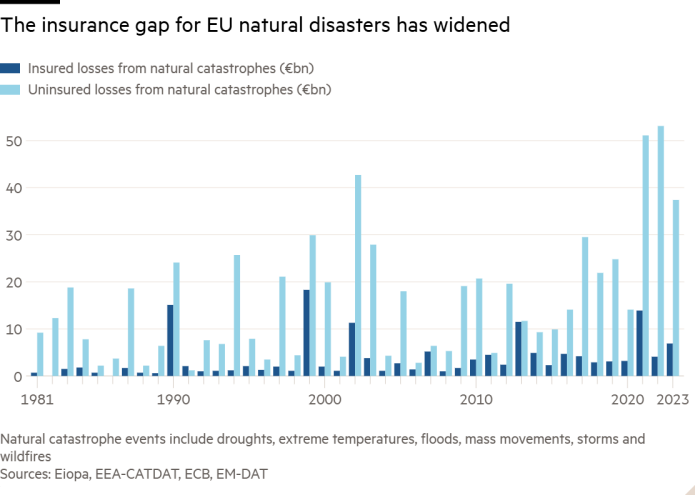

Climate change is increasing the frequency of natural disasters with more of their multibillion euro costs being left uncovered by insurance, the European Central Bank and European Insurance and Occupational Pensions Authority said in a report published on Wednesday.

Only about a quarter of the €900bn of losses caused by EU natural catastrophes in the past 22 years were insured and the level of cover has been falling in recent years, the financial watchdogs said.

They called for the EU to set up a new fund to cover reconstruction costs of major natural disasters, financed with contributions from the bloc’s 27 member states, to bolster current resources that are “too small”.

Intense flooding this year in Europe, in particular Spain, resulted in the second-highest ever insured losses from water damage in the region, according to Swiss Re estimates.

Floods in the Spanish region of Valencia in October left more than 200 people dead, forced thousands of companies to close and damaged vast areas of farmland, which rating agency Moody’s estimated would trigger €3.8bn of insurance losses.

The ECB and Eiopa called on Brussels to follow the lead of several EU countries by setting up a bloc-wide public-private partnership to provide reinsurance of the highest-risk natural disasters backed by public guarantees.

“As natural catastrophes become more frequent and more severe, insurance is expected to become less affordable and the already sizeable insurance protection gap is likely to widen further,” the watchdogs said.

While the regulators lack the power to implement their proposals, they hope to prompt the EU to introduce legislation in line with their recommendations.

“The proposals presented are meant to spark a discussion on possible ways to reduce the insurance protection gap through an EU-level solution, while preserving the integrity of national insurance schemes,” said Eiopa chair Petra Hielkema.

Hielkema told the FT recently there was growing support among politicians in Europe — the world’s fastest-warming continent — for national risk-sharing schemes to cover natural catastrophes.

The EU already has a Solidarity and Emergency Aid Reserve to provide funding to countries hit by severe natural disasters and this year Brussels said its maximum annual budget would be increased from €1.2bn to €2.7bn.

However, the ECB and Eiopa said the reserve’s resources were “still too small to make a significant contribution to reconstruction efforts”. They gave the example of last year’s flooding in Greece, France, Italy, Austria and Slovenia, which caused €23bn of damage — of which only about €1bn has been covered by commitments from the EU fund.

The regulators recommended incentivising countries to do more to tackle the risks of natural disasters by adjusting national contributions to a new EU fund to reflect their risk profiles and making payouts contingent on suitable risk-mitigation.

There are 12 EU countries that have set up national public-private partnerships to provide reinsurance for natural catastrophes, which the regulators said “help improve insurance coverage and reduce the insurance protection gap”.

Recommending the EU set up a similar bloc-wide scheme, they said it “could cover a wider range of perils and assets across several member states, thus allowing for greater risk pooling and risk diversification benefits than at a national level”.

ECB vice-president Luis de Guindos said: “We need to get prepared for the rising climate risks.” He described the proposals as “one possible way to mitigate the macroeconomic and financial stability risks from natural catastrophes, while also reducing moral hazard”.