Eurozone manufacturing recession looks ‘endless’ after latest plunge in activity

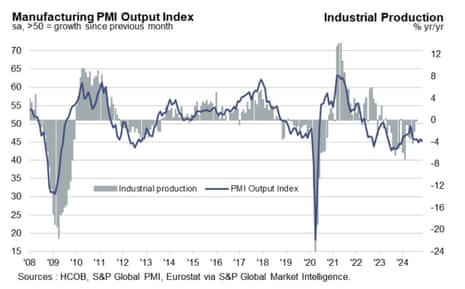

The eurozone’s manufacturing recession has deepened, driven by a sharp slowdown in the region’s largest economies.

Data provider S&P Global has reported that the euro area’s manufacturing sector deteriorated at a faster pace during November.

This wasa driven by quicker declines in new factory orders, production, purchasing activity and inventories.

It pulled the HCOB eurozone manufacturing PMI down to a two-month low of 45.2, down from October’s 46.0. Any reading below 50 shows a contraction.

Among eurozone members, Germany recorded the fastest drop in output, Italy’s factory sector shrank at the fastest rate in a year, while France recorded the steepest contraction in 10 months.

Dr. Cyrus de la Rubia, chief economist at Hamburg Commercial Bank, says:

“These numbers look terrible. It’s like the eurozone’s manufacturing recession is never going to end. As new orders fell fast and at an accelerated pace, there’s no sign of a recovery anytime soon. According to our nowcast, the manufacturing sector’s output is going to decrease by 0.7% in the fourth quarter compared to the previous quarter. This slump is likely going to drag into next year.

“The downturn is widespread, hitting all of the top three eurozone countries. Germany and France are faring the worst, and Italy is not doing much better. By main industrial grouping, it’s the capital goods sector which is taking the biggest hit. In an interesting development, Spain’s companies in the capital goods sector were able to show accelerated growth. This might be linked to the heavy floods in Spain, where an estimated 100,000 cars were destroyed and need to be replaced. But this boom most probably won’t last.

The report also found that companies continue to trim staffing levels, while firms continued to run down their inventories of materials and finished goods as they continued to destock.

Key events

News that the eurozone manufacturing recession has deepened came as Volkswagen workers across Germany began a walkout.

The “warning strikes”, which usually last a few hours, are a protest against VW’s plans to lay off thousands of people, cut pay and close plants for the first time in its home country.

Thorsten Gröger, the union IG Metall’s lead negotiator with VW, said:

“If need be, it will be the toughest collective bargaining battle Volkswagen has ever seen.”

The union leader accused VW managers of making the situation worse, adding:

“Volkswagen has set fire to our collective agreements.”

Eurozone manufacturing recession looks ‘endless’ after latest plunge in activity

The eurozone’s manufacturing recession has deepened, driven by a sharp slowdown in the region’s largest economies.

Data provider S&P Global has reported that the euro area’s manufacturing sector deteriorated at a faster pace during November.

This wasa driven by quicker declines in new factory orders, production, purchasing activity and inventories.

It pulled the HCOB eurozone manufacturing PMI down to a two-month low of 45.2, down from October’s 46.0. Any reading below 50 shows a contraction.

Among eurozone members, Germany recorded the fastest drop in output, Italy’s factory sector shrank at the fastest rate in a year, while France recorded the steepest contraction in 10 months.

Dr. Cyrus de la Rubia, chief economist at Hamburg Commercial Bank, says:

“These numbers look terrible. It’s like the eurozone’s manufacturing recession is never going to end. As new orders fell fast and at an accelerated pace, there’s no sign of a recovery anytime soon. According to our nowcast, the manufacturing sector’s output is going to decrease by 0.7% in the fourth quarter compared to the previous quarter. This slump is likely going to drag into next year.

“The downturn is widespread, hitting all of the top three eurozone countries. Germany and France are faring the worst, and Italy is not doing much better. By main industrial grouping, it’s the capital goods sector which is taking the biggest hit. In an interesting development, Spain’s companies in the capital goods sector were able to show accelerated growth. This might be linked to the heavy floods in Spain, where an estimated 100,000 cars were destroyed and need to be replaced. But this boom most probably won’t last.

The report also found that companies continue to trim staffing levels, while firms continued to run down their inventories of materials and finished goods as they continued to destock.

Stellantis’s Milan-listed shares were just briefly halted from trading in Milan, Reuters, reports, after falling 7.99%.

The pickup in house price growth last month is “unlikely” to have been driven by upcoming stamp duty changes, Nationwide argues, as the majority of mortgage applications commenced before the Budget announcement.

Ouch. Stellantis’s shares are now down 7.3% in Paris.

Carlos Tavares’s resignation comes two months after the departure of Stellantis’s chief financial officer Natalie Knight.

In a research note today, JP Morgan say:

“This sets an unprecedented challenge for investors looking to invest in a firm with such volatility in the management team….

With such a turnaround in the top management team, question marks may be raised as the market will in our view price in no major earnings improvement in FY25.”

Stellantis’s shares are also down on the Milan stock exchange, where they’ve lost 6.6% – after initially not trading when the market opened.

Stellantis shares drop after CEO’s resignation

Shares in car giant Stellantis have dropped at the start of trading, following the surprise resignation of CEO Carlos Tavares last night.

Stellantis’s shares are down 5.5% in Paris, as traders digest the shake-up at the company behind brands including Vauxhall, Fiat, Jeep and Peugeot.

Last night, Stellantis announced that Tavaras would leave “with immedaite effect”, and that the process to appointing the new permanent Chief Executive Officer was “well under way”.

Henri de Castries, Stellantis’s senior independent director, hinted at boardroom tensions last night, saying:

“Stellantis’ success since its creation has been rooted in a perfect alignment between the reference shareholders, the Board and the CEO.

However, in recent weeks different views have emerged which have resulted in the Board and the CEO coming to today’s decision.”

Tavaras departure follows a decline in Stellantis’s financial performance. At the end of October, the world’s fourth-largest carmaker reported a steep fall in sales, which it blamed production delays and flagging demand in Europe.

One person familiar with the situation told the Financial Times:

“[Tavares] was focusing on the short term rather than the group’s longer term and managed to anger everybody in the process.”

House price growth rises: what the experts say

Here’s some reaction to this morning’s Nationwide house price report:

Guy Gittins, CEO of Foxtons:

“After the rate of house price growth slowed in the lead up to the Autumn Budget, the latest figures suggest the market is once again starting to accelerate.

This consistent positivity demonstrates the current strength of the market despite the complications posed by wider economic headwinds. Over the last 12 months we’ve seen a huge increase in new buyer volumes, viewings and offers made and there is a very healthy level of stock currently on the market. So, whilst house prices are climbing, there is certainly a good level of stock for buyers to choose from and the market isn’t overheating due to the usual supply and demand imbalance.

The market traditionally pauses for breath during the festive period, however, we’re seeing a flurry of activity driven by buyers looking to secure stamp duty relief before next April’s deadline. We anticipate the start of next year to be much the same, although those buyers who are looking to take advantage of current stamp duty relief thresholds need to be acting now to stand a chance of completing in time.

Matt Thompson, head of sales at Chesterton:

“November’s property market saw an increasing number of first-time buyers who were and still are motivated to purchase a property before the stamp duty changes in April 2025. This, in addition to high demand from house hunters in general, led to more sales being finalised than in November of last year.

With the current level of buyer activity expected to continue well into the new year, we predict London properties to hold their value or see a gradual value increase of up to 3% over the course of next year.”

Tomer Aboody, director of specialist lender MT Finance:

“Another month of house price growth further indicates the level of confidence in the market which has been evident since the reduction and stability in both mortgage rates and inflation.

“Both sellers and buyers are pushing to transact, as affordability is improving.

“While the Budget is now behind us, its full impact has yet to be felt. However, we are hopeful that this confidence in the market continues, with further rate cuts expected in the new year.”

Jeremy Leaf, north London estate agent:

“In our offices we are seeing prices hardening and stock levels rising, partly because the Budget, though not particularly helpful, was not as bad as many feared either.

“As a result, some pent-up demand was released and buyers are digging a little deeper. That extra choice, as well as broad acceptance that inflation and mortgage rates will not reduce as far and as fast as many expected, has meant caution still prevails. Transaction lengths are extending too, particularly bearing in mind the seasonal distractions so sellers still need to be extra competitive to attract serious attention at this time of year.”

Dollar rallies after Trump’s Brics tariff threat

The US dollar is rallying, after Donald Trump warned countries in the Brics bloc that he would impose 100% tariffs if they challenged America’s currency.

Over the weekend, Trump posted that he would impose 100% tariffs on Brics members if they create a new currency to rival the US dollar.

The president-elect declared:

We require a commitment from these Countries that they will neither create a new BRICS Currency, nor back any other Currency to replace the mighty U.S. Dollar or, they will face 100% Tariffs, and should expect to say goodbye to selling into the wonderful U.S. Economy.

With fears of a trade war rising, the dollar has gained 0.5% against a basket of major currencies – even though there’s no agreement among Brics members to go it along with their own currency.

This has pushed the pound down by half a cent to $1.2695.

The euro, which is also weighed down by political instability in France, is also half a cent lower at $1.052.

Trump’s comments may be a sign that his administration will favour a stronger dollar.

Jim Reid of Deutsche Bank told clients this morning

As ever with Mr Trump it seems to be a shot across the bows but likely wouldn’t ultimately be great for the US economy if implemented….

it seems to further point to Dollar strength being a theme of the new administration as against Trump 1.0 where initially they tried to talk the Dollar down.

Introduction: “Surprising” acceleration in house price growth

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

UK house prices growth has “surprisingly” picked up to a two-year high, a new survey this morning shows, despite the recent rise in mortgage rates.

The average prices of a house sold in November rose by 1.2% compared with October, lender Nationwide reports, to £268,144. That’s the largest monthly gain since March 20.

That lifts the annual increase in house prices to 3.7% – the fastest since November 2022, shortly after Liz Truss’s mini-budget – up from 2.4% in October.

House prices are just 1% below the all-time high recorded in the summer of 2022.

Robert Gardner, Nationwide’s chief economist, says the pace of the increase is unexpected:

“The acceleration in house price growth is surprising, since affordability remains stretched by historic standards, with house prices still high relative to average incomes and interest rates well above pre-Covid levels.

Housing market activity has remained “relatively resilient in recent months”, Gardner adds, with mortgage approvals approaching the levels seen before the Covid-19 pandemic.

Gardner adds:

“Solid labour market conditions, with low levels of unemployment and strong income gains, even after taking account of inflation, have helped underpin a steady rise in activity and house prices since the start of the year. Household balance sheets are also in good shape with debt levels at their lowest levels relative to household income since the mid-2000s.

Nationwide also predicts there will be a jump in transactions in the first three months of 2025. as buyers try to seal deals before changes to stamp duty kick in next April.

These surveys from lenders can’t give a perfect measure of the market though; they only track buyers taking out a mortgage, rather than cash buyers. And changes in the ‘mix’ of houses being sold can also distort the data.

The agenda

-

9am GMT: Eurozone manufacturing PMI report for November

-

9.30am GMT: UK manufacturing PMI report for November

-

10am Christine Lagarde speaks at the EIB Group Climate and Environment Advisory Council in Luxembourg

-

2.45pm GMT: US manufacturing PMI report for November