US inflation slowed to 6.4%

Newsflash: US inflation was higher than expected in January.

The US consumer prices index rose by 6.4% in the year to January, the U.S. Bureau of Labor Statistics reports, only slightly lower than December’s 6.5%.

That’s higher than expected (the consensus was for a drop to 6.2%), but it is the smallest 12-month increase since October 2021.

In January alone, prices rose by 0.5%, an acceleration after rising 0.1% during December.

The index for shelter was by far the largest contributor to the monthly increase in inflation, accounting for nearly half of the pick-up, the BLS says. The indexes for food, gasoline, and natural gas also contributed.

The report explains:

The food index increased 0.5 percent over the month with the food at home index rising 0.4 percent. The energy index increased 2.0 percent over the month as all major energy component indexes rose over the month.

The drop in the annual rate does suggest that price pressures are easing, but not by as much as economists had thought.

Oooopf…

US CPI came out higher than expected.

Out at 6.4% vs 6.2%. Previously 6.5%.

— Johann Biermann 🇿🇦 (@JohannBiermann1) February 14, 2023

Key events

Filters BETA

Jason Furman, the former director of Barack Obama’s National Economic Council, is concerned about core US inflation:

A month ago 3 month-annualized supercore inflation (i.e., ex food, energy, shelter and used cars) was 1.8%.

Now with new seasonal adjustment and an additional month of data it is 3.7%.

Time to update your inflation views. pic.twitter.com/5C1PSoozCt

— Jason Furman (@jasonfurman) February 14, 2023

Most anyway you look at it underlying inflation is well above 3%. And underlying inflation may not even be coming down. And that is even before you start to think about the upward pressure that could be exerted from the extremely tight labor market. pic.twitter.com/SODS8LnL7R

— Jason Furman (@jasonfurman) February 14, 2023

I have a hard time seeing how the implied market breakeven of 2% inflation this year makes any sense. Absent a recession inflation below 3% is unlikely. And even with one inflation below 3% is far from guaranteed. pic.twitter.com/pGmdJ6g3n8

— Jason Furman (@jasonfurman) February 14, 2023

US inflation report: What the experts say

The year-on-year US inflation figures are not looking good, warns Neil Birrell, Chief Investment Officer at Premier Miton Investors.

Core inflation is higher than expected and we may have seen a pause in the improvement that we have been hoping for.

The outlook remains clouded by the uncertainty over inflation and resultant policy action. This might have all been priced in the short term, but it’s the longer term that should be the concern.”

The 0.5% m/m increase in consumer prices in January illustrates that US inflation is “still declining only gradually”, says Andrew Hunter, chief US economist at Capital Economics.

But… Hunter does still expect that downward trend to accelerate soon, as easing goods shortages feed through and housing inflation starts to turn down.

He says:

The headline index was boosted by a 2.0% m/m rebound in energy prices, but that partly reflects a strong rise in household utilities prices, which is very hard to square with the recent plunge in natural gas spot prices.

Core prices rise by a slightly smaller 0.4% m/m, with a 0.1% rebound in core goods prices offsetting a slower gain in core services, which rose by 0.5%. The former came despite a further 1.9% m/m decline in used vehicle prices, and instead mainly reflected a 0.8% gain in clothing prices, a 0.5% rise in household furnishings prices and a 2.1% rise in prescription drug prices. With the surveys continuing to suggest that global goods supply chain shortages are fading rapidly, we suspect it’s only matter of time before core goods prices resume their decline.

Tom Kremer, senior macro strategist at Quintet Private Bank, says US inflation continues to be on a downward trend, but the decline may not be quite as fast and smoothly as markets had come to anticipate in recent months.

Kremer explains:

Having said that, shelter inflation in particular will become a supporting factor later in the year once the observed declines in rents feed through to the official inflation measure, while base effects should also turn favourable as last year’s large increases in spring and summer fall out of the calculations.

While today’s data was somewhat disappointing for those hoping for a rapid normalisation in inflation pressures, we don’t think it fundamentally changes the outlook for the Federal Reserve. We look for the Fed funds rate to peak just above 5% in spring, followed by long pause as policymakers wait for evidence that underlying price pressures – particularly in core services – are moderating more sustainably alongside a rebalancing in the labour market.

Full story: US inflation eases again for seventh consecutive month

Dominic Rushe

Inflation continued to cool in the US in January, rising at an annual rate of 6.4%, according to figures released on Tuesday by the Bureau of Labor Statistics, our US business editor Dominic Rushe reports.

The consumer price index (CPI) – which measures a basket of goods and services – has now fallen for seven consecutive months, down from a four-decade high of 9.1% last June and down from an annual rate of 6.5% in December.

On a monthly basis, prices rose 0.5% from 0.1% in December, showing the continuing strength of inflationary pressures as the cost of shelter rose again.

The fall was smaller than some economists had expected, however, January’s rise was still the smallest 12-month increase since the period ending October 2021. After subtracting volatile food and energy prices, the so-called “core index” rose 5.6% over the last 12 months, its smallest 12-month increase since December 2021.

Here’s the full story:

Over the past year, the cost of food to consume at home has jumped by 11.3% in America.

Today’s inflation report shows that the index for cereals and bakery products rose 15.6 percent over the 12 months ending in January.

Fruit and vegetable prices are up 7.2% over the year, while dairy and related products cost 14% more.

Eating out is also much pricier, with the index for food away from home up 8.2% over the last year.

It’s not hard to understand why Americans are still frustrated w/this economy when you look at the latest inflation report:

Groceries +11.3% in past yr

Eating out +8.2%

Natural gas +26.7%

Electricity +11.9%

Rent +8.6%

Airfare +25.6%

Vehicle insurance +14.7%

Pet services +8.4%— Heather Long (@byHeatherLong) February 14, 2023

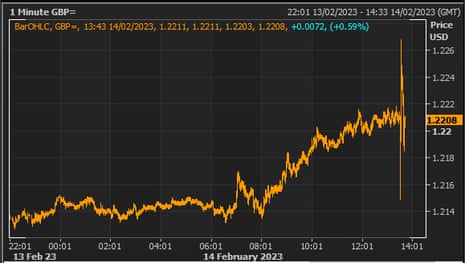

There were also wild swings in the bond market:

We promised you volatility in the markets when the US inflation report was released – and the pound did not disappoint.

Sterling had been trading around $1.22 before the CPI data hit the wires – it promptly slumped to $1.215, before immediately retracing its steps and soaring over $1.226.

The pound is now back to $1.221, presumably feeling a little queazy.

Neal Keane, head of sales trading at the international brokerage ADSS, says the CPI report shows that the battle from inflation has hit headwinds.

“US CPI holding relatively flat at 6.4% shows that the Fed’s fight against inflation has met some headwinds as it tries to move closer towards its 2% inflation target.”

Core US inflation slowed in the year to January too.

The all items less food and energy index rose 5.6% over the last 12 months, its smallest 12-month increase since December 2021, the inflation report says.

In January alone, core inflation rose by 0.4%, lifted by shelter (ie housing costs), motor vehicle insurance, recreation, apparel, and household furnishings.

The Federal Reserve will be watching core inflation measures closely, for signs as to whether inflationary pressures are ebbing.

Here’s Heather Long of the Washington Post on the increase in monthly US inflation last month:

JUST IN: US inflation cooled slightly to 6.4% in January (y/y), down from 6.5% in December and the high of 9.1% in June.

But…on a monthly basis, inflation rose +0.5% in January –> This is a pickup

Overall, rent, food and energy are driving a lot of inflation now.

— Heather Long (@byHeatherLong) February 14, 2023

US inflation slowed to 6.4%

Newsflash: US inflation was higher than expected in January.

The US consumer prices index rose by 6.4% in the year to January, the U.S. Bureau of Labor Statistics reports, only slightly lower than December’s 6.5%.

That’s higher than expected (the consensus was for a drop to 6.2%), but it is the smallest 12-month increase since October 2021.

In January alone, prices rose by 0.5%, an acceleration after rising 0.1% during December.

The index for shelter was by far the largest contributor to the monthly increase in inflation, accounting for nearly half of the pick-up, the BLS says. The indexes for food, gasoline, and natural gas also contributed.

The report explains:

The food index increased 0.5 percent over the month with the food at home index rising 0.4 percent. The energy index increased 2.0 percent over the month as all major energy component indexes rose over the month.

The drop in the annual rate does suggest that price pressures are easing, but not by as much as economists had thought.

Oooopf…

US CPI came out higher than expected.

Out at 6.4% vs 6.2%. Previously 6.5%.

— Johann Biermann 🇿🇦 (@JohannBiermann1) February 14, 2023

There’s less than five minutes until the US inflation report is released….

The consensus forecast is that annual CPI inflation slowed to 6.2%, from 6.5% in December.

Everybody thinks inflation is going to come in higher than people think

— Joe Weisenthal (@TheStalwart) February 13, 2023

In the energy market, OPEC has raised its 2023 forecast for global oil demand growth in its first upward revision for months.

The Paris-based thinktank cited China’s relaxation of COVID-19 restrictions and slightly stronger prospects for the world economy.

Global oil demand will rise this year by 2.32 million barrels per day (bpd), or 2.3%, the Organization of the Petroleum Exporting Countries (OPEC) said on Tuesday in a monthly report. The projection was 100,000 bpd higher than last month’s forecast.

“Key to oil demand growth in 2023 will be the return of China from its mandated mobility restrictions and the effect this will have on the country, the region and the world,” OPEC said in the report.

“Concern hovers around the depth and pace of the country’s economic recovery and the consequent impact on oil demand.”

The markets could be volatile once the US inflation report hits the wires:

JPMorgan traders say the S&P 500 is set for a wild ride after Tuesday’s inflation report.

There is a 65% chance the S&P moves up 1.5% to 2% if US CPI comes in between 6.0% to 6.3%.$SPY $SPX $ES_F 🇺🇸 🇺🇸 pic.twitter.com/FuJzmxt6Bt

— Jesse Cohen (@JesseCohenInv) February 14, 2023

Wall Street stock index futures have crept a little higher, ahead of January’s US consumer inflation data at 1.30pm UK time (8.30am EST).

That report could offer investors further clues to when the Federal Reserve might relax monetary policy.

The Dow Jones industrial average is 0.1% higher in pre-market trading, while the broader S&P 500 is on track to open 0.25% higher.

The global oil and gas industry’s profits in 2022 jumped to some $4 trillion from an average of $1.5 trillion in recent years, the head of the International Energy Agency (IEA), Fatih Birol, said today.

Reuters has the details:

Despite those profits, countries depending on oil and gas revenue should prepare to reduce their reliance on petroleum as demand is going to fall in the longer term, Birol told a conference in Oslo while speaking via video link.

“Especially the countries in the Middle East have to diversify the their economies. In my view, the COP28 (climate summit) could be an excellent milestone to change the destiny of the Middle East countries,” Birol said.

“You cannot anymore run a country whose economy is 90% reliant on oil and gas revenues because oil demand will go down,” he added.

This year’s United Nations climate talks will be hosted by the United Arab Emirates, a members of the OPEC group of oil producing countries.

The jump in energy prices due to Russia’s invasion of Ukraine allowed several oil giants to report record profits for last year, including BP, Shell, Exxon and Chevron.

After a morning of gains, the FTSE 100 index is trading around 7981 points as the clocks chime noon in the City, up 0.45% or 34 points.

That leaves the index firmly on track for a new alltime closing high today, after it hit a new intraday high of 7996 points this morning.

Investors will be watching the latest US inflation report, in 90 minutes, to see if price pressures have eased. If so, shares could be lifted higher still, perhaps to the heights of 8,000 points for the first time….

The FTSE 100 is up 30 at 7977.

News editors everywhere are going, come on, just another 23, then we can run that 8000 headline thing…— SimonEnglish (@SimonEngStand) February 14, 2023

Rob Morgan, chief investment analyst at Charles Stanley points out that the FTSE 100 has underperformed other indices over the last 20 years, but it has a good track record of returning dividends to shareholders.

“Over the past two decades, the UK’s FTSE 100 index has been a poor performer compared with most other markets. The index, representing the 100 largest stock market-listed UK companies, is a mere 25% higher than at the turn of the millennium.

“Admittedly, this represents an unflattering starting point. The index was puffed up by unsustainable valuations of ‘TMT’ stocks during the dotcom bubble in the late 1990s. Yet it has been a clear laggard against the US or emerging markets where investors have comfortably trebled their money – in capital growth terms alone.

“Where the FTSE has stood out, and consequently generated respectable returns, is dividends – the profits declared by companies and paid to shareholders. Reinvesting these for growth has boosted returns substantially, and the old fashioned values of seeking out sustainable and growing pay outs from shares could finally nudge it over the line to its next milestone: 8,000 points.”

Britain welcomes Air India deal with Airbus and Rolls-Royce

The UK government has welcomed the news today that Air India has agreed to buy 250 jets from Airbus, including 210 narrowbody planes and 40 widebody aircraft

The deal is part of a huge order by Air India for 470 planes, which is expected to also include an order for 220 planes from Airbus rival Boeing, Reuters reports, as the airline heralds a decade-long expansion and reinvents itself under the new ownership of Tata.

N Chandrasekaran, chairman of Tata Group, said today:

“We on our part are going through a massive transformation because we are committed to building a world class airline. One of the most important thing is a modern fleet which is efficient and can perform for all routes.”

Prime minister Rishi Sunak says the deal will create jobs and boost exports from Britain, where the French planemaker designs and makes aircraft wings.

The deal should create 450 manufacturing jobs and bring more than £100m of investment to Wales, where Airbus manufactures wings, the British department for business and trade said.

The deal also includes 40 wide-body A350 aircraft powered by Rolls-Royce engines, which are assembled and tested in Derby in central England.

Holiday group TUI has given travel stocks a lift today, by telling shareholders it is seeing encouraging booking trends for summer and next winter.

TUI reported that it carried 3.3m customers in the final quarter of 2022 – an increase of one million versus the prior year, and 93% of the number just before the pandemic in October-December 2019.

Booking volumes overall in the last four weeks are now above pre-pandemic at higher prices, TUI said:

The start into the new year has seen significant booking momentum with record booking days online in both the UK and Germany.

Shares in TUI are up 1.7% this morning, on the FTSE 250 index of medium-sized companies. EasyJet have gained 4.4% and Wizz Air are up 2.1%.

Concerns among investors of a global recession have ‘melted away’, according to a survey of European fund managers.

Bank of America reports that a net 24% of those fund managers polled think the global economy will go into a recession over the next twelve months. That’s down from 51% last month and a peak of 77% in November.

This easing of recession worries has helped to push up stock markets this year.

BofA says:

Whereas 61% of investors still think European growth will slow in response to tightening credit conditions (down from 70% last month), a growing share of 33% expects growth to be resilient thanks to savings and order backlogs (up from 16%). 33% see resilient US growth in the near term before a slowdown due to monetary tightening (up from 25%).