Insolvencies jump 16% in England and Wales

The number of firms collapsing into insolvency across England and Wales jumped last month, as companies were hit by economic headwinds such as soaring costs and weak consumer spending.

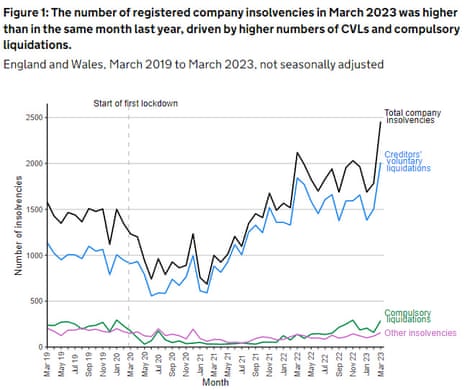

There were 2,457 company insolvencies in March, government data shows, which is a 16% increase on the same month a year ago.

Compulsory liquidations more than doubled, to 288.

The Insolvency Service explains:

Numbers of compulsory liquidations have increased from historical lows seen during the coronavirus pandemic, partly as a result of an increase in winding-up petitions presented by HMRC.

There was also a 9% increase in Creditors’ Voluntary Liquidations (CVLs), to 2,011, in which directors decide to put their company into liquidation because it is insolvent.

Experts say this jump in insolvencies shows the economic pressures facing UK companies.

Gareth Harris, partner at RSM UK Restructuring Advisory, explains:

‘It is clear from these latest numbers and our increasing workloads that while we may not be in a technical recession, the economic headwinds are continuing to bite.

Although some confidence is returning in the wider economy those companies that are struggling are clearly seeing less options available to them than in the last four years. The majority of the current insolvency figures remain “shut-down” style liquidations of smaller companies which we expect to peak soon before falling in the second half of the year.

David Hudson, restructuring advisory partner at FRP, warns that high energy bills could force more companies to close down:

“More and more firms are at risk of tipping from ‘danger’ to ‘distress’. And with trading conditions still punishing, we can anticipate higher than-usual levels of insolvency for some time to come.

“Energy is one factor that will continue to pose a significant threat to businesses’ stability. While wholesale prices have been falling, the new government support scheme provides businesses with less protection from future volatility. As just one example of the impact this could have, as many as a fifth of retailers we recently polled were not confident in trading through the next year with this degree of reduced support.

“Additionally, nearly all Covid-19-era support measures have now closed to businesses, with many now having to service repayments on Covid support debt – only adding to the pressures they face.”

Key events

Closing summary

Time to wrap up… here are today’s main stories.

First on today’s jobless figures….

… the cost of living squeeze….

…The clampdown on energy firms…

….The latest economic data…

…and also:

FTSE 100 posts eighth day of gains

In the City, the FTSE 100 shares index has closed 30 points higher at 7909 points, its eighth daily rise in a row.

That’s its joint-best run since December 2020, when it also rose for eight days in a row.

Mining stocks were lifted by China’s forecast-beating growth of 4.5% in the first quarter of this year, while gambling company Entain gained 7.2% after reporting a rise in gaming revenue this morning.

Hopes that the UK economy might avoid recession this year have also boosted markets in recent weeks, while the panic in the US and European banking sector has eased.

Following this morning’s rise in unemployment, and higher-than-expected pay growth, City investors are now bracing for the latest inflation data.

Economists predict that Britain’s annual inflation rate could fall below 10% for the first time since last August when the latest official figures for the cost of living are released at 7am on Wednesday (see you there!).

Our economics editor Larry Elliott reports:

A sharp fall in energy prices is thought likely to have dragged down the government’s preferred measure of inflation from 10.4% in February to 9.8% in March, according to a poll of economists conducted by Reuters.

The Bank of England, which is responsible for hitting the official 2% inflation target, believes there will be further falls over the coming months as the impact fades of last year’s invasion of Ukraine by Russia.

The consumer prices index rose by 1.1% in March alone last year, followed by a further 2.5% increase in April, but the price of gas on global wholesale markets is now lower than it was before the war began on 24 February 2022.

We’ve seen a flurry of takeover approaches in recent days, and a dearth of companies coming onto the stock market to replace them.

My colleague Nils Pratley has a solution: create a regulated platform that would allow private companies to operate share-trading windows – perhaps once a week or once a month – as a stepping stone towards the public arena.

That could cut the number of start-ups who cash out through a sale to private equity, rather than floating….

As Nils explains:

The aim is to lessen the perceived cliff edge between private ownership and quoted life. A company would get access to a bit of public market liquidity without the full-blown reporting demands of a proper IPO. Early-stage backers would be able to cash in a few chips, which might dampen their lobbying for an all-or-nothing outcome in which a trade sale too often beats an IPO. Big UK institutional investors would be able to test the waters, get familiar with a company and maybe, over time, exert influence in favour of the stock market.

The proposal is clearly not a cure-all (reforming the regulatory rulebook in areas where London’s setup just looks more cumbersome than other venues is probably more important). Nor is it likely to happen soon, since stock exchange officials are clear that some serious rewriting of rules would be necessary, not least to ensure equality of information between all investors while still preserving the looser touch of private life. Nor, obviously, would all companies on such a new platform convert to the full market. But, after a taster experience, some might.

At the very least, it is a genuinely novel idea since it isn’t being done elsewhere. If the London Stock Exchange wants to be “young and scrappy” to compete, as newish boss Julia Hoggett has argued, this is the sort of thing it should be trying. The dominance of private equity has gone too far.

Richard Partington

India and Russia have entered “advanced negotiations” over a free trade agreement that aims to build closer economic ties as most western governments push to isolate Moscow over the war in Ukraine.

In a development likely to add to tensions in Washington, London and EU capitals, Russia and India’s trade ministers said on Monday the two countries were in talks to strike a free trade deal.

Speaking on a visit to Delhi, the Russian deputy prime minister Denis Manturov, who is also the trade minister, said:

“Together with the Eurasian Economic Commission, we are looking forward to intensifying negotiations on a free trade agreement with India.”

Sarah Butler

Online UK retail tech company THG said its annual losses widened last year to £550m amid higher costs and as home shopping waned with the end of pandemic lockdowns.

Shares in the troubled group dived 17% on Tuesday as it revealed that pretax losses had almost tripled in the year to 31 March while sales had risen just 2.7% to £2.2bn.

THG, formerly known as The Hut Group, said it had faced higher prices for vital commodities including whey, a product in its sports nutrition business. It had also taken on one-off costs from cutting 2,000 jobs at ditched divisions including the specialist cycling site ProBikeKit.

The group has written down the value of assets to reflect “more challenging global markets”.

The cost of settling tens of thousands of lawsuits alleging that talc in its iconic Baby Powder and other products caused cancer has pushed Johnson & Johnson into the red.

J&J reported a net loss of $68m for the first quarter of this year, down from a profit of $5.15bn in Q1 2022.

Earnings were pulled down by a $6.9bn litigation expense.

Earnings per share fell by 101.6% to -$0.03 in Q1, from $1.93/share a year earlier, due to this charge.

J&J also reported a gross profit of $16.35bn on $24.75bn of sales.

Earlier this month J&J agreed to pay $8.9bn to settle with talc claimants, after a January appeals court invalidated its attempt to offload the liability on to a subsidiary that immediately filed for Chapter 11 bankrupcy protection.

Reuters reports today that a Johnson & Johnson subsidiary is again asking a U.S. judge to pause tens of thousands of lawsuits alleging that the company’s baby powder and other talc products cause cancer.

This is another attempt to resolve the litigation in bankruptcy after a federal appeals court found its first attempt improper. More here.

Hundreds of UK civil servants working in JobCentres are to stage a fresh strike in a long-running dispute over jobs, pay, pensions and conditions.

The Public and Commercial Services union (PCS) said more than 600 of its members at 13 JobCentres in Glasgow and Liverpool will walk out for five days from May 2.

The union said Glasgow has been targeted for disruptive action because it is one of the areas piloting a scheme on claimants having to attend an office several times over two weeks, while Liverpool will face action because of plans to close a local JobCentre.

Wall Street has made a mixed start to trading, with Goldman Sach’s drop in profits dampening the mood.

The Dow Jones industrial average is down 0.35% or 122 points in early trading, at 33,864 points, with Goldman leading the fallers, while the tech-focused Nasdaq Composite is 0.2% higher.

Bank of America had a stronger start to the year, though, reporting a 15% increase in pretax income in the first quarter of 2023.

BofA benefited from higher interest rates and solid loan growth, but did also set aside $931m to cover potential credit losses.

On Wall Street, shares in Goldman Sachs have dropped 3% at the open after it reported a drop in earnings.

Net profits at Goldman Sachs fell 18% in the first quarter of this year, to $3.23bn. It also missed analysts’ expectations for revenue, after taking a $470m hit related to the sale of loans from its consumer unit, Marcus.

David Solomon, Goldman’s chairman and chief executive officer, says it was an eventful quarter.

The events of the first quarter acted as another real-life stress test, demonstrating the resilience of Goldman Sachs and the nation’s largest financial institutions.

But Goldman did suffer from a slowdown in dealmaking, which led to lower net revenues at its Global Banking & Markets arm.

The company says:

Investment banking fees were $1.58 billion, 26% lower than the first quarter of 2022, primarily due to significantly lower net revenues in Advisory, reflecting a significant decline in industry-wide completed mergers and acquisitions transactions, and Debt underwriting, reflecting a decline in industry-wide volumes.

EasyJet boss says travel sector better prepared this summer

The boss of easyJet has said the travel industry is much better prepared for this summer than last year, when staff shortages led to chaos at airports – but passengers are likely to pay significantly more to get away.

The budget airline lifted its profit outlook for this year after summer bookings rose and passenger numbers over Easter returned to pre-pandemic levels. Fares have risen sharply, although Johan Lundgren, the easyJet chief executive, defended the increase as being largely driven by fuel and comparable to wider cost-of-living rises in supermarkets.

Revenue per seat, which is mainly fares, rose by 31% in the last quarter and is expected to be 20% higher than 2022 until the end of June, although it “remains to be seen” where demand would push fares in summer.

Lundgren said the £12 average increase in the last few months was “a couple of coffees and a snack in an airport”.

He said the airline had completed its largest ever crew recruitment drive, after hiring around 3,000 people in the last year.

He said:

“We are fully recruited in terms of cabin crew and pilots but of course the difficulty is that you will see weaknesses across the industry in other parts of the chain – but everybody is significantly better prepared than they were at this point last year”.”

More here:

The US housing sector cooled last month, new official data shows.

The number of building permits issued to permit new houses to be built fell by 8.8% month-on-month in March, to an annual rate of 1,413,000. That’s almost 25% lower than a year ago.

New housing starts dipped a little too last month, to 1,420,000. That’s 0.8% less than in February, or 17.2% lower than in March 2022.

Housing Starts & Building Permits Data Are A Leading Indicator.

Although it tends to be a volatile statistic, it’s prudent to monitor the MoM changes since they can reflect the monthly impact of mortgage rates on the overall housing market.

Mar activity showed a cooling in both. pic.twitter.com/WbwVQCSJ2D— Jerry Kopensky – REALTOR® (@JerryKopensky) April 18, 2023

Exclusive: Liontrust Asset Management is among the suitors showing an interest in a takeover of its struggling Zurich-listed peer, GAM Holding. A combination of the two companies would create a fund manager with roughly £100bn under management. https://t.co/XcRTFRRWPZ

— Mark Kleinman (@MarkKleinmanSky) April 18, 2023

Liontrust in talks over possible buyout of Zurich-based GAM Holding

Liontrust Asset Management is exploring a takeover of GAM Holding, its struggling Zurich-listed peer.

Liontrust Asset Management says it is in talks with GAM over a potential buyout of the Zurich-based company, but did not disclose any terms of the offer.

The London-listed fund manager said the proposed deal intends to combine GAM’s investment management business with its unit, Reuters adds.

The news comes after Sky News reported that Liontrust was among a number of parties which have been actively considering a bid for GAM.

GAM’s share price has jumped 15% today, to 0.69 Swiss francs, but is down 95% over the last five years.

GAM has been engulfed in turmoil linked to the collapse of Greensill Capital, the controversial supply chain finance group advised by former PM David Cameron.

In 2018 GAM surprisingly fired its former top fund manager, Tim Haywood. Haywood, a star performer at GAM, had invested in bonds issued by Greensill.

The UK’s FCA later fined GAM and Haywood, £9.1m and £230,000 respectively, over failings including not reporting a dinner at Buckingham Palace, a £15,000 private jet trip to Sardinia, or secret fees and share options offered to his company by Greensill.

Haldane, Valero and Symonds to join Hunt’s economic advisory council

Andy Haldane, the ever-quotable former Bank of England chief economist, is joining the group of experts advising chancellor Jeremy Hunt how to run the economy.

The Treasury has announced that Haldane, productivity and growth expert Dr Anna Valero and Sir Jonathan Symonds, the chair of pharmaceuticals firm GSK, are joining Hunt’s Economic Advisory Council.

The Council was announced last October, when Hunt was trying to rebuild confidence in the government after the mini-budget shambles. It already includes Rupert Harrison, a former advisor to George Osborne, Karen Ward of JP Morgan Asset Management, and former Bank of England policymakers Sushil Wadhwani and Gertjan Vlieghe

Today, Hunt says:

“I am delighted to announce three new members of the Economic Advisory Council who collectively have decades of economic experience across the private and public sector.

“Economic growth is essential to our long-term prospects and in the face of global headwinds, this council plays a critical role in helping our economy meet these challenges.”

Haldane left the BoE in the summer of 2021, with a prescient warning that the ‘beast of inflation’ was prowling in the UK economy.

During his time at the Bank, he rattled out some rather decent speeches.

This included comparing curbing financial crises to a dog chasing a frisbee (the trick, apparently, is to peg along at a speed where the angle of gaze to the frisbee remains roughly constant), and explaining monetary policy in the context of cricket shots (playing off the back foot works best when there are reasons to be fearful).

And last summer, Haldane warned that Britain’s serious economic problems won’t be solved by massive tax cuts, telling The Guardian:

“The solution to the growth conundrum and the solution to the cost of living crisis both lie squarely on the supply side of the economy.”

Europe’s Stoxx 600 share index hits 14-month high

Back in the financial markets, European stock markets have hit their highest level since February 2022.

EUROPE’S STOXX 600 HITS FRESH 14-MONTH HIGH, LAST UP 0.51%

— *Walter Bloomberg (@DeItaone) April 18, 2023

The pan-European Stoxx 600 has gained 0.5%, lifted by the stronger-than-forecast Chinese growth data this morning.

It’s trading at 469.32, a 14-month high.

Investors are hopeful that China’s recovery is on track, after GDP rose by a better-than-expected 4.5% per year in Q1, as we learned overnight.

Raffi Boyadjian, lead investment analyst at XM, says:

The economic recovery in China appears to be gaining tract as GDP expanded by a stronger-than-expected 4.5% in the first quarter of 2023, beating forecasts of 4.0%. At a quarterly level, growth quickened to 2.2% from an upwardly revised 0.6% in the prior period.

However, the upbeat data didn’t offer everything the markets wanted to hear as the reopening rebound was led mainly by consumers and private investment remained weak, raising question marks about the sustainability of the recovery. Property investment was one of the soft spots as, despite a pickup in sales, new developments slumped in the three months to March.

Recent turmoil in the banking sector could push UK insolvencies higher this year, according to David Kelly, Head of Insolvency at PwC.

Kelly explains:

“While there was some good news earlier this month that the UK avoided a technical recession, this has been of little comfort to businesses, many of whom are still struggling with adverse economic conditions.

As a result, there has been a sharp uptick in insolvencies in March, with 2,457 the highest we’ve seen this year so far and the highest they have been for 4 years.

“Businesses are struggling to secure financing and pay off their loans due to high interest rates and the wider impact inflation and consumer sentiment is having on sales and cash flows, so company insolvencies will likely continue to rise in the short term, making for a challenging spring. This is particularly the case following the collapse of Silicon Valley Bank, which has caused lenders to reassess risk appetites. However, hard hit sectors like hospitality and leisure might soon begin to reap the benefits of the weather improving, so we hope to see the number of insolvencies in these sectors dip during the summer months, which will be a relief to pubs, restaurants and hotels who have struggled through the start of the year.