- Markets price in more rate cuts as two MPC members vote for bigger fall

- Inflation is expected to rise, and could hit 3.6% this summer

The FTSE 100 close at a new record high after soaring 103.99 points to 8727.28 today.

It also hit a new intraday record of 8,767.50 earlier as investors cheered a ‘dovish’ Bank of England base rate cut, despite forecasts of a worsening economic outlook.

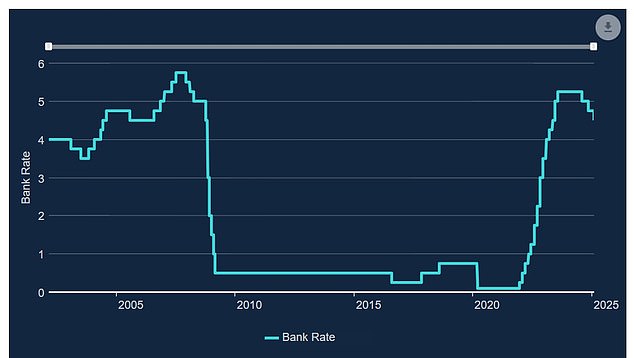

Base rate fell by 25 basis points to 4.5 per cent after a 7-2 vote of the bank’s Monetary Policy Committee, with the two dissenting policymakers voting for a more aggressive cut of 50bps.

The FTSE 100 extended earlier gains in the wake of the announcement. Gains were achieved across all sectors as sterling fell, boosting multinationals with overseas earnings. The FTSE 250 closed up 1 per cent.

Investor enthusiasm was not dented by upgrades to the bank’s forecast for inflation, which is now set to rise from 2.5 to 3.5 per cent by June, and weaker economic growth.

The bank thinks wage, energy and food costs will drive inflation higher, with CPI set to remain above its 2 per cent target for the next two years.

However, the bank said policy makers think this pick-up in headline inflation ‘will not lead to additional second-round effects on underlying domestic inflationary pressures’.

The British economy is now forecast to grow by just 0.75 per cent this year, half of the 1.5 per cent predicted by the BoE’s November monetary report. GDP is forecast to grow 1.5 and 1.3 per cent in 2026 and 2027.

The Bank of England cut base rate by 25bps to 4.5%

Susannah Streeter, head of money and markets at Hargreaves Lansdown, said while the ‘risks of stagflation are stark’, two MPC members voting for a larger rate cut has increased market expectations for more rate cuts at a faster pace this year.

Market pricing now suggests base rate will be close to 3.75 per cent by December, indicating three further cuts of 25bps each.

Streeter added: ‘The speed will depend on how the economy responds in the months to come. Businesses are already feeling the pain of upcoming changes to National Insurance contributions, as with suppliers starting to pass on the costs of higher expected wage bills.’

Simon Dangoor, head of fixed income macro strategies at Goldman Sachs Asset Management, thinks markets are currently pricing too few rate cuts this year.

He said: ‘Amid a stagnant economy and a worsening labour market, the BoE delivered the anticipated 25bps cut, with a dovish tone and vote.

‘Despite the looming inflation risks, the BoE has maintained its ‘gradual’ easing guidance.

‘We foresee the BoE continuing its quarterly easing pace through the uncertain period in H1 but accelerating in H2 when dust settles, with a total of five cuts this year.’

Four more 25bps rate cuts this year would take base rate to 3.5 per cent by December, where it last stood in January 2023.

In the nearer term, Polar Capital fund manager Georgina Hamilton said the BoE’s latest base rate cut ‘should be good for housebuilding shares, REITs and domestic consumer shares more broadly’.

She added: ‘The five-year swap rate, the key metric from which mortgage rates are calculated moved down on the news and is actually lower than at the October Budget.’

Hamilton said: ‘The voting split was more dovish than forecast with two members voting for a 50 basis point cut.

‘This is likely to lower the forward interest rate curve towards the MPC’s forecast of 4 rate cuts this year which in turn should lower the mortgage rate.’

The Bank of England now expects inflation to be higher and growth to be weaker than previously forecast

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading fees

Trading 212

Trading 212

Free dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.