FTSE 100 hits record high as traders anticipate interest rate cuts

Boom! Britain’s blue-chip share index has hit a new alltime high.

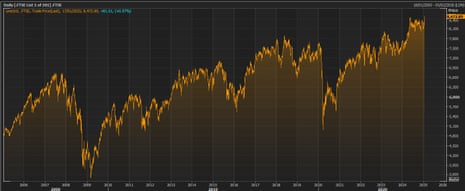

The FTSE 100 index, which tracks the hundred largest companies listed in London, has jumped by over 1% to 8480.36 points in early trading, above its previous intraday high of 8474 points set last May.

Stocks are on a three-day rally, which started on Wednesday when UK inflation dropped unexpectedly, potentially paving the way for several interest rate cuts this year.

Today’s disappointing retail sales figures, folowing Thursday’s weaker-than-expected growth data for December, have added to hopes that the Bank of England will ease monetary policy this year.

This morning, the financial markets are pricing in between two and three interest rate cuts this year – last week, duing the bond market mayhem, fewer than two were expected.

That has pushed down the pound, which raises the value of multinational companies listed in London (it makes their earnings in other currencies more valuable).

Global stocks have also benefited from reports that Donald Trump could take a more cautious approach to implementing tariffs than feared.

Mining companies are rallying in London this morning, following reports that Rio Tinto and Glencore have discussed combining their businesses (see earlier post)

Key events

Relief for Reeves as UK bond yield surge evaporates

There’s encouraging news for Rachel Reeves in the bond markets today.

UK borrowing costs have fallen, and are now almost back at their levels early last week before bond yields surged.

The yield, or interest rate, on 10-year UK government bonds has dipped by four basis points, or 0.04 percentage points, to 4.627%. That’s the lowest level since last Tuesday, 7 January, the first day of the sell-off in UK debt that drove 10-year borrowing costs to their highest since 2008.

The yield on 30-year UK bonds has also dropped by 4bps, down to 5.187%. Last week it hit 5.474%, the highest since 1998, but has fallen for the last three days.

The recovery comes after the UK government insisted it would stick to its fiscal rules, an indication that spending cuts or tax rises might be implemented rather than increased borrowing.

It also reflects expectations that the Bank of England may cut interest rates several times this year, after the latest inflation, growth and retail sales figures were lower than exepcted this week.

But it is also part of a wider recovery in bond prices in recent days. US Treasury yields have also dropped this week, following reports that Donald Trump’s administration may take a more gradual approach to tariffs.

FTSE 100 over 8,500 points

The FTSE 100 is continuing to rally, and just poked its nose over the 8,500-point mark for the first time ever.

The blue-chip share index has now hit a new alltime high of 8506.80 points.

As we covered late last year, analysts had predicting stock markets would rally this year – with AJ Bell suggesting the FTSE 100 could reach 9,000 points.

The recent jump in Britain’s bond market borrowing costs are a “concern”, according to credit ratings agency S&P Global today.

However, S&P said it wasn’t severe enough yet to have an immediate impact on the UK’s AA credit rating.

In a research note, S&P argue that the situation is “manageable”, although higher borrowing costs may lead to a fall in investment.

S&P Global Ratings credit analyst Frank Gill says:

“The selloff, which started at the end of 2024, has been fairly broad-based across the safe asset space. Yet G7 governments with larger net borrowing requirements–including France, the U.S., and the U.K.–have underperformed, pointing to a rise in risk premia.”

S&P point out that UK policymakers have options – the Bank of England could slow the pace of its sales of UK debt (under its QT programme, which is unwinding stimulus).

City traders are increasingly confident that the Bank of England will cut UK interest rates next month.

The money markets now indicate there’s an 81.5% chance that Bank rate is lowered to 4.5%, from 4.75%, at the BoE’s next meeting on 6 February.

Those interest rate expectations have pushed the pound down to $1.22 this morning.

Raffi Boyadjian, lead market analystat XM, says:

The pound stands out as being the weak link among the majors, as it looks set to post a third straight weekly decline. It’s been a busy week for UK data releases consisting of CPI, GDP and retail sales figures. But all three reports came in below expectations, boosting the odds that the Bank of England will lower rates at its February 6 meeting.

Nevertheless, the pound’s freefall has been good news for UK stocks, with the FTSE 100 hitting intra-day record highs today.

The FTSE 100 has been derided as a ‘Jurassic Park’ index over the years, for its lack of exciting technology companies.

But that boring nature is actually attractive to investors because it provides some protection for investors in a time of geopolitical uncertainty, says Susannah Streeter, head of money and markets at Hargreaves Lansdown.

Streeter says:

FTSE 100 stars like Rolls Royce and NatWest, which saw their share prices double over the [last] year, are among the climbers today. The FTSE 100 has been a laggard compared to US indices. They surged higher in 2024, with the S&P 500 gaining more than 23%, helped by big gains among the mighty tech stocks, fuelled by AI optimism.

But appetite for UK market is being revived, as investors are attracted by its defensive characteristics in an era of global uncertainty. Sectors like healthcare, utilities, consumer staples and telecoms companies can offer stable returns. The impressive dividend-paying potential is a key attraction to the UK stock market. There are plenty of mature companies boasting strong dividend cover and the potential for income to grow over the long term.

£60m funding boost for UK creative industries amid Soft Power push

Mark Sweney

The government has announced a £60m funding package for the creative industries, including investment in British film and TV, grass roots music and start-up video game companies.

The government said that the investment, £40m of which will be spent over the next financial year, will benefit hundreds of creative businesses “marking the first step of the government’s sector plan for the creative industries.

Chancellor Rachel Reeves says:

“Our number one mission is to grow the economy and our creative industries are a British success story with a big part to play.”

The announcement was made as Lisa Nandy, the culture secretary, held a creative industries summit in Gatehead attended by more than 250 businesses and cultural leaders including Netflix, Spotify, Warner Bros, the National Theatre and British Museum.

Nandy says:

“From film and fashion to music and advertising, our creative industries are truly world-class and play a critical role in helping us deliver on this Government’s mission to drive economic growth in all parts of the UK.

The British Business Bank, which supports £17.4bn of finance to over 64,000 smaller businesses, has committed to increase its support for creative businesses to access the finance they need to grow.

The government also formally announced the creation of a Soft Power Council, which will advise the government on driving growth and investment at home and abroad, comprised of leading executives including former ITV chairman Sir Peter Bazalgette, Roland Rudd, the co-chair of PR giant FGS Global and Victoria and Albert Museum director Tristram Hunt.

Sir David Lammy, the foreign secretary, said that its aim is to “re-imagine Britain’s role on the world stage”, adding:

“Soft power is fundamental to the UK’s impact and reputation around the world.

I am often struck by the enormous love and respect which our music, sport and educational institutions generate on every continent. But we have not taken a sufficiently strategic approach to these huge assets as a country.”

The FTSE 100 has hit a new record high despite the much-discussed impact of higher taxes on UK businesses contained in last year’s budget, and the recent turmoil in the bond market.

Dan Coatsworth, investment analyst at AJ Bell, says:

“It’s refreshing to see positive news around the UK stock market given its unloved reputation.

“Helping to drive the index up more than 1% and above its previous intraday record of 8,474 in May 2024 was a further slump in the pound as retail sales came in below expectations for December.

“Three quarters of companies in the FTSE 100 generate their earnings overseas, and the relative value of those foreign earnings is boosted when the pound weakens. The natural resources sector was also lifted by merger and takeover chatter, encouraging investors to bid up shares in the likes of Glencore and Anglo American.

“Weak UK retail sales in December are a worry as they indicate further pressure on the economy following weak GDP data yesterday. Traders are pricing in an 81.5% probability that the Bank of England will cut interest rates by a quarter percentage point next month. Retailers will be keeping their fingers crossed this happens as it could help to take some of the pressure off household finances and encourage more spending.”

The FTSE 100 has hit a record high after a strong start to the year.

Since the beginning of January, the index has climbed by 3.75%, adding to the 5.7% it gained during the whole of 2024.

Other equity markets have also started the new year well; Germany’s DAX has gained 4.6%, despite its economic malaise, while France’s CAC has shrugged off the endless political turmoil in Paris by gaining 4.5%.

FTSE 100 hits record high as traders anticipate interest rate cuts

Boom! Britain’s blue-chip share index has hit a new alltime high.

The FTSE 100 index, which tracks the hundred largest companies listed in London, has jumped by over 1% to 8480.36 points in early trading, above its previous intraday high of 8474 points set last May.

Stocks are on a three-day rally, which started on Wednesday when UK inflation dropped unexpectedly, potentially paving the way for several interest rate cuts this year.

Today’s disappointing retail sales figures, folowing Thursday’s weaker-than-expected growth data for December, have added to hopes that the Bank of England will ease monetary policy this year.

This morning, the financial markets are pricing in between two and three interest rate cuts this year – last week, duing the bond market mayhem, fewer than two were expected.

That has pushed down the pound, which raises the value of multinational companies listed in London (it makes their earnings in other currencies more valuable).

Global stocks have also benefited from reports that Donald Trump could take a more cautious approach to implementing tariffs than feared.

Mining companies are rallying in London this morning, following reports that Rio Tinto and Glencore have discussed combining their businesses (see earlier post)

In the City, shares in mining giants Glencore and Rio Tinto have jumped following reports they have held talks about combining part or all of their businesses.

The Financial Times and Bloomberg both reported that the two mining giants held “early stage” talks about a possible combination last year.

Bloomberg explains:

A potential combination of the two companies would rank as the largest-ever mining deal, but any transaction would be complex and face multiple potential hurdles. While Glencore has large copper assets at a time when the world’s biggest producers are all seeking to expand in the metal crucial to the energy transition, it also owns a massive coal business that would likely be unattractive to Rio. The larger miner’s chief executive has repeatedly expressed wariness about mega deals, and the two companies have vastly different cultures.

The discussions follow BHP’s failed £39bn bid for Anglo American last year, which led companies across the sector to review strategic options.

Glencore’s share price has risen by 3% in early trading, while Rio Tinto are up 1.5%.

Retail sales drop ‘disappointing’ say economists, but is it true?!

Several economists report that the 0.3% drop in retail sales volumes across Britain last month was disappointing.

Alex Kerr, UK economist at Capital Economics, says the economy clearly struggled at the end of last year, but expects the retail sector will have a better 2025:

After big declines of 4.1% in 2022 and 2.9% in 2023, sales rose only by 0.7% in 2024. And as with the wider economy, most of that growth in sales was from earlier last year and the year finished with very little momentum.

Indeed, the level of sales volumes in December was just 0.1% higher than in June and the 3m/3m growth rate has slowed from a healthy +1.2% in September to -0.8% in December. That said, the breakdown was a bit more encouraging with sales rising in four of the seven sub-sectors. Admittedly, food and online sales both fell by 1.9% m/m.

But the rises in sales in department, clothing and household goods stores suggests that, after big falls in October and November, households were holding back some of their spending for the Christmas period and may be in a better position than the recent retail weakness suggests.

Jacqui Baker, head of retail at RSM UK, says December’s drop in sales marks a disappointing end to tough year:

“Despite record-breaking sales for some retailers over Christmas, plus the later than usual Black Friday event, it was a disappointing end to 2024 for the sector. A lacklustre Golden Quarter is particularly concerning after a tough year as retailers would have been hoping for a Christmas boost. However, retail sales excluding fuel did increase 2.9% year-on-year due to poor sales figures in December 2023.

“Many retailers had little choice but to launch their Boxing Day discounting early to maximise sales and clear as much stock as possible ahead of the seasonal slowdown in January. However, without the ‘golden’ boost to sales many retailers will find it difficult to navigate the imminent headwinds post-Budget and we could see prominent brands struggle to compete in 2025.

But there are questions about the data. Matt Swannell, chief economic advisor to the EY ITEM Club, points out that these figures are volatile.

“Seasonal spending has a large impact on the retail sector at the end of the year, and recent shifts in spending patterns can introduce large volatility into official estimates of retail activity, so the EY ITEM Club wouldn’t recommend reading too much into December’s fall.

Indeed, December 2023 saw retail activity fall by nearly 4%, also with a collapse in food sales, only for most of this lost ground to be made up in January 2024. However, when considering the last three months, the picture remains soft, with retail sales falling 0.8% across Q4.

Retailing analyst Nick Bubb has his own doubts, saying…

Well, City economists will lap up the news that the ONS Retail Sales figures for December were down, but they should be asking if the figures are simply wrong, as the ONS must be living on a different planet if it thinks that Large Food Retailers saw sales fall by 0.2% last month (year-on-year, non-seasonally adjusted value), given what we’ve heard from Kantar and Nielsen.

The retail sales picture is rosier if you take an annual view.

Compared with December 2023, sales volumes were 2.9% higher last year, while sales values (the amount spent) rose by 3.5%.

Kris Hamer, director of insight at the British Retail Consortium, said:

Retail sales picked up in December, but this unfortunately did not offset the shaky start to the ‘Golden Quarter’. In non-food, electricals, beauty and books made for popular presents.

Meanwhile, sales of furniture and other large ticket items were hard hit as families continued to think twice before making larger purchases, and clothing and footwear sales remained muted.

Pound drops after retail sales figures

The pound has weakened following this morning’s weaker-than-expected retail sales figures.

Sterling has fallen by over half a cent to $1.218, towards the 14-month lows hit against the US dollar last week.

Traders are calculating that the Bank of England could be spurred to cut interest rates by the weak spending in the shops last month.

Neil Birrell, chief investment officer at Premier Miton Investors, says:

Consumers in the UK obviously had a quiet Christmas. December’s retail sales are reflective of the general tone in the country, coming in much worse than expected.

Whilst that might be good news on the inflation front, it does nothing for the economy’s growth prospects. The numbers will no doubt encourage the Bank of England to cut interest rates when they meet, but they must worry the government at the same time. The economy is in need of stimulus.

Despite December’s drop, retail sales did rise across Britain during 2024 – the first annual increase in three years.

The ONS reports that retail sales volumes rose by 0.7% in 2024, following a fall of 2.9% in 2023 and of 4.1% in 2022.

“Although this marked the first rise in three years, sales volumes have not returned to 2022 levels,” it adds.

Sales fall at specialist food stores, and vaping shops

Today’s retail sales report shows that the drop in food sales (-1.9% on the month) was strongest at supermarkets.

However, sales volumes also fell in specialist food stores, such as butchers and bakers, and alcohol and tobacco stores (including vaping shops), the ONS reports.

UK retail sales dip in December

Retail sales across Great Britain shrank last month, as consumers took a cautious approach to Christmas shopping.

Retail sales volumes dipped by 0.3% month-on-month in December, the Office for National Statistics has reported, missing forecasts of a 0.4% rise.

The ONS reports that sales volumes at supermarkets fell, with food stores sales volumes down 1.9%, which was partly offset by a rise in sales at non-food stores such as clothing shops.

That drop in food sales is surprising, as several retailers have reported strong festive sales. Tesco said it had its biggest ever Christmas, for example.

December’s drop in retail sales followed a small, 0.1%, rise in November.

And over the last three months, the sales volumes (the amount of stuff bought in the shops or online) fell by 0.8% compared the three months to September.

This suggests consumer spending weakened towards the end of last year – several surveys have suggested that confidence declined,

However, there is a wrinkle – the ONS seasonally adjusts its data, to adjust for the impact of Christmas spending, and because Black Friday (29th November this year) fell in its December reporting period this year, which muddied the data.

On a non-seasonally adjusted basis, sales volumes rose by 10.0% in December!

ONS senior statistician Hannah Finselbach says:

“Retail sales fell in December following last month’s slight increase.

“This was driven by a very poor month for food sales, which sank to their lowest level since 2013, with supermarkets particularly affected.

“It was a better month for clothing shops and household goods stores, where retailers reported strong Christmas trading.

“With the timing of Black Friday falling within these latest data, our figures when not adjusted for seasonal spending show overall retail sales grew more strongly than in recent Decembers.”

Introduction: China hits 5% growth target

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Along with death and taxes, you can usually rely on China to hit its economic growth targets.

And it’s done it again, with the National Bureau of Statistics of China reporting overnight that China’s economy grew by 5% in 2024. That means it hit Beijing’s official target of “around 5%.”

The target was reached thanks to a burst of activity in the fourth quarter of last year. GDP rose at an annual rate of 5.4% in October-December, beating the market’s expectation, helped by a flurry of stimulus measures powered the economy to meet Beijing’s growth target.

China’s economy shrugged off “a relentless barrage of economic pessimism,” says Stephen Innes, managing partner at SPI Asset Management, to hit Beijing’s growth target, adding:

“This surge was fueled by a vigorous export boom and aggressive stimulus measures that counterbalanced the sluggish domestic demand.

Although slightly outpacing analyst forecasts, this growth fell just shy of the 5.2% expansion seen in 2023, painting a picture of an economy with both promising highs and undeniable challenges”

The NSB also reported that China’s retail sales rose 3.7% year-on-year in December, while industrial output expanded by 6.2% – both faster than expected.