- GALA saw strong bearish momentum in recent days that drove the RSI below 50

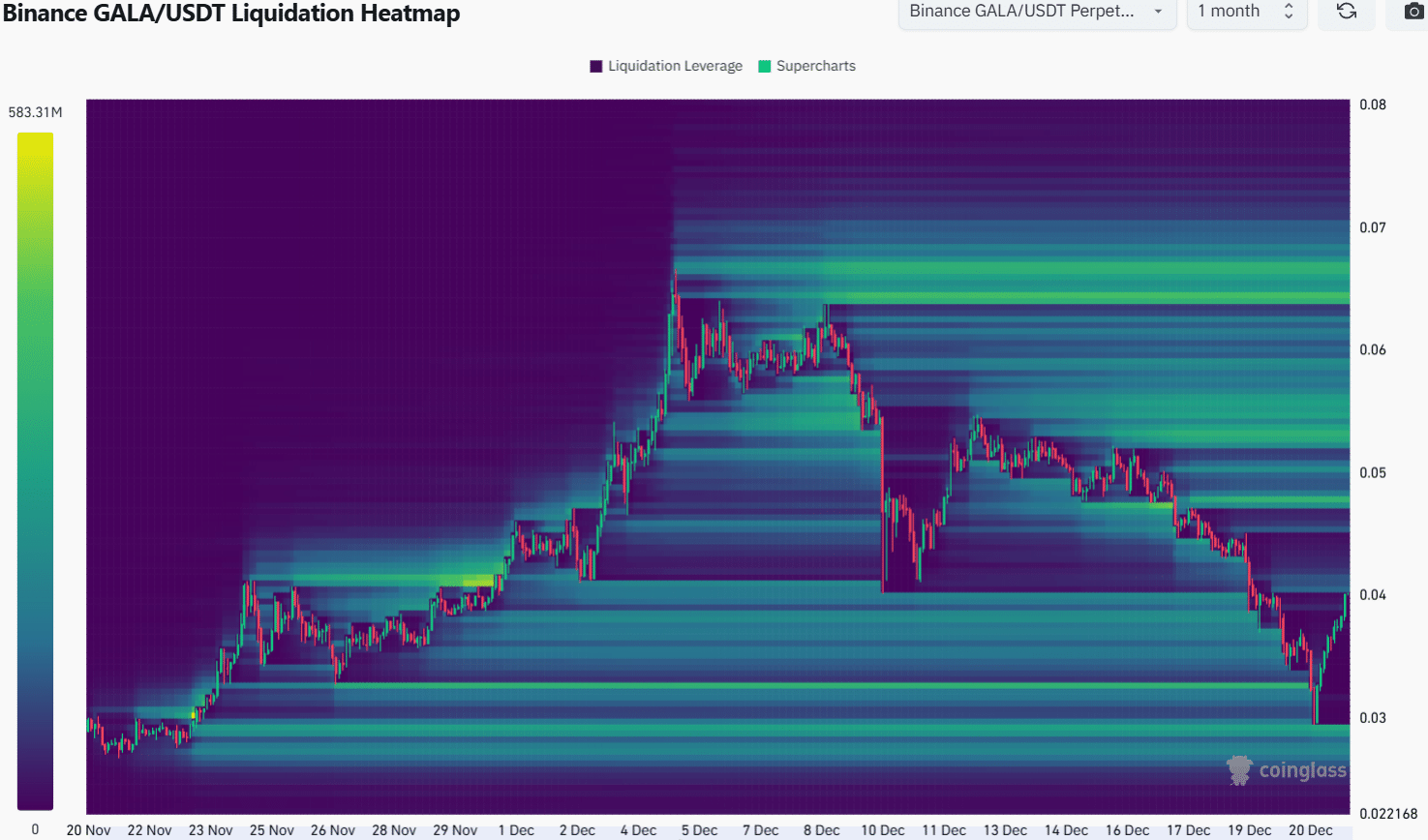

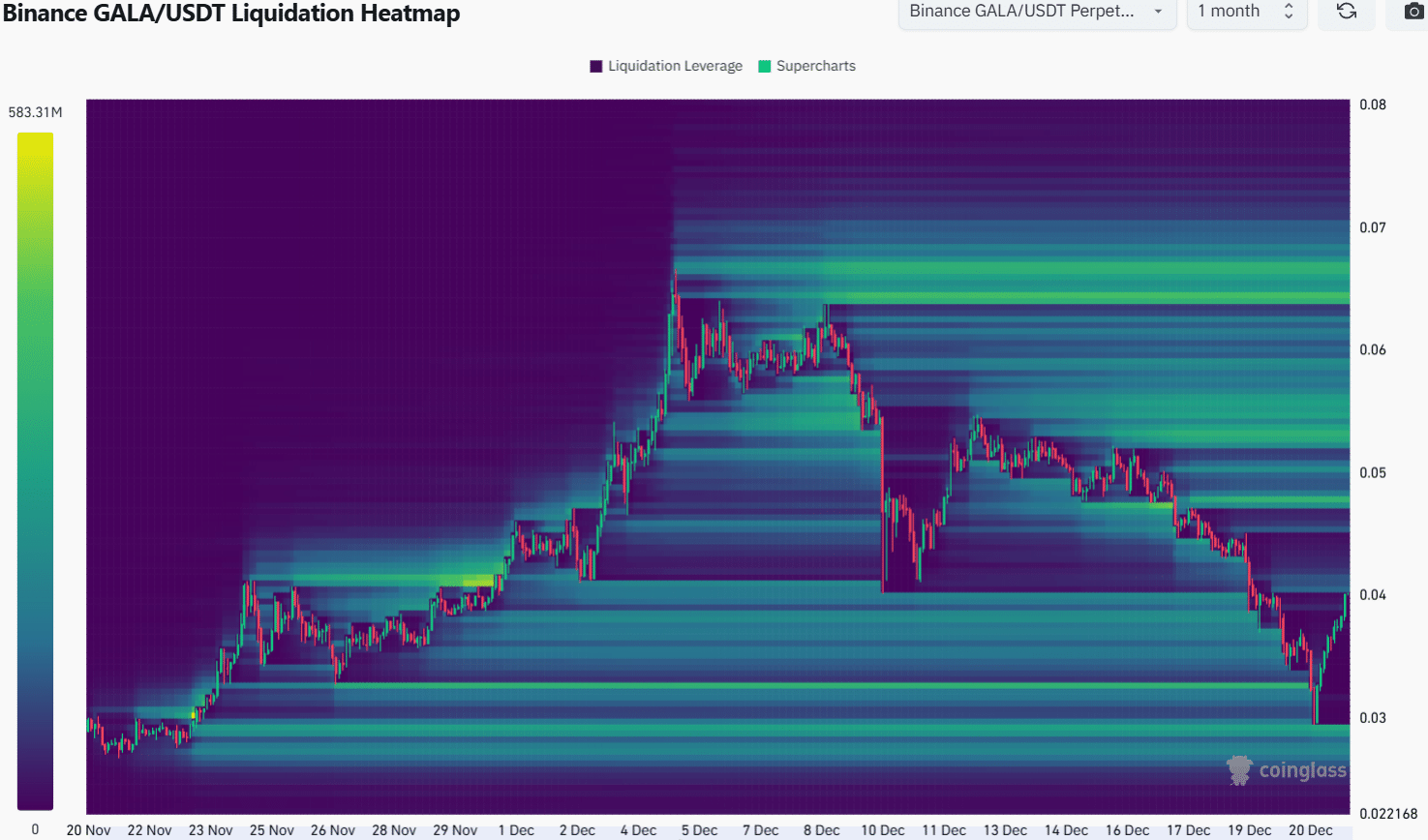

- OBV fell to reflect selling, but the liquidity pooled around $0.052

GALA, at the time of writing, was up 35.4% from its local low at $0.0295, formed less than 24 hours ago. Bitcoin’s [BTC] volatility dragged sentiment across the market through the mud, and many altcoins shed more than 20% to 30% from their local high to the local bottom.

In fact, GALA experienced a 55% drawdown from $0.0665 to $0.0295. At press time, it was trading at $0.04. In the coming days, it could consolidate around the $0.05-level for a while before rallying higher.

Bearish structure and momentum dominate GALA

The $0.045-$0.05 zone had been an important resistance zone in April and May of 2024. The rally in November saw the altcoin’s price smash past this zone and retest it as support in the second week of December.

The 78.6% Fibonacci retracement level at $0.028 was nearly retested as support. In the lower timeframes, a move past $0.0427 would be a short-term bullish sign.

The OBV took a hit and has trended south in December. However, at press time, it was still a healthy margin higher than where it was six weeks ago. This seemed to be a signal of firm buying pressure in recent weeks and bodes well for another GALA move beyond $0.05.

However, the market structure of the altcoin was bearish. A daily session close beyond $0.0547 would flip the structure bullishly.

Liquidity pockets to the north beckon the price

Source: Coinglass

To the south, the $0.033 and $0.029 levels had marked sizeable liquidity concentrations. Both were swept in recent days, and the price has strongly bounced since then. The recent bounce appeared to be heading for the $0.047 and $0.052 levels next. Beyond that, it was hard to gauge if there was enough short-term demand to fuel further gains.

Read Gala’s [GALA] Price Prediction 2024-25

The $0.052-$0.056 zone is an interesting zone of the liquidation heatmap. It is a target for GALA over the next week, but a move further higher could be difficult immediately afterwards as the bulls would need time to consolidate.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion