Fashion design company House of Anita Dongre (HOADPL) is initiating a buyback of its nearly 40% stake from US private equity firm General Atlantic (GA), executives aware of the development said. GA had acquired the stake in the owner of brands such as AND and Global Desi in the women’s wear category about nine years ago. According to reports then, the PE firm had invested nearly ₹150 crore in Dongre’s company in 2015.

“There is continued uncertainty over recovery in revenue and earnings in the coming quarters due to weak demand growth outlook and reduction in Anita Dongre’s scale of operations,” rating agency ICRA said in a January report on HOADPL. The report expects the company’s revenue to decline to ₹500-₹550 crore in FY24 and FY25, from ₹606 crore in FY23, with an annual operating profit margin of 19-20%. The company is yet to file its FY24 earnings.

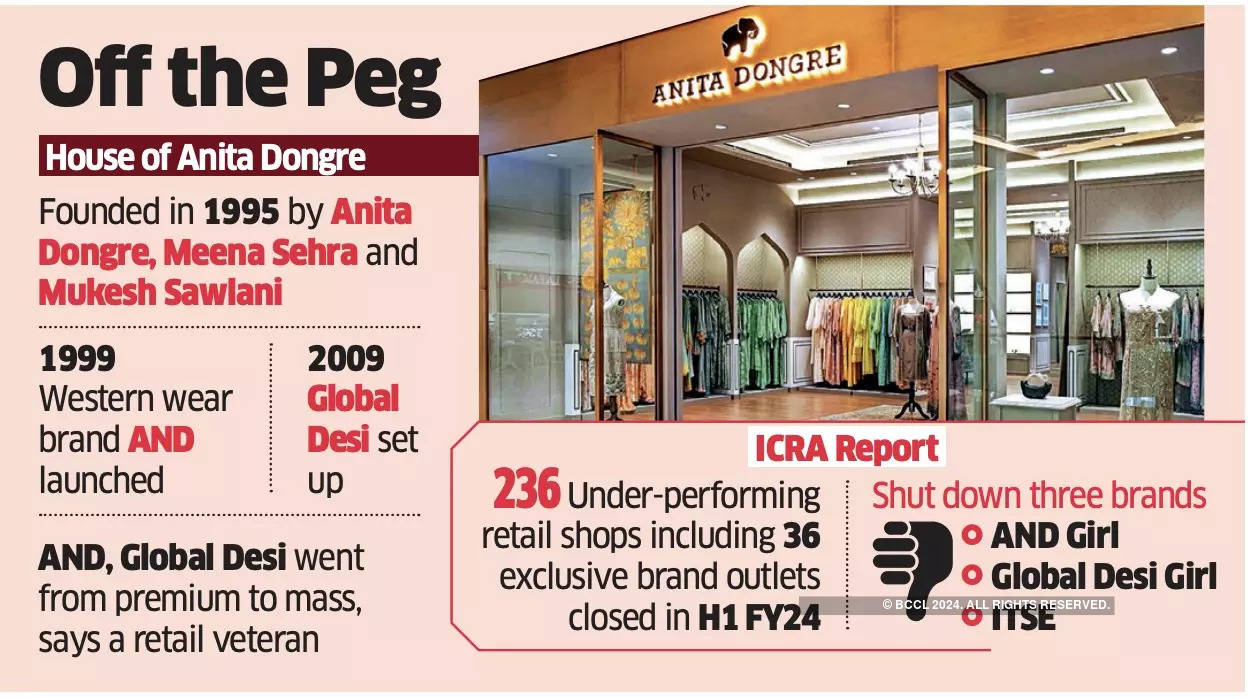

A fashion retail veteran said brands like AND and Global Desi went from premium to mass and discounted heavily on online channels. “The product was reengineered as a result and lost its lustre in the process. Profit margins in the fashion industry should be robust so that it can be reinvested in the brand,” the person said.

An email sent to the office of Anita Dongre did not elicit a response. GA declined to comment.

Founded in 1995 by Anita Dongre, Meena Sehra and Mukesh Sawlani, House of Anita Dongre was among the first fashion houses in India.

GA first took a 23% stake in Dongre’s company from Future Lifestyle Fashions for close to ₹150 crore, eventually scaling it up to nearly 38%. The remaining stake is held by members of the Dongre family.

While PE firms typically have an exit window of 6-7 years, GA stayed invested in the House of Anita Dongre. House of Anita Dongre’s western wear brand AND was launched in 1999, and in 2009, the fashion house introduced its fusion wear brand Global Desi. While these are its flagship brands contributing close to a third of the group’s revenue, luxury designer wear brand Anita Dongre accounts for the remaining share.

According to ICRA, as of September 30, 2023, the group had a network of 209 exclusive brand outlets comprising a mix of company-owned and franchised stores and 798 large-format stores and multi-brand outlets.

“Post a rejig in the top management in March 2023, the group’s promoters implemented a new strategy amid industry-wide demand headwinds…it closed 236 under-performing retail locations including 36 exclusive brand outlets in H1 FY2024, many of which were opened in tier- II and tier-III cities over the last two years,” ICRA said in the report. “The fashion house also shut down three brands-AND Girl (western kid’s wear), Global Desi Girl (ethnic kid’s wear) and ITSE (economy ethnic wear). The corresponding inventory was liquidated at steep discounts to manage cash flows, thereby impacting the Group’s revenue and profitability.”

ICRA expects the group’s debt coverage indicators to remain constrained in FY24 though it is expected to have sufficient liquidity to meet debt repayment obligations over the medium term, largely from improving profitability and tight control over inventory build-up.

While a proliferation of mid-sized fashion labels, ecommerce platforms and a young population have added to the overall size of the fashion industry, the overall traditional and designer fashion space has got a lot more fragmented, according to industry reports.