Gold hits record high over $3,000 amid geopolitical tensions and weakening US dollar

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

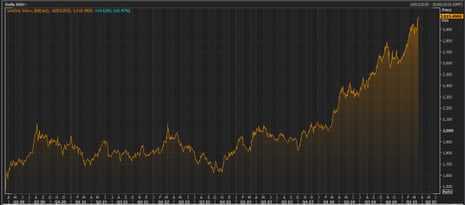

It’s been a record-breaking year for gold, as nervous investors have sought out safe-haven assets.

And this morning, the precious metal has hit a fresh all-time high above $3,000 per ounce, driven by escalating geopolitical tensions in the Middle East, trade war fears and the weakening US dollar.

Gold touched $3,017.64 per ounce, as news broke that Israeli military forces have launched widespread strikes on targets across Gaza early today, leading to fears that the shaky ceasefire in the region is over.

This means gold has climbed by 15% since the start of this year, having ended December at $2,623/ounce, adding to its 27% surge during 2024.

As this chart shows, it has now doubled over the last five years:

The recent weakness of the US dollar has also pushed up the gold price. The greenback is trading near a five-month low against a basket of other currencies, as traders worry that Donald Trump’s enthusiasm for tariffs will trigger a full-blown trade war, that could push the US into recession.

As analysts at Deutshe Bank put it:

Investors continue to rotate away from the US dollar and find perceived safe havens amidst the heightened policy uncertainty.

Linh Tran, market analyst at XS.com, reports that rising tensions in the Middle East and the escalating U.S.-China trade conflict have both driven investors toward gold as a safe investment channel, adding:

These uncertainties have not only increased demand for gold but have also pushed significant capital inflows into the precious metals market, contributing to gold reaching record-high prices.

The agenda

-

9.30am: ONS releases changes to the UK inflation basket

-

10am GMT: ZEW eurozone economic confidence survey

-

12.30pm GMT: US housing starts/building permits data for February

-

1.15pm GMT: US industrial production for February

Key events

Closing post

Time to wrap up…

The company hopes to agree a deal by the end of June, and complete it by the end of September.

Its appeal to lift customers bills by more than regulators allowed has been paused while talks continue, but the CMA will consider appeals by five other water companies.

Geopolitical tensions have pushed the gold price to a new all-time high of $3,038 per ounce. Analysts said the weaker dollar, and fears of a global trade war, were fuelling a new gold rush.

The dollar has recovered ground this afternoon, after slipping to a four-month low which saw the pound trade at $1.30 for the first time since November.

Back on bosses’ earnings… the CEO of Centrica’s pay packet has almost halved.

Chris O’Shea received £4.322m last year, the company’s annual report shows, down from £8.231m in 2023.

The decline was due to a lower bonus – O’Shea’s variable remuneration declined to £3.376m, down from £7.328m last year.

Two years ago, O’Shea admitted that a £4.5m pay packet was “impossible to justify”.

Back in Berlin, Germany’s outgoing parliament has passed a massive increase in government borrowing, including a sweeping change to the country’s debt rules.

The legislation now goes to the Bundesrat upper house, which represents Germany’s 16 states, and is set to vote on Friday.

🇩🇪 Wir haben es geschafft.

— Frederik Ducrozet (@fwred) March 18, 2025

Robin Winkler, chief German economist at Deutsche Bank Research, says:

“After much nail-biting over the last fortnight, Germany’s outgoing parliament today decided to reform the constitutional debt brake. In our view, this is a historic fiscal regime shift, arguably the largest since German reunification.

Yet, as with reunification, a fiscal expansion does not guarantee success: the next government will need to deliver structural reforms to turn this fiscal package into sustainable growth.”

Our Europe liveblog has all the action:

Top bosses’ pay soars at Reach

Mark Sweney

Bosses at the publisher of the Mirror, Express and Star newspapers took home more than £2m in pay and bonuses last year, angering staff who were awarded a few hundred pounds each following a boost in profits last year.

Jim Mullen, the chief executive of Reach, the owner of more than 100 news brands including the Manchester Evening News, the Birmingham Mail and the Liverpool Echo, received total remuneration of £1.25m last year.

His pay packet was sweetened by a maximum bonus of £662,000 after the company boosted operating profit by 6% to £102m last year.

According to Reach’s annual financial report Mullen was paid 35 times that of an employee in the 25th percentile, the lower end of the company’s pay structure.

Darren Fisher, Reach’s finance chief, received £857,000 including a £378,000 bonus.

Following deep cuts affecting more than 800 staff Reach struck a deal to boost employee pay by 5% last year, and a £600 bonus payment this month as part of the company’s profit share scheme.

Management is currently in negotiations with the National Union of Journalists over a proposed 2% increase this year, while any increase in the base salary of Mullen and Fisher will be decided on 1 April.

The NUJ said that in light of the publication of top executive pay Reach should reconsider its pay offer.

“It is good news that the business has turned around its key digital revenues and has improved its operating profits out of which these bonuses will be paid,” said Reach’s NUJ chapel.

“But this was done on the back of heroic efforts by employees to dramatically increase the number of stories going online and by those in print outperforming the market with threadbare resources thanks to significant redundancies.”

Fund managers make record shift out of US stocks

Donald Trump appears to have triggered a stampede out of the US stock market.

Bank of America’s March Global Fund Manager Survey has found there was a record rotation out of US stocks by fund managers this month, as investor sentiment was hit by fears of a trade war and possible US recession.

BofA reports there has been a “bull crash” in fund manager sentiment this month, with March seeing the second biggest drop in global growth expectations ever, the biggest drop in US equity allocation ever, and the biggest jump in cash allocation since Marcn 2020.

This is reflected in market prices this year – the S&P 500 share index is down 4.5% during 2025, while Europe’s Stoxx 600 has jumped 9%.

Gold hits new high: $3,038

Back in the financial markets, the US dollar has shaken off its earlier losses – pulling the pound down to $1.296.

Gold, though, is undaunted, and has now touched a new all-time high of $3,038 per ounce, up 1% today, thanks to a cocktail of Middle East tensions, US trade war fears, and the ongoing scamper into safe-haven assets.

CMA to consider water company demands for even higher bills

The news that Thames Water has received six takeover proposals since last summer comes as regulator Ofwat asks the competition watchdog to consider requests from several other water companies to lift their bills even higher than has been allowed.

Ofwat is referring redetermination requests from Anglian Water, Northumbrian Water, South East Water, Southern Water and Wessex Water to the Competition and Markets Authority (CMA).

The five companies are all challenging Ofwat’s ruling last year about how they can raise their bills between 2025 and 2030, arguing that the increase – 36% on average across the industry – wasn’t enough to invest in pipes, drains, reservoirs and treatment works.

Ofwat defends its decisions, saying:

The increase in investment means that customers’ bills will increase from 1 April; many customers are already expressing concerns about the level of increase.

While the companies have not yet set out the details of their reasons for appealing, their initial statements highlight the need for additional funding beyond the substantial increase already allowed. This would mean a further increase in bills for customers.

Interestingly, the regulator has also agreed a request from Thames Water to defer its referal to the CMA for up to 18 weeks. That delay, Thames says, will give it time to potentially “unlock a market-led solution for the recapitalisation of the Company” (presumably through one of the six offers on the table).

Thames Water: We’ve received six takeover approaches

Thames Water has revealed it has received six approaches from potential suitors.

The struggling utility, which has been on the verge of collapse for months, says it has received proposals from six parties in response to a fundraising process launched in 2024, and that it “has since been conducting a detailed assessment of each proposal”.

Thames says that many of the proposals included its bond holders taking a hit:

The proposals involve a range of potential valuations, structures and outcomes for stakeholders. Of the five proposals that provided financial metrics, all except one (from a Class B Creditor and with significant conditions attached) indicated a material impairment of the Class A debt.

The sixth proposal was for minority equity, intended to partner with investors, and did not set out financial metrics.

In certain of the contemplated proposals, relevant creditors would receive – in exchange for debt impairment – certain rights to share in future growth in the value of the Company, and/or will have the ability to co-invest in the business.

Thames adds that most of the proposals are conditional on the company achieving various “regulatory support and accommodations” – a nod to its financial and operational problems, from a £19bn debt pile to crumbling infrastructure.

It explains:

Discussions with relevant parties are ongoing, although there is no certainty that a binding equity proposal will be forthcoming or that any such proposals will be capable of being implemented. As a result, certain senior creditors continue to progress in parallel alternative transaction structures to seek to recapitalise the business.

Thames does not name any of its suitors.

But in December, the company received a £5bn bid from infrastructure investor Covalis Capital.

News of the six takeover approaches comes a day after the UK court of appeal has upheld an emergency debt package worth up to £3bn. That debt should keep Thames operating for a few months while efforts to recapitalise it are progressing.

The Guardian reported last week that Thames Water is asking to be spared billions of pounds of costs and fines over the next five years and heap more on to bills so it can attract new investors.

The company is hoping to persuade the regulator Ofwat to grant it significant leniency on penalties and extra costs, to help woo bidders.

South Yorkshire taking buses into public control

Gwyn Topham

South Yorkshire has become the latest combined authority to announce it will take buses into public control.

Mayor Oliver Coppard has followed his fellow metro mayors in the north in deciding to pursue bus franchising to improve local services.

Today’s decision came after a public consultation in which the authority said nearly 90% of 7,800 respondents backed local authority control of buses.

South Yorkshire will, like Greater Manchester, West Yorkshire and Liverpool, now take control of the bus network – including depots and vehicle fleets, and setting routes, timetables, ticketing and fares. Buses are expected to operate under the new system from September 2027.

Coppard said the move was “turning back the tide on the failed experiment of the privatisation of our bus network that was started in the 1980s, putting the public back into public transport.”

He added:

“Over the last forty years we’ve seen public transport taken apart; fares go up, routes and passenger numbers go down, and our city centres, our high streets and our economy flatline.

“I want us to build a bigger and better economy in South Yorkshire and we need a public transport system that allows people to get to where they want to go, when they want to go there.

“The destination is a fully integrated transport system across Barnsley, Doncaster, Rotherham and Sheffield, one that works in the interests of our communities and our economy, putting people back in control of essential services.”

It is expected to have new branding, covering buses and trams and other public transport, much like Manchester’s Bee Network.

FT: Google parent Alphabet agrees to buy cyber security group Wiz for $32bn

Google is reportedy poised to make its biggest acquisition ever – posing a test for competition regulators.

Google parent Alphabet has agreed to buy cyber security start-up Wiz for at least $32bn, the Financial Times is reportiing, with an announcement expected today.

Wiz, which offers a service that scans the data on cloud storage providers such as Amazon Web Services and Microsoft Azure for security risks, was founded by alumni of Israel’s elite cyber intelligence unit in 2020.

It rejected a $23bn offer from Google last year, and recently opened its European headquarters in London.

The FT says:

The all-cash deal, which will rank as the biggest deal of the year so far, will be announced on Tuesday morning, the people said. It will probably still face scrutiny from the Federal Trade Commission under President Donald Trump, whose new chair Andrew Ferguson has maintained guidelines giving the agency the ability to block large deals used by his predecessor Lina Khan. There will be an additional retention bonus offered to employees as part of the deal, which could be worth an extra $1bn, the people added.